It’s been a weird few months for your 401(k). If you’ve been staring at the stock market last 3 months graph, you’ve probably noticed that the line isn't just going up—it’s zig-zagging in a way that’s making even the most seasoned Wall Street veterans a little jumpy. We’re sitting here in mid-January 2026, and the S&P 500 is hovering around 6,945. That sounds great, right? It is. But the story behind that number is kinda messy.

Honestly, the last 90 days have been a total tug-of-war. On one side, you have the "AI supercycle" enthusiasts who think Nvidia and the "Magnificent Seven" are basically invincible. On the other, you have folks like Peter Berezin at BCA Research warning that the massive capital expenditure (capex) we’re seeing in tech might not actually pay off as fast as we hope.

It’s a lot to process.

Breaking Down the Chart: November to January

When you look at the stock market last 3 months graph, you can basically divide it into three distinct "moods."

November started with a massive case of the jitters. There was this lingering fear of an "AI bubble" that really shook things up around November 5th. The Nasdaq actually dropped 2% in a single day back then. Everyone was worried that valuations had finally outpaced reality. But then, Nvidia did what Nvidia does. They dropped a Q3 earnings report showing revenue up 62% year-over-year.

Suddenly, the "bubble" talk vanished. The market roared back.

Then came December. This was the "Wait and See" month. The S&P 500 ended December almost flat, but that hides the internal chaos. While tech was catching its breath, the financial sector actually led the way, jumping about 3.1%. People started rotating their money out of high-flying tech and into "boring" stuff like banks and materials. It wasn't a crash; it was just a reshuffling.

The January 2026 Surge and the "Tariff" Variable

Now that we’ve hit January, things have turned spicy again. The S&P 500 hit an all-time high of 6,994.55 earlier this month. But have you noticed the volatility? Just a few days ago, on January 14th, the Dow Jones dropped 398 points because bank earnings from giants like JPMorgan Chase and Wells Fargo came in mixed.

There’s also a new elephant in the room: trade policy. J.P. Morgan’s Bruce Kasman recently pointed out that shifts in U.S. trade policy and incoming tariffs are starting to "shock" global growth expectations. It’s why you see the graph looking so jagged lately. One day we’re celebrating 12% earnings growth projections from Goldman Sachs, and the next we’re worrying about a "growth downshift" in developed markets.

What’s Actually Driving the Price Action?

If you want to understand the stock market last 3 months graph, you have to look at three specific pillars that are propping everything up (or pulling it down).

- The Fed’s "Long Goodbye" to High Rates: We’ve seen the Fed cut rates down to a range of 3.50-3.75%. They’ve been gradual. Maybe too gradual for some? But it’s keeping the wheels greased.

- Corporate Resilience: Despite all the talk of a recession (which J.P. Morgan still pegs at a 35% probability for 2026), companies are still making money. The S&P 500 is expected to grow earnings by 12% this year. That’s a solid floor for any market.

- The Search for Value: This is the big trend for early 2026. Investors are tired of overpaying for tech. They’re looking for "middle-income consumer" stocks and non-residential construction firms. Basically, the "stuff" of the real economy.

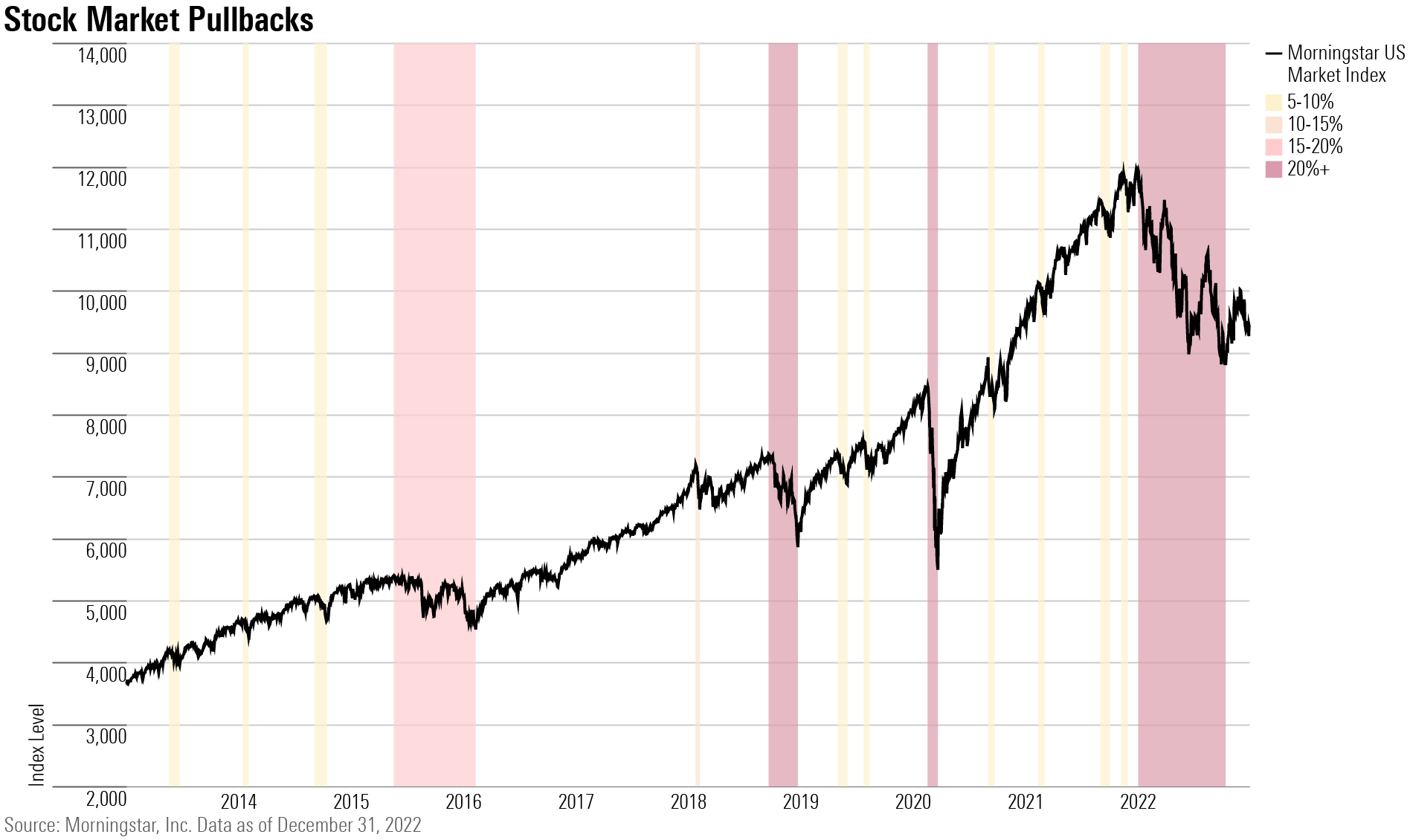

Don't Let the Green Line Fool You

It's easy to look at a 3-month chart, see that it’s higher than where it started, and think everything is fine. But look closer. The "market concentration" is at record levels. A handful of stocks are doing the heavy lifting. If Microsoft or Apple has a bad week, the whole index feels it.

We also saw a weird spike in gold and silver recently. Gold hit $4,650 an ounce this week. Usually, when people pile into gold, it means they’re scared of something. It might be the geopolitical tension involving Iran, or maybe it’s just a hedge against "sticky" inflation that won't drop below 3%.

Actionable Steps for Your Portfolio

So, what do you actually do with this information? Watching the stock market last 3 months graph is a hobby; managing your money is a job.

Check your tech weight. If you haven't rebalanced in a year, your portfolio is probably 40% tech by accident. It might be time to lock in some of those "AI supercycle" gains.

Watch the 10-year Treasury yield. It’s hovering around 4.15% right now. If that starts climbing toward 4.5%, it’s going to put a lot of pressure on stocks. High yields are the natural enemy of high stock prices.

Don't ignore the "Boring" sectors. Goldman Sachs is betting on value stocks for 2026. Look at sectors like Utilities or Materials that haven't had their "moon" moment yet. They might offer a smoother ride if the Nasdaq decides to take another 2% dip.

The biggest takeaway from the last 90 days? The "easy money" phase of the rally is likely over. We’re in a "show me the money" phase where companies actually have to prove their AI investments are turning into real profit.

Keep an eye on the January 28th FOMC meeting. The market is only pricing in a 16% chance of another rate cut. If the Fed surprises us, that 3-month graph is going to look very different by February.

💡 You might also like: Why Use a Currency Converter ZMW to USD When Rates Change This Fast?

Summary of Key Market Levels (Jan 15, 2026)

- S&P 500: 6,945 (Trading near all-time highs but facing resistance)

- Dow Jones: 49,442 (Recovering from a sharp 400-point drop)

- Nasdaq: 23,733 (Volatile, heavily influenced by semiconductor sentiment)

- Gold: $4,635 (Signaling underlying investor anxiety)

Start by reviewing your most recent brokerage statement to see exactly how much of your growth is tied to the top five stocks in the S&P 500. Knowing your "concentration risk" is the first step to surviving whatever the next three months throw at us.