When people talk about the heavy hitters of private equity and specialty lending, they usually name-drop the flashy CEOs or the firms that buy up entire sports leagues. But honestly, if you want to understand how the gears actually turn at a place like Sixth Street, you have to look at the architects who built the foundation. Steven Pluss is exactly that kind of figure.

He’s a co-founding partner. He’s the guy who’s been the Chief Risk Officer (CRO) since basically the beginning. If you’ve ever wondered how a firm goes from a 2009 startup to managing over $115 billion in assets, the answer lies in the risk management and structural integrity folks like Pluss provide.

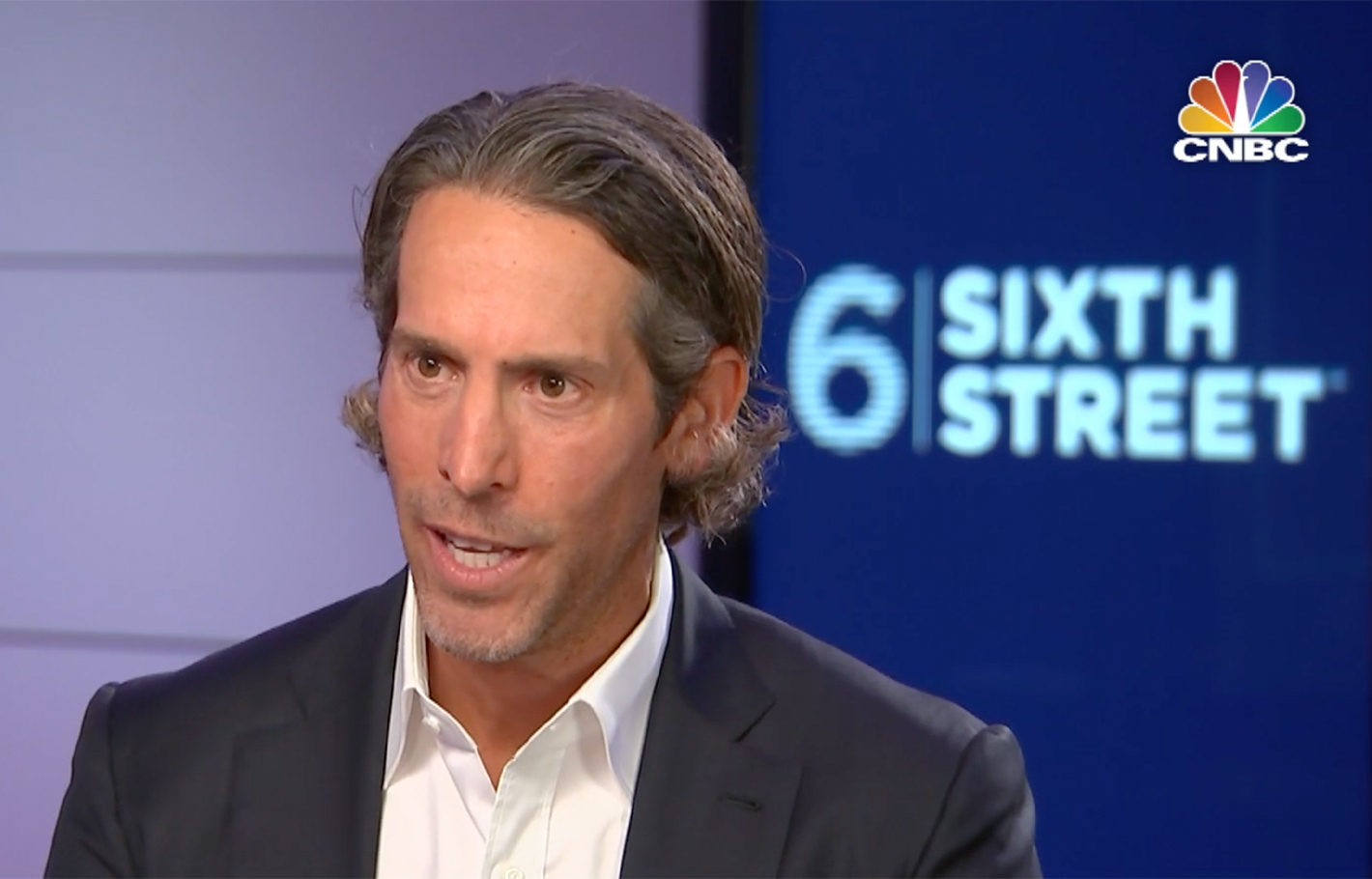

Who Is Steven Pluss at Sixth Street?

Steven Pluss isn't just a name on a masthead. He currently serves as a Partner and Managing Director at Sixth Street, and he carries a pretty heavy portfolio of responsibilities. He’s the Vice President of Sixth Street Specialty Lending (TSLX), which is their big, publicly traded business development company.

Basically, he’s been there since day one.

Before the firm became the independent giant it is today, it was known as TSSP (TPG Sixth Street Partners). Pluss was part of that core group of "Goldman Sachs refugees"—as the media sometimes calls them—who left the white-shoe world of investment banking to build something more flexible. Specifically, he spent about a decade at Goldman Sachs as a Managing Director and co-head of the Specialty Lending Group.

That’s where the "One Team" philosophy started to bake.

He didn't just jump into the deep end without a plan. Pluss holds a B.B.A. from Texas A&M and an M.B.A. from Southern Methodist University. He’s a Texas guy through and through, which makes sense given that Sixth Street maintains a massive presence in Dallas and Austin alongside its San Francisco and New York hubs.

📖 Related: Average Uber Driver Income: What People Get Wrong About the Numbers

The Pivot from Goldman to Independent Giant

It’s easy to forget that Sixth Street started in the wake of the 2008 financial crisis.

In 2009, Alan Waxman and the founding partners—including Pluss—saw a gap. Traditional banks were pulling back. The world needed "flexible capital." They launched with a strategic partnership with TPG, but by 2020, they were ready to fly solo.

Pluss’s role as Chief Financial Officer (2013–2016) and his long tenure as Chief Risk Officer (2013–present) mean he was the one overseeing the math while the firm was tripling its assets under management. It’s not just about picking winners. It’s about not losing your shirt when the market gets weird.

Why the Market Watches TSLX and Steven Pluss

Investors track Pluss because of his role in TSLX.

When you look at SEC filings, you see his name attached to the "Adviser" side of things. TSLX is externally managed, meaning the people running it are employees of the Sixth Street platform. Pluss is one of those key decision-makers.

- Skin in the game: As of early 2026, reports suggest Pluss holds tens of thousands of shares in TSLX.

- The "Goldman" DNA: The specialty lending group he co-headed at Goldman was the blueprint for how Sixth Street operates today.

- Risk oversight: In a high-interest-rate environment, the Chief Risk Officer is the most important person in the room.

The firm doesn't just do boring loans. They’ve bought 20% of the San Antonio Spurs, huge stakes in FC Barcelona’s TV rights, and even a majority of Legends Hospitality.

👉 See also: Why People Search How to Leave the Union NYT and What Happens Next

That’s a lot of diverse risk to manage.

The "One Team" Culture Explained

You’ll hear the phrase "One Team" constantly if you hang around Sixth Street.

It sounds like corporate fluff, but for Steven Pluss and his partners, it’s a functional strategy. They don't have "silos" where the real estate guys don't talk to the tech guys. Everything is collaborative. If a deal comes in that’s half-real estate and half-growth tech, they can price it and fund it faster than a bank that has to go through five different committees.

Honestly, it’s probably why they’ve been able to scale so fast. They operate nine different platforms—from infrastructure to agriculture—but they use a unified pool of knowledge.

Real-World Impact: What They Actually Fund

While Pluss is often in the background of the big headlines, the deals his team approves are massive. Recently, Sixth Street has been moving into:

- Industrial Real Estate: Expanding their UK portfolio to over 3 million square feet.

- Sports Finance: They’ve become the "go-to" for teams needing liquidity without selling the whole farm.

- Insurance Solutions: Acquiring companies like Enstar for $5.1 billion to create long-term stability.

It’s all about "idiosyncratic opportunities." That’s a fancy way of saying they look for deals that are too weird or complicated for a standard bank.

✨ Don't miss: TT Ltd Stock Price Explained: What Most Investors Get Wrong About This Textile Pivot

Actionable Takeaways for Professionals and Investors

If you're looking at the career of Steven Pluss or the trajectory of Sixth Street, there are a few things you can actually apply to your own strategy.

First, specialization is a trap. Pluss and his team succeeded by taking the "specialty lending" model and applying it to everything from soccer to software. They didn't stay in one lane; they brought their lending expertise to new asset classes.

Second, risk management isn't a "no" department. In the Sixth Street model, the CRO is a founding partner. This suggests that risk is viewed as a way to structure better deals, not just a way to stop them.

Finally, keep an eye on the TSLX filings. For retail investors, this is the most transparent way to see what the Sixth Street brain trust is actually doing with their capital.

The firm is now a $115+ billion powerhouse. It’s no longer the "scrappy" startup from 2009, but with the original founding group like Steven Pluss still at the helm, the DNA of that original Goldman Sachs Specialty Lending Group remains very much alive.

Next Steps for Research:

Check the most recent SEC Form 4 filings for Sixth Street Specialty Lending (TSLX) to see insider buying trends among the partner group. You can also review the Sixth Street Newsroom for their latest "MaSH" summit recaps, which give a surprisingly candid look at how their portfolio CEOs interact with the firm's leadership.