You’re sitting at a kitchen table in Bangor or maybe a coffee shop in Portland, and someone mentions a "POA." It sounds legalistic. It sounds like something only wealthy people with estates on Mount Desert Island need to worry about. But honestly? If you live in the Pine Tree State, understanding the state of Maine power of attorney laws is probably the most important "adulting" task you’ll ever do. It’s about control. It’s about making sure that if life throws a curveball—a car accident on I-95 or a sudden health crisis—you aren't leaving your family in a legal lurch.

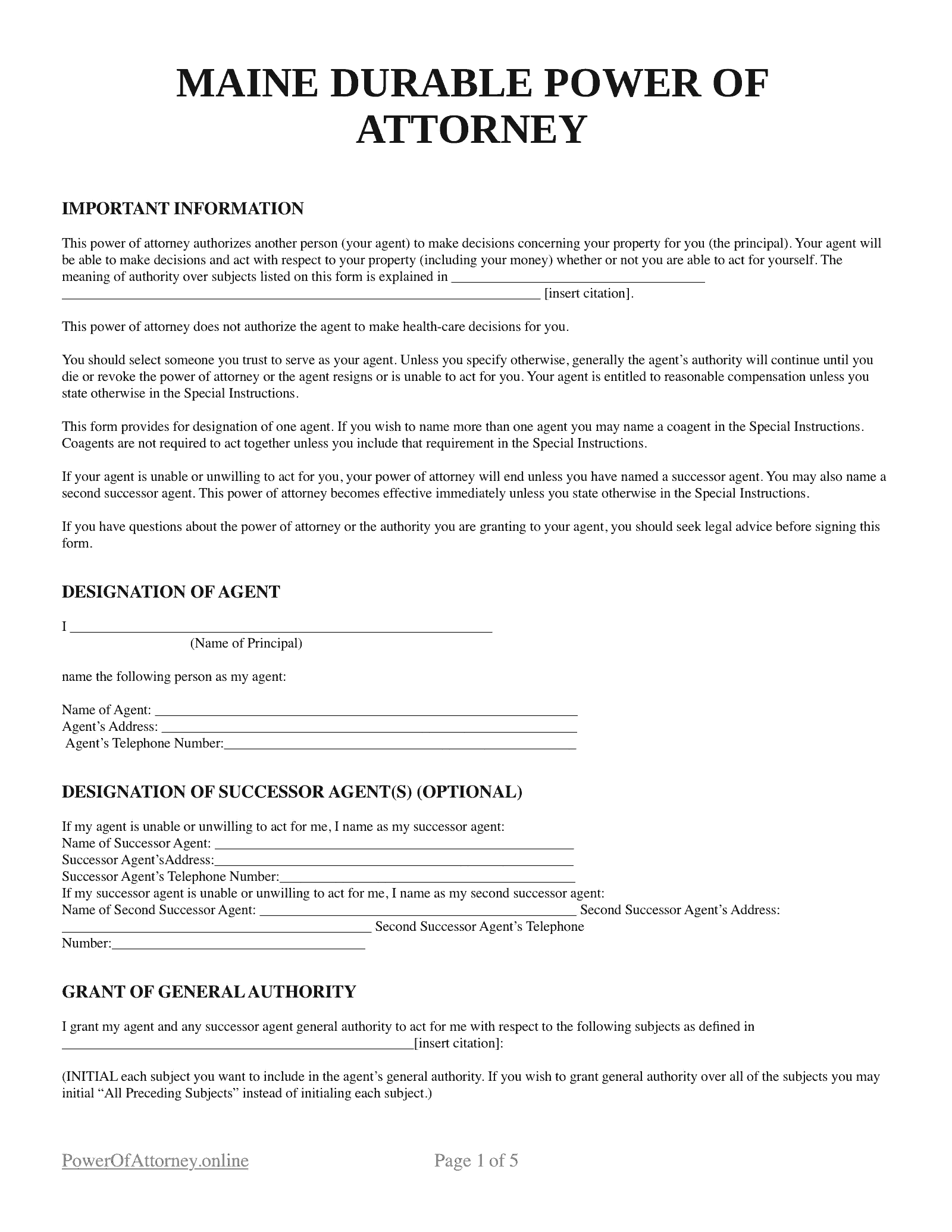

Maine transitioned to the Uniform Power of Attorney Act back in 2010. That was a big deal. Before that, things were a bit like the Wild West. Now, there’s a specific structure, but people still mess it up. They download a random form from a website based in California, get it signed, and think they’re protected. They aren't. Maine has very specific quirks, especially regarding "hot powers" and how we treat real estate transactions.

Why the State of Maine Power of Attorney is Different

Maine isn't like other states. We have a specific way of doing things here, and that includes the state of Maine power of attorney. One of the biggest misconceptions is that a POA is a single, catch-all document. It’s not. In Maine, you’re usually looking at two distinct animals: the Financial Power of Attorney and the Advance Health Care Directive.

Think of it this way.

The financial one lets someone pay your mortgage or sell your house in Augusta if you can’t. The health care one lets them tell the doctor whether or not you want a feeding tube. If you only have one, you’re only half-covered. Most people don’t realize that under the Maine Uniform Probate Code, a power of attorney is "durable" by default. This is huge. "Durable" means the document stays valid even if you become mentally incompetent. In the old days, you had to write specific "magic words" to make that happen. Now, the law assumes you want it to last unless you explicitly state otherwise.

But there’s a catch.

Banks in Maine can be notoriously picky. You might have a perfectly legal document, but if it doesn’t have the specific statutory language or if it’s more than a few years old, some local credit unions might give your agent a hard time. It’s not fair, but it’s the reality of the "boots on the ground" legal landscape here.

🔗 Read more: Curtain Bangs on Fine Hair: Why Yours Probably Look Flat and How to Fix It

The Danger of "Hot Powers" You Probably Haven't Heard Of

Most people just sign the form. They see a list of powers—real estate, taxes, banking—and they check all the boxes. But in Maine, there are certain things called "hot powers" that require an extra level of authorization. These are actions that could significantly alter your estate plan or deplete your assets.

For example, if you want your agent to be able to make gifts of your money to your grandkids, you can't just give them "general authority." You have to specifically initial a section that allows for gifting. Same goes for changing beneficiaries on a life insurance policy or creating a trust. Maine law is protective. It assumes your agent cannot do these high-stakes things unless you specifically, deliberately say they can.

Imagine your daughter is your agent. She needs to move you into assisted living and wants to sell your home to pay for it. If your state of Maine power of attorney doesn't explicitly grant the power to handle real estate or, more importantly, create a trust for Medicaid planning, she might be stuck going to a judge. That’s a guardianship proceeding. It’s expensive. It’s public. It’s exactly what a POA is supposed to avoid.

Witnessing and Notarization: The Maine Standard

Maine is strict about how these documents are "born." To be valid for real estate transactions—which is why most people get them—the document must be acknowledged before a notary public. If you just sign it in front of your neighbor and call it a day, the York County Registry of Deeds is going to laugh you out of the building.

Actually, they won't laugh. They'll just reject the filing. And if you’re already incapacitated by then, you can’t sign a new one.

- The Notary: Must be present. They aren't just there to stamp a paper; they are verifying you are who you say you are and that you aren't being coerced by a greedy relative.

- Capacity: You must be of "sound mind." This is a fuzzy legal term. In Maine, if you can understand the general nature and effect of what you’re signing, you’re usually good. But if there’s a hint of dementia, get a doctor’s note first. It prevents lawsuits later.

- The Agent: You can pick anyone. Your spouse, your kid, your best friend from high school. But they have a "fiduciary duty." That means they have to act in your best interest, not theirs. If they use your money to buy themselves a new snowmobile, that’s elder abuse, and Maine prosecutors take that very seriously.

Financial vs. Health Care: The Maine Divide

In many states, people combine everything into one massive document. In Maine, we tend to keep the state of Maine power of attorney for finances separate from the Advance Health Care Directive.

💡 You might also like: Bates Nut Farm Woods Valley Road Valley Center CA: Why Everyone Still Goes After 100 Years

The health care side of things is governed by the Maine Health Care Decisions Act. It covers everything from who can see your medical records (HIPAA) to the "end of life" stuff. One thing Maine does differently is the "Surrogate" rule. If you don't have a power of attorney and you end up in the hospital, the law provides a hierarchy of who gets to make decisions: spouse, adult children, parents, then siblings.

But relying on the "surrogate" law is a gamble. What if your kids don't agree? What if you’re estranged from your brother? By signing a formal document, you override that default list. You pick the person you trust most.

Common Mistakes That Void Your Maine POA

I've seen it happen. A family thinks they are all set, and then the bank says "No." Here is where the wheels usually fall off the wagon:

- The "Springing" Trap: Some people make their POA "springing," meaning it only takes effect if a doctor certifies they are incapacitated. It sounds safe. In reality, it’s a nightmare. Doctors are busy and often hesitant to sign legal declarations. Your agent might wait weeks for a "determination of incapacity" while bills go unpaid. Most Maine attorneys now recommend "immediate" powers but tell the agent not to use the document until it's actually needed.

- Old Forms: Using a form from 1995. The laws changed. If your document doesn't reference the current Maine statutes, it's a red flag for institutions.

- Missing "Successor" Agents: You name your husband. He dies. If you didn't name a backup, your POA died with him. Always have a "Plan B" and a "Plan C."

- Vague Language: Using phrases like "handle my stuff." The law needs specifics. If you want them to handle your Maine State Retirement System benefits, say so.

Real-World Scenario: The Camden Cottage

Let’s look at an example. "John" owns a beautiful cottage in Camden. He’s 82. He signs a state of Maine power of attorney naming his son, Mike, as his agent. John uses a generic form he found online.

Three years later, John has a stroke. Mike needs to sell the cottage to pay for John’s care at a specialized facility. He goes to the closing, and the title company looks at the POA. The form doesn't have the specific Maine statutory language regarding the sale of a primary residence or the necessary notary acknowledgment that matches Maine's 2026 standards.

The sale falls through. Mike has to petition the court for conservatorship. It takes six months and costs $5,000 in legal fees. All because the original document wasn't "Maine-proofed."

📖 Related: Why T. Pepin’s Hospitality Centre Still Dominates the Tampa Event Scene

How to Actually Get This Done Right

You don't necessarily need a high-priced lawyer in a mahogany office, but you do need to be precise.

First, talk to your family. This is the awkward part. Tell them who you’re picking and why. It prevents hurt feelings and "will contests" later. Second, use the Maine Statutory Short Form. It’s a template provided by the legislature. It’s not fancy, but it works because every bank in the state recognizes it.

Third, get it notarized. Don't skip this. Even if you think you don't need it, do it. It adds a layer of "officialness" that makes everything smoother.

Finally, give copies to the right people. A state of Maine power of attorney is useless if it’s locked in a safe-deposit box that no one can open because... well, they need the power of attorney to open it. Catch-22. Give a copy to your agent, your primary care doctor, and maybe your CPA.

Actionable Next Steps for Mainers

Don't let this sit on your to-do list for another year.

- Check your current documents: If your POA was signed before September 2010, it's likely still valid, but it's "old." A newer one following the Uniform Power of Attorney Act is much safer.

- Specifics over Generalities: If you own a business or have unique assets like timberland or commercial fishing rights, ensure your state of Maine power of attorney includes specific language for those industries.

- Review the "Notice to Principal": Under Maine law, the first page of a financial POA must have a specific warning in all caps telling you exactly what you are giving away. If your document is missing this, it might be legally deficient.

- Execute an Advance Health Care Directive separately: Ensure your medical wishes are documented on the specific Maine-approved health care form, which includes the "donative intent" for organ donation if that’s your thing.

- Update your agent's contact info: People move. People change phone numbers. Make sure your "Successor" agent list is actually current.

Laws regarding the state of Maine power of attorney are designed to protect your autonomy. Use them. By choosing your representative now, you’re making sure that the state—and the courts—stay out of your private business later. It’s the ultimate gift of clarity for your family.

Disclaimer: This article provides general information regarding Maine law as of 2026. It is not legal advice. Because every financial and family situation is unique, you should consult with a qualified Maine attorney to ensure your documents meet your specific needs and comply with the most recent legislative updates.