You've probably heard the chatter. Wall Street is obsessed with the "Magnificent Seven," those tech behemoths that seem to dictate whether the entire world is having a good financial day or not. But while everyone is busy staring at Nvidia’s latest chart, something much weirder and—honestly—more interesting is happening downstairs in the basement of the market. I'm talking about stocks in the Russell 2000.

If the S&P 500 is the varsity football team, the Russell 2000 is the chaotic, high-energy middle school tryouts. It is a collection of 2,000 small-cap companies that most people couldn't name if you paid them. But here is the kicker: as of mid-January 2026, these "little guys" are starting to outpace the giants.

The 2026 Rotation is Real

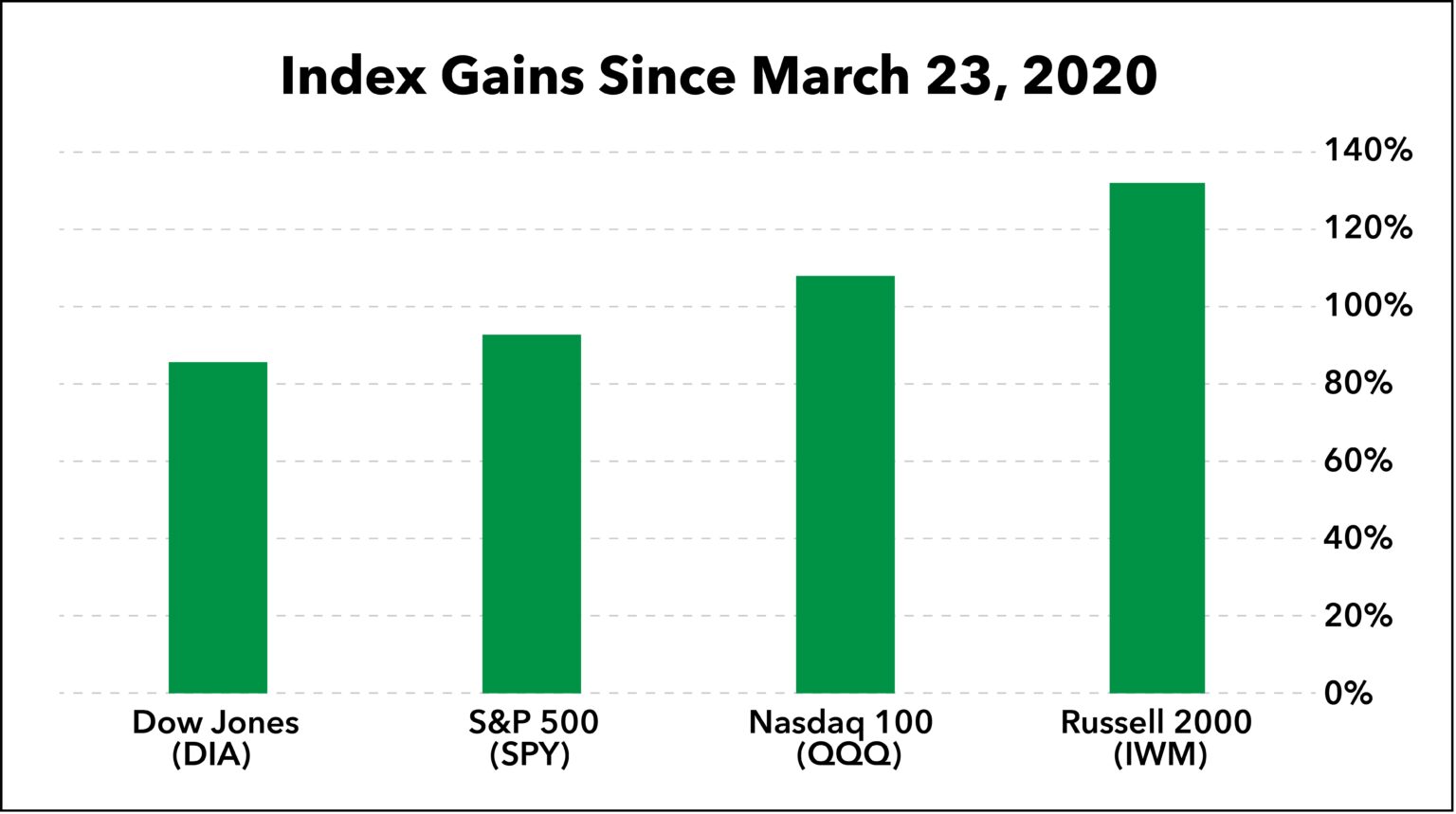

For years, small caps were the punching bag of the investing world. High interest rates crushed them because small companies usually carry more debt and need to borrow to grow. But the vibe has shifted. With the Federal Reserve easing up and the "One Big Beautiful Bill Act" pumping fiscal stimulus into domestic manufacturing, the Russell 2000 has seen gains of roughly 5.5% in the first few weeks of 2026 alone. Compare that to the measly 0.5% gain for large caps in the same period.

Basically, the "rotation trade" is in full swing. Money is flowing out of overvalued tech and into things that actually make the world go 'round—like valves, mid-sized banks, and biotech labs.

Why Small Caps Suddenly Matter Again

It isn’t just about interest rates. It’s about where the money is physically going. Most stocks in the Russell 2000 get their revenue right here in the U.S. When "reshoring" becomes more than just a buzzword and factories start popping up in Ohio or Arizona, it’s the small-cap industrial companies that get the contracts. They aren't global entities like Apple; they are domestic engines.

Michael Arone over at State Street recently pointed out that the earnings gap is finally closing. For a long time, large caps had all the profit growth. Now? Small-cap earnings are approximating large-cap levels for the first time in what feels like forever.

The Names You’re Overlooking

You can't just buy the index and hope for the best. Well, you can, but it’s a bumpy ride. The Russell 2000 is notoriously "junk-heavy"—about a third of these companies don't even turn a profit. You have to be picky.

Take Bloom Energy (BE). It’s currently one of the heavy hitters in the index. They do solid oxide fuel cells. In a world obsessed with data centers and AI power needs, Bloom is sitting in a very sweet spot. Then you have Credo Technology (CRDO), which is basically the plumbing for high-speed data. These aren't household names, but they are the ones doing the heavy lifting while the big tech stocks "consolidate" (which is just a fancy word for "going sideways because they're too expensive").

On the flip side, you’ve got the speculative wildcards. Ever heard of Regencell Bioscience (RGC)? In late 2025, it had a run that looked like a typo—up thousands of percent. That is the Russell 2000 in a nutshell. It’s a casino in some corners and a value-investor's dream in others.

The Fintech and Biotech Surge

Biotech is having a moment because big pharma is terrified of their patents expiring. To fix that, they are buying up small companies in the Russell 2000 like kids in a candy store. Celcuity (CELC) is a prime example. It skyrocketed because of breakthrough trials in precision oncology.

And then there's the fintech side. Better Home & Finance (BETR) has been riding the wave of AI-powered mortgages. It’s volatile. It’s stressful. But the growth is there if you have the stomach for it.

The Risks Nobody Mentions

I’m not going to sit here and tell you it’s all sunshine and moon-bound stocks. Investing in small caps is kinda like dating a drummer; it’s exciting until they don't show up for three weeks.

The "quality" problem is real.

- Low Margins: The average operating margin for a small-cap company is about 6%. For a large-cap, it’s 18%.

- Volatility: These stocks move on whispers. A bad earnings report doesn't just drop the stock 2%; it can crater it 20% by lunchtime.

- Debt: Even with rates coming down, these companies are sensitive. If inflation stays "sticky"—which it sort of is right now, hovering around 2.7%—the cost of capital remains a weight around their necks.

How to Actually Play This

If you’re looking to get exposure without picking individual losers, the iShares Russell 2000 ETF (IWM) is the standard. It’s huge—over $70 billion in assets. But if you want a smoother ride, look at the Vanguard Russell 2000 Value ETF (VTWV). It filters out the "hope and a prayer" tech stocks and focuses on companies that actually have balance sheets.

Honestly, the smartest move right now is looking at the "boring" sectors.

- Industrials: Think infrastructure and reshoring.

- Regional Banks: With Kevin Warsh being a frontrunner for the next Fed Chair, the yield curve might steepen, which is like a shot of adrenaline for regional banks like Huntington Bank (HBAN).

- Consumer Staples: Stocks like Cal-Maine Foods (CALM) are literally just selling eggs, but they have P/E ratios that make sense in a crazy market.

Actionable Next Steps

If you want to dive into stocks in the Russell 2000, start by looking at the "Quality-Value" crossover. Look for companies with positive free cash flow and a debt-to-equity ratio below 1.0. Don't chase the 100% gainers from last week; look for the companies that provide the services those gainers rely on.

✨ Don't miss: Walmart Stock Price Chart: What Most People Get Wrong

- Check the "Profitability" Filter: Use a stock screener to exclude any Russell 2000 company with negative earnings over the last 12 months. This immediately removes most of the "junk" that drags the index down.

- Watch the 10-Year Yield: If it stays above 4.2%, small caps might struggle to sustain this rally. If it drops, the Russell 2000 could have its best year in a decade.

- Diversify Sectors: Don't just load up on biotech. Balance it with boring industrials and financials to survive the inevitable swings.

The market is broadening out. For the first time in years, you don't have to own the biggest companies in the world to make money. You just have to be willing to look where everyone else isn't.

Disclaimer: I’m a writer, not your financial advisor. Small-cap stocks can lose value quickly. Always do your own research or talk to a professional before throwing your hard-earned cash at a ticker symbol you found on the internet.