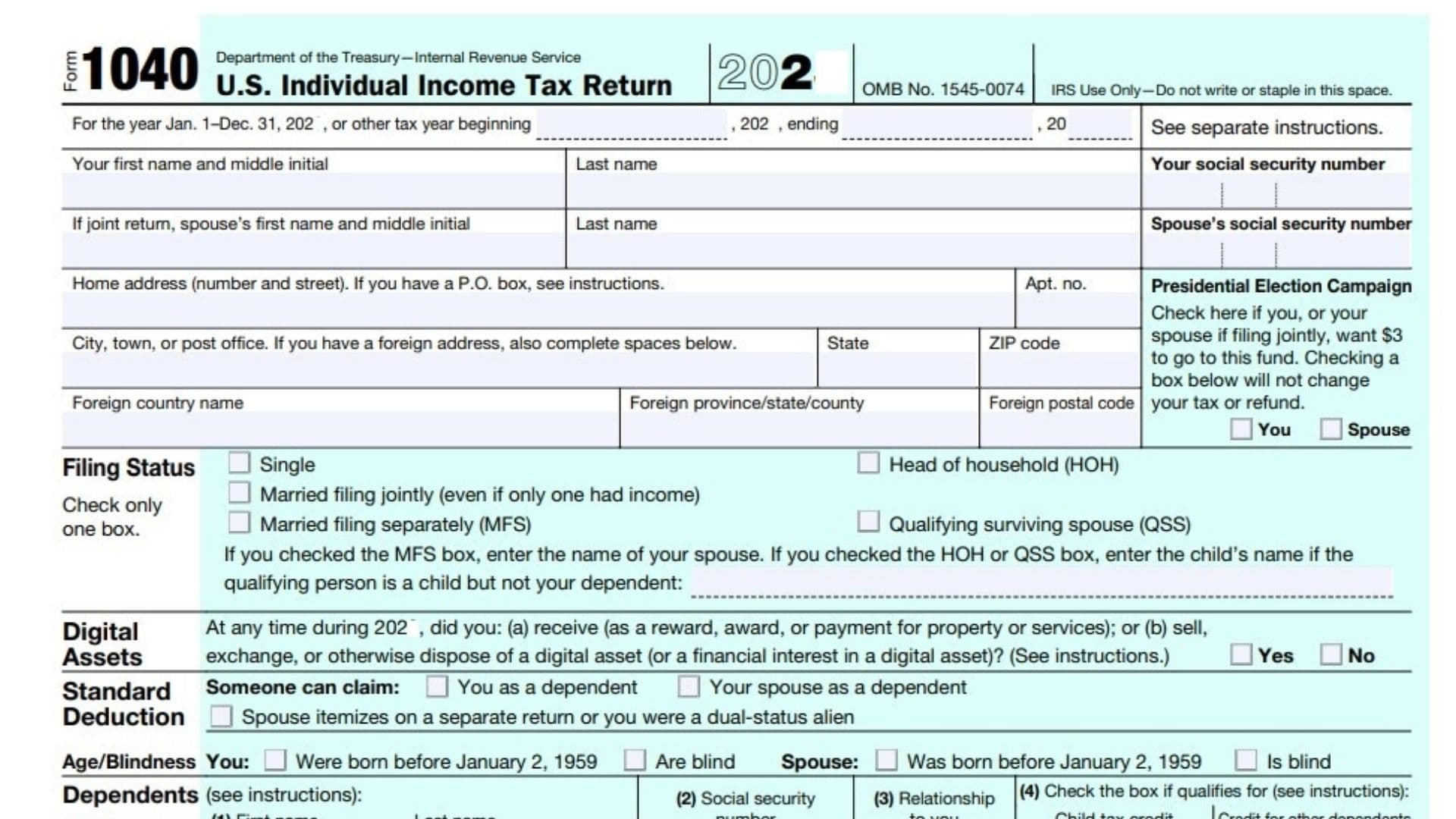

Tax season usually feels like a looming shadow. It’s that time of year when everyone starts frantically searching for their W-2s and wondering if they can deduct that ergonomic chair they bought last July. Honestly, looking at the tax instructions for 1040 is enough to make anyone’s head spin. The IRS isn't exactly known for breezy prose. Form 1040 is the "U.S. Individual Income Tax Return," and while it looks like a simple two-page document, the instructions manual for it is often over 100 pages long. That’s a lot of fine print for something that dictates your financial life.

Most people just click through a software program and hope for the best. But software is only as good as the data you give it. If you don't understand the logic behind the tax instructions for 1040, you’re probably leaving money on the table or, worse, inviting an unwanted letter from the IRS.

📖 Related: Chinese Currency Explained (Simply): Why It Has Two Different Names

The Standard Deduction vs. Itemizing: The Big Fork in the Road

One of the first things you’ll encounter in the tax instructions for 1040 is the choice between the standard deduction and itemizing. It's a binary choice. You can't have both. For 2025 (the taxes you’re filing in early 2026), the standard deduction has been adjusted for inflation again. For single filers, it's $15,000. For married couples filing jointly, it’s $30,000.

Most people—roughly 90% of taxpayers—take the standard deduction because it's easy. It’s a flat "no questions asked" discount on your taxable income. But if you’re a homeowner in a high-tax state like New Jersey or California, or if you had massive medical expenses that exceeded 7.5% of your adjusted gross income, you might be better off itemizing on Schedule A. You have to do the math. Every single time.

The IRS instructions explicitly state that medical expenses must be "unreimbursed." If your insurance paid for it, you can't claim it. This sounds obvious, but people mess it up constantly. I’ve seen folks try to deduct the full cost of a surgery when they only paid a $500 deductible. That’s a fast track to an audit.

Income Isn't Just Your Salary

When you're looking at the income section of the tax instructions for 1040, you’ll see lines for wages, tips, and salaries. That’s the easy part. But then there’s Line 8: "Other income." This is where things get weird. Basically, the IRS wants a cut of everything. If you won $600 at a casino, you’re supposed to report it. If you sold a vintage watch on eBay for a significant profit, that’s a capital gain.

✨ Don't miss: Dollar vs Egyptian Pound: What Most People Get Wrong

The Crypto Conundrum

The IRS has been obsessed with digital assets lately. Right at the top of Form 1040, there’s a question asking if you received, sold, exchanged, or otherwise disposed of any digital assets. You cannot lie about this. The IRS has been winning "John Doe" summons against major exchanges like Coinbase and Kraken to get user data.

If you just bought Bitcoin and held it (HODL), you check "No." But if you swapped ETH for a different token or bought an NFT, that’s a taxable event. The tax instructions for 1040 make it clear that you need to calculate the fair market value at the time of the trade. It's a bookkeeping nightmare if you're an active trader.

Credits vs. Deductions: Why One Is Way Better

People use these terms interchangeably. They shouldn't. A deduction lowers the amount of income you're taxed on. A credit lowers your actual tax bill dollar-for-dollar.

Take the Child Tax Credit. For many, it's worth up to $2,000 per qualifying child. If you owe $3,000 in taxes and you have one child, your bill drops to $1,000. Simple. But the tax instructions for 1040 specify that the child must be under age 17 at the end of the year. If your kid turned 17 on December 31st, you’re out of luck for the full credit, though you might still qualify for the $500 Credit for Other Dependents.

The Earned Income Tax Credit (EITC) is another big one. It’s "refundable," which is tax-speak for "the government might actually send you a check even if you didn't owe any taxes." However, the EITC is one of the most common areas for errors. The IRS spends a massive amount of its enforcement budget checking these claims because the rules regarding "qualifying children" and residency are incredibly pedantic.

Common Blunders in the Tax Instructions for 1040

You'd be surprised how many people forget to sign the return. If you file a paper return and forget the signature, it’s not valid. It's like it never happened.

Then there’s the Social Security number mismatch. If you recently got married and changed your name but didn't update the Social Security Administration, the IRS computers will kick your return back. They check the name on the 1040 against the SSA database. If it doesn't match, the refund gets frozen.

The Home Office Deduction Myth

A lot of people think that because they worked from home a few days a week, they can take the home office deduction. If you are a W-2 employee, you generally cannot deduct home office expenses. That ship sailed with the Tax Cuts and Jobs Act of 2017. Only self-employed individuals and 1099 contractors can claim this on Schedule C. And even then, the space must be used "regularly and exclusively" for business. Using your kitchen table doesn't count if you also eat dinner there.

Dealing with Form 1099-K

Starting recently, the threshold for 1099-K reporting has been in flux. If you use Venmo, PayPal, or Zelle for a side hustle, you might get one of these forms if you earned over a certain threshold. The tax instructions for 1040 are very specific here: just because you got a 1099-K for a personal reimbursement (like your friend paying you back for pizza) doesn't mean it’s taxable income. But you have to show the IRS that it was a personal transaction so they don't think you're hiding business revenue.

🔗 Read more: Braeburn Alloy Steel Division: The Legacy and Reality of High-Speed Tool Steel

Actionable Next Steps for Filing

Don't wait until April 14th. The stress leads to typos.

First, gather every single piece of paper that says "Important Tax Document." This includes W-2s, 1099-INTs for that $12 in interest from your savings account, and 1098-T forms if you paid tuition.

Second, decide if you're going to use the Free File program. If your Adjusted Gross Income (AGI) is $79,000 or less, you can use brand-name software for free through the IRS website. It’s a resource people ignore far too often.

Third, look at your retirement contributions. You often have until the filing deadline to contribute to a traditional IRA and have it count for the previous tax year. This is one of the few ways to lower your tax bill after the year has already ended.

Finally, double-check your bank routing and account numbers. If you’re due a refund, direct deposit is the only way to go. Paper checks are slow and prone to getting lost in the mail or stolen. If you've moved, make sure the IRS has your current address by filing Form 8822. It’s a small detail that saves weeks of headache.

Check your math one last time. Or let the computer do it. But remember, the computer doesn't know if you're eligible for a "Head of Household" filing status—only you know your life situation. Read the tax instructions for 1040 regarding filing status carefully, as "Head of Household" offers a much larger standard deduction than "Single," but the residency requirements for your dependents are strict. Accuracy here is the difference between a smooth refund and a multi-month delay.