You're standing in line at a bodega or sitting at your desk in Midtown, and you realize you need your TD Bank routing New York number. It’s one of those things you never think about until a HR manager stares at you expectantly or a closing attorney sends a frantic email about a wire transfer. Most people assume there's just one number for the whole country. Honestly, that’s a mistake that can lead to rejected payments or, worse, your money floating in some digital purgatory for three business days.

Banks are weirdly regional. Even though TD Bank brands itself as "America’s Most Convenient Bank," it operates on a legacy system of mergers and acquisitions. That means the routing number you use in Manhattan or Buffalo might not be the same one your cousin uses in New Jersey.

The Numbers You Actually Need

If you are looking for the standard electronic routing number for TD Bank in New York, it is 026013673.

This nine-digit string is the "Address" for your money. It tells the Federal Reserve exactly where to send that direct deposit or that Venmo cash-out. But wait. There is a catch. If you are doing a wire transfer—which is totally different from a standard ACH transfer—you might need to look closer at your specific account paperwork. For the vast majority of people setting up a paycheck or paying a utility bill online, 026013673 is the golden ticket.

Why does New York have its own? It’s basically history. TD Bank grew by gobbling up smaller banks like Commerce Bank and Riverside National. Each of those old banks had their own "transit" numbers. Over time, TD consolidated them, but they kept the regional distinctions to keep the plumbing of the financial system from leaking.

ACH vs. Wire Transfers: Don't Mix Them Up

People use "wire" and "transfer" like they’re the same thing. They aren't. Not even close. If you give a title company your ACH routing number for a house down payment, the transaction will likely fail.

💡 You might also like: Fast Food Restaurants Logo: Why You Crave Burgers Based on a Color

- ACH (Automated Clearing House): This is for your Netflix subscription, your paycheck, and moving money between your own apps. Use the standard NY routing number here.

- Domestic Wires: This is for large, immediate transfers. TD Bank often uses a specific domestic wire routing number which, for the New York region, is usually the same 026013673, but you should always double-check the "Wire Transfer" section of the TD mobile app to be certain.

- International Wires: This is a whole different beast. You’ll need a SWIFT code (often TDBKUS33 for TD) and potentially a specific intermediary bank.

I once saw a guy try to wire money to a landlord in Queens using a routing number he found on a random, outdated blog. The money didn't vanish, but it took five days to "bounce back" to his account, and he got hit with a $30 fee. TD is pretty strict about these digits.

Where to Find Your Specific Number if You’re Paranoid

If you don't trust a random article—which, fair enough, it's your money—there are three foolproof ways to verify your TD Bank routing New York details.

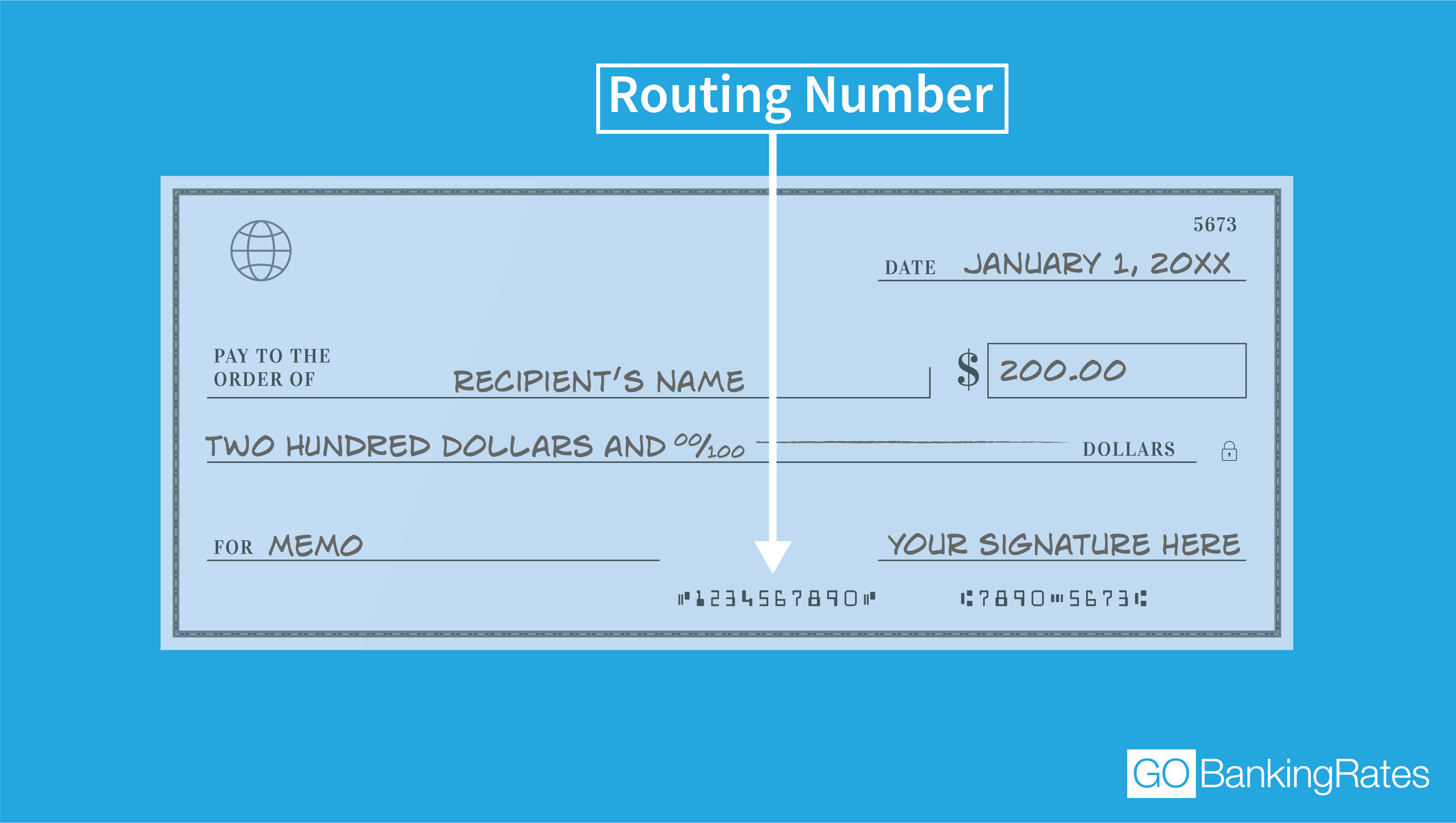

First, look at a physical check. If you still have those paper things in a drawer somewhere, look at the bottom left corner. There will be three sets of numbers. The first set is your routing number. The second set is your account number. The third is the check number.

Second, the app. If you log into the TD Bank mobile app and click on your specific account (like "Convenience Checking"), there’s usually an "Account Info" or "Details" tab. It’ll show you the routing number assigned to that specific account. This is the most accurate method because it accounts for where you actually opened the account.

Third, the website. You can go to the TD Bank official routing number page. They have a dropdown menu. You select "New York," and it spits out the number.

📖 Related: Exchange rate of dollar to uganda shillings: What Most People Get Wrong

The "I Moved From Jersey" Problem

Here is a scenario that happens all the time in the tri-state area. You lived in Hoboken, opened a TD account, and then moved to Brooklyn. You’re now a New Yorker. You feel like a New Yorker. But your bank account is still a "New Jersey account" in the eyes of the Federal Reserve.

In this case, you do not use the New York routing number.

You must use the routing number for the state where the account was originally opened. Your account doesn't "migrate" just because you started using a branch on 14th Street. If you use the New York number for an account opened in New Jersey, the system might flag it as "Account Not Found." It’s annoying, but that’s how the legacy banking grid operates.

Is TD Bank Actually "Convenient" in New York?

Since you're looking for routing info, you're likely already a customer or about to be one. TD has a massive footprint in NYC. They’re the ones with the green signs that stay open until 7:00 PM when Chase and Citi have already locked their doors.

They have over 150 branches in the New York metro area alone. From the tip of Manhattan to the deep reaches of Staten Island, you can find a TD. But keep in mind, their "New York" region actually covers a lot of ground. Whether you’re in Albany, Rochester, or The Bronx, that 026013673 number is generally your primary point of contact for the banking system.

👉 See also: Enterprise Products Partners Stock Price: Why High Yield Seekers Are Bracing for 2026

Troubleshooting Common Errors

Sometimes you enter the number and the website says "Invalid Routing Number." This usually happens for a few reasons:

- Typos: It’s nine digits. It is incredibly easy to swap a 6 for a 3.

- Wrong Type: You're trying to use a Canadian TD routing number for a US account (or vice versa). TD Canada and TD Bank N.A. are technically separate entities.

- Browser Autofill: Sometimes Chrome tries to be helpful and fills in an old routing number from a bank you closed three years ago.

If you’re doing a "Direct Deposit" for a new job, most HR software like Workday or ADP will automatically recognize "TD Bank" as soon as you type those first few digits. If it doesn't pop up, stop. Don't just force it. Re-verify your digits.

What to Do Next

Don't just memorize the number and move on. Do these three things to make sure your finances are actually set up correctly in the Empire State:

Verify your "Home Branch" location. Check your original account opening documents or the mobile app to see if your account is technically a New York, New Jersey, or Connecticut account. This determines which routing number you use forever—unless you close the account and open a new one.

Update your direct deposit.

If you've just moved to NY and opened a new account, give your employer the 026013673 number immediately. It usually takes one to two pay cycles for the change to kick in, so don't close your old bank account until you see the money land in your TD New York account.

Set up "Account Alerts."

Since you’re dealing with transfers, turn on notifications for "Large Transfers" in the TD app. If a wire goes out or a large ACH hits using your routing number, you’ll get a text immediately. It's the best defense against fraud.

The TD Bank routing New York system is built on old-school banking rules masked by a modern green logo. As long as you know where your account was "born" and you distinguish between a simple transfer and a formal wire, your money will get where it needs to go without the headache of a "Return to Sender" notification.