Money moves fast, but only if you have the right numbers. Honestly, nothing stops a direct deposit or a wire transfer in its tracks quite like a simple typo or, worse, using the wrong nine-digit code for your specific region. If you’re banking with TD Bank in the Empire State, finding the TD routing number New York is probably the only thing standing between you and your paycheck or a successful rent payment.

It’s easy to think all TD Bank accounts are the same. They aren’t.

Banks use these routing transit numbers (RTNs) as an internal GPS. Since TD Bank grew by acquiring dozens of smaller local banks over several decades—think back to the Commerce Bank days—their backend systems are still somewhat segmented by geography. This means the number someone uses in Florida is totally useless for your account opened in Manhattan or Albany.

The Specific Number You Actually Need

Let’s get straight to the point because you’re likely staring at a form right now. For the vast majority of TD Bank customers who opened their accounts in New York, the routing number is 026013673.

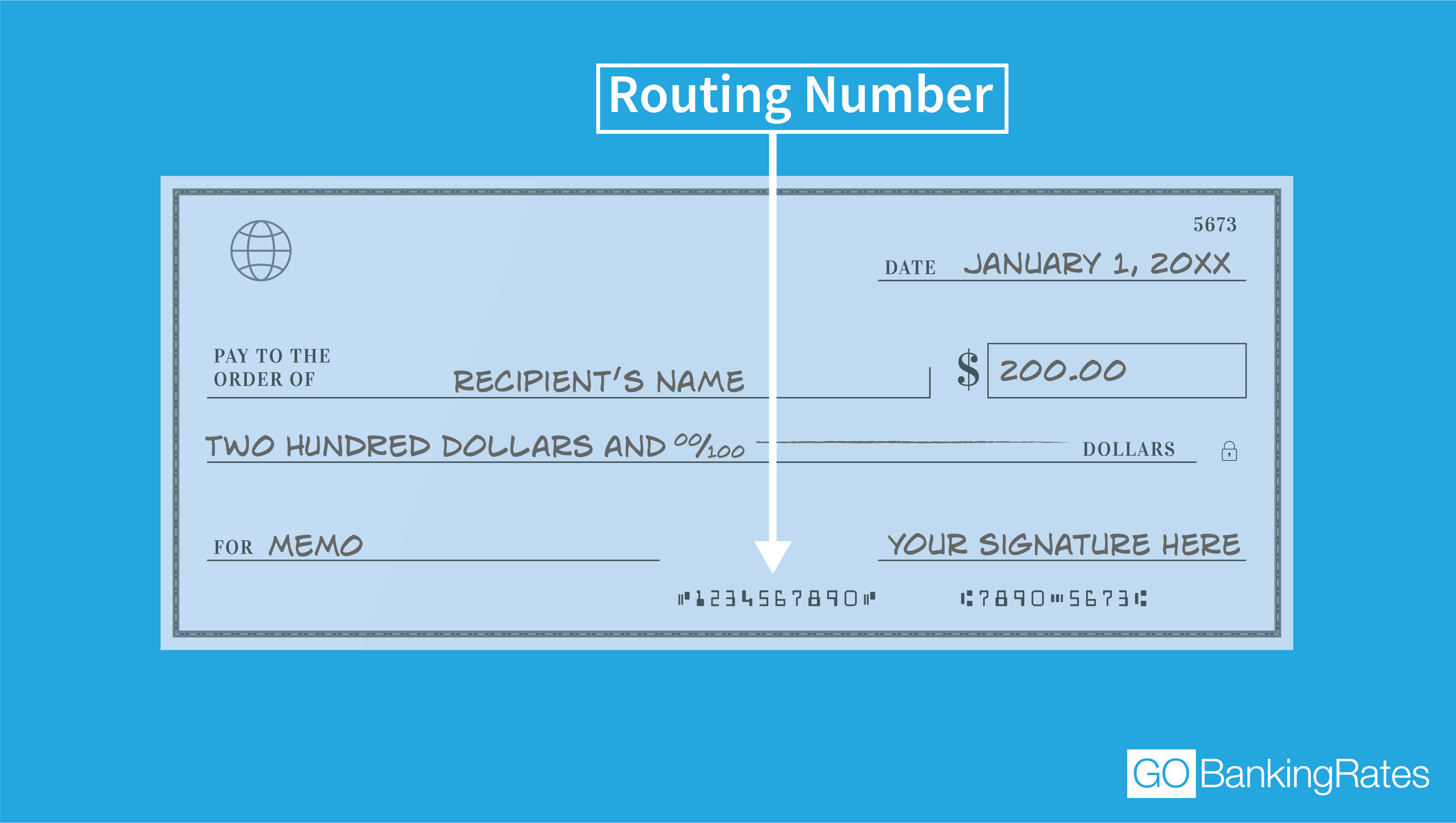

Don't just take my word for it. You can verify this on the bottom left corner of your physical checks. It's the first set of nine digits. If you don't have a checkbook, you’ve probably noticed that the TD mobile app hides this info behind a few menus for "Account Details."

Why does this number matter so much? It identifies the specific Federal Reserve district and the institution responsible for the funds. For New York, that’s the Second Federal Reserve District. If you use a New Jersey or Connecticut number by mistake, the automated clearing house (ACH) system might kick the transaction back. That leads to "return fees," which nobody wants to pay.

Does the City Actually Matter?

You might be in Buffalo. Maybe you’re in Brooklyn. Does it change? Generally, no. TD Bank uses a unified routing number for the entire state of New York for most standard personal and business checking accounts.

However, there is a nuance people often miss.

If you are receiving an international wire transfer—not just a domestic ACH transfer—the routing number isn't enough. You’ll need a SWIFT code (often TDBKUS33 for TD Bank). Also, if you’re dealing with specialized commercial accounts or very old legacy accounts from a specific acquisition, things can get weird. But for 99% of us? That nine-digit code above is the golden ticket.

The Paper Check Test

Look at a check. Any check. Look at the bottom.

💡 You might also like: Who is the current chair of the federal reserve: What Most People Get Wrong

You'll see three groups of numbers. The first is the routing number. The second is your account number. The third is the check number.

It’s a system that hasn't changed much since the 1960s. Even in 2026, with all our digital wallets and crypto talk, the American banking system still relies on these strings of digits to move trillions of dollars. It’s archaic. It’s clunky. But it works.

Common Mistakes When Sending Money

People mix up "routing" and "account" numbers all the time. It's a classic headache. Think of the routing number like the zip code for your bank's headquarters in that state. The account number is your specific house address. If you get the zip code wrong, the mailman (the Federal Reserve) doesn't even know which city to go to.

Another thing? Wire transfers vs. ACH.

- ACH: This is for payroll, paying your utility bill, or sending money to a friend via some apps. It’s usually free or very cheap. It takes a day or two.

- Wire Transfers: This is for "I need this money there in two hours" situations, like closing on a house.

Some banks have different routing numbers for wires than they do for ACH. TD Bank generally keeps it simple for New York customers by using the same one for both, but it's always worth a quick double-check with the specific branch if you're moving a massive amount of money, like a down payment on a home.

The "Electronic" Routing Number Confusion

Sometimes a form asks for your "Electronic" routing number. This is just a fancy way of saying the ACH number. It’s the same TD routing number New York we already talked about.

📖 Related: Donald Trump Jr and Eric Trump: How the Brothers Actually Run the Family Empire

There's a lot of jargon in banking. Banks love jargon. It makes things sound more complicated than they are. But at the end of the day, these nine digits are just a routing protocol.

Why Does TD Have So Many Different Numbers?

If you search for TD routing numbers, you'll see a long list. Maine, Massachusetts, Pennsylvania... the list goes on. This happens because TD is "America's Most Convenient Bank," but it’s also a collection of many older banks.

When TD buys a bank in a new state, they often inherit that bank's existing routing numbers to avoid making every single customer order new checks. Over time, they consolidate them. For New York, the system is pretty streamlined now, but the ghosts of banks past still haunt the digital ledgers.

Security and Your Routing Number

Is it a secret? Not really. Your routing number is public information. Anyone can find it online. Your account number, however, is the one you need to guard with your life.

If someone has both, they can technically initiate an ACH pull from your account. That’s how you pay your phone bill, right? You give them both numbers. So, while you don't need to hide your routing number, you should definitely be careful about who sees the two of them together.

How to Double Check Right Now

If you're skeptical—and you should be when it comes to money—there are three "official" ways to confirm your specific number:

✨ Don't miss: The Jaffe Family Texas Net Worth: How One San Antonio Dynasty Built a Fortune

- The App: Log in, tap your account, and look for "Account Info" or the little "i" icon.

- Online Banking: Same deal, usually found under "Account Details."

- The Official TD Website: They have a routing number locator tool where you select your state.

Don't rely on third-party "routing number databases" if you can help it. They aren't always updated. Banks merge. Numbers change. It’s rare, but it happens.

Moving Money Between States

Say you opened your account in New York City, but now you live in New Jersey. Which routing number do you use?

You stick with the New York one.

Your routing number is tied to the location where the account was opened, not where you currently live. This trips up a lot of people who move for work. If you opened that account at the branch on 5th Ave, you are a New York account holder for life—or at least until you close that specific account and open a new one in a different state.

What Happens if You Get It Wrong?

Usually, the transaction just fails. The bank receiving the request will see the number, realize it doesn't match their records for that account holder, and send it back.

The real pain is the timing. It can take 3 to 5 business days for a "bounce-back" to process. If that was your mortgage payment, you're now looking at late fees. If it was your paycheck, you’re eating ramen for a week while the HR department tries to figure out why the payment didn't go through.

Actionable Steps for Success

Avoid the drama. Do these things before you hit "submit" on that direct deposit form:

- Verify the state of origin: Make 100% sure you opened the account in New York. If you opened it online, it usually defaults to the state of your home address at the time.

- Copy-paste, don't type: If you're using a mobile app, copy the number directly to avoid "fat-finger" typos.

- Check the "Wire" vs "ACH" requirement: If the form specifically asks for a "Wire Routing Number," ensure the recipient bank doesn't require a special code (though for TD NY, it's usually the same).

- Keep a voided check handy: Or at least a digital photo of one. It’s the ultimate source of truth for your specific account.

Banking doesn't have to be a headache. Just get that nine-digit string right, and the rest of the plumbing usually takes care of itself. If you're ever in doubt, just walk into a branch. New York has plenty of them. They can print out a direct deposit form for you in about thirty seconds that has all the numbers pre-filled. It’s the safest way to go if you're dealing with a lot of zeros.