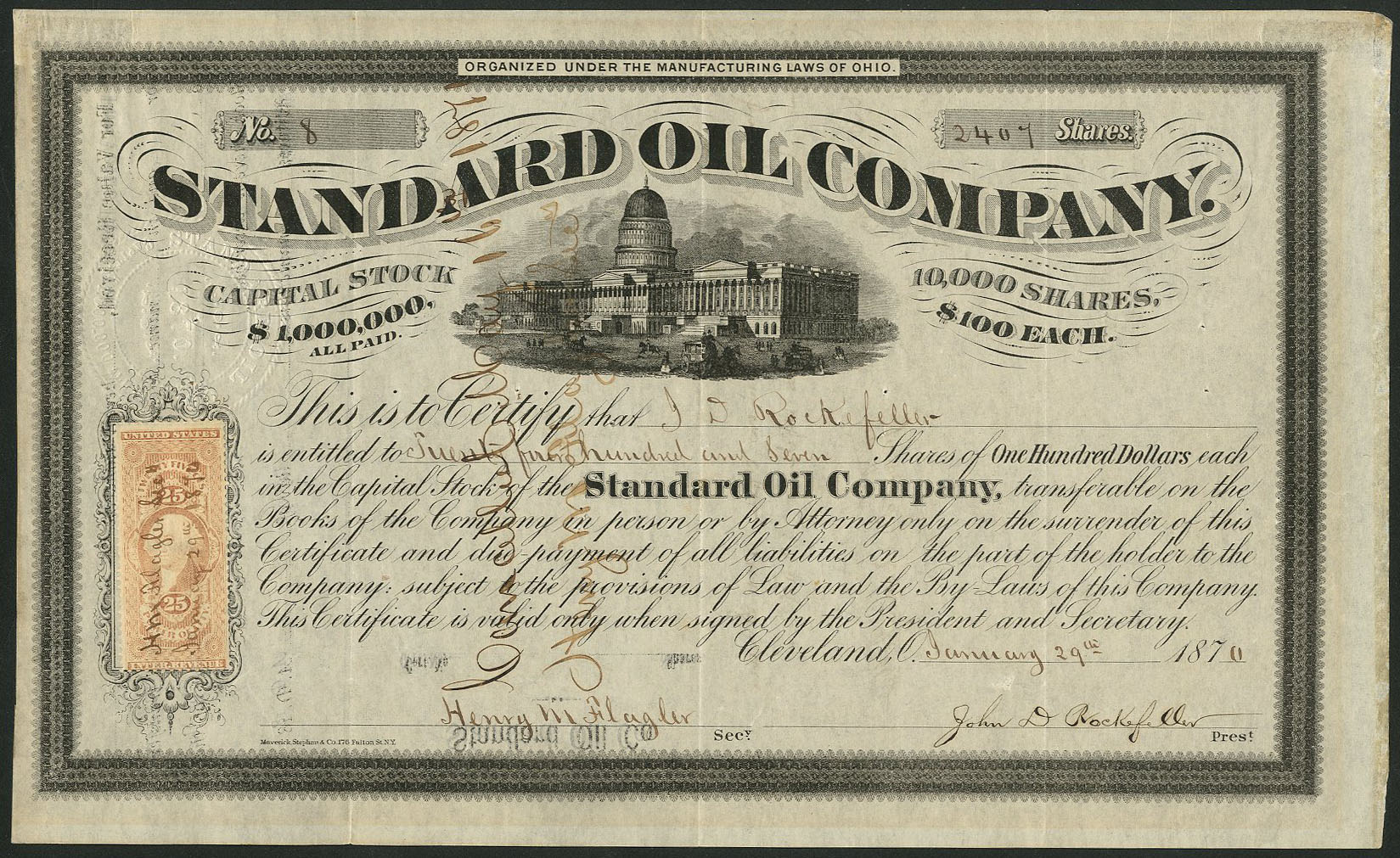

John D. Rockefeller wasn't just rich. He was the kind of rich that makes modern billionaires look like they’re running a lemonade stand. By the late 1800s, his brainchild, Standard Oil, controlled roughly 90% of the refined oil in America. It was a behemoth. It was a "trust." And eventually, it became the biggest target in legal history. If you've ever wondered why tech giants are constantly hauled before Congress today, you have to look back at Standard Oil Co. v. United States. This wasn't just a court case; it was a total vibe shift in how the government handles massive corporations.

Honestly, the story starts with a law that was kind of a mess. The Sherman Antitrust Act of 1890 was passed with good intentions, but it was incredibly vague. It basically said "monopolies are bad" and "restraint of trade is illegal," but it didn't really explain what those things meant in a practical sense. For nearly twenty years, the government poked and prodded at Standard Oil, but Rockefeller’s lawyers were brilliant at navigating the gray areas. They built a web of companies that was so complex it was almost impossible to untangle.

The Breakup That Changed Everything

In 1911, the Supreme Court finally had enough. They looked at the way Standard Oil used secret rebates from railroads to crush competitors and how they’d buy out local refineries only to shut them down. It wasn't just that they were big—it was that they were predatory. The Court didn't just fine them. They ordered the entire company to be chopped into 34 independent pieces.

Think about that for a second.

One day you have the most powerful entity on earth, and the next, it’s shattered. You’ve probably heard of the "Baby Bells" from the AT&T breakup in the 80s, but this was the original blueprint. From the ashes of Standard Oil came names you still see at the gas station today: Exxon (Standard Oil of New Jersey), Mobil (Standard Oil of New York), and Chevron (Standard Oil of California). It’s wild to think that these global titans were just fragments of Rockefeller’s original empire.

The most fascinating part? Rockefeller actually got richer after the breakup. Because he owned shares in all the new "baby" companies, and because the oil industry was about to explode thanks to the internal combustion engine, his net worth skyrocketed. It’s a weird paradox of antitrust law—sometimes breaking a company up actually unlocks more value for the shareholders than keeping it together.

👉 See also: Why Saying Sorry We Are Closed on Friday is Actually Good for Your Business

The Rule of Reason: A Legal Game Changer

If you talk to a law professor about Standard Oil Co. v. United States, they won't just talk about oil. They’ll talk about the "Rule of Reason." This was Justice Edward White’s big contribution to American law.

Before this case, some people thought the Sherman Act meant any contract that restrained trade was illegal. That’s impossible. Every contract restrains trade in some tiny way. If I agree to sell my car to you, I’m "restraining" myself from selling it to someone else. Justice White realized the law needed nuance. He argued that the court should only step in when a business’s conduct was "unreasonably" restrictive.

This sounds like a boring legal technicality, but it’s actually the reason why companies like Google, Apple, and Amazon aren't broken up every single week. The government has to prove not just that they are big, but that their bigness is actually hurting the market in an "unreasonable" way. It shifted the focus from the size of the company to the behavior of the company.

Why We Are Still Reliving 1911

We are currently in the middle of "Antitrust Summer," except it’s been lasting for about five years. When you see the Department of Justice going after Live Nation or the FTC looking at Microsoft’s acquisitions, they are using the tools forged in the Standard Oil Co. v. United States decision.

People often get confused about what a monopoly actually is. Being a monopoly isn't illegal in the U.S. If you make a product so good that everyone wants it and your competitors give up, congrats! You won capitalism. The problem—and what Standard Oil got busted for—is "monopolization." That’s when you use your power to prevent anyone else from even trying to compete.

✨ Don't miss: Why A Force of One Still Matters in 2026: The Truth About Solo Success

Rockefeller didn't just build a better mousetrap; he made sure nobody else could buy wood or springs.

The Ida Tarbell Factor

You can't tell this story without mentioning Ida Tarbell. She was a "muckraker"—a journalist who decided to take on the world's most powerful man. Her father had been ruined by Rockefeller's business tactics, so she had a bit of a grudge, but her reporting was meticulous. She spent years digging through public records and interviewing former employees.

Her series in McClure's Magazine basically turned public opinion against Standard Oil. It’s a great example of how journalism, public sentiment, and the legal system all have to align to take down a giant. Without Tarbell’s work, the government might never have had the political will to pursue the case to the Supreme Court.

Modern Parallels and Misconceptions

There’s a common myth that the Standard Oil breakup lowered gas prices immediately. It’s actually more complicated. Prices did drop eventually, but that was mostly due to new oil discoveries in Texas and Oklahoma and the massive increase in competition. The breakup didn't just fix the market overnight; it created the conditions for a competitive market to exist in the first place.

Another big misconception is that the Supreme Court was unanimous in its reasoning. While the vote to break up the company was 9-0, Justice John Marshall Harlan (the "Great Dissenter") was actually furious about the "Rule of Reason." He thought the Court was overstepping its bounds by adding the word "unreasonable" to a law where Congress hadn't put it. He feared it gave judges too much power to decide which monopolies were "good" and which were "bad."

🔗 Read more: Who Bought TikTok After the Ban: What Really Happened

Looking back, he might have had a point. The "Rule of Reason" is exactly why antitrust cases today take ten years and cost millions of dollars in expert witness fees. It turned law into economics.

Practical Takeaways for the Modern World

If you’re a business owner, a student, or just someone trying to understand the news, Standard Oil Co. v. United States offers a few heavy-hitting lessons that still apply today.

- Size isn't a crime, but tactics are. You can be the biggest player in your niche, but the second you start using that power to cut off a competitor's access to suppliers or customers, you're in the "Standard Oil Zone."

- Documentation is forever. The evidence that eventually sank Rockefeller wasn't just hearsay; it was the trail of contracts and secret agreements his companies had signed over decades.

- Vertical vs. Horizontal matters. Standard Oil didn't just own the refineries (horizontal); they owned the pipelines and the barrels (vertical). This "vertical integration" is exactly what regulators are looking at today with tech companies that own both the marketplace and the products sold on that marketplace.

If you want to dive deeper, don't just read the legal summary. Read Ron Chernow’s biography of Rockefeller, Titan. It gives you the human side of the corporate maneuvering. Also, keep an eye on current DOJ filings against big tech—you’ll notice they reference the 1911 "Rule of Reason" constantly.

The best way to stay informed is to follow the "Consumer Welfare Standard" debates. For the last 40 years, courts have mostly cared if prices stay low for you and me. But now, some regulators are saying we should go back to the older way of thinking—the way they thought during the Standard Oil era—where the goal was to protect the structure of the market and the small competitors, regardless of the price at the pump.

History doesn't repeat, but it definitely rhymes. And right now, it’s rhyming with 1911.

Next Steps for Deeper Insight:

- Audit Your Market Position: If you are a dominant player in a local or digital market, review your exclusive dealing contracts. Ensure they don't meet the modern definition of "unreasonable restraint" under the Rule of Reason.

- Monitor Current Precedents: Track the ongoing U.S. v. Google search engine case. Compare the government's arguments regarding "default status" to the "railroad rebates" used by Standard Oil; the parallels in leveraging infrastructure to exclude rivals are striking.

- Review Corporate Structure: Understand the difference between a holding company and operating subsidiaries. The 34 companies spun off from Standard Oil provide a roadmap for how "divestiture" works as a legal remedy.