You finally landed the job or switched your primary checking account. Now comes the paperwork. Getting your money where it needs to go shouldn't feel like a chore, but honestly, if you mess up a single digit on that td bank direct deposit form, your paycheck might end up in a digital void for days. It happens.

Direct deposit is basically just an electronic transfer of funds from a payer—usually your employer or the government—straight into your TD Bank account. No paper checks. No waiting for the mail. No standing in line at the branch on a Friday afternoon when you’d rather be literally anywhere else. It uses the Automated Clearing House (ACH) network to move the cash.

Most people think they need to go into a branch to get this started. You don’t.

Where to Find Your TD Bank Direct Deposit Form Right Now

Stop looking for a physical pad of paper. If you have the TD Bank mobile app or access to a laptop, you're halfway there. The easiest way to grab your specific form—pre-filled with your routing and account numbers—is through the TD Bank Online Banking portal.

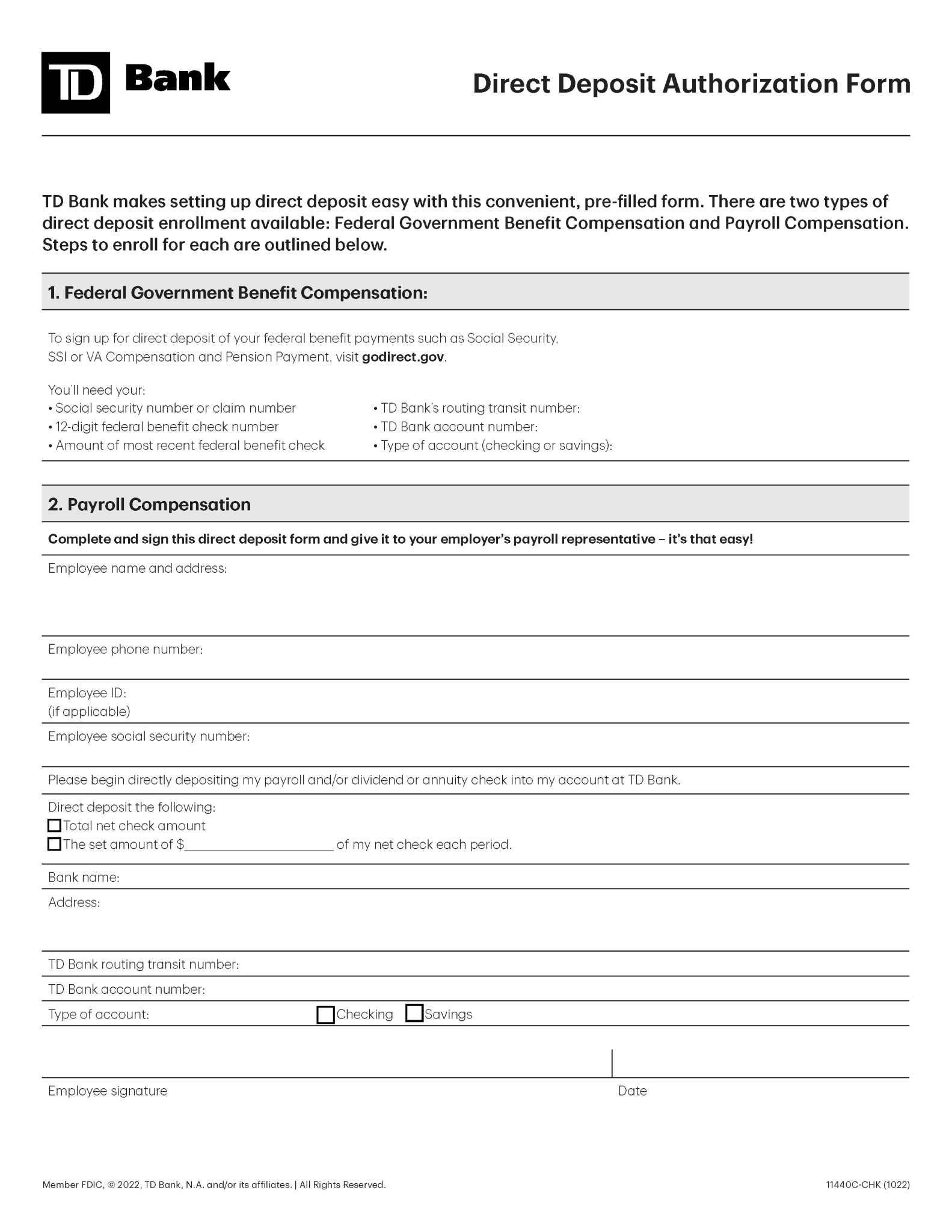

Log in. Click on your specific checking or savings account. Look for "Account Details" or a tab labeled "Direct Deposit." Usually, there’s a "Print Direct Deposit Form" link that generates a PDF. This is the gold standard because it eliminates the risk of you accidentally swapping a 6 for a 0 when writing it out by hand.

If you aren't enrolled in online banking, you can use a generic TD Bank direct deposit form, which is basically a template where you fill in the blanks. Just make sure you’re looking at the right one for your region. TD Bank operates in different states, and while the routing numbers are generally consistent across the "TD Bank, N.A." umbrella, double-checking never hurts.

The Three Pieces of Info You Absolutely Cannot Mess Up

Accuracy matters.

- The Routing Number. This is a nine-digit code that identifies TD Bank. It's like an address for the bank itself. Interestingly, TD Bank has different routing numbers depending on where you opened your account. An account opened in New Jersey might have a different routing number than one opened in Florida.

- Your Account Number. This is your specific "mailbox" at the bank. It's usually between 10 and 12 digits.

- Account Type. Checking or Savings? If you tell your employer it's a checking account but it's actually a Simple Savings account, the transfer might bounce.

How to read a check for these numbers

If you still have a physical checkbook (I know, they feel like relics), look at the bottom. The first nine digits on the left are the routing number. The middle set of numbers is your account number. Don't include the check number, which is usually the short set of digits on the far right.

🔗 Read more: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

Why Some Deposits Take Longer Than Others

Standard ACH transfers usually take 1 to 3 business days. However, TD Bank is known for its "Fast Funds" or early direct deposit features on certain account types. If your employer submits payroll early, TD might credit your account up to two days before the official "payday."

But there’s a catch.

If you submit your td bank direct deposit form on a Thursday, don't expect your Friday paycheck to magically appear in your account. Most HR departments need one or two full pay cycles to process the change. You might get one more paper check before the electronic system kicks in. Don't throw away that paper check.

Setting Up Government Benefits (SSA, VA, etc.)

If you’re trying to get Social Security or VA benefits sent to TD Bank, the process is slightly different. You can still use the information from your TD Bank direct deposit form, but you usually have to initiate the change through the government’s portal, like my Social Security.

You’ll need:

- Your 12-digit Social Security claim number.

- The "Type of Payment" (e.g., Social Security, SSI).

- The Routing and Account numbers we talked about.

It's a bit more bureaucratic. The federal government is famously slow. If you’re changing where your benefits go, keep your old account open until you see the first deposit hit your TD Bank account. Seriously. You don't want your rent money stuck in the "processing" phase between two banks.

Common Mistakes People Make with the Form

I've seen people try to use their debit card number instead of their account number.

💡 You might also like: Private Credit News Today: Why the Golden Age is Getting a Reality Check

Don't do that. Your 16-digit debit card number has nothing to do with your ACH account number. If you put that on the form, the transaction will fail.

Another weird one? Using the "Wire Transfer" routing number for a direct deposit. TD Bank, like many large institutions, often has a separate routing number for domestic wire transfers and international wires. For a standard paycheck, you want the Electronic/ACH routing number. Using the wire number can result in fees or the deposit being rejected entirely.

The "Voided Check" Requirement

Some old-school employers still ask for a voided check along with the td bank direct deposit form. This is just a security measure so they can verify the numbers. If you don't have checks, don't panic. You can print an "Account Verification Letter" from the TD app or ask a teller for one. It serves the exact same purpose. Just write "VOID" in big letters across a check if you have one, ensuring you don't cover the numbers at the bottom.

What to Do if the Money Doesn't Show Up

If it's 9:00 AM on payday and your balance is $0.00, don't freak out.

First, check the "Pending" section of your transactions. Sometimes the bank has the money, but it hasn't "cleared" for you to spend yet. Usually, direct deposits hit between midnight and 6:00 AM.

Second, talk to your payroll department. 90% of the time, the delay is on the employer's end. They might have missed the submission deadline. If HR says the money was sent, ask for the ACH Trace Number. You can give this number to TD Bank customer service, and they can track down exactly where that money is in the system.

Actionable Steps to Get Started

Go to the TD Bank website and download the PDF. It's cleaner than scribbling on a piece of paper. If you're on your phone, open the app, tap your account, and look for the direct deposit info.

📖 Related: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

Double-check your routing number against the official TD Bank list for your state. If you opened your account online, your routing number is usually tied to the state you lived in when you applied.

Fill out the form and email it—or better yet, upload it to your company’s secure HR portal. Avoid sending your bank details via unencrypted email if you can help it. Identity theft is a nightmare you don't want.

Once submitted, keep an eye on your account for a "pre-note." This is a $0.00 transaction banks use to test if the connection works. If you see that, you're golden. Your next paycheck should be right on time.

Check your TD Bank account settings for "Alerts." You can set it up so your phone pings you the second a deposit over a certain amount hits. It’s a great way to know you’re getting paid without constantly refreshing your balance.

Make sure your name on the bank account matches the name on your payroll. If you’re "Jonathan" at work but "Jon" at the bank, most systems are smart enough to figure it out, but if the names are significantly different—like a maiden name vs. a married name—the bank might flag it for manual review. Keep it consistent.

If you have multiple accounts, consider "Split Deposit." You can tell your employer to send 80% to checking and 20% to your TD Simple Savings. It’s the easiest way to save money because you never see it hit your spending account. Most TD Bank direct deposit forms have a section for "Partial Deposits" for this exact reason.