You’re sitting at a kitchen table in Franklin or maybe a coffee shop in Knoxville, and someone brings up "the paperwork." Usually, they mean a will. But honestly, a will only helps after you’re gone. If you’re still here but can’t speak for yourself—maybe because of a sudden accident on I-40 or a tough medical diagnosis—the state of tennessee power of attorney is actually the most important document you’ll ever sign.

It’s about control.

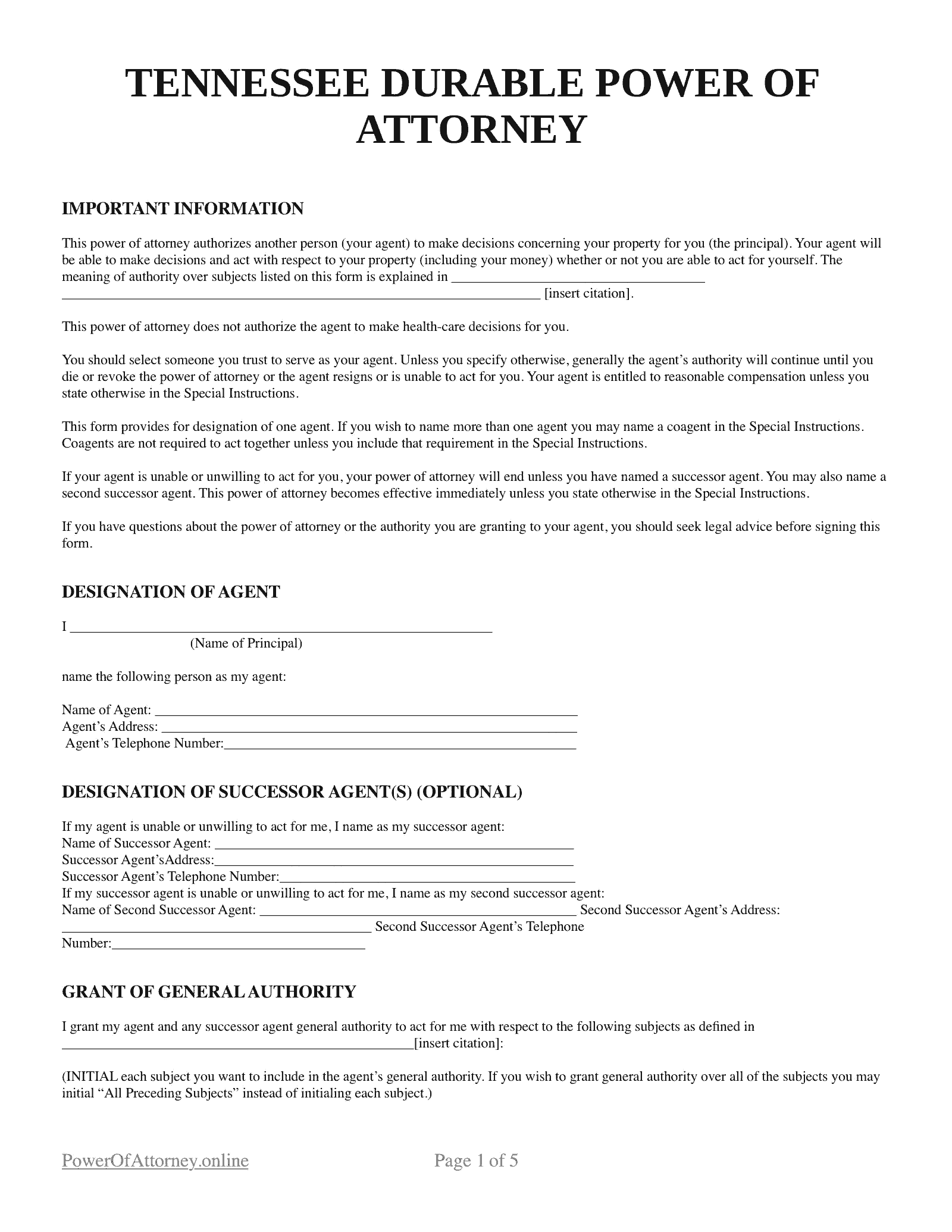

Most people think a power of attorney (POA) is a single, cookie-cutter form. It’s not. In Tennessee, we deal with a specific set of laws, primarily the Tennessee Uniform Durable Power of Attorney Act. If you get the phrasing wrong, your family might end up in a courtroom fighting for a conservatorship while you're lying in a hospital bed. That's a nightmare nobody wants.

Why "Durable" Is the Only Word That Really Matters

In the legal world, "durable" has a very specific meaning. Most powers of attorney actually die the moment you become incapacitated. Think about how backward that is. You hire someone to help you, but the second you actually need them because you can't think for yourself, their authority vanishes.

To fix this, Tennessee Code § 34-6-102 requires magic words.

You’ve got to include a sentence like: "This power of attorney shall not be affected by subsequent disability or incapacity of the principal." Without that specific intent, the document is basically a fair-weather friend. It works while you’re fine, and quits when things get real.

✨ Don't miss: Ariana Grande Blue Cloud Perfume: What Most People Get Wrong

The "Springing" Trap

Some people get nervous about giving away power while they are still healthy. They use what’s called a "springing" POA. It only "springs" into action once a doctor certifies you’re incapacitated.

Sounds safe, right?

Well, it’s kinda a headache in practice. Imagine your spouse trying to pay the mortgage, but the bank won't talk to them because they’re waiting on a letter from a doctor who is currently busy in surgery. It creates a gap in time—a "limbo" period—where no one can move your money or sign your papers.

The Two Big Players: Financial vs. Health Care

Tennessee treats your money and your body as two totally different legal buckets. You can't just have one document that covers everything unless it’s drafted very, very carefully to meet two different sets of statutory requirements.

1. The Durable General Power of Attorney (Money)

This handles the "business of being you." We're talking about Tennessee Code § 34-6-109, which lists 23 specific powers an agent can have. This includes:

🔗 Read more: Apartment Decorations for Men: Why Your Place Still Looks Like a Dorm

- Selling your house in Murfreesboro.

- Filing your taxes with the IRS.

- Dealing with your social security benefits.

- Managing your "digital assets" (your Facebook or Gmail, thanks to the Revised Uniform Fiduciary Access to Digital Assets Act).

2. The Durable Power of Attorney for Health Care

This is different. This agent makes the hard calls. Should you stay on a ventilator? Can the doctors perform that risky surgery? Tennessee law is pretty strict here. Under the Durable Power of Attorney for Health Care Act, your agent can even sign arbitration agreements for nursing homes—a point the Tennessee Supreme Court clarified in the 2024 Williams v. Smyrna Residential case.

What Most People Mess Up

You'd be surprised how many folks just download a random form off the internet, sign it, and stick it in a drawer. That’s a recipe for a legal wall.

The Witness Problem

Tennessee law is picky about who watches you sign. For a financial POA, you generally need a Notary Public. For a Health Care POA, you need either a Notary OR two "disinterested" witnesses.

Who is disinterested? Not your brother who’s inheriting the house. Not the agent you just named. You need people who don't have skin in the game.

The "Bank Power" Myth

Just because you have a signed state of tennessee power of attorney doesn't mean Regions or First Horizon will automatically let your agent in. Banks are notoriously terrified of fraud. They might demand your agent sign their own internal forms. If your POA is ten years old and looks like it was written on a napkin, they will definitely give you a hard time.

💡 You might also like: AP Royal Oak White: Why This Often Overlooked Dial Is Actually The Smart Play

The Fiduciary Duty

Being an agent isn't a "license to spend." It’s a "fiduciary" role. This means the agent has a legal bond to act in your best interest, not theirs. If your daughter is your agent and she uses your money to buy herself a new truck, that’s not just a family feud—it’s a crime in Tennessee. Agents have to keep meticulous records. A simple "trust me" doesn't work when the court or other siblings start asking questions.

How to Actually Make It Work

If you're ready to get this sorted, don't just wing it.

Start by picking the right person. Don't pick your oldest child just because they're the oldest. Pick the one who is good with spreadsheets for the financial stuff, and the one who doesn't faint at the sight of blood for the medical stuff.

Steps to Take Right Now:

- Be Specific: If you want your agent to be able to give gifts to your grandkids or move money into a trust, you have to say it explicitly. Tennessee law assumes they cannot do these things unless the document says they can.

- The Notary is Non-Negotiable: Even if the law says you might get away with just witnesses, just get it notarized. It makes the document "self-authenticating" and much easier for banks to accept.

- Talk to Your Agent: Don't surprise them. Make sure they actually want the job. It’s a lot of work and a lot of responsibility.

- Distribute the Copies: A POA is useless if it's locked in a safe that only you have the key to. Give a copy to your primary doctor, your bank, and your agent.

The state of tennessee power of attorney isn't about giving up your independence. It's about making sure that if you ever can't speak, the person speaking for you is someone you actually like.

Your Immediate Checklist

- Locate your current documents. If they are more than 5 years old, the laws or your life situation have likely changed.

- Verify the "Durability" clause. Check for that specific "shall not be affected by incapacity" language.

- Schedule a Notary. Most local banks in Tennessee provide this service for free to their customers.

- Review your successor agents. If your primary agent is your spouse and they are the same age as you, ensure you have a "Plan B" listed in case they can't serve.