Ever stared at a stock market performance chart until the colors started to blur? You're not alone. We’ve all been there, squinting at a jagged green line on Yahoo Finance or Robinhood, trying to divine the future like it’s some kind of digital crystal ball. Most people think they’re looking at reality. Honestly? They’re usually looking at a curated slice of history that’s designed to make them feel a very specific way—usually either panicked or irrationally exuberant.

Charts are sneaky. They aren't just data; they are narratives.

If you change the timeframe from one day to five years, the "disaster" of yesterday suddenly looks like a tiny, insignificant blip in a massive bull run. Context is everything. When you look at a stock market performance chart, you’re seeing the collective psychological state of millions of humans (and a whole lot of high-frequency trading algorithms) distilled into a two-dimensional plane. It’s messy. It’s loud. And if you don't know how to filter the noise, it’ll lead you straight into making a trade you’ll regret by Tuesday.

The Illusion of the Y-Axis and Logarithmic Scaling

Let’s talk about something most casual investors completely ignore: the scale. You’ve got your linear scales and your logarithmic scales.

A linear scale treats every dollar the same. If a stock goes from $10 to $20, it looks the same as a move from $100 to $110. But think about that for a second. That first move is a 100% gain! The second is a measly 10%. When you look at a long-term stock market performance chart of the S&P 500 over fifty years on a linear scale, it looks like a giant hockey stick that’s about to snap. It’s terrifying. It makes everything in the past look flat and everything today look like a bubble.

Switch that bad boy to a logarithmic scale. Now, the vertical distance represents percentage changes. Suddenly, the growth of the 1950s looks just as significant as the growth of the 2020s. It smoothes out the "fear factor." Serious analysts at firms like Goldman Sachs or BlackRock aren't just glancing at the price; they are looking at the rate of change. If you’re trying to build a retirement fund, stop looking at linear charts. They’re basically horror movies for your portfolio.

What a Stock Market Performance Chart Doesn't Tell You

Dividends.

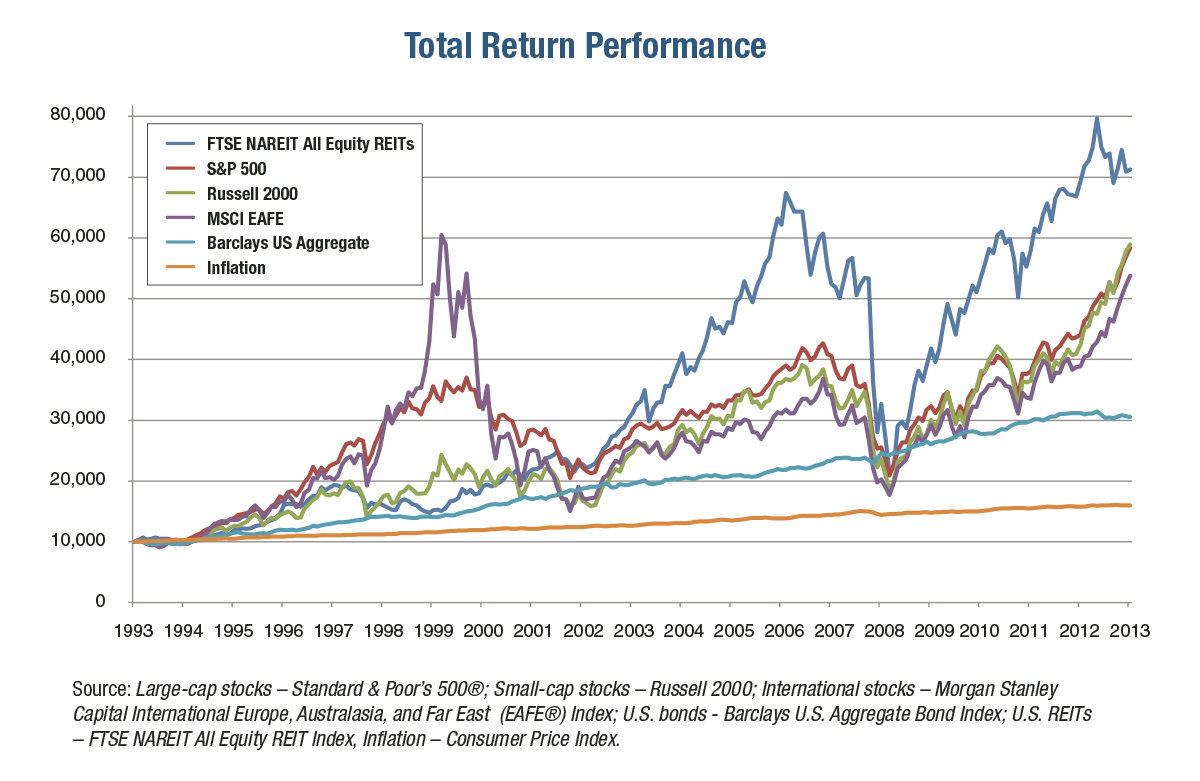

This is the big one. Most charts you see on news sites show "price return." They track the price of the index or the stock. But if you look at the S&P 500 over the last century, a massive chunk of the actual wealth generated came from reinvesting dividends.

If you look at a standard stock market performance chart of the S&P 500 from 1960 to today, it looks great. But if you look at a "Total Return" chart—which assumes you took every dividend check and bought more shares—the numbers are staggering. We’re talking about the difference between a 10x return and a 50x return over long horizons. According to data from S&P Dow Jones Indices, dividends have historically accounted for roughly 40% of the total return of the equity market. If your chart doesn't account for that, it’s lying to you about how much money was actually made.

Inflation is the other silent killer.

A chart showing the Nikkei 225 or the Dow hitting "All-Time Highs" is fun for headlines. But if inflation ran at 5% and the market grew at 4%, you actually lost purchasing power. You’re poorer, even though the line went up. You’ve gotta be careful with nominal versus real returns.

💡 You might also like: What Do I Need to Bring for an Interview? The Realistic Checklist

The Moving Average: Cutting Through the Bull

You ever see those smooth lines layered over the jagged price action? Those are moving averages. The 50-day and the 200-day are the celebrities of the charting world.

When the price is dancing way above the 200-day moving average, the market is "extended." It’s basically a rubber band stretched too far. Eventually, it snaps back. Conversely, when the price drops below that line, people start using words like "death cross" and "bear market territory."

But here’s the kicker: these indicators are lagging. They tell you what happened, not necessarily what will happen. People treat the 200-day average like a floor (support) or a ceiling (resistance). It works because enough people believe in it. It’s a self-fulfilling prophecy. If every trader on Wall Street thinks the S&P 500 will bounce at 5,000, they all set buy orders at 5,000. And guess what? It bounces. Not because of math, but because of human behavior.

Why Everyone Obsesses Over the S&P 500 Chart

The S&P 500 is the "market" for most people. But it’s top-heavy. It’s a market-cap-weighted index. This means the giants—Apple, Microsoft, Amazon, Nvidia—dictate where the chart goes.

In 2023 and early 2024, the "Magnificent Seven" were doing all the heavy lifting. You could look at a stock market performance chart and see a beautiful upward trend. But if you looked "under the hood" at the Equal Weight S&P 500 (where every company counts the same), the chart was flat or even down.

This is called "breadth."

🔗 Read more: Transfer Money from US to India: What Most People Get Wrong

A healthy market has a lot of stocks participating in the rally. A dangerous market is one where only five tech companies are propping up the entire economy. If those five giants stumble, the whole chart collapses. You should always compare the standard index chart to an equal-weighted version to see if the "average" company is actually doing well or if you're just riding the coattails of a few AI companies.

Timeframes: The Great Manipulator

Short-term charts are noise. Intraday charts? Pure chaos.

If you look at a 1-minute chart, it looks like a heart attack. If you look at a monthly chart, it looks like a steady climb. This is why day trading is so incredibly hard for the average person. You are fighting against algorithms that can process a stock market performance chart in microseconds.

- The 1-Day View: Useful for seeing how the market reacted to a specific news event (like a Fed rate hike).

- The 1-Year View: Good for seeing the current medium-term trend and identifying "cycles."

- The 10-Year+ View: The only view that matters for your 401k.

Most of the "volatility" we stress about is just tiny wiggles on a much larger, upward-sloping line. Since 1926, the US large-cap stocks have returned about 10% annually on average. But they rarely return exactly 10% in a single year. It’s usually +30% or -20%. The chart is the path, but most people get motion sickness and jump off the bus before they reach the destination.

Volume: The Secret Ingredient

Price is the "what." Volume is the "why."

If a stock price jumps 5% on tiny volume, nobody cares. It’s a fluke. It’s a few people trading shares in a garage. But if a stock price jumps 5% on massive volume—millions of shares trading hands—that’s the "big money" moving. That’s institutional investors, pension funds, and hedge funds making a move.

💡 You might also like: Exchange rate of dominican pesos to us dollars: What Most People Get Wrong

A stock market performance chart without a volume bar at the bottom is like a car without a fuel gauge. You don't know how much conviction is behind the move. High-volume breakouts are usually the start of a real trend. Low-volume rallies are often "bull traps" that reverse the moment a real seller enters the room.

Practical Steps for Your Next Portfolio Review

Don't just stare at the lines. Do this instead:

- Toggle to Logarithmic: If you're looking at any timeframe longer than two years, switch the scale. It will give you a much more realistic perspective on growth percentages rather than just dollar amounts.

- Check the Equal Weight Index: Compare the SPY (S&P 500) to RSP (Invesco S&P 500 Equal Weight ETF). If the SPY is way ahead, the market is being driven by a few mega-caps. Be cautious.

- Look for Total Return: Use a tool like StockCharts or TradingView to find "Total Return" symbols. This includes those reinvested dividends we talked about. Your "gains" will likely look much better than the standard price chart suggests.

- Ignore the 1-Day Chart: Unless you are a professional trader, the daily "heartbeat" of the market is irrelevant to your long-term wealth. Check the weekly or monthly charts to find the real trend.

- Watch the VIX: The CBOE Volatility Index, or the "Fear Gauge," often moves inversely to the market. If the S&P 500 chart is hitting new highs but the VIX is also starting to creep up, it might mean big players are buying "insurance" because they expect a drop.

Basically, a chart is just a map of where we've been. It’s not a GPS for where we’re going. Use it to understand the context, but don't let a "scary" candle on a Tuesday afternoon talk you out of a ten-year investment plan. The market has survived wars, pandemics, and depressions. It usually finds a way to move to the upper right corner of the screen—you just have to give it enough time to get there.