You're tired of seeing a chunk of your paycheck vanish before it even hits your bank account. I get it. Honestly, everyone does. When you start looking at the states with no income tax 2025 list, it feels like finding a cheat code for your finances.

But here is the thing.

Uncle Sam always gets his cut one way or another. Whether it’s through property taxes that make your eyes water or sales taxes that sneak up on you at the register, "tax-free" is a bit of a myth. Still, for high earners or retirees living off distributions, moving to a state without a personal income tax can save tens of thousands of dollars every single year.

As of 2025, there are nine states that don't tax your earned income. Some are famous for it, like Florida. Others might surprise you. If you’re planning a move this year, you need the ground truth on where these states stand and what the catch is. Because there is always a catch.

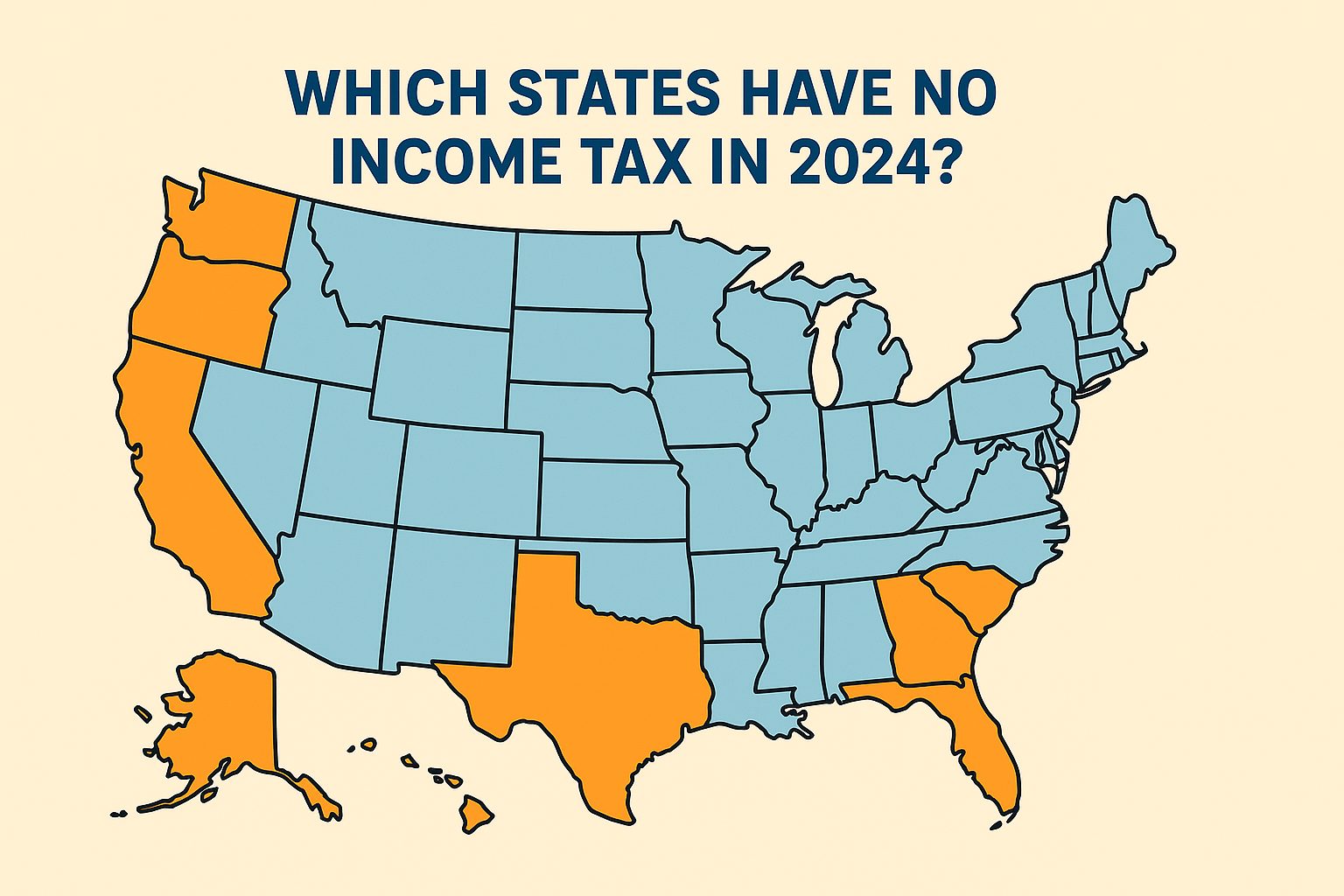

The current states with no income tax 2025 list

Let's just list them out. No fluff. As we roll into 2025, the states holding the line on zero income tax are Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. Wait, that's eight.

New Hampshire is the ninth, but it’s in a weird transition phase. Technically, New Hampshire never taxed earned income (your salary), but they did tax interest and dividends. They've been phasing that out, and for the 2025 tax year, that tax is officially scheduled to be history. So, for the first time, New Hampshire truly joins the "zero tax" club in its purest form.

📖 Related: What Does a Stoner Mean? Why the Answer Is Changing in 2026

Alaska: The outlier

Alaska is basically the final boss of tax-free living. Not only is there no state income tax, but there’s also no state-level sales tax. You actually get paid to live there via the Permanent Fund Dividend (PFD). But don't pack your bags just yet. Unless you enjoy -40 degree winters and paying $8 for a gallon of milk in remote areas, the "savings" might be swallowed by the cost of living. It's a rugged trade-off.

Florida: The retiree magnet

Florida is the big dog. It’s the most popular destination on the states with no income tax 2025 list for a reason. They've baked the no-income-tax rule into their state constitution, making it incredibly hard for politicians to change their minds later. They fund the government through a 6% sales tax and a massive tourism industry. You’re essentially letting tourists pay for your roads. Pretty smart, right?

Texas: Growth at a price

Texas is booming. People are flocking to Austin, Dallas, and Houston. Like Florida, the no-income-tax rule is a massive draw for tech workers and businesses. But here is the reality check: Texas has some of the highest property taxes in the country. According to the Tax Foundation, Texas property taxes often rank in the top ten highest nationwide. If you own a $500,000 home, you might pay $10,000 or more in property taxes annually. That income tax "saving" suddenly feels a lot smaller.

Why Washington is the controversial member of the list

Washington State is a bit of a lightning rod right now. While it technically belongs on the states with no income tax 2025 list, the state supreme court recently upheld a capital gains tax.

If you sell more than $262,000 worth of stocks or bonds (with some exceptions) in a year, you’re paying a 7% tax on those profits. For a regular W-2 employee making $80,000 a year, Washington is still a tax haven. For a tech founder or a heavy investor? It’s complicated. It’s not a traditional income tax, but it feels a lot like one to the people paying it.

👉 See also: Am I Gay Buzzfeed Quizzes and the Quest for Identity Online

Nevada and South Dakota are the quiet overachievers. Nevada relies on gambling and tourism, much like Florida. South Dakota is a hub for the banking and credit card industry. Both offer very low overall tax burdens without the insane property taxes you see in Texas or the high cost of living found in Washington.

The math of "Tax-Free" living

Don't just look at the 0%. That's a rookie mistake. You have to look at the total tax burden.

Tax analysts often use a metric that combines sales tax, property tax, and income tax to see what percentage of personal income actually goes to the state. For example, Tennessee has no income tax, but it has one of the highest combined state and local sales tax rates in the U.S., often hitting 9.55%. If you’re a big spender, you might actually pay more in Tennessee than you would in a state with a low, flat income tax like Indiana or Pennsylvania.

Then there is the "hidden" cost of services.

States with no income tax often have less funding for public infrastructure, schools, or social programs. In some of these states, you might find yourself paying more for private school tuition or dealing with toll roads that eat into your monthly budget. It’s a balance. You're choosing a "pay-as-you-go" model over a "pay-as-you-earn" model.

✨ Don't miss: Easy recipes dinner for two: Why you are probably overcomplicating date night

Is New Hampshire finally the best option?

For 2025, New Hampshire is looking incredibly attractive. By eliminating the tax on interest and dividends, they’ve become arguably the most tax-friendly state in the Northeast.

No income tax.

No sales tax.

Sounds perfect, right? Well, they make up for it with property taxes that can be absolutely staggering. We’re talking about rates that often exceed 2% of the home's value. If you’re renting, you’re still paying those taxes indirectly through your landlord’s high overhead. It’s a great state for people with high salaries who live in modest homes, but it's tough for those who want a mansion on a budget.

Making the move: Practical steps

If you’re actually looking at the states with no income tax 2025 list because you want to relocate, don't just guess.

- Run a shadow budget. Take your current spending and apply the sales tax and estimated property tax of your target zip code.

- Check the "Domicile" rules. You can't just buy a condo in Florida and keep working in New York without consequences. States like New York and California are notorious for "residency audits." They will look at where you spend your time, where your dog lives, and where you see your primary doctor. If you don't truly move, they will still come for their cut.

- Factor in insurance. This is huge in 2025. In Florida and Texas, homeowners insurance rates are skyrocketing due to climate risks. You might save $5,000 in income tax but spend an extra $6,000 on insurance premiums.

The 2025 landscape for tax-free states is stable but shifting under the surface. While the list of names hasn't changed much, the "cost" of living in these states is being reshaped by inflation and insurance markets.

Before you hire the movers, look past the zero. The best state for your wallet isn't always the one with the lowest income tax—it's the one where the total cost of your specific lifestyle is lowest. Often, that’s a state like Wyoming or South Dakota, where the lack of income tax isn't offset by massive spikes in other areas. Do the math. Your future self will thank you.

Actionable Next Steps

- Compare property tax rates by using a tool like the SmartAsset property tax calculator for specific counties in your top three target states.

- Calculate your "Break-Even" point. Determine how much you currently pay in state income tax and compare it against the estimated increase in sales and property taxes in a tax-free state.

- Review "Statutory Resident" laws. If you plan to split time between two states, ensure you spend fewer than 183 days in the high-tax state to avoid being double-taxed.

- Verify insurance availability. Call an insurance broker in states like Florida or Washington to get a quote on homeowners and auto insurance before committing to a mortgage, as these costs are the primary "hidden" expense in 2025.