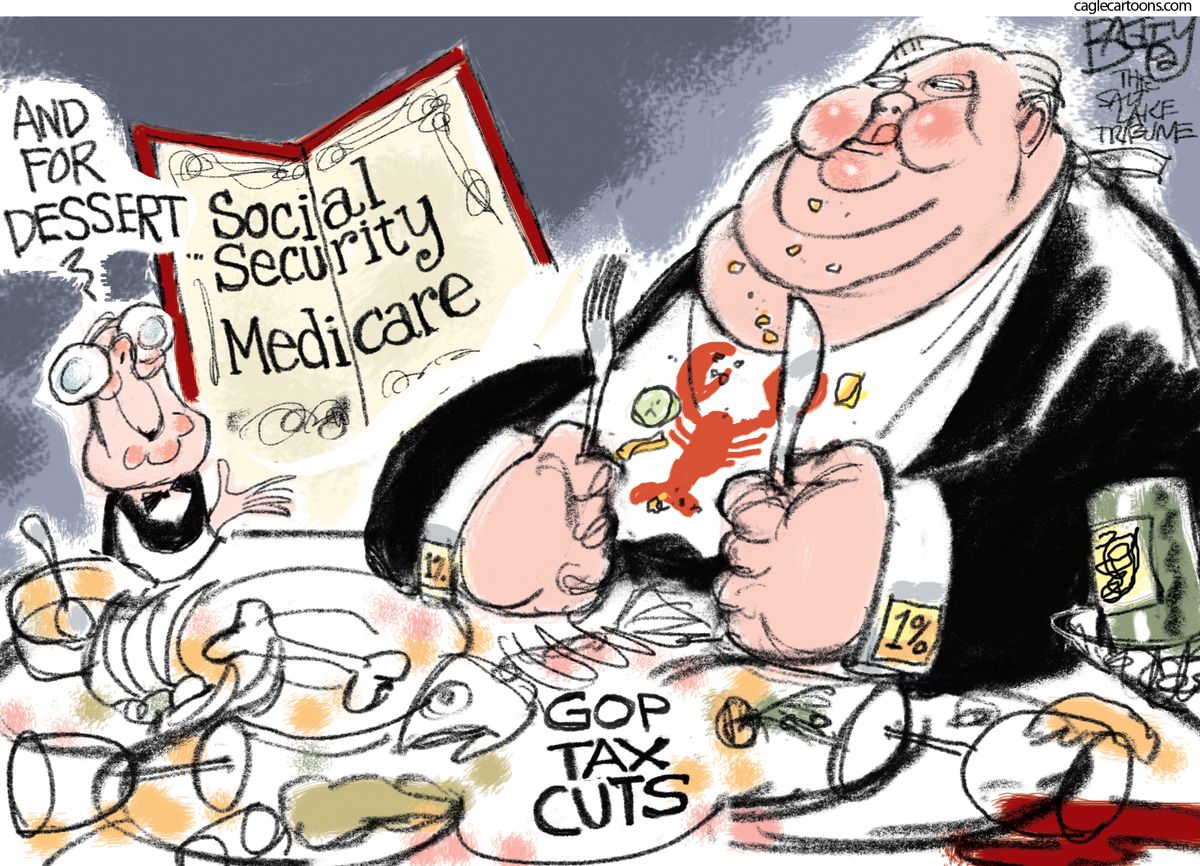

You’ve probably seen the headlines or heard the rumors at the dinner table. There’s a lot of noise about tax cuts on social security right now, and honestly, it’s getting confusing. Some people think the tax has vanished entirely. Others are terrified that a "stealth tax" is about to eat their cost-of-living adjustment.

The reality? It’s a bit of both, but not in the way you might think.

As we move through 2026, the landscape of retirement income has shifted because of the One Big Beautiful Bill Act (OBBBA). While the federal government didn't technically strike the "Social Security tax" law from the books, they did something else that basically accomplishes the same goal for millions of retirees. They introduced a massive new deduction.

The $6,000 "Senior Bonus" is the Real Story

If you're looking for a direct repeal of the 1983 Social Security tax rules, you won't find it yet. The "You Earned It, You Keep It Act"—which would actually delete those federal taxes—is still sitting in Congress as of early 2026.

But wait.

The OBBBA, signed back in July 2025, created something called the Senior Bonus Deduction. Starting with the tax returns you're filing right now in 2026, seniors aged 65 and older can claim an extra **$6,000 deduction** ($12,000 for married couples).

📖 Related: Timothy Sykes Net Worth: What Most People Get Wrong

Why does this matter? Because of how "combined income" works.

To determine if your benefits are taxed, the IRS uses a formula:

Adjusted Gross Income + Nontaxable Interest + 50% of your Social Security benefits.

If that number hits $25,000 for individuals or $32,000 for couples, you start losing money to the taxman. By adding a massive $6,000 (or $12,000) deduction on top of the standard deduction, the government is essentially "shielding" that income. For about 88% of seniors, this new deduction is enough to wipe out their federal tax liability on Social Security entirely.

It’s a tax cut without calling it a tax cut.

The COLA Catch-22

Here is where things get tricky. In January 2026, Social Security recipients saw a 2.8% Cost-of-Living Adjustment (COLA). On paper, that’s great. More money in the bank.

But there’s a side effect.

Because the income thresholds for taxing Social Security benefits ($25k and $32k) are not indexed for inflation—and haven’t been since the 80s—every time you get a raise, you get closer to the "tax hump."

- Example: A retired couple in Florida gets a 2.8% bump.

- That extra $800 a year might push their "combined income" from $31,500 to $32,300.

- Suddenly, they owe tax on 50% of their benefits for the first time.

This is why the tax cuts on social security discussion is so heated. Even with the new $6,000 deduction, the underlying thresholds are still stuck in 1983. It’s like trying to fit 2026 groceries into a 1983 budget. It doesn't work.

What’s Happening at the State Level?

While Washington bickers, the states are actually moving faster. As of 2026, only nine states still tax Social Security benefits.

West Virginia officially finished its phase-out this year. If you live in Charleston, you're done. Your benefits are fully exempt on the state return you file in 2027.

In contrast, states like Minnesota and Utah still have some skin in the game, though they’ve expanded their own credits to mirror the federal relief. If you’re living in one of the 41 states that don't tax benefits, your only worry is the IRS.

The States Still Taxing Benefits in 2026:

- Colorado: Offers a full subtraction for those 65+.

- Connecticut: Exempts benefits for those under certain AGI limits ($75k/$100k).

- Minnesota: Recently increased their subtraction limits, but high earners still pay.

- Montana: Uses a complex formula, though relief is increasing.

- New Mexico: Offers exemptions for low-to-middle income earners.

- Rhode Island: Taxable only if you haven't reached Full Retirement Age (FRA).

- Utah: Provides a tax credit that gradually phases out.

- Vermont: Exempts benefits for joint filers under $65,000.

- New Jersey: Wait—actually, New Jersey is largely exempt now for most, but keep an eye on those specific "other income" limits.

How to Keep More of Your Check

Let's talk strategy. If you’re worried about the tax cuts on social security not covering your specific situation, you have tools.

Managing your "combined income" is the name of the game.

Watch your Roth conversions. If you're doing Roth conversions in 2026 to avoid future taxes, remember that the converted amount counts as income now. This could accidentally trigger a tax on your Social Security benefits this year.

✨ Don't miss: Country Is Countrywide: Why Local Marketing is Dying in 2026

The QCD trick. If you’re over 70½, use Qualified Charitable Distributions. You can send up to $100,000 directly from your IRA to a charity. This money never touches your AGI, which means it doesn't count toward the Social Security tax formula.

The $184,500 Cap. For those still working while collecting, the Social Security wage base has hit $184,500 for 2026. If you're a high earner, you're paying into the system on more of your income than last year.

Is the "Full Repeal" Coming?

Politics is messy. Senator Ruben Gallego and Representative Angie Craig are still pushing the "You Earned It, You Keep It Act."

The argument is simple: you paid into the system with post-tax dollars, so why tax the benefit?

The counter-argument is the "solvency" scare. Social Security trust funds are projected to hit a wall around 2033 or 2034. Taxing benefits brings in billions that keep the lights on. The Gallego bill proposes fixing this by taxing wages above $250,000—eliminating the "cap" for the wealthy to pay for the tax cut for seniors.

Whether that passes in 2026 is anyone's guess. But for now, the OBBBA's Senior Bonus is the closest thing to a "win" most retirees have.

Actionable Steps for Your 2026 Taxes

- Check your MAGI. Calculate your "combined income" now, not in April. If you're hovering near the $25k or $32k line, consider reducing IRA withdrawals in favor of cash savings or Roth accounts.

- Claim the Bonus. Ensure your tax preparer (or software) is applying the new $6,000 Senior Bonus Deduction. It is stackable with the standard deduction.

- Adjust Withholding. If you find you do owe tax, don't wait for a surprise bill. Fill out IRS Form W-4V to have 7%, 10%, 12%, or 22% of your monthly benefit withheld.

- Review State Residency. If you’re in one of the nine states that still tax benefits, it might be time to look at the math of moving. A 5% state tax on a $30,000 benefit is $1,500 a year—that's a lot of groceries.

The system is complex, and "tax-free" isn't a reality for everyone yet. But with the 2026 rules, more people are keeping more of their checks than they have in decades. Just make sure you're not the one who misses the deduction because you didn't know it existed.