You’ve probably heard it a thousand times at a dinner party or on a heated social media thread. Someone insists that the "other guy" being in the White House is a total disaster for your 401(k). Then someone else fires back with a chart they found on a random blog. Honestly, the way people talk about stock market performance by president makes it sound like the Commander-in-Chief has a "Stonks Go Up" lever right next to the Diet Coke button on the Resolute Desk.

It’s just not that simple. Not even close.

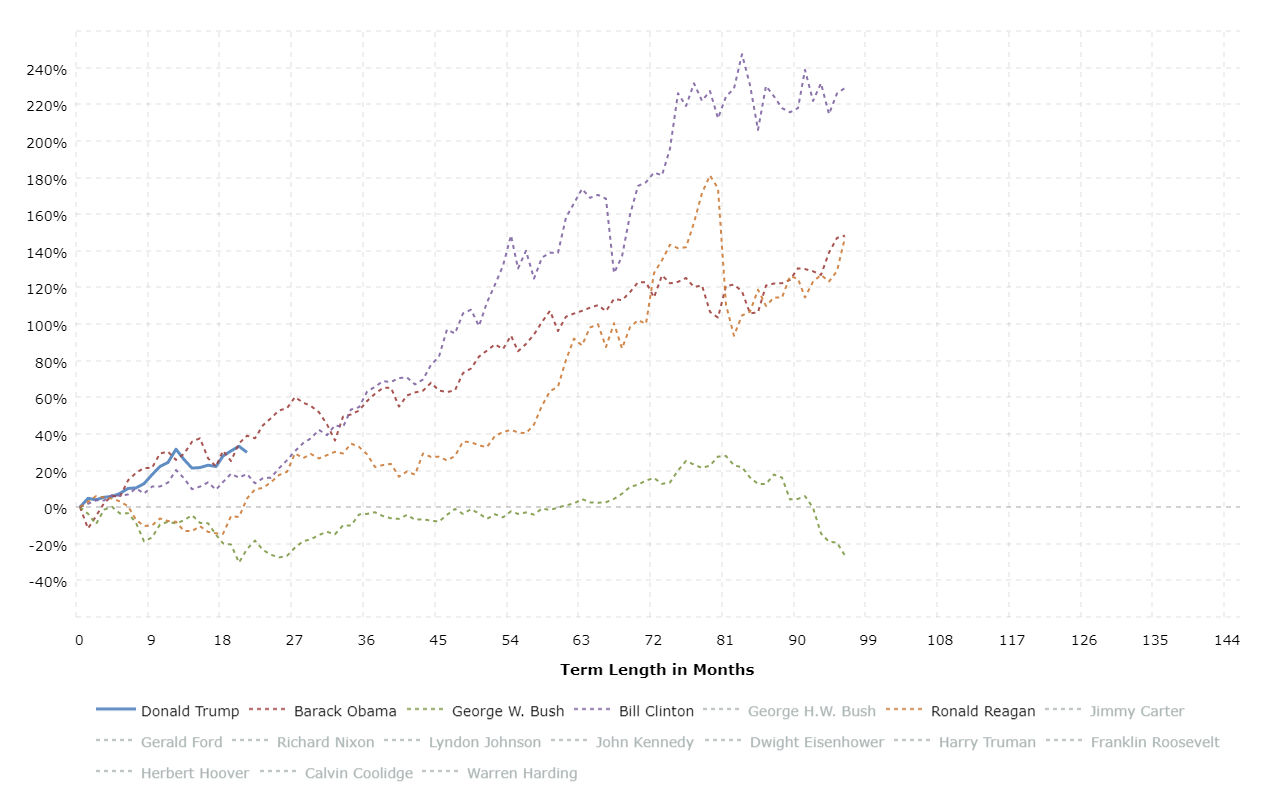

If you look at the raw numbers, the history of the S&P 500 under different administrations is full of weird outliers, massive strokes of luck, and timing that would make a professional gambler sweat. To really understand what’s going on, you have to look past the campaign slogans.

The Winners, The Losers, and the Genuinely Lucky

Basically, if we’re just looking at the scoreboard, some names stand out in a big way. Calvin Coolidge is the absolute heavyweight champion here. Under "Silent Cal" in the 1920s, the market roared at an annualized return of about 26.1%. That’s insane. You could’ve thrown a dart at a list of tickers and retired a king. But let’s be real—he was riding the wave of the Roaring Twenties, a massive post-war boom that was destined to pop.

Then you’ve got the modern era. Bill Clinton saw the S&P 500 climb about 15% annually. People love to credit his policies, and sure, the 1990s tech boom was a wild ride. But he also left office right as the dot-com bubble started to hiss and leak. Timing is everything.

On the flip side, you have the "unlucky" group. Herbert Hoover is the name most people point to when they want to show a market bloodbath. His term saw returns of -30.8% per year. Ouch. But did Hoover personally cause the Great Depression? Most historians would say he was the guy standing on the beach when the tsunami hit. Similarly, George W. Bush saw a negative annualized return (about -5.6%) because his term was bookended by the dot-com crash and the 2008 Great Financial Crisis.

Does Party Actually Matter?

This is where things get spicy. If you look at the broad averages since 1947, Democratic presidents have historically seen higher average annual returns—roughly 10.8% compared to about 5.6% for Republicans.

Wait. Don’t run off and change your voter registration just yet.

Research from firms like Research Affiliates suggests this might be a "spurious" correlation. In plain English: it might just be a fluke. They pointed out that a Republican just happened to be in the chair during the 1929 and 2008 crashes. Meanwhile, Democrats often took over right when the market was at rock bottom, meaning they got to ride the "recovery" elevator back up.

It’s sorta like taking over a marathon at mile 22 when the first runner did all the hard work. You get to cross the finish line and hold the trophy, but your legs aren't the ones that are tired.

The Myth of the "Sweep"

A lot of investors get terrified when one party controls the White House, the House, and the Senate. The "Blue Wave" or "Red Wave" panic. But historical data from U.S. Bank shows that "gridlock" is actually pretty popular with investors. When the government is split, it’s harder to pass radical new laws or massive tax hikes. Markets hate uncertainty. Gridlock is the ultimate form of certainty—nothing is going to happen.

👉 See also: S\&P Average Return for the Last 10 Years: Why Your Portfolio Might Not Match the Charts

Biden vs. Trump: The Recent Heavyweights

Comparing the stock market performance by president for the most recent guys is a favorite pastime for news pundits. Donald Trump’s first term saw the S&P 500 jump about 67% (roughly 13.6% annualized). He talked about the market constantly. It was his favorite metric for success.

Then came Joe Biden. Despite all the talk about inflation and "Bidenomics," the S&P 500 actually climbed over 50% during his term, hitting dozens of new all-time highs. If you compare the Dow Jones Industrial Average, Trump’s first term saw a 56% gain, while Biden’s saw about 40%.

Both guys benefited from something totally out of their control: Federal Reserve policy. When the Fed keeps interest rates low, money is cheap, and stocks tend to fly. When the Fed cranks up rates to fight inflation—like they did in 2022—the market takes a punch to the gut, regardless of who is tweeting from the Oval Office.

What Actually Moves the Needle?

If the president isn't the primary driver, what is? Basically, it’s the boring stuff.

📖 Related: Rite Aid Linglestown Road: What Most People Get Wrong About This Location Now

- Corporate Earnings: Are companies actually making money?

- The Fed: Are they printing money or taking it away?

- Innovation: Did someone just invent ChatGPT or a new weight-loss drug?

- Global Events: Wars, pandemics, and Suez Canal blockages don't care who won Ohio.

Take the "AI Craze" that started in late 2022. That single technological shift did more for the S&P 500 than almost any piece of legislation passed in Washington. Nvidia doesn't care about the State of the Union address; it cares about how many H100 chips it can ship.

Actionable Insights for Your Portfolio

So, what are you supposed to do with this? If you’re trading based on who’s winning the polls, you’re probably going to lose money.

First, ignore the noise. The "Pre-Election Dip" is a real thing—markets often get jittery in August and September of election years because they don't know what's coming. But once the winner is declared, the market almost always stabilizes. It doesn't matter who wins; the market just likes knowing the answer.

Second, look at sectors, not the whole market. Different parties do favor different industries. Defense and traditional energy (oil/gas) often get a tailwind under Republicans. Clean energy and healthcare sometimes see more love under Democrats. If you want to play politics with your money, do it with a scalpel, not a sledgehammer.

Third, stay invested. The biggest mistake people make is sitting on the sidelines in cash because they "don't like the direction of the country." The stock market has gone up under every single president in the last 100 years except for three. If you stayed out of the market during the Obama years because you were a Republican, or stayed out during the Trump years because you were a Democrat, you missed out on massive, life-changing gains.

Basically, the President is the captain of the ship, but the stock market is the ocean. The captain can try to steer, but they can't stop the waves.

Next Steps for Your Strategy

- Review your sector exposure: Check if your portfolio is over-indexed in areas that might be sensitive to upcoming policy shifts (like Green Energy or Defense).

- Rebalance based on fundamentals: Instead of political vibes, look at current P/E ratios and the Federal Reserve's interest rate trajectory.

- Audit your "emotional" trades: Look back at your trading history to see if you've ever sold stocks out of political fear. If you did, calculate the "opportunity cost" of what those stocks would be worth today. It's usually a sobering lesson in staying the course.