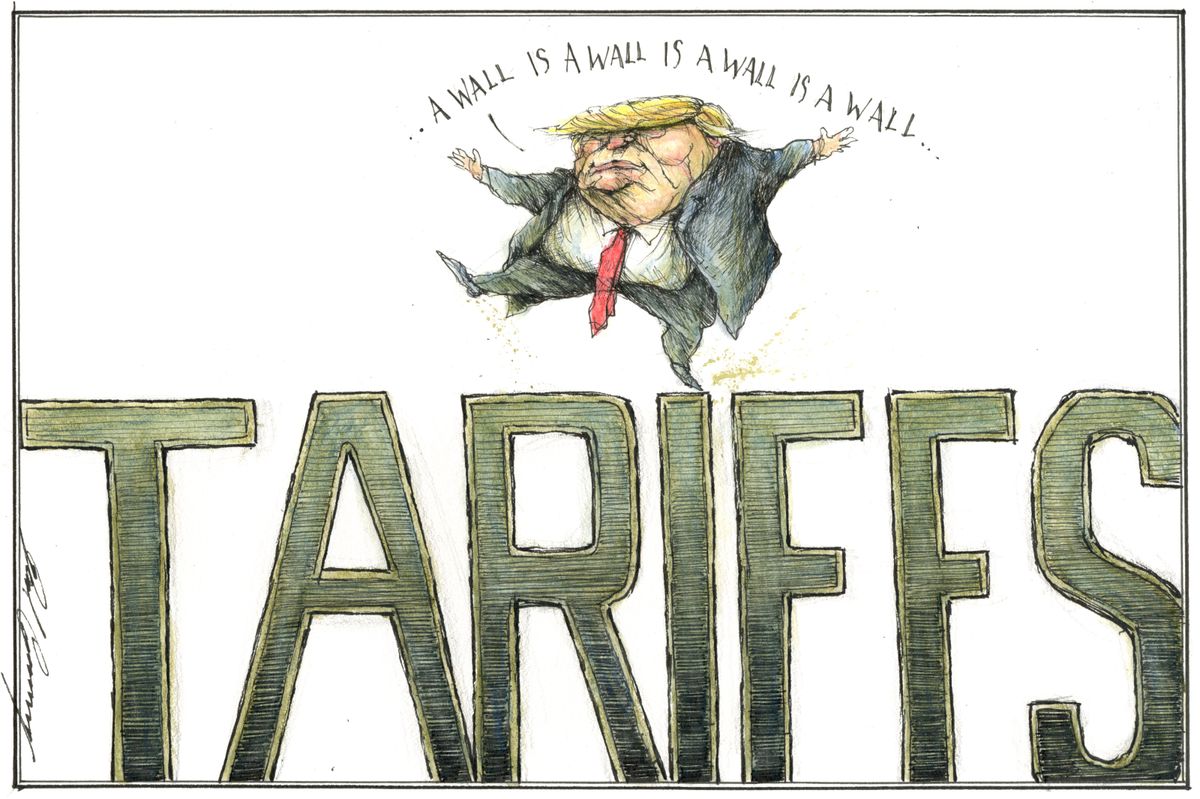

You've probably seen it. It’s that grainy, black-and-white image from a hundred years ago—or maybe a slick, modern political sketch—showing a giant wall or a guy in a top hat literally reaching into a consumer's pocket. It’s the classic how tariffs work cartoon, and honestly, it explains the economy better than most textbooks I’ve ever read. Economic policy usually feels like a giant snooze-fest until you realize it’s the reason your new sneakers cost $30 more than they did last year.

Tariffs are basically just taxes. But they aren't taxes on the country selling the stuff; they’re taxes on the people buying it.

People get this wrong constantly. Even politicians. They’ll stand on a stage and tell you they’re "taxing China" or "taxing Europe." But that’s not how the plumbing works. When the U.S. government slaps a tariff on imported steel, the Chinese or German company doesn't write a check to the Treasury. The American company importing that steel—the one building your car or your washing machine—is the one that pays the bill at the border. Then, because they don't want to lose money, they pass that cost right down to you.

The Visual Truth: Why the How Tariffs Work Cartoon Matters

Visuals stick because the math is boring. If you look at a vintage how tariffs work cartoon, you’ll often see a "Protective Wall." On one side, you have the domestic manufacturer, fat and happy, protected from competition. On the other side, you have the "Consumer," trying to climb over the wall just to get a decent price on a loaf of bread or a shovel.

It’s an old trick.

Cartoons from the late 19th century, particularly during the McKinley era, often used a "Dinner Pail" motif. They argued that tariffs protected the American worker’s wages. But the counter-cartoons showed those same workers paying double for their clothes and tools. It’s a tug-of-war that hasn't changed in over a century. We’re still pulling on the same rope.

Winners and Losers in the Sketch

In any economic drawing, there are clear winners. Usually, it’s a specific industry. Let's say, domestic sugar producers. If a tariff keeps cheap foreign sugar out, the local sugar guys can raise their prices. They love it. They hire more people. They buy bigger houses.

But then there’s the rest of the drawing.

The candy company? Their costs just went up. They might have to lay people off. The family buying a birthday cake? They have less money for shoes now. Economists call this a "deadweight loss." It’s basically money that just vanishes into the ether because of market inefficiency.

Real World Friction: It’s Not Just Ink and Paper

History gives us the best data, and it's rarely pretty. Take the Smoot-Hawley Tariff Act of 1930. If you wanted to draw a how tariffs work cartoon about that, it would be a picture of someone trying to put out a fire with gasoline.

The U.S. wanted to protect farmers during the Depression. They raised tariffs on over 20,000 imported goods. What happened? Every other country got mad. They raised their own tariffs in retaliation. Global trade didn't just slow down; it fell off a cliff. It plummeted by about 66% between 1929 and 1934.

- Canada was furious.

- Europe was broke and angry.

- The Great Depression got deeper and longer.

Fast forward to the 21st century. We saw the same thing with the 2018-2019 trade wars. When the U.S. put tariffs on aluminum and steel, companies like Ford and General Motors reported massive hits to their bottom line. Ford alone estimated that the metal tariffs cost them roughly $1 billion in profit. That’s a lot of money that could have gone into R&D or employee bonuses.

The "Whack-a-Mole" Effect

Think of it like this: the economy is a giant waterbed. You push down on one spot—say, protecting washing machine manufacturers—and the water has to go somewhere else. Suddenly, the price of dryers goes up. Or the country you blocked stops buying your soybeans.

American soybean farmers were the accidental victims of the recent trade wars. When we taxed foreign goods, China stopped buying our beans. The government then had to spend billions of taxpayer dollars in subsidies to save the farmers who were hurt by the policy meant to "help" the country. It’s a circle of chaos that cartoonists have a field day with.

Why Do We Keep Doing This?

If tariffs are so messy, why are they still a thing? It’s not just because politicians are bad at math. There are actual, nuanced reasons to use them, though they rarely work out as cleanly as a campaign speech suggests.

- National Security: You don't want to rely on a rival nation for the chips that go into your fighter jets. Sometimes, you pay a premium (via tariffs) to keep a local industry alive just in case things go south globally.

- Infant Industries: If a country is trying to start a brand-new industry—like electric vehicles—they might use tariffs to give their local companies a head start against massive, established foreign players.

- Anti-Dumping: Sometimes a foreign country "dumps" products at below-cost prices just to kill off the competition. A tariff here acts like a "penalty box" in hockey. It’s supposed to level the playing field.

But here’s the rub. Once you put a tariff in place, the companies receiving that protection never want to let it go. They get addicted to the lack of competition. They stop innovating because they don't have to.

The Stealth Tax on Your Living Room

When you see a how tariffs work cartoon, look at the person labeled "Consumer." That’s you. You are the one paying the tariff.

A study by the National Bureau of Economic Research (NBER) looked at the 2018 tariffs and found that the full cost of the tariffs was passed through to U.S. consumers and firms. The foreign exporters didn't lower their prices to stay competitive; they just kept them the same, and the U.S. buyer paid the tax on top.

- Washing Machines: Prices jumped by about 12%.

- Bicycles: Most parts are imported; prices climbed significantly.

- Lumber: Tariffs on Canadian timber made the cost of building a new house jump by thousands of dollars.

It’s a sneaky tax. Most people don't see a line item on their receipt that says "Trade War Surcharge." It’s just baked into the price tag. You just think, "Wow, everything is expensive lately," without realizing that a policy designed to "protect" you is actually thinning your wallet.

The Complexity of Global Supply Chains

The old-school how tariffs work cartoon usually shows a finished product, like a completed car, being stopped at a gate. But the modern world is way more complicated. A "Japanese" car might be assembled in Kentucky with parts from Mexico, electronics from Taiwan, and steel from Brazil.

If you put a tariff on "auto parts," you’re hitting a car that is "Made in America." This is why modern trade policy is such a headache. You can't just target "the other guy" without hitting your own team in the process. We’re all too interconnected now.

What Actually Happens to the Jobs?

This is the big promise: "Tariffs bring back jobs."

Does it work? Sort of. But it’s expensive.

The Peterson Institute for International Economics (PIIE) did a deep dive into the 2002 steel tariffs. They found that for every one steel-producing job saved, about 16 jobs were lost in steel-consuming industries (like construction and auto manufacturing). The cost to the U.S. economy was roughly $400,000 per steel job saved.

Imagine if the government just handed those workers $100,000 checks instead. It would have been cheaper for the taxpayer.

The Automation Factor

Even when tariffs do bring manufacturing back to the U.S., the jobs don't always come back with it. A modern factory doesn't look like the one in a 1950s how tariffs work cartoon. It’s full of robots. A company might move its plant from Shanghai to South Carolina to avoid a tariff, but they’ll fill it with 500 robots and 50 technicians instead of the 5,000 workers they had 40 years ago.

Practical Steps to Navigate a High-Tariff Economy

So, what do you actually do when the trade wars start heating up and the cartoons start appearing in your newsfeed again? You can't change international law, but you can change how you shop.

Watch the "Origin" Labels

If a major round of tariffs hits a specific country, prices for goods from that region will spike. If you’re planning a big purchase—like a kitchen remodel—check where the materials are coming from. Switching from a country currently in a "trade spat" to one that isn't can save you 15% to 25% easily.

Buy Before the Effective Date

Tariffs usually have a "grace period" before they kick in. When the government announces new duties on electronics or furniture, there’s often a 30 to 60-day window. Retailers will often have a "pre-tariff sale" to move existing inventory. That is the time to buy your laptop or sofa, not three months later when the new shipments arrive with the higher tax baked in.

✨ Don't miss: BB and T Stock Price: What Most People Get Wrong

Look for Used or Refurbished Goods

Tariffs apply to new imports. The secondary market—eBay, local thrift shops, or refurbished tech—is largely insulated from these price swings. If new mountain bikes are getting hit with a 25% tariff, the value of used bikes might go up slightly, but they won't have that direct tax applied to them.

Understand the "Substitution" Effect

When the price of imported beef goes up, people buy more chicken. When imported Italian tile gets too pricey, domestic vinyl flooring sales soar. Keep an eye on what the "protected" industry is. If it’s something you use, start looking for alternatives now before the price hike becomes the "new normal."

Support Local Direct-to-Consumer

Small local craftsmen often get hit by the cost of raw materials, but they don't have the same massive supply chain overhead as giant corporations. Sometimes, the price gap between a mass-produced imported table and a locally made one narrows significantly during a trade war. It’s a good time to check out your local makers.

The how tariffs work cartoon will always be around because the fundamental tension of trade never goes away. Someone wants protection, someone else wants a bargain, and the government wants revenue. Understanding that you’re the one holding the bill is the first step to being a smarter consumer in a messy, globalized world.