If you’re sitting in Florida right now, looking at a stack of receipts and wondering when the IRS is going to come knocking, you aren't alone. Honestly, it’s a bit of a mess this year. Usually, we all just circle April 15 on the calendar and call it a day, but the tax deadline 2025 Florida situation has been anything but "usual."

Between massive hurricanes and specific state-level quirks, the dates you see on national news might not actually apply to you.

Basically, the IRS shifted the goalposts for the entire state. If you live anywhere from the Panhandle down to the Keys, your federal filing world looks very different than someone living in, say, Ohio or Idaho. You’ve probably heard whispers of a May extension, and for once, the rumors are actually true.

The Big Shift: The IRS May 1 Extension Explained

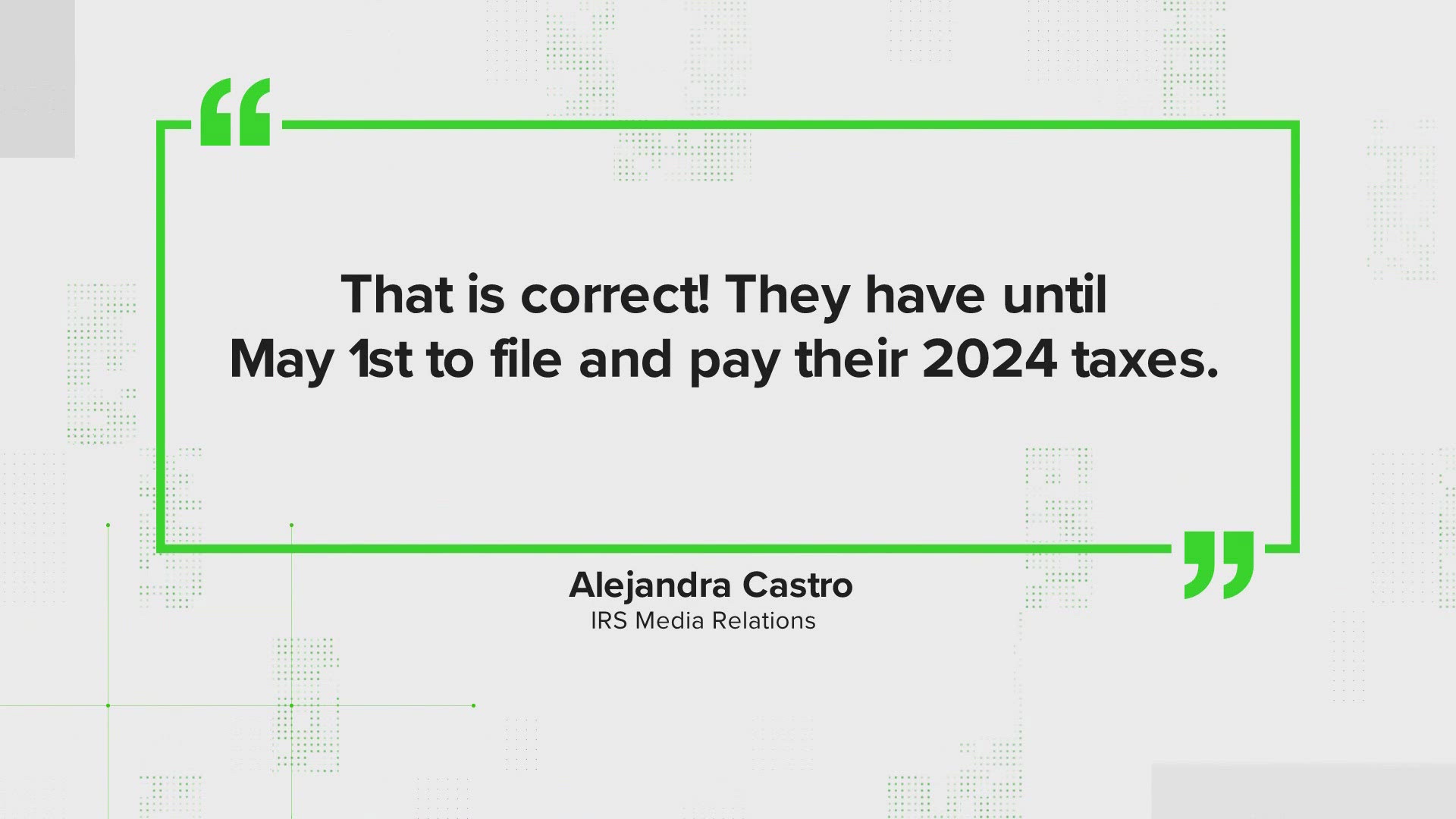

Let's cut to the chase. The IRS officially pushed the federal income tax filing and payment deadline to May 1, 2025, for the entire state of Florida. This wasn't just a random act of kindness. It was a direct response to the absolute havoc wreaked by Hurricanes Debby, Helene, and Milton.

Because those storms hit so close together, the federal government decided to blanket the whole state with relief.

This means your 2024 individual income tax returns—the ones normally due in mid-April—get a few extra weeks of breathing room. It’s a rare win. But don't get too comfortable. This extension also covers those annoying quarterly estimated tax payments that were originally due on January 15, 2025, and April 15, 2025.

💡 You might also like: North Myrtle Beach Fires: Why the Grand Strand is Burning More Than You Think

If you're self-employed, this is huge.

You can basically bundle those payments and get them in by May 1 without the IRS hitting you with a late-payment penalty. Just remember, this is an automatic thing. You don’t need to call anyone or mail in a special "please forgive me" form. If your address on file is in Florida, the IRS systems should already know you’re part of the disaster relief group.

Who actually qualifies?

It’s simple. If you live in Florida or have a business based here, you're in.

- Individuals filing 1040s.

- C-corporations.

- Trusts and estates.

- Tax-exempt organizations.

Even if you’re a Floridian who was working out of state when the storms hit, as long as your "tax home" is in the Sunshine State, that May 1 date is yours.

What Most People Get Wrong About Florida Taxes

Here is the thing: Florida has no state income tax. We love to brag about it. But that doesn’t mean we don’t have state-level deadlines that can ruin your week if you miss them. People often conflate "no income tax" with "no tax deadlines," and that’s a dangerous game to play with the Florida Department of Revenue (DOR).

Specifically, if you own a business, you're still on the hook for Sales and Use tax.

The DOR is surprisingly strict. They don’t always mirror the IRS disaster extensions unless specifically announced. For 2025, the state actually launched a brand new eFile and Pay system in December. If you’re used to the old portal, forget it. It’s gone.

The Property Tax Trap

Property taxes in Florida are another beast entirely. These aren't handled by the IRS or the state DOR—they’re managed by your local County Tax Collector.

✨ Don't miss: The Meaning of Holocaust: Why a Single Definition Is Not Enough

The "deadline" for property taxes is technically March 31, 2025.

But if you wait until March 31, you're actually losing money. Florida has this unique "early bird" discount system that most newcomers don't realize exists. If you paid back in November, you got 4% off. December was 3%. By the time January 2025 rolled around, the discount dropped to 2%.

In February? Just 1%.

If you’re reading this in March, you're paying the full "gross" amount. And if you wait until April 1, 2025? You’re officially delinquent. At that point, the tax collector starts adding a 3% penalty and advertising your debt for a tax certificate sale. It gets expensive fast.

Tangible Personal Property (TPP) Deadlines

If you own a business or a rental property (like an Airbnb), you have to file a Tangible Personal Property return. This is basically a list of all the stuff you own that isn't the land or the building—think furniture, computers, and heavy machinery.

The deadline for TPP returns in Florida is April 1, 2025.

Unlike the federal income tax, this one rarely moves. If you miss it, the property appraiser can slap you with a 25% penalty. That is a massive hit just for being late with a piece of paper. Most people forget this because they focus entirely on the tax deadline 2025 Florida for their income, but the TPP is where the local government really keeps tabs on small business owners.

Actionable Steps for the 2025 Filing Season

Don't wait until the last minute just because you have until May. That's a recipe for disaster. Here is exactly what you should be doing right now to stay ahead of the game:

Verify Your IRS Status

Double-check that the IRS has your current Florida address. If you recently moved from out of state and haven't filed a 2024 return yet, they might still think you’re in New York or California. You can update your address using Form 8822.

Handle Property Taxes Immediately

If you haven't paid your 2024 property taxes (due by March 31, 2025), do it today. Even a 1% discount in February is better than a 3% penalty in April. Check your specific County Tax Collector’s website—places like Miami-Dade, Orange, and Hillsborough all have slightly different online portals.

Gather Disaster Documentation

Since the extension is due to hurricanes, keep records of any losses. You might be able to claim "casualty loss" deductions on your federal return. This is complex and usually requires professional help, but it can significantly lower your tax bill if your home or business was damaged.

Mark the TPP Deadline

If you have a side hustle or a rental, get that Tangible Personal Property return to the county appraiser by April 1. Use the Florida DOR Form DR-405. It’s tedious, but the 25% penalty for missing it is much worse.

Set Up the New State Portal

For business owners, make sure you've registered for the new "eFile and Pay" system that Florida rolled out. The old login credentials might work, but the interface is different. Don't try to learn a new software system on the night your sales tax is due.

The reality of the tax deadline 2025 Florida is that it’s a patchwork of different dates. You have the federal government giving you more time (May 1), the county government expecting their cut by March 31, and the state government watching your sales tax every single month. Stay organized, keep your receipts, and don't let the extra time from the IRS lure you into a false sense of security.