Black Tuesday. That’s the name everyone remembers. But if you look at stock market crash 1929 pictures, you’ll notice something weird right away. Most of the famous photos aren't actually from October 29th. They can't be.

Why? Because photographers weren't exactly allowed to set up tripods on the floor of the New York Stock Exchange while the world was ending.

Most of what we see is the aftermath. It’s the crowds. It’s the guys in flat caps looking stunned. It's that specific brand of 1920s despair that looks sharp because of the suits but feels hollow because of the eyes. You’ve probably seen the one of the crowd gathered outside the Sub-Treasury Building across from the NYSE. Thousands of men. Just standing. Waiting for a miracle that didn’t show up for a decade.

It’s easy to look at these images and think it was just one bad afternoon. It wasn't. It was a slow-motion train wreck that started in September, fell off a cliff in October, and then just kept digging. Honestly, the photos tell a story of a psychological break more than a financial one. People truly believed the "Roaring Twenties" would never end. Then, the ticker tape couldn't keep up.

The faces of the ticker tape panic

When you scan through stock market crash 1929 pictures, look at the ticker tape. It’s everywhere. It looks like snow or confetti in some shots, but in others, it’s a tangled mess on the floor.

Back then, the ticker was the heartbeat of Wall Street. On October 24 (Black Thursday) and October 29 (Black Tuesday), the volume of selling was so high that the machines fell hours behind. Imagine trying to sell your life savings when the "current" price you’re seeing is actually from two hours ago. You’re flying blind.

The photos of the clerks are the most haunting to me. You see these young guys, shirtsleeves rolled up, surrounded by mountains of paper. They look exhausted. Not just "long day at the office" tired, but "I am witnessing the death of the American Dream" tired.

There’s a specific photograph by Broad Street where the crowd is so dense you can’t see the pavement. They weren't all millionaires. A lot of them were just regular people who had bought on margin—basically gambling with borrowed money. When the margin calls hit, they didn't just lose their profit; they lost their houses.

The myth of the jumpers

We need to address the "suicide" photos. You’ve heard the stories. Bankers jumping out of windows left and right.

It’s mostly a myth.

While there were certainly tragic suicides, the image of bodies raining down on Wall Street was largely sensationalized by the press. The Chief Medical Examiner of New York City, Dr. Charles Norris, actually reported that the suicide rate in the city dropped in the weeks immediately following the crash.

However, the stock market crash 1929 pictures of the "Breadlines" and "Hoovervilles" that followed are very real. The crash was the trigger, but the images of men in line for soup outside Al Capone’s free kitchen in Chicago—yeah, the gangster ran a soup kitchen—show the true cost.

🔗 Read more: Foreign Exchange Rates in Nepal Rastra Bank: What Most People Get Wrong

Why the lighting in these photos feels so heavy

A lot of the 1929 photography was captured using large-format cameras or early Leicas. The film of the era had a specific silver-rich quality. It created deep, crushing blacks and stark whites.

When you look at a photo of the crowd on Wall Street, the shadows under their hats make everyone look like a ghost. It fits the mood.

The famous Chrysler Imperial

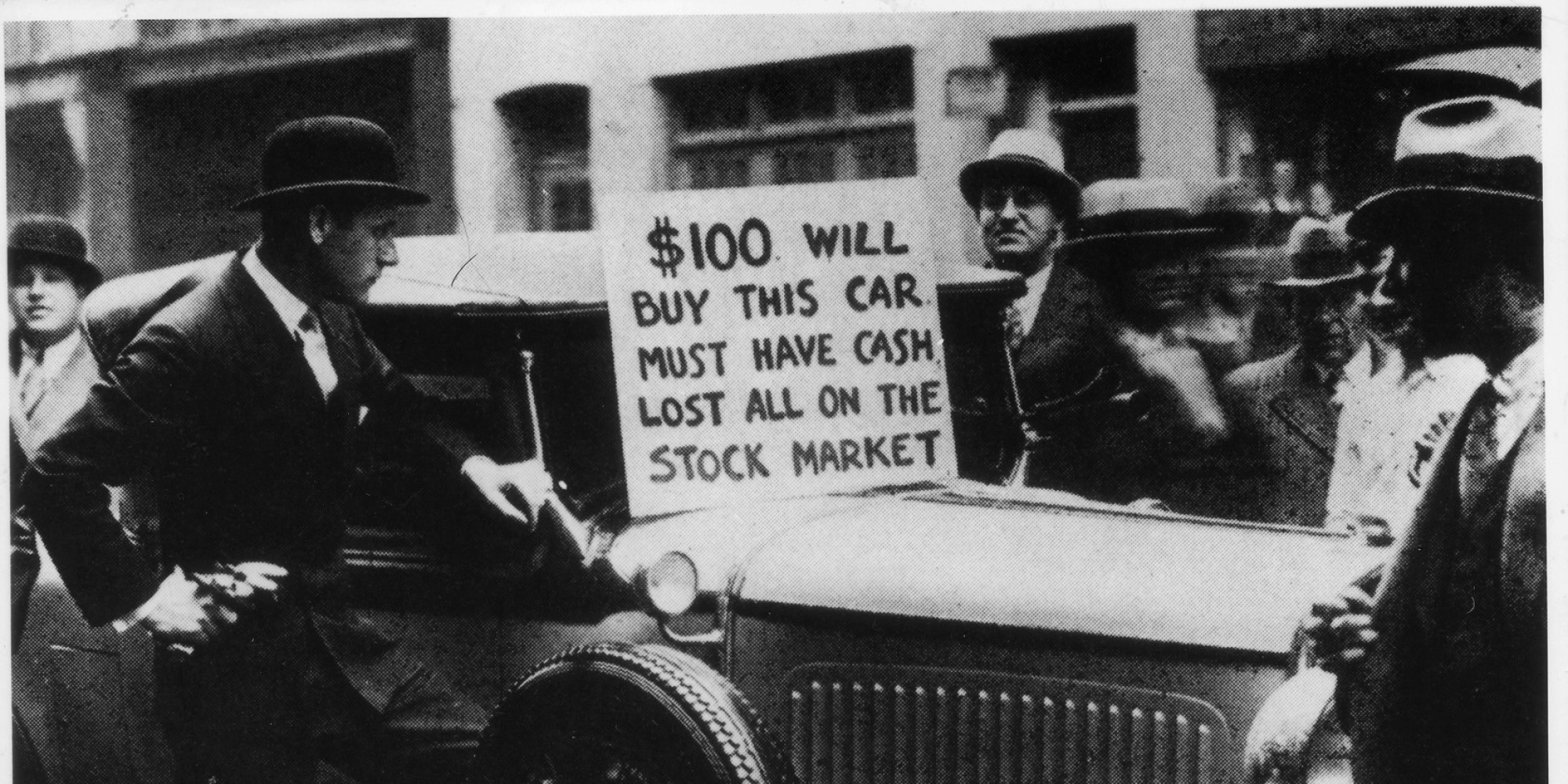

You know the one. The guy in the long coat, leaning against a luxury car with a sign that says: "$100 will buy this car. Must have cash. Lost all on the stock market."

That’s Walter Thornton. He was a real estate agent. That photo is the ultimate "I messed up" meme of the 1920s. It captures the suddenness of the shift. One day you’re driving a Chrysler Imperial—a serious status symbol—and the next day you’re begging for a hundred bucks just to get out of town.

It’s a reminder that liquidity is everything. You can be "rich" on paper, but if the market vanishes, you’re just a guy with a heavy piece of metal you can't afford to fuel.

The architectural silence

Some of the most underrated stock market crash 1929 pictures aren't of people. They’re of the buildings.

The late 1920s saw a massive construction boom. The Empire State Building and the Chrysler Building were being finished just as the economy was tanking. There are photos of these massive, gleaming skyscrapers rising up while the streets below were filled with people who couldn't afford a nickel for a cup of coffee.

It’s a jarring contrast.

Historians like Broadus Mitchell have noted that the crash didn’t just break banks; it broke the collective psyche. The photos of the empty trading floors after hours, littered with paper, look like a battlefield after the retreat.

What the history books miss

They usually miss the small stuff. The photos of pawn shops with lines out the door. The images of people selling apples on street corners.

Selling apples wasn't just a random choice. The International Apple Shippers Association had a surplus of fruit and decided to sell them on credit to the unemployed. It became the visual shorthand for the Great Depression. When you see an apple seller in those 1929-1930 photos, you’re looking at a desperate attempt by a trade group to move product by using the newly homeless as a sales force.

The logic of the lens

Photographers like Margaret Bourke-White and Dorothea Lange eventually captured the fallout, but the immediate 1929 shots were mostly wire service photos. They were meant for newspapers. They were fast, grainy, and visceral.

They weren't trying to be art. They were evidence.

When you look at these pictures today, you should look for the details in the background. Look at the shoes. In October 1929, the shoes are still polished. By 1930, in the same types of photos, the soles are worn through. That’s how you track the collapse. Not by the Dow Jones Industrial Average—which dropped from a high of 381 to a low of 41—but by the state of a stranger's footwear.

Real-world takeaways for today

Looking at stock market crash 1929 pictures isn't just a history lesson. It’s a warning about "irrational exuberance," a term popularized much later by Alan Greenspan but perfectly applicable to 1929.

- Margin is a double-edged sword. Most of the people in those crowd photos were wiped out because they used 10:1 leverage. If the stock dropped 10%, they lost 100%.

- Don't trust the "New Era" talk. In 1929, economists like Irving Fisher famously said stock prices had reached "what looks like a permanently high plateau." He was wrong. Very wrong.

- Panic is physical. The photos show that when a market crashes, people don't stay home. They gather. They want to see the "scene of the crime."

- Liquidity matters most. Having assets is great; having cash when no one else does is better.

If you want to understand the 1929 crash, stop looking at the charts for a second. The charts are just lines. Look at the faces in the photos. Look at the way they’re holding their newspapers. That’s where the real data is.

To dive deeper into this, you can visit the Library of Congress digital archives. They hold the original glass plate negatives for many of these images. You can actually zoom in enough to read the headlines on the papers people are holding. It’s a trip. Also, check out the Museum of the City of New York; they have a massive collection of "Wall Street" specific photography that shows the transition from the boom to the bust in high resolution.

Finally, if you’re trying to build a resilient portfolio today, remember the 1929 lesson: the market can stay irrational longer than you can stay solvent. Diversification isn't just a buzzword; it’s the only reason some people in those 1929 photos still had a house to go home to at the end of the day.