You’ve probably seen the headlines. They’re kind of everywhere lately. Talk of a 100% tax on movies made outside the United States has sent shockwaves from Hollywood to London and all the way to the soundstages of Sydney. It sounds like a plot point from a political thriller, but for the global film industry, the anxiety is very real.

Honestly, the idea that a movie could be treated like a crate of bananas or a shipment of steel is a bit wild. Usually, when we talk about trade wars, we’re thinking about tangible goods—stuff you can drop on your foot. Movies? They’re basically just code and light. But as we move through 2026, the lines between "creative art" and "taxable commodity" are getting seriously blurred.

Why Everyone is Talking About Movie Tariffs Now

So, what’s actually happening?

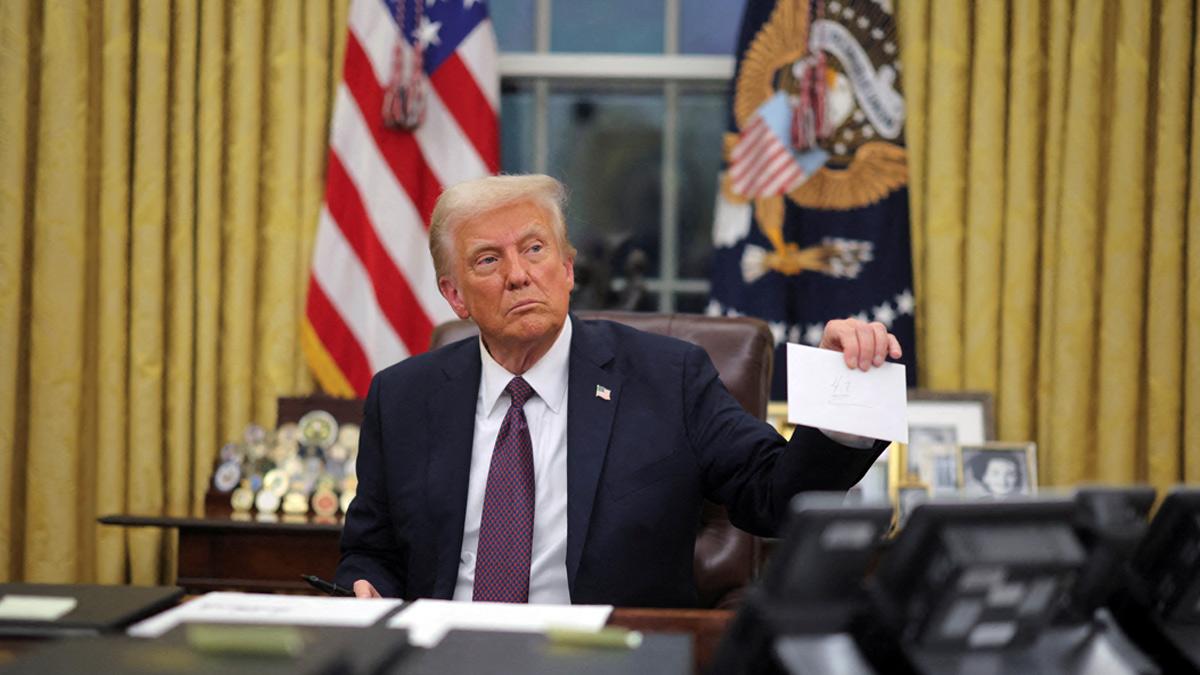

The conversation really kicked into high gear when President Trump doubled down on a plan to slap massive tariffs on any film production that happens outside U.S. borders. The logic is pretty straightforward, if a bit aggressive: he argues that American film jobs have been "stolen" by countries offering massive tax breaks.

Think about it. Why was the latest Marvel blockbuster filmed in the UK? Or why does "Vancouver" always seem to play "Seattle" in every TV show you watch? It’s because countries like Canada, the UK, and Australia offer rebates that can slash production costs by 30% or more.

The proposed tariffs on foreign-made movies are designed to be a giant "Stay at Home" sign for Hollywood studios. The goal is to make it so expensive to shoot abroad that Disney, Netflix, and Warner Bros. have no choice but to bring those jobs back to Georgia, New Mexico, or California.

The "What counts as foreign?" Nightmare

Here is where things get messy. Really messy.

Modern filmmaking is basically the definition of globalism. You might have an American director, a British lead actor, a French cinematographer, and a post-production team in India. If 40% of a movie is shot in Morocco but the money comes from a New York hedge fund, is that a "foreign" movie?

If the government goes through with a 100% tariff, how do they even define the "value" of the import?

- Is it based on the production budget?

- Is it the licensing fee a streaming service pays?

- Or is it 120% of the tax incentive the studio received from a foreign government?

There’s a real fear in the industry that these definitions could be arbitrary. One expert from the Tax Policy Center pointed out that determining the value of a film is a nightmare because, unlike a car, a movie’s value changes based on reviews, word-of-mouth, and even the weather on opening weekend.

The Digital Border Problem

We aren't in 1950 anymore. Movies don't usually arrive at the border in heavy metal canisters. They are transmitted digitally.

The World Trade Organization (WTO) has had a moratorium on customs duties for "electronic transmissions" since 1998. Basically, countries agreed not to tax data as it crosses the border. But that moratorium is set to expire in March 2026 unless it gets renewed in Cameroon this year.

If that deal falls apart, it’s "Wild West" time.

🔗 Read more: Pounds to Metric Tons: Why Most Cargo Math Goes Wrong

Without that international agreement, the U.S. (or any country) could theoretically try to tax every gigabyte of a foreign film as it’s uploaded to a server in Virginia. It sounds technically impossible to track, but several countries, including Indonesia, have already started creating tariff categories for "software and digital products."

Will Your Movie Tickets Actually Double?

This is the big question for anyone who just wants to go see Dune: Messiah without taking out a second mortgage.

If a studio has to pay a 100% tariff to bring a foreign-shot movie into the U.S., they aren't just going to eat that cost. They’re a business. They’ll pass it on. Analysts have warned that a $15 ticket could easily jump to $30 for any movie shot overseas.

But it's not just the price. It's the variety. If foreign indie films—the ones that win at Cannes or Sundance—suddenly face a massive tax just to be shown in an American theater, many distributors might just stop buying them. We could end up in a world where the only thing playing at your local cinema is "Safe, Domestic, and Domestic-only."

Retaliation is the Real "Golden Goose" Killer

Here’s the thing: The U.S. actually dominates the global film market. We export way more movies than we import. In 2024 alone, the U.S. had a surplus of over $37 billion in film and TV services.

👉 See also: Rite Aid Amboy Road: What’s Actually Happening with Your Local Pharmacy

If the U.S. starts taxing foreign movies, you can bet your last popcorn kernel that France, China, and the UK will hit back. They could put their own tariffs on foreign-made movies (meaning our movies), or they could bring back "screen quotas" that limit how many American films can even be shown in their theaters.

As Barry Appleton of the Center for International Law put it, we might be "cooking the golden goose." If we close our borders to their films, they’ll close theirs to ours—and Hollywood needs those international box office numbers to survive.

Practical Realities for the Industry

For people working in the industry, this isn't just a political debate. It’s a logistics puzzle that needs to be solved yesterday.

- Origin Tracking: Studios are already starting to treat "film origin" like food labels. They’re keeping meticulous records of exactly where every dollar is spent, just in case they have to prove a movie is "American enough" to avoid a tax.

- Location Shifts: We’re seeing a "wait and see" approach for big productions. Some movies that were supposed to shoot in Hungary or Australia are pausing to see if U.S. states will match those foreign tax credits.

- Legal Challenges: If the administration tries to use "National Security" laws (Section 232) to justify these tariffs, expect a mountain of lawsuits. It’s a stretch to argue that Paddington 3 being filmed in Peru is a threat to the safety of the United States.

What Happens Next?

The next few months are the "make or break" period. Between the Supreme Court ruling on the President's use of emergency tariff powers and the WTO meeting in March, the rules of the game are about to be rewritten.

If you’re a filmmaker or an investor, your best move right now is to diversify your production footprint. Don't put all your eggs in one "tax-incentive" basket overseas.

For the average moviegoer? Keep an eye on those ticket prices and the "filmed in" credits at the end of the movie. The era of cheap, globally-produced blockbusters might be coming to a very expensive end.

What you can do now:

- Audit your current productions: If you have projects filming abroad, consult with a trade attorney to see if your "substantial transformation" (post-production/editing) happens in the U.S., which could potentially lower your tariff risk.

- Watch the WTO Moratorium: Follow the news out of the Yaoundé meeting in March. If the moratorium on digital duties expires, every digital streaming platform will need to completely reconfigure their tax compliance software by summer.

- Check State Incentives: Look into the new, beefed-up tax credits in states like California and Georgia. They’re being designed specifically to compete with foreign markets as a "tariff-proof" alternative.