Numbers lie. Or, at the very least, they keep secrets. You can have two groups of people with an average age of 30, but one group is a room full of thirty-year-olds and the other is a mix of toddlers and retirees. The mean is the same. The reality? Totally different. This is where the standard deviation formula variance relationship comes into play. It’s the difference between knowing the "middle" and actually understanding the risk, the chaos, or the consistency of whatever you’re measuring.

Most people treat these terms like interchangeable math jargon. They aren't. Variance gives you the big picture of spread in squared units, while standard deviation brings it back down to earth so you can actually use it. If you're managing a supply chain, trading stocks, or just trying to figure out if your morning commute is actually "usually 20 minutes," you’re dancing with these formulas whether you realize it or not.

The Messy Reality of Variance

Variance is the grandfather of dispersion. Mathematically, it's the average of the squared differences from the Mean. To calculate the standard deviation formula variance start point, you first find the mean (the average). Then, you take every single data point, subtract the mean from it, and square the result. Why square it? Because if you didn't, the positive and negative differences would just cancel each other out and leave you with zero. Zero is useless. Squaring makes everything positive.

🔗 Read more: IRS Form W-9: What Most People Get Wrong for 2025

$$\sigma^2 = \frac{\sum (x_i - \mu)^2}{N}$$

That's the population variance formula. It looks intimidating. It’s basically just telling you how much "room" there is in your data. But here is the kicker: the units are weird. If you’re measuring height in inches, your variance is in "squared inches." What on earth is a squared inch in the context of a person’s height? Nobody knows. It’s an abstract concept that’s hard to visualize. This is exactly why we don't stop at variance. We need something more human.

Standard Deviation is the "Real World" Translation

To get to standard deviation, you just take the square root of the variance.

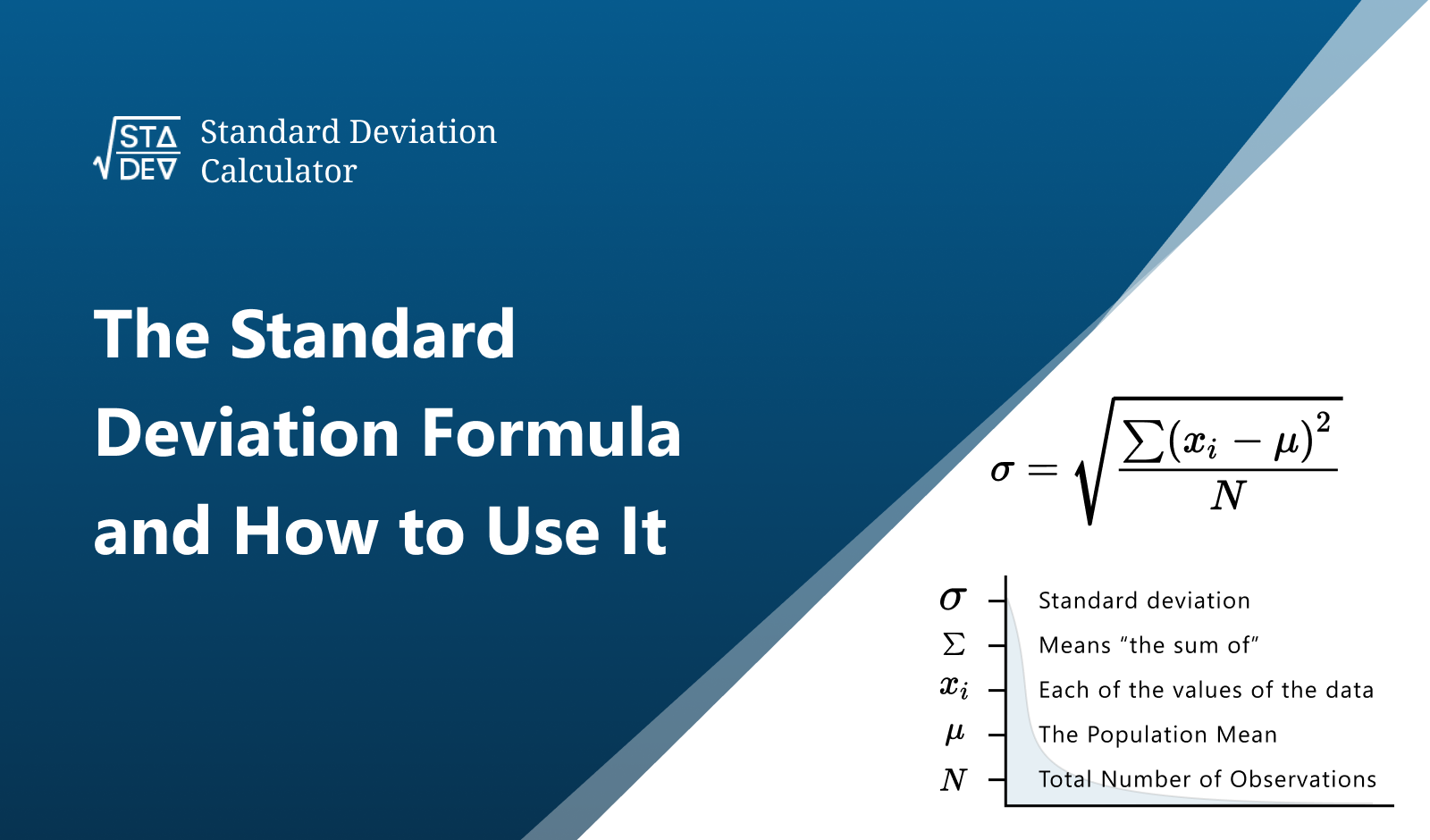

$$\sigma = \sqrt{\frac{\sum (x_i - \mu)^2}{N}}$$

Suddenly, those "squared inches" become regular inches again. Now you can say, "The average height is 68 inches with a standard deviation of 3 inches." That makes sense. It tells you that most people fall between 65 and 71 inches. It’s actionable. In the world of finance, this is how we define volatility. If a stock has a high standard deviation, it’s a roller coaster. If it’s low, it’s a slow, boring climb. Most people prefer boring when it's their retirement fund.

Why the "N-1" Thing Actually Matters

If you've ever looked at a textbook, you’ve probably seen two different versions of these formulas. One divides by $N$ (the total number of items) and the other divides by $n - 1$. This is the difference between a population and a sample.

It’s called Bessel’s Correction.

Think about it this way: if you’re measuring every single person in the world, you use $N$. But you’re never doing that. You’re usually measuring a small group to guess what the big group looks like. Because a sample is just a snapshot, it’s likely to be slightly less "spread out" than the whole population. Dividing by $n - 1$ artificially inflates the result just a tiny bit to account for that uncertainty. It’s a mathematical safety net.

If you forget to use $n - 1$ when working with samples, you’re underestimating risk. In business, underestimating risk is how companies go bust.

👉 See also: PHP to USD: Why the Exchange Rate Phil Peso to US Dollar is Acting So Weird Lately

Real-World Chaos: Quality Control and Pizza

Imagine you own a pizza shop. You tell customers the pizzas are 12 inches. If your standard deviation formula variance shows a high degree of spread, some customers are getting 10-inch crackers and others are getting 14-inch monsters. Your "average" is still 12 inches, but your customers are annoyed.

One day, the 10-inch customer complains. You check the oven. You check the dough. You realize your "variance" is high because your nighttime chef is lazy with the rolling pin. By calculating the standard deviation, you can set a "tolerance." Maybe you decide that any pizza more than 0.5 inches away from the target is a failure. Without the formula, you’re just guessing. With it, you have a quality control system.

The Bell Curve and the 68-95-99.7 Rule

When we talk about standard deviation, we usually assume a "normal distribution." You’ve seen the bell curve. It’s the shape of most things in nature—test scores, shoe sizes, the weight of apples.

- 68% of your data falls within one standard deviation.

- 95% falls within two.

- 99.7% falls within three.

If you’re a Six Sigma black belt in a manufacturing plant, you’re obsessed with that 99.7%. You want your defects to be so rare they only happen in that tiny 0.3% tail of the curve. If your variance is too wide, that bell curve flattens out like a pancake, and your "predictable" results fly out the window.

Common Mistakes People Make

Honestly, the biggest mistake is thinking a low standard deviation is always "good." It’s not. It just means things are consistent. If you’re a heart surgeon, a low standard deviation in your success rate is great. If you’re a creative director, a low standard deviation in your team’s ideas might mean everyone is bored and uninspired. Context is everything.

Another slip-up? Outliers.

Standard deviation is incredibly sensitive to extreme values. One billionaire walks into a dive bar, and suddenly the "average" patron is a millionaire with a massive standard deviation. In these cases, the standard deviation formula variance results can be misleading. Sometimes you need to look at the median instead, or "trim" your data to see what’s actually happening.

Actionable Steps for Using This Today

Don't just stare at the math. Use it to make better decisions.

📖 Related: Other Ways to Say Opportunity: Why Your Word Choice Changes Everything

- Check your samples. If you are looking at customer feedback or sales data, always use the "Sample Standard Deviation" (the one with $n - 1$). It’s more honest about the stuff you don't know.

- Visualize the spread. Don't just report the average. If you’re presenting to a boss, show the mean and the standard deviation. It proves you understand the risks, not just the middle ground.

- Identify the "Normal." Use the 68-95-99.7 rule to spot anomalies. If a daily sales figure is more than three standard deviations away from the mean, something happened. Don't ignore it. It’s either a massive opportunity or a looming disaster.

- Clean your data. Before you run the numbers, look for those "billionaires in a dive bar." If one data point is clearly an error or a one-time fluke, remove it. Otherwise, your variance will be so high the data becomes white noise.

Data isn't just a collection of numbers. It’s a story about how things vary. The variance tells you the scale of the story, and the standard deviation gives you the language to tell it. Stop looking at the average and start looking at the spread. That’s where the real insight is hiding.