The opening bell is loud. It’s iconic. But honestly, if you think the stock market open time is just a simple "9:30 AM to 4:00 PM" window, you’re missing the actual drama happening behind the curtains. For most retail traders sitting at home in their pajamas, the day starts when the New York Stock Exchange (NYSE) and the Nasdaq flick the lights on in Manhattan. But for the big players? The day started hours ago.

Money never actually sleeps. It just naps.

Most people assume the stock market open time is a hard boundary, like a store opening its doors. It isn't. It's more like a gradual awakening. While the "official" session is 9:30 AM to 4:00 PM Eastern Time, the pre-market session kicks off as early as 4:00 AM. Imagine trying to make a high-stakes financial decision while the sun isn't even up and you’re on your third cup of coffee. That’s where the "smart money" often tries to front-run the news before the rest of the world wakes up.

The Chaos of the 9:30 AM Bell

The actual stock market open time is a mess of algorithms. When 9:30 AM hits, it’s not just people clicking "buy." It’s thousands of lines of code executing orders that have been queuing up all night. This is why you see those massive, jagged spikes in the first fifteen minutes. Experts call this the "amateur hour," though that’s kinda mean. It’s actually just the period of highest volatility.

Why does it matter to you? Because the price you see at 9:31 AM is often a lie.

It’s a price discovery phase. The market is trying to figure out what happened while we were all asleep. Did a tech giant lose a lawsuit in Europe? Did a shipping vessel get stuck in the Suez Canal again? The opening bell is the moment all that overnight anxiety hits the reality of the order book. If you place a market order right at the stock market open time, you might get "filled" at a price that makes your stomach sink five minutes later.

I've seen traders lose thousands in seconds because they didn't realize the spread—the gap between the bid and the ask—is wide enough to drive a truck through during the first few minutes of trading.

💡 You might also like: How Much Is One Peso in American Dollars? Why the 2026 Rate Might Surprise You

After Hours: The Secret Second Shift

Then there's the flip side. 4:00 PM hits. The bell rings. Most people turn off their monitors and go grab a drink. But the market stays open until 8:00 PM ET. This is the "After-Hours" session.

This is where the real skeletons come out of the closet.

Public companies almost never release their earnings reports during the standard stock market open time. They wait. They wait for the bell to ring at 4:00 PM so they can drop their data when the "crazy" volatility of the day has simmered down. Or so they think. In reality, after-hours trading is a ghost town. Because there are fewer people trading, a small sell-off can turn into a total collapse. You'll see a stock drop 10% on a "missed" earnings report in seconds. If that happened at 2:00 PM, the sheer volume of buyers might have propped it up. At 5:00 PM? It’s a freefall.

Time Zones and the Global Ripple Effect

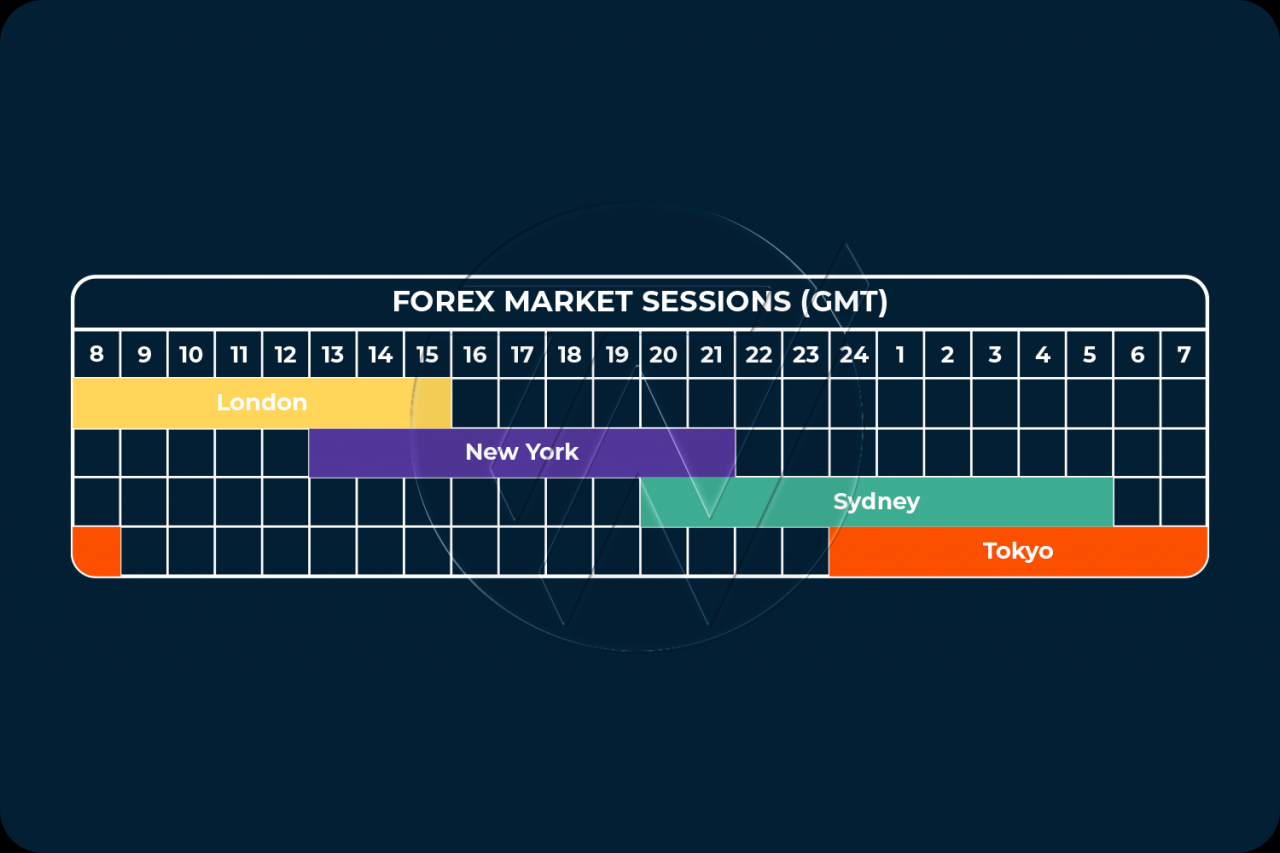

We talk about the NYSE like it's the center of the universe. For US investors, it basically is. But the stock market open time in New York is heavily influenced by what happened in Tokyo and London while you were dreaming.

- London (LSE): Opens at 3:00 AM ET. By the time New York opens, London is already halfway through its day.

- Tokyo (TSE): Opens at 7:00 PM ET (the night before).

- Hong Kong (HKEX): Opens at 8:30 PM ET.

If the Hang Seng index in Hong Kong craters overnight, the US stock market open time is going to be a bloodbath. You can almost feel the tension building at 8:00 AM in New York as traders watch the European markets close. There’s a specific overlap—roughly from 9:30 AM to 11:30 AM ET—where both the US and European markets are open at the same time. This is arguably the most liquid, most important two hours in the entire global financial system.

If you want to move a billion dollars, you do it when London and New York are both awake.

The "Weekend Effect" and Monday Mornings

Sundays are stressful for fund managers. While the stock market open time for the NYSE isn't until Monday morning, "Futures" start trading on Sunday night at 6:00 PM ET.

This is the sneak peek.

If you want to know if Monday is going to be a "Green Day" or a "Red Day," you check the S&P 500 futures on Sunday night. It’s the market’s way of processing the weekend news. If a geopolitical crisis breaks out on a Saturday, the Sunday night futures market is the first place the panic shows up. By the time the actual stock market open time rolls around on Monday, the "gap down" has already happened. You’re already late to the party.

Why 11:30 AM to 1:30 PM is the "Dead Zone"

Have you ever noticed that the market feels... boring around lunchtime? It’s not your imagination.

Traders eat. Even the ones using algorithms. Between 11:30 AM and 1:30 PM ET, volume drops off a cliff. This is the "Lull." Institutional investors usually step back, and the market drifts. If you’re looking for big, trend-setting moves, you usually won't find them here. Trying to day-trade during the lunch hour is like trying to surf in a bathtub. There’s just no waves.

Then, around 2:00 PM, things pick up again. This is often triggered by the "Bond Market" or Federal Reserve announcements, which frequently happen in the afternoon.

The Power Hour: 3:00 PM to 4:00 PM

The final hour is the "Power Hour." It’s the mirror image of the stock market open time.

Everything that was decided in the morning is either confirmed or rejected. Fund managers have to "square their books." If they need to buy five million shares of Apple to balance their portfolio, they have to do it before the 4:00 PM cutoff. This leads to massive surges in volume. It's high-speed, high-stakes, and definitely not for the faint of heart.

The closing cross—the very last fraction of a second at 4:00 PM—determines the "official" closing price that you see on the news. That single number affects trillions of dollars in 401ks, pension funds, and ETFs.

Practical Steps for Handling the Market Clock

Understanding the clock is better than understanding the charts sometimes. Here is how you actually use this info:

Avoid the "Open" Trap

Don't trade in the first 15 minutes of the stock market open time. Let the "noise" settle. Let the algorithms fight it out. By 9:45 AM or 10:00 AM, the true direction of the day usually reveals itself. You'll get much better "fills" on your orders.

Check the Futures on Sunday

If you have a lot of money in the market, don't wait until Monday morning to see what happened. Open a finance app at 7:00 PM ET on Sunday. If the futures are down 2%, you have time to mentally prepare or plan your exits before the madness starts the next day.

Use Limit Orders, Always

Especially during the volatile stock market open time or after-hours. A "Market Order" tells the broker "get me in at any price." In a fast-moving market, that "any price" could be 3% higher than what you saw on your screen. A "Limit Order" says "I will only pay $150.00, not a penny more." It protects you from the timing glitches that happen when millions of people are hitting "Buy" at the same second.

Watch the 2:00 PM Reversal

If the market has been rallying all morning, watch out for the 2:00 PM window. Often, the "smart money" starts taking profits in the afternoon, which can cause a morning rally to evaporate by the time the closing bell rings.

The market doesn't care about your schedule. It operates on a very specific, rhythmic heartbeat governed by the stock market open time and the various sessions surrounding it. Respect the clock, or the clock will take your money.