Banking in the Twin Cities is a weirdly crowded space. You can’t drive two blocks down American Boulevard without seeing a massive glass-and-steel branch of some national bank that probably doesn't even know your name. But tucked away in the mix is Star Choice Credit Union Bloomington MN, a financial institution that has managed to survive and actually thrive by doing things the "old-fashioned" way—while somehow keeping up with the tech.

It's a credit union. That's the first thing you need to grasp.

Unlike a bank, which basically exists to make its shareholders rich, Star Choice is a member-owned cooperative. If you have an account there, you're technically an owner. This isn't just some marketing fluff; it actually changes how the math works on your savings account and your car loan.

People often ask me if smaller credit unions in Bloomington are actually safe. Honestly, I get the skepticism. In an era of massive financial collapses, putting your money in a smaller spot feels risky to some. However, Star Choice is federally insured by the National Credit Union Administration (NCUA). Your deposits are backed up to $250,000, exactly like the FDIC insurance you get at a big bank. So, the "safety" argument is a wash.

The Bloomington Connection: More Than Just a Zip Code

The main office is located right on West 78th Street. It’s a convenient spot, especially if you’re navigating the usual Bloomington traffic patterns near I-494 and Highway 100. But the geographic location of Star Choice Credit Union Bloomington MN is only half the story.

Credit unions are built on the concept of a "field of membership." Years ago, these were strictly for employees of certain companies. For Star Choice, the roots go back to the Minneapolis Star and Tribune employees. That’s where the name comes from. Today, it’s much more open. If you live, work, worship, or attend school in Hennepin County, you’re usually in.

Why does this matter? Because the money stays here.

When you take out a mortgage at a massive national bank, that interest you pay might end up funding a corporate retreat in New York or a new branch in London. When you pay interest to a local credit union, it stays in the local ecosystem. It funds the next neighbor's car loan or a local student's first credit card. It’s a closed loop that actually benefits the Bloomington economy.

Breaking Down the Services: Is It Actually Better?

Let's talk about the actual products. Most people think they have to sacrifice "stuff" to go local.

Star Choice Credit Union Bloomington MN offers the standard suite: checking, savings, IRAs, and certificates. But the real "meat" is in the lending. Because they don't have to provide a profit margin for Wall Street investors, they can often shave a half-percentage point or more off an auto loan. Over five years, that's a lot of gas money.

- Kasasa Checking: This is a big draw. It’s basically a rewards checking account that pays you back in interest or cash back, provided you do basic things like use your debit card and log into online banking. It beats the 0.01% interest you’re likely getting at a "mega-bank."

- Auto Loans: They are aggressive here. They often have specialized rates for new and used vehicles that beat dealership financing.

- Mortgages: They do the whole range—fixed-rate, adjustable, and even home equity lines of credit (HELOCs).

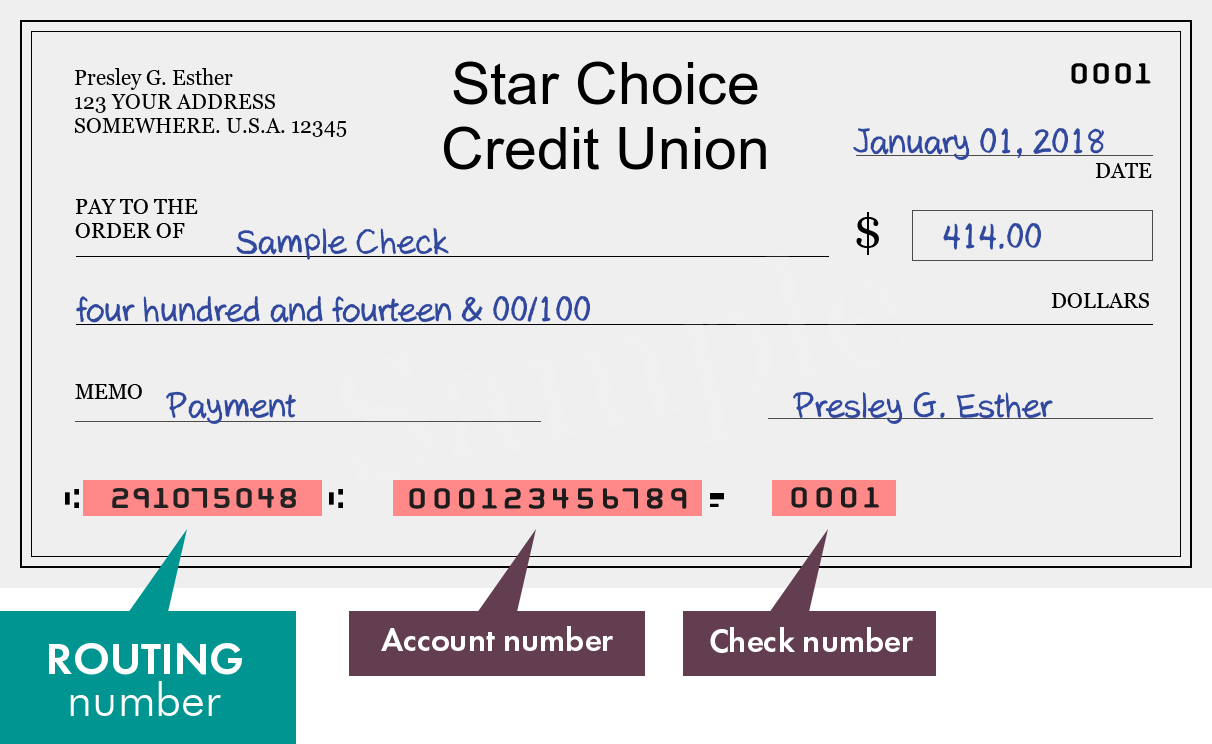

The technology side is surprisingly robust. You get a mobile app, remote deposit capture (taking a picture of your check), and access to a massive network of surcharge-free ATMs. Through the CO-OP network, you can actually use thousands of ATMs across the country without paying a fee, which effectively makes this tiny Bloomington office feel like it has branches in every state.

The "Human" Factor You Can't Script

I heard a story once about a member who was stuck out of state with a locked debit card. At a big bank, you're stuck in a phone tree for forty minutes. At Star Choice, they actually answer the phone.

They know the local market. If you're trying to buy a house in a specific Bloomington neighborhood, the loan officers probably know the area. They aren't looking at a map in an office in North Carolina. They live here. This nuance matters when you're trying to get a loan approved that doesn't perfectly fit into a "cookie-cutter" box.

Misconceptions About Joining

One of the biggest myths is that it's hard to join. It’s not.

Usually, it just takes a $5 deposit into a savings account. That $5 represents your "share" of the credit union. Once you’re in, you’re in for life, regardless of where you move later. You could move to Florida and still keep your Bloomington accounts.

Another misconception is that they lack "sophisticated" tools. While they might not have a $100 million AI chatbot, their online banking does everything a normal human needs: bill pay, transfers, and fraud monitoring. Most of us don't need a high-frequency trading platform; we just need to see if our paycheck hit and pay the electric bill.

The Reality of Rates in 2026

The economy has been a rollercoaster. Interest rates have been all over the place. In this environment, Star Choice Credit Union Bloomington MN acts as a bit of a stabilizer.

When the Federal Reserve hikes rates, big banks are notoriously slow to raise the interest they pay you on your savings. They want to keep that "spread." Credit unions, being member-owned, tend to be a bit more aggressive in passing those rate increases back to the members. Conversely, they try to keep loan rates as low as possible for as long as possible.

It’s a different philosophy. It’s not about maximizing the "take"; it’s about maximizing the "benefit."

Actionable Steps for Transitioning

If you're tired of being a number at a giant bank, making the switch to a credit union isn't as painful as it used to be. You don't have to close everything at once.

- Check Eligibility: Confirm you live or work in Hennepin County. This is the easiest way in.

- Open a Basic Savings: Put your $5 in. This establishes your membership.

- Test the App: Download their mobile app and see if you like the interface.

- Move One Bill at a Time: Don't move your entire financial life in one afternoon. Start with your direct deposit and one or two recurring bills.

- Look at Your Current Loans: If you have a car loan or a credit card with a high rate elsewhere, ask for a "refinance quote" at Star Choice. They love "buying" debt from big banks by offering a lower rate.

The branch is located at 500 West 78th Street, Bloomington, MN 55420. You can walk in and talk to a human being. That alone is a luxury in today's financial world.

Stop settling for fees that exist solely to pad a corporate balance sheet. Whether you need a better way to save for a house or just want a checking account that doesn't charge you for breathing, a local institution like this is usually the smarter play. It’s about keeping Bloomington money in Bloomington. It’s about being an owner, not just a customer. It’s basic math, honestly.