You’ve probably seen the stock quote for occidental petroleum flashing on your screen and wondered if the "Buffett effect" has finally run its course. It’s a fair question. The energy market in early 2026 is a strange beast, caught between the old-school reality of oil demand and the high-tech promise of carbon capture.

Honestly, tracking OXY isn't just about watching a line go up or down. It's about understanding a company that is essentially a massive bet on the American oil patch. As of January 16, 2026, the stock closed at $42.70. It’s been a bit of a bumpy ride lately. The day's range saw a high of $43.32 and a low of $42.63. If you’re looking at the 52-week data, the stock has swung between a low of $34.78 and a peak of $52.58.

That is a lot of volatility for a company that some of the world's most "boring" investors love.

What is Driving the Stock Quote for Occidental Petroleum Right Now?

Prices change. Everyone knows that. But the why behind the stock quote for occidental petroleum is more interesting than the numbers themselves.

First, let's talk about the Elephant in the room: Berkshire Hathaway. Warren Buffett may have officially retired as CEO at the start of 2026, passing the torch to Greg Abel, but his fingerprints are all over this ticker. Berkshire still holds a massive stake, roughly 27% to 28% of the company. When a guy like Buffett (or his successor) owns a third of a company, it creates a "floor" for the price. People don't want to bet against the Oracle's legacy.

But there is a catch.

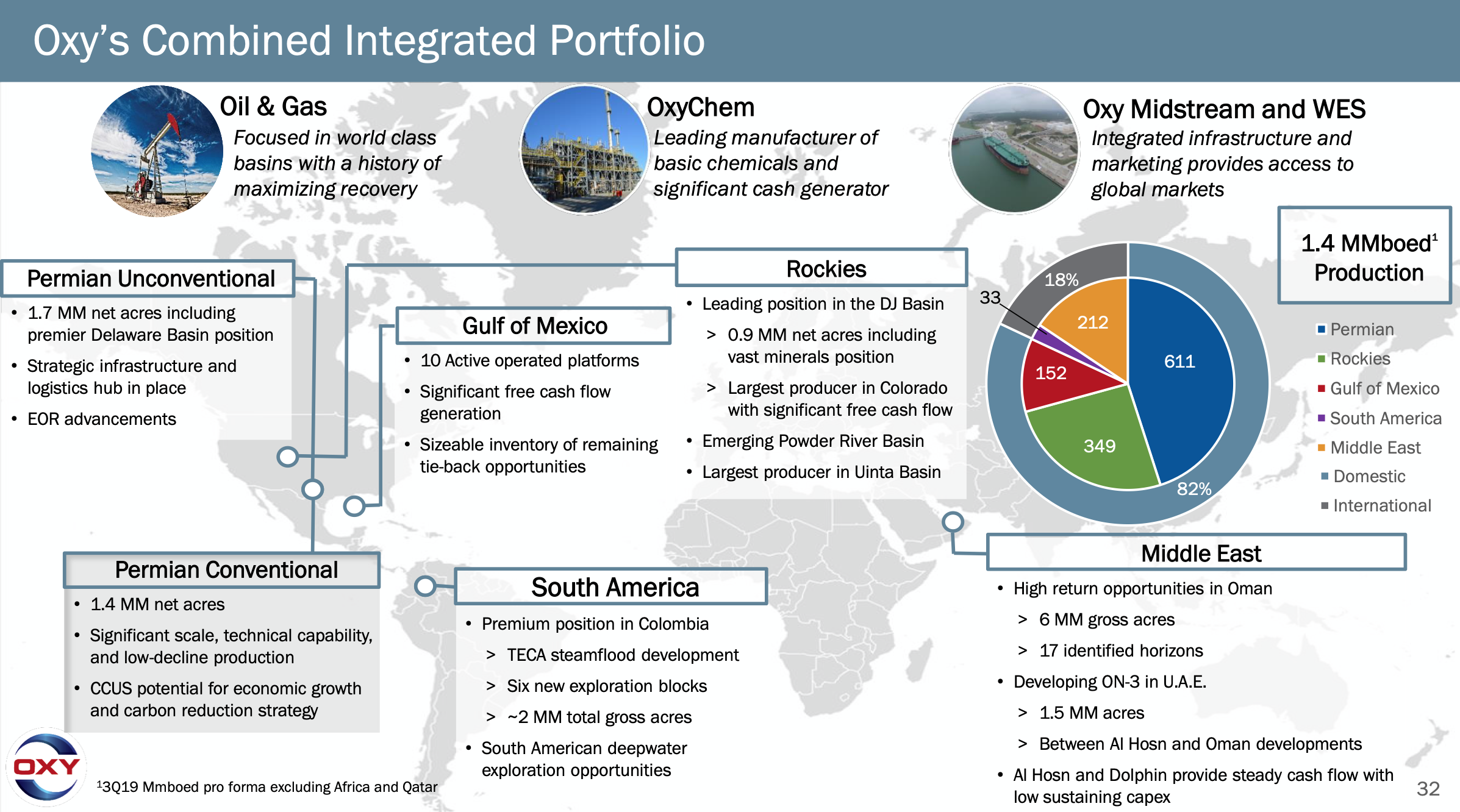

Occidental is way more sensitive to oil prices than its big brothers like Exxon or Chevron. Why? Because OXY is an "upstream" powerhouse. They live and die by the drill bit in the Permian Basin. If crude prices take a dip, the stock quote for occidental petroleum usually feels the sting faster than more diversified integrated majors.

The OxyChem Twist

Interestingly, the company just closed a massive deal to sell its OxyChem division to Berkshire Hathaway for $9.7 billion late last year. This was a huge move. For years, OxyChem was the "steady" part of the business that balanced out the wild swings of oil. Now, OXY is leaner. They are using that cash—specifically about $6.5 billion of it—to slash their debt.

🔗 Read more: Converting 30k pounds to dollars: Why the Math is Only Half the Battle

Basically, the company is trying to get its house in order so it can start returning more cash to you, the shareholder.

The Carbon Capture Wildcard

If you look at the stock quote for occidental petroleum and only see oil, you're missing half the story. CEO Vicki Hollub has bet the farm on Direct Air Capture (DAC).

Their flagship "Stratos" plant in West Texas is the real deal. It’s designed to suck carbon right out of the sky. In mid-2025, it moved from a "cool idea" to an operational reality. They even signed a massive deal to sell 500,000 metric tons of carbon removal credits to Microsoft.

Is this making them money yet? Not really. It’s expensive. We are talking $400 to $600 per ton to capture that carbon. But if the tech scales, OXY becomes a tech company that happens to own oil wells. That is the "moonshot" that keeps long-term investors interested even when the daily quote looks sluggish.

Dividends and the 2026 Outlook

Let’s get into the nitty-gritty of what you actually get for holding the stock. On January 15, 2026, OXY paid out a quarterly dividend of $0.24 per share. That’s an annual payout of $0.96.

- Current Dividend Yield: Roughly 2.25%

- Payout Ratio: Around 71%

- Recent Trend: Five consecutive years of increases.

Some analysts, like Mark Hake, have been pointing to "unusual" activity in call options lately. There’s a lot of chatter that the board might hike the dividend again in early February 2026. If they move that annual payout toward the $1.00 mark, the stock quote for occidental petroleum could see a nice little bump as yield-hungry investors pile in.

But don't get too comfortable. The earnings estimate for the current quarter is sitting around $0.33 per share, which is actually a significant drop year-over-year. Energy is a cyclical game. You have to have a stomach for the red days.

How to Trade the Stock Quote for Occidental Petroleum

If you're watching the ticker, don't just stare at the price. Watch the debt. The magic number for OXY is $15 billion. That is the principal debt target management wants to hit. Once they are below that, the "buyback machine" is expected to kick into high gear.

✨ Don't miss: Exchange rate IDR to USD: Why your money buys less in Bali than it used to

The market loves buybacks. When a company buys its own shares, your slice of the pie gets bigger.

Keep an eye on the February 19, 2026, earnings call. That’s when we’ll get the first full look at how the company is performing without OxyChem and whether the Stratos plant is actually hitting its efficiency targets.

If you are looking for a "safe" entry, many technical traders watch the $40 support level. It’s held fairly steady over the last few months. On the flip side, breaking through $45 would likely require a sustained rally in WTI crude prices or a surprise announcement regarding their Oman drilling extensions.

Actionable Next Steps for Investors

- Check the Debt Clock: Monitor the upcoming Q4 2025 earnings report (scheduled for February 18-19, 2026) to see if total debt has finally dropped below the $15 billion threshold.

- Watch the $43.00 Level: Recent options volume suggests $43 is a psychological "battleground" for the stock; a clean break above this with high volume could signal a new bullish trend.

- Monitor Crude Benchmarks: Since OXY is heavily weighted toward upstream production, a $5 move in WTI crude will impact this stock more than it will its larger competitors.

- Evaluate Your Yield: If you are holding for income, compare OXY’s 2.2% yield against the sector average; if a dividend hike doesn't materialize in February, the stock might lag behind higher-yielding peers.