You’re looking at your paycheck, and something feels... off. You’ve done the math, but the number hitting your bank account seems way smaller than it should be. It’s a common frustration. Most people think "taxes" just means that percentage taken out of their salary, but the reality is much more aggressive. It’s a massive web of property levies, sales surcharges, and "hidden" excise fees that vary wildly depending on which side of a state line you sleep on.

Honestly, comparing taxes between states is a mess.

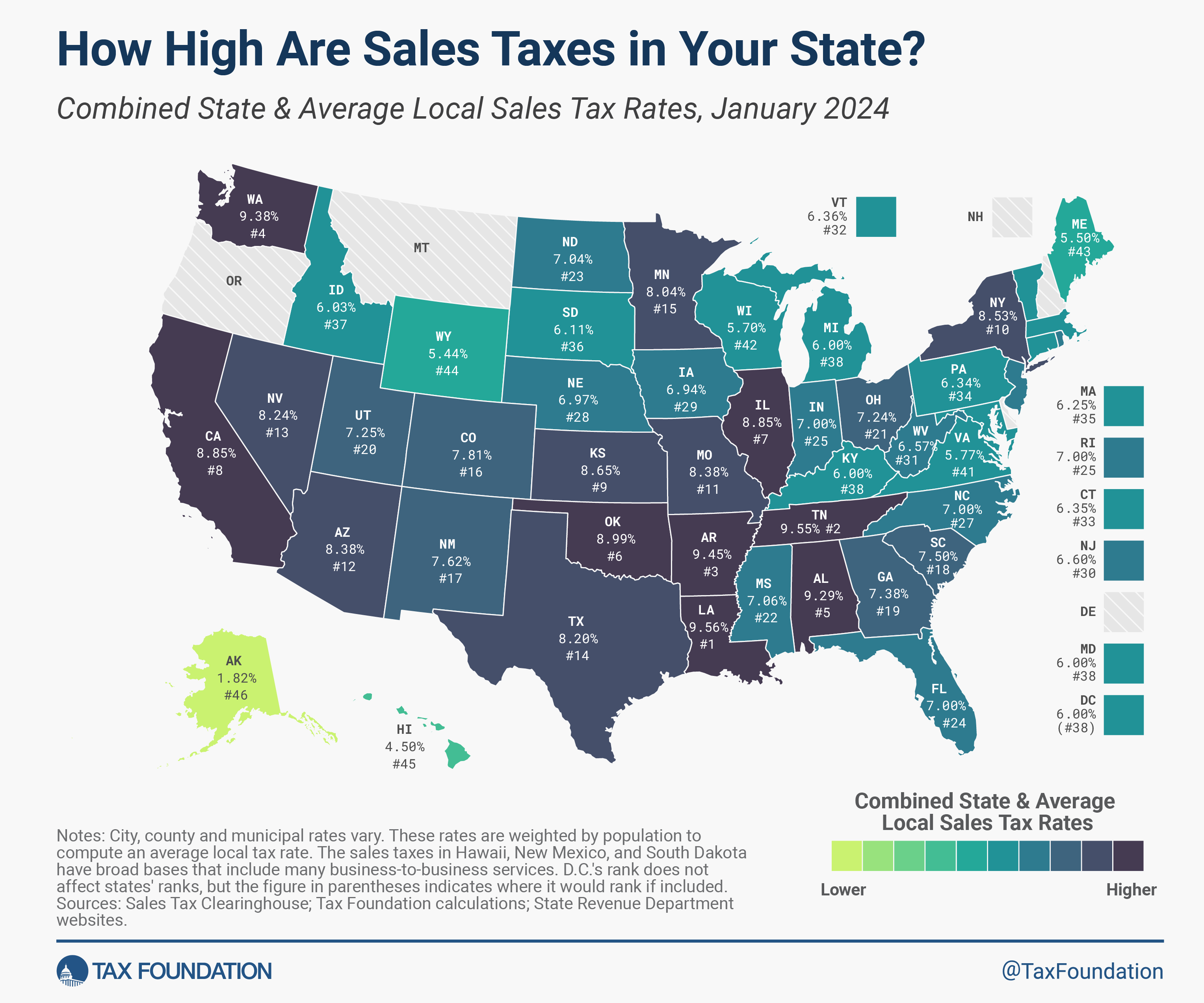

If you just look at income tax, you’re only seeing a third of the picture. Some states lure you in with a "0% income tax" promise—looking at you, Texas and Florida—only to clobber you with some of the highest property or sales taxes in the country. To truly find the states with highest overall taxes, we have to look at the "tax burden." This is the percentage of total personal income that residents actually pay to state and local governments.

According to 2026 data from the Tax Foundation and recent analysis by WalletHub, the numbers are pretty eye-watering.

The Top Contenders for Your Cash

When you aggregate everything—income, property, and sales—Hawaii and New York are basically locked in a permanent battle for the top spot. As of early 2026, Hawaii’s total tax burden sits at a staggering 13.92%.

Think about that.

💡 You might also like: John Murphy Coca Cola: Why This Strategic Pivot Actually Matters Now

Nearly 14 cents of every dollar earned by the average resident goes straight to the government. Hawaii has the highest sales and excise tax burden in the nation (7.17%), largely because they tax almost everything, including many services and business-to-business transactions that other states leave alone.

Then there’s New York.

New York’s overall burden is roughly 13.56%. If you live in New York City, it’s even more intense because you’re hit with a local income tax on top of the state’s 10.9% top marginal rate. You’ve got high property taxes in Westchester and Nassau counties, combined with a 4% state sales tax that usually hits 8.5% or higher once the local jurisdictions take their cut.

Why the Northeast Dominates the List

It’s not just New York. The Northeast is a high-tax fortress.

Vermont holds the third spot with an 11.53% burden. Why? Property taxes. Vermont has the highest property tax burden in the U.S. as a percentage of personal income. It’s a beautiful state, but you pay for that scenery.

New Jersey and Connecticut aren't far behind. New Jersey is infamous for its property taxes; it has the highest effective real estate tax rate in the country at 2.23%. For a median-valued home in the Garden State, residents are shelling out nearly $10,000 a year just in property tax.

Here is how the "Big Three" of tax types currently shake out in the high-burden states:

- New York: Top-tier income tax and high local sales taxes.

- New Jersey: The undisputed king of property tax.

- California: Home to the highest state income tax rate in the U.S. at 13.3% for top earners.

The Income Tax Mirage

You’ve probably heard people say, "I’m moving to Texas to save on taxes."

It sounds like a smart move. Texas has no state income tax. But if you look at the states with highest overall taxes, Texas isn't as low as you’d think. Its overall tax burden is around 7.77%, which is actually higher than "taxed" states like Delaware (6.52%) or even Florida (6.49%).

Texas makes up for the lack of income tax by leaning heavily on property owners. The effective property tax rate in Texas is about 1.58%—roughly double what you’d pay in California or Colorado.

Washington state is another weird one. No income tax (mostly, though they have a capital gains tax), but they have a combined sales tax rate that can hit 9.5% in places like Seattle. They also have a high "gross receipts" tax on businesses which often gets passed down to consumers in the form of higher prices.

The 2026 "Death Tax" Factor

One thing experts like Shona Ponda from Deloitte or the researchers at the Tax Foundation point out is that "overall taxes" should include what happens when you die.

Most people ignore estate and inheritance taxes until it’s too late. Oregon, for example, has a relatively low estate tax threshold ($1 million). If you own a modest home and a decent 401(k) in Portland, the state might take a 10% to 16% bite out of what you leave your kids.

Maryland is the only state in the country that hits you with both an estate tax and an inheritance tax.

It’s these layers that create the true "burden."

Breaking Down the Top 10 Highest Tax Burdens (2026 Estimates)

- Hawaii (13.92%): Mostly driven by a brutal 7%+ sales/excise burden.

- New York (13.56%): High everything. Income, property, and local surcharges.

- Vermont (11.53%): Driven by the #1 property tax burden in the U.S.

- California (11.00%): The income tax here is the primary driver.

- Maine (10.64%): High property and income taxes for a relatively low-income population.

- New Jersey (10.30%): Property taxes are the main culprit.

- Illinois (10.22%): A flat income tax (4.95%) but massive property tax bills.

- Rhode Island (10.08%): High property and sales taxes.

- Maryland (10.04%): Local income taxes add up fast here.

- Connecticut (9.90%): High property taxes and a progressive income tax.

Is High Tax Always "Bad"?

It’s easy to look at these numbers and want to run for the hills. But there’s a nuance here.

Economists often talk about the "Taxpayer ROI." States like New Hampshire and Minnesota often rank high for services. You might pay more in Minnesota (9.72% burden), but you’re often getting better infrastructure, higher-ranked schools, and more public parks.

On the flip side, states with the lowest burdens, like Alaska (4.93%) or Wyoming (5.79%), often rely on oil and mineral "severance taxes" to fund their governments. They aren't necessarily "cheaper" to live in—groceries in remote Alaska will cost you way more than the tax savings you'll find.

Actionable Steps for Navigating High-Tax States

If you're stuck in a high-tax state or planning a move, don't just look at the headline rate.

Calculate your "Personal Tax Burden"

Take your annual income and multiply it by the state's "Tax Burden %" from the list above. Then, compare that to your actual property tax bill and what you spend on sales tax. You might find that a "low tax" state with high property values actually costs you more than a "high tax" state with lower housing costs.

Look for Local Credits

Many high-tax states offer "Circuit Breaker" credits. For instance, New Jersey and New York have programs that provide property tax relief or rebates to seniors and lower-income homeowners.

Consider the "Remote Work" Trap

If you live in a low-tax state but work for a company in New York, beware the "convenience of the employer" rule. New York is aggressive about taxing remote workers if their home office is technically "for their own convenience" rather than a requirement of the job.

Max Out Pre-Tax Accounts

In states like California or Hawaii with high progressive brackets, every dollar you put into a 401(k) or HSA is saving you a much larger percentage than it would in a flat-tax state like Indiana.

Understanding the states with highest overall taxes is about more than just complaining—it's about knowing exactly where your money is going so you can make a move that actually benefits your bottom line. It’s not just what you earn; it’s what you keep.

Key Takeaways for 2026

- Hawaii and New York remain the costliest states for the average taxpayer when all factors are combined.

- Property tax is the hidden killer in the Midwest and Northeast, often outweighing the impact of income tax.

- No-income-tax states like Texas and Washington often "backfill" their budgets with higher sales or property levies.

- Taxpayer ROI varies; high taxes don't always mean better services, but low taxes often mean fewer public amenities.

Check your local municipality’s "mill rate" before buying a home in the Northeast. That $500,000 house in New Jersey could easily cost you an extra $1,200 a month just in taxes compared to the same house in Arizona. Be smart, look at the "burden," and plan accordingly.