You’ve seen the name pop up on ticker tapes for years, but let’s be real—the story of the sterlite optical share price is way more of a roller coaster than the dry financial PDFs suggest. Most people still search for "Sterlite Optical," even though the company rebranded to Sterlite Technologies (STL) ages ago.

It’s a classic case of brand memory.

Right now, if you look at the screen, the stock is hovering around 93.45 to 94.10. It’s been a rough week for the bulls. On January 16, 2026, the price slipped about 0.68%, continuing a bit of a sideways-to-downward drift that has left many retail investors scratching their heads.

The Reality Behind the Sterlite Optical Share Price

Why is the price acting so weirdly? Honestly, it’s a mix of global fiber demand and some heavy-duty legal baggage.

Back in late 2025, the company got hit with a massive $96.5 million damages order in a U.S. court. That’s a huge pill to swallow for a company with a market cap of roughly 4,500 crore. The case involved allegations of trade secret misappropriation against their U.S. subsidiary. When that news dropped, the share price didn't just fall; it cratered by nearly 8% in a single day.

Since then, the market has been trying to price in the risk of this payout versus the potential for an appeal.

But it’s not all doom.

The order book is actually looking pretty healthy. We’re talking over 5,100 crore as of the last quarterly update. That’s a lot of fiber to be laid. While the "Optical" part of their name is technically gone, it’s still the engine of the business.

Breaking Down the 2026 Numbers

If you’re the kind of person who likes to stare at 52-week ranges, the spread is wild. We've seen a high of 140.40 and a low of 50.66.

Think about that.

If you timed it perfectly (and let's be honest, almost nobody does), you could have doubled your money. If you bought at the top during the 5G hype cycle of mid-2025, you’re likely staring at a sea of red.

- Current Momentum: Bearish. The stock is trading below its 50-day and 200-day moving averages (DMA).

- The Dividend Situation: It’s basically non-existent right now. The yield is 0%. The company is focusing every rupee on stabilizing the ship and managing its debt-to-equity ratio, which sits around 0.94.

- Profitability: They finally eked out a small profit of 4 crore in the September 2025 quarter. It's a "turnaround," sure, but it's a tiny one.

Why the Market is Hesitant

Investors are kinda waiting for a "catalyst."

The shift to 5G was supposed to be the big payday. And while data center operators in the U.S. are buying their new 11.7 mm low-diameter cables, the revenue hasn't exploded the way the hype suggested it would.

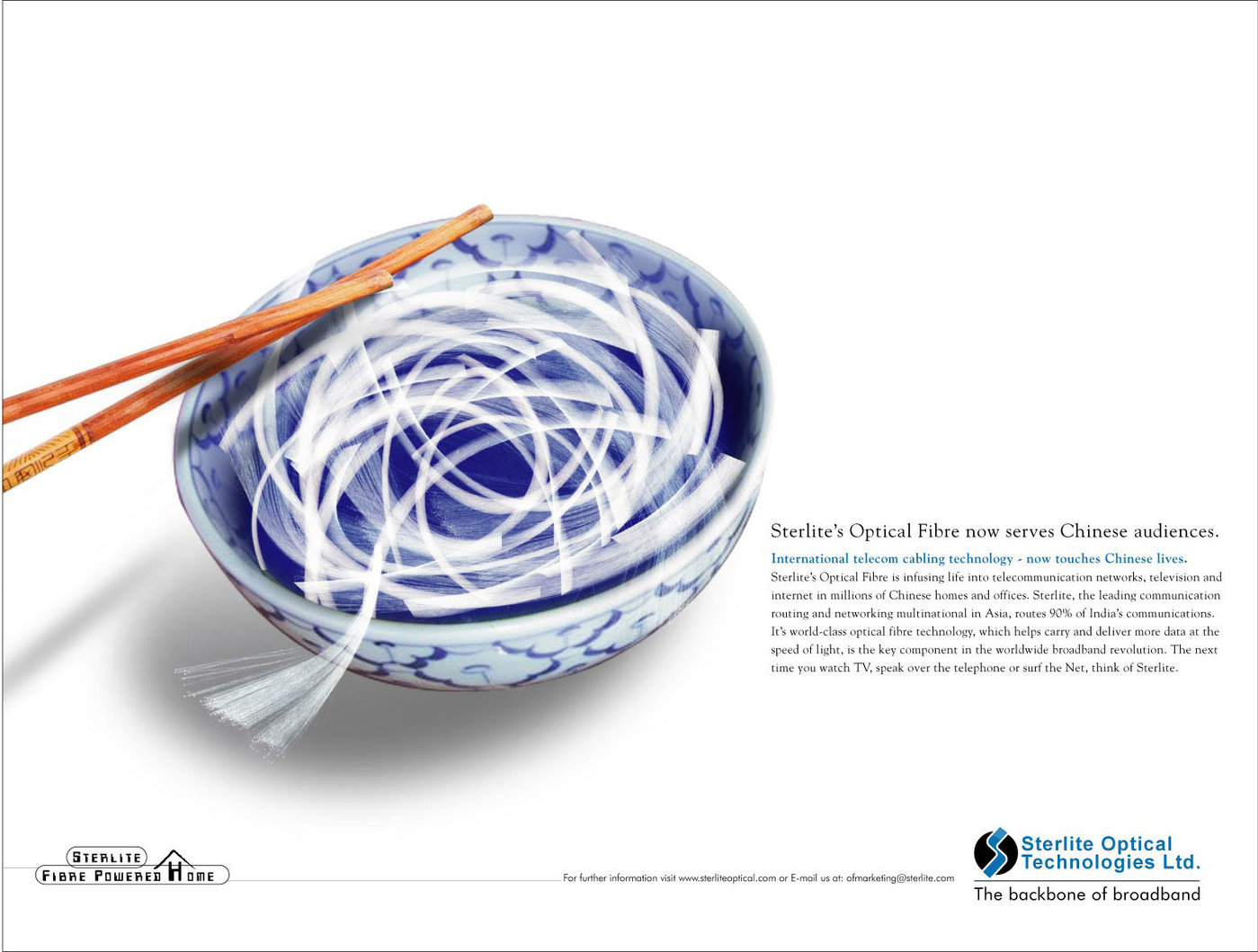

There's also the "China factor." The global market share for non-China optical fiber cables dropped to 8% recently, down from 12% the year before. That’s a significant loss of territory.

What the Experts are Whispering

If you talk to analysts at places like Nuvama or CLSA, you get two very different vibes. Some see an upside target of 129 to 150, betting on a massive rebound in infrastructure spending. Others are more cautious, keeping "Hold" ratings with targets closer to 80 or 90 until the legal dust in the U.S. settles.

It's a tug-of-war.

On one side, you have institutional accumulation. Mutual funds like Bandhan Flexi Cap and HDFC Large and Mid Cap still hold chunks. On the other side, the public—people like you and me—owns about 33% of the company, and retail sentiment is, frankly, exhausted.

Actionable Strategy for Investors

If you’re holding or looking to jump in, don’t just watch the daily candles.

Watch the debt. The company has been trying to trim its interest costs. If they can keep reducing debt (which they have, down from 3,475 crore a few years ago), the earnings per share (EPS) will eventually start to look human again.

Wait for the breakout. Technically, the stock is in a "symmetrical triangle" on the monthly charts. In plain English? It's squeezing. Usually, when a stock squeezes this much, the eventual move—up or down—is violent.

📖 Related: Why You Got Mail from PO Box 17316 Salt Lake City Card Enclosed 2023

Monitor the January 23 earnings. The next big date is January 23, 2026. If they show a surprise jump in revenue from their AI Center of Excellence or U.S. networking business, that could be the spark.

If you are looking for a quick flip, this probably isn't the one. But for those who believe that the world will only get more connected and that fiber is the "nervous system" of the internet, the current price represents a significant discount from historical highs. Just keep an eye on that U.S. court appeal. That's the real wild card.

Keep your position size small. This isn't a "bet the house" kind of stock. It's a "wait and see if the turnaround is real" kind of play. Use stop-losses around the 82 mark, as that's been a historical zone of strong support. If it breaks that, the floor might be further down than most people want to admit.