You’re sitting there at 8:00 AM with a cup of coffee, watching a tech giant's stock price do backflips on your screen. You want in. You hit "buy," but nothing happens, or maybe your broker gives you a weird warning about "limit orders only." It’s frustrating. Most people think the stock market is like a grocery store—open from 9 to 5, lights on, doors unlocked. It isn't.

Understanding stock market times open is actually about navigating three distinct "sessions" that behave like entirely different animals. If you're looking at the New York Stock Exchange (NYSE) or the Nasdaq, the official "Opening Bell" rings at 9:30 AM Eastern Time. That is the Core Trading Session. It runs until 4:00 PM ET. But that six-and-a-half-hour window is just the tip of the iceberg.

Why the 9:30 AM Start Time is Kinda a Lie

The market doesn't actually "sleep." While the big floor traders in Manhattan might not start shouting until 9:30, the electronic systems are humming way before that. This is the Pre-Market session. It starts as early as 4:00 AM ET for some brokers, though most retail traders get access around 7:00 AM or 8:00 AM.

Why does this matter? Because by the time the "official" market opens, the price might have already moved 5% based on news from Europe or an early morning earnings report. If you wait until the 9:30 AM bell to react to news that broke at 7:15 AM, you’re often too late. You’re buying the "gap."

But honestly, trading at 4:00 AM is risky. Volume is thin. Liquidity is a ghost town. This means a relatively small sell order can send a stock screaming downward because there aren't enough buyers to catch it. It’s volatile. It’s wild. Most experts, including those at Fidelity and Charles Schwab, warn that price discovery in these early hours is notoriously unreliable.

The Lunchtime Lull

Ever noticed how things get quiet around Noon ET? Traders eat too. Between 12:00 PM and 2:00 PM, trading volume usually craters. This is often called the "lunchtime lull." If you’re trying to execute a massive trade, doing it while everyone is grabbing a sandwich is a recipe for getting a bad price. Wait for the "Power Hour."

📖 Related: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

After-Hours: Where the Real Drama Happens

When the 4:00 PM bell rings, the "Regular" session ends. But then comes the After-Hours session, which typically runs until 8:00 PM ET.

This is where the big stuff happens. Most companies release their quarterly earnings reports at 4:01 PM or 4:05 PM. Why? To avoid causing a massive panic-induced circuit breaker halt during regular hours. If a company misses its revenue targets, you’ll see the stock drop 10% in seconds at 4:10 PM.

If you aren't aware of these stock market times open for the extended session, you might wake up the next morning to find your portfolio has taken a massive hit while you were watching Netflix.

- Pre-Market: 4:00 AM – 9:30 AM ET.

- Core Session: 9:30 AM – 4:00 PM ET.

- After-Hours: 4:00 PM – 8:00 PM ET.

The rules change here. In the extended sessions, you generally have to use "Limit Orders." You can't just say "buy this at whatever the price is." You have to specify the exact price you’re willing to pay. This is a protection mechanism because the "spread"—the gap between what sellers want and what buyers offer—can be massive.

Weekends, Holidays, and the "Saturday Myth"

The US stock market is closed on Saturdays and Sundays. Period. If you see prices moving on a Saturday, you’re likely looking at crypto or perhaps a very specific foreign exchange (FX) market that hasn't closed yet.

👉 See also: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

Then you’ve got the federal holidays. The NYSE and Nasdaq follow a specific schedule. They close for New Year’s Day, Martin Luther King Jr. Day, Washington’s Birthday, Good Friday, Memorial Day, Juneteenth, Independence Day, Labor Day, Thanksgiving, and Christmas.

On some days, like the Friday after Thanksgiving (Black Friday) or Christmas Eve, the market has an "Early Close" at 1:00 PM ET. If you're trying to square up your positions at 3:00 PM on Black Friday, you’re going to find a locked door.

Global Markets: The Sun Never Sets on Your Portfolio

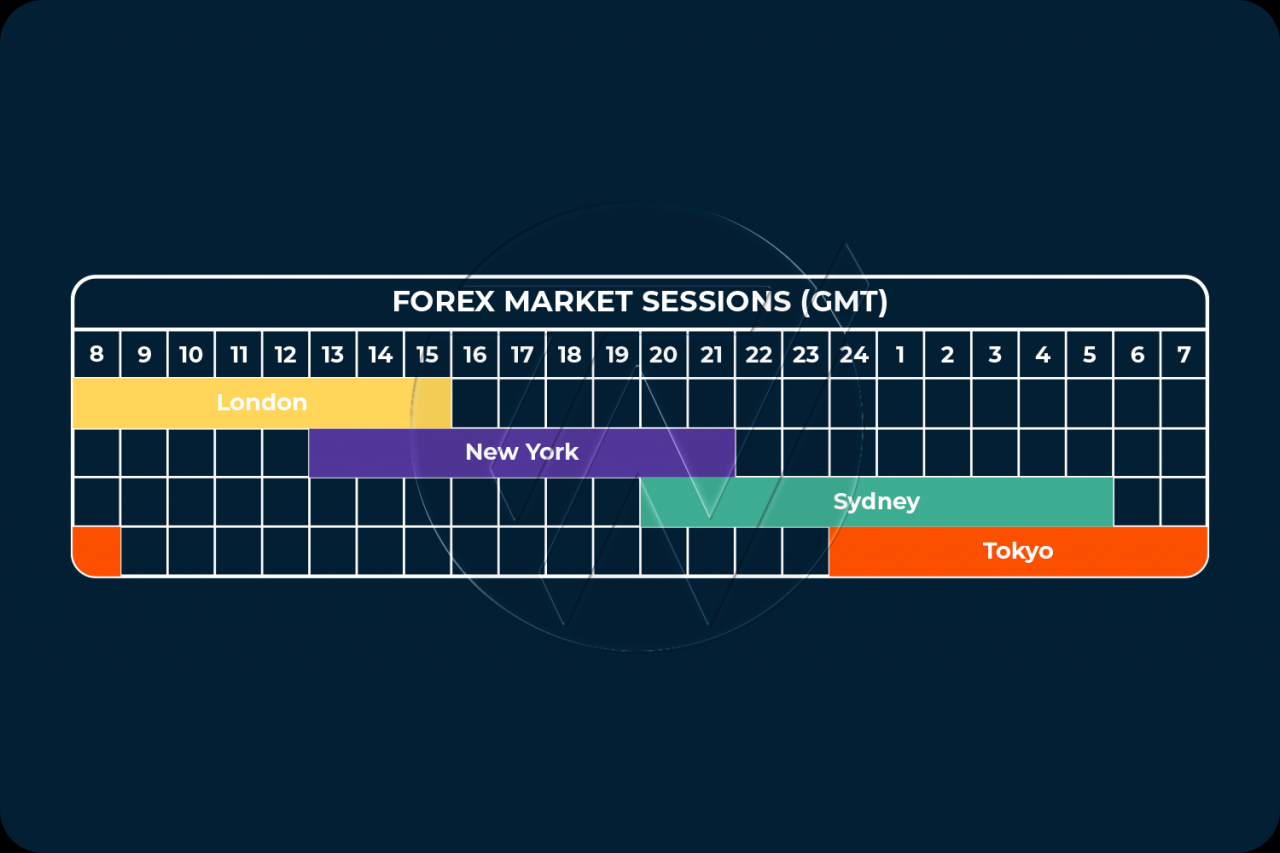

If you’re trading international stocks, "open" means something entirely different. The London Stock Exchange (LSE) opens at 8:00 AM GMT, which is 3:00 AM ET. If you’re a night owl in New York, you can watch the European markets react to world events before the US even wakes up.

- Tokyo (TSE): 8:00 PM – 2:00 AM ET (with a lunch break!).

- Hong Kong (HKEX): 8:30 PM – 3:00 AM ET.

- London (LSE): 3:00 AM – 11:30 AM ET.

There is a fascinating overlap between 8:00 AM and 11:30 AM ET where both the US and European markets are active. This is often the most liquid time of the day for global macro assets.

The Danger of "Market on Open" Orders

Many beginners place "Market" orders at 11:00 PM on a Sunday, thinking they’ll get the Monday morning price. Don't do this.

✨ Don't miss: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

When the market opens at 9:30 AM, there is a "matching auction." All those orders that piled up over the weekend get processed at once. This creates a massive spike in volatility. You might think a stock is worth $50, but because of a weekend news blast, it opens at $55. Your market order will fill at $55, and if the stock immediately cools off to $52, you’ve lost money in the first ten seconds of the day.

Instead, wait. Let the "opening print" settle. Usually, the first 15 to 30 minutes of the trading day are the most chaotic. Professionals often refer to this as the "Amateur Hour" because it’s filled with retail orders being filled at sub-optimal prices.

Real-World Impact: The 2024 "Flash" Events

We've seen instances where electronic glitches during these fringe hours caused mayhem. In early 2024, technical issues at the NYSE led to dozens of stocks showing incorrect prices at the open, triggering hundreds of volatility halts. If you were trading in those first few seconds without a limit order, you were essentially gambling with a blindfold on.

The complexity of stock market times open isn't just a matter of trivia; it’s a matter of risk management. The "Tape" (the record of trades) moves differently at 10:00 AM than it does at 6:00 PM.

Actionable Steps for Navigating Market Hours

- Check your broker’s extended hours settings. Platforms like Robinhood, E*Trade, and TD Ameritrade (now Schwab) have different toggles you must flip to trade before 9:30 AM or after 4:00 PM.

- Always use Limit Orders outside of core hours. Never, ever use a Market Order in the pre-market or after-hours sessions. The spreads will eat you alive.

- Watch the 8:30 AM ET Economic Reports. The US government often releases Consumer Price Index (CPI) or jobs data at 8:30 AM. The market's reaction in the pre-market session will tell you exactly how the 9:30 AM open is going to go.

- Respect the "Power Hour." The final hour of trading (3:00 PM – 4:00 PM ET) is when institutional investors rebalance their portfolios. It’s high volume and often sets the trend for the following day.

- Mind the Gap. Look at the difference between the Friday close and the Monday open. This "gap" is where most of the market's long-term gains (and losses) actually happen, while the "day session" is often just noise.

Trading isn't just about what you buy; it's about when you buy it. The clock is just as important as the chart. Keep an eye on the Eastern Time zone, regardless of where you live, because that's where the heart of the global financial system beats. Be careful during those thin-volume hours, and maybe give the opening bell a few minutes to ring out before you dive into the deep end.

Next Steps:

- Log into your brokerage account and verify if you have "Extended Hours Trading" enabled.

- Set a recurring alert for 8:30 AM ET on days when the Bureau of Labor Statistics releases inflation data to observe how pre-market prices decouple from the previous day's close.

- Review your "Good 'Til Canceled" (GTC) orders to ensure they are set to "Include Extended Hours" if you want them to execute during earnings season volatility.