Ever looked at a receipt and felt like the math just wasn't mathing? You see a price, you expect to pay that price, but then there's this weird middle-man number sitting right above the total. That's the subtotal. It’s the raw cost of everything you’ve tossed into your cart before the government, the delivery app, or the restaurant adds their "extra" bits.

Honestly, most people ignore it. They shouldn't.

Understanding what a subtotal represents is basically the secret to not getting sticker shock at the register. It is the sum of all your line items. If you buy three shirts at $20 each, your subtotal is $60. Simple, right? Well, it gets way more complicated when you start adding in discounts, coupons, and those pesky service fees that seem to come out of nowhere.

The Raw Math Behind the Subtotal

A subtotal is the foundation of any financial transaction. Think of it as the "clean" price. When you’re looking at an invoice or a grocery receipt, the subtotal is the aggregate cost of the goods or services provided. It doesn't include taxes. It doesn't include shipping. It definitely doesn't include that 22% tip you felt pressured to leave at the coffee shop.

In accounting terms, it’s a temporary sum.

Businesses use it to track gross sales before external variables—like state-specific sales tax or regional levies—distort the data. If you’re a business owner using a platform like QuickBooks, the subtotal is what helps you understand your inventory's movement. If your subtotal is $500, but your total is $650, you know exactly how much "overhead" is leaking out to third parties or the IRS.

Where the Confusion Starts

People often mix up "subtotal" and "total." It’s an easy mistake. But here is the kicker: the subtotal is almost always the number you actually agreed to pay when you looked at the price tag. The total is the number you actually pay when you swipe your card.

👉 See also: How Much Do Chick fil A Operators Make: What Most People Get Wrong

The gap between those two numbers is where most consumer frustration lives.

Take a look at a DoorDash receipt. You might see a subtotal of $25.00 for a burger and fries. By the time you reach the bottom of the screen, you're paying $42.00. That $17.00 difference isn't part of the subtotal; it's a mix of delivery fees, "small order" fees, and taxes. If you want to know if a restaurant is overcharging for the food itself, you look at the subtotal, not the final price.

Why the Subtotal Matters for Discounts

This is where things get interesting for the bargain hunters. Most coupons apply to the subtotal, not the total.

If you have a "20% off your order" coupon, the store usually takes that 20% off the subtotal.

Imagine you’re buying a $100 jacket.

The subtotal is $100.

The coupon drops the subtotal to $80.

Then, the tax is calculated based on that $80.

If they calculated tax on the original $100 and then gave you the discount, you’d be paying more. Knowing this helps you verify if a POS (Point of Sale) system is actually programmed correctly. Sometimes they aren't. Tech glitches happen, and being able to spot an error in how a subtotal is calculated can save you a few bucks over time.

✨ Don't miss: ROST Stock Price History: What Most People Get Wrong

The Difference in B2B Invoicing

In the world of business-to-business (B2B) transactions, subtotals are even more vital. Companies often deal with "tax-exempt" status. If a non-profit buys 500 chairs, they might not pay sales tax. In that specific case, the subtotal and the total might actually be the identical number.

However, they might still see a subtotal followed by a "Shipping and Handling" line.

According to the Financial Accounting Standards Board (FASB), keeping these figures distinct is crucial for clear financial reporting. It allows auditors to see exactly what was paid for the product versus what was paid for the logistics of getting that product to the warehouse.

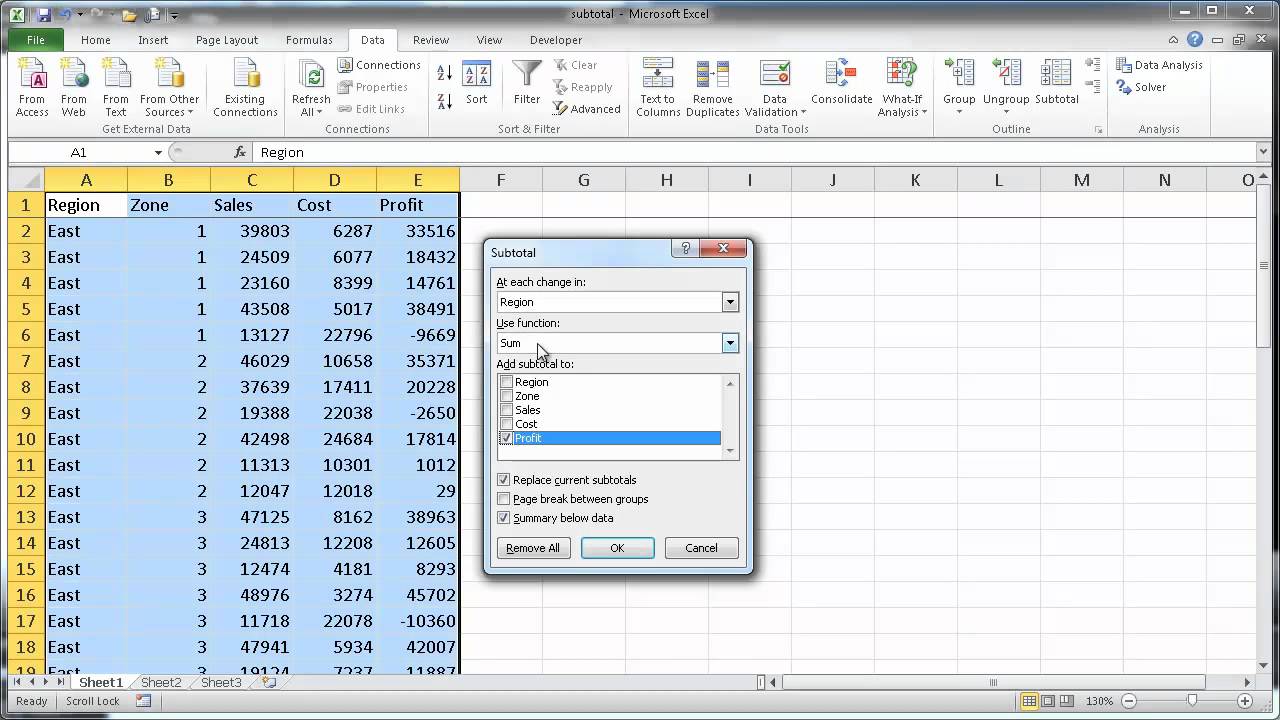

Subtotals in Excel and Spreadsheets

If you've ever spent a late night staring at a spreadsheet, you've probably used the SUBTOTAL function. It’s different from a simple SUM.

Why? Because SUBTOTAL is smart.

If you filter a list of expenses to only show "Marketing," a standard sum might still count all the hidden rows for "Rent" and "Utilities." The SUBTOTAL function (specifically function 9 or 109 in Excel) only adds up what you can actually see on the screen. It’s a dynamic way to analyze data without deleting rows or creating ten different tables.

🔗 Read more: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

- Use

=SUBTOTAL(9, A1:A10)to sum visible cells. - It ignores other subtotals in the range to avoid double-counting.

- It’s the gold standard for inventory managers.

Most people don't realize that a subtotal in a spreadsheet is a functional tool, whereas a subtotal on a receipt is a static piece of information. One is for calculating; the other is for informing.

Common Misconceptions About Fees

Does a service fee count toward the subtotal? Usually, no.

But it depends on the industry. In some high-end restaurants, a "Mandatory Service Charge" might be lumped into the subtotal before tax is applied, because some states (like California or New York) actually require sales tax to be paid on mandatory tips. It’s a mess.

Check your local laws. Or better yet, just look at the line breaks.

If you see a line that says "Subtotal," anything below it is an "add-on." Anything above it is the "core cost." If you see a "Convenience Fee" above the subtotal line, the business is likely trying to trick the system into thinking that fee is part of the product cost, which might affect how much tax they owe or how they report their earnings.

How to Audit Your Own Receipts

Next time you go to a big-box retailer like Target or Walmart, take five seconds to look at that middle number.

- Verify the items: Does the subtotal match the sum of the prices on the shelf?

- Check the discount timing: Was the "Buy One Get One" taken off before the subtotal was finalized?

- Look at the tax: Is the tax percentage being applied to the subtotal or the original price?

It sounds tedious. It kind of is. But if you’re running a small business or even just trying to stick to a tight household budget, these small discrepancies add up to hundreds of dollars a year. You’ve got to be your own accountant.

The subtotal is your starting point. It's the only number on that paper that represents the value of what you actually walked away with in your bags. The rest is just the cost of doing business in a modern economy.

Actionable Steps for Better Money Management

- Always ask for an itemized receipt. A total alone tells you nothing. You need to see the subtotal to ensure you weren't double-charged for an item.

- When budgeting for a project, add 15% to your subtotal. This "buffer" usually covers the taxes and fees that will inevitably appear at the bottom of the invoice.

- Learn the

SUBTOTALfunction in Google Sheets. If you track your spending, it allows you to filter by category (like "Groceries" or "Gas") and see a real-time sum without messing up your formulas. - Compare subtotals between competitors. When shopping for services (like car repair), don't compare the total. Compare the subtotal of labor and parts. Taxes are the same everywhere, but the subtotal reveals who is actually charging more for the work.

- Watch for "Subtotal Creep." Some digital platforms add "suggested donations" or "carbon offsets" just above the subtotal. If you aren't looking, you're paying for things you didn't explicitly choose.