You're sitting at your kitchen table, staring at a stack of W-2s and wondering if you should actually care about the standard deduction for 2024 single filers. Most people don't. They just click "next" on their tax software and let the algorithm do the heavy lifting. But here’s the thing: understanding this number is basically like finding "free" money that the IRS agrees not to touch.

For the 2024 tax year—the returns we are all obsessing over in early 2025—the base amount is $14,600.

✨ Don't miss: Elon Musk Latest News: Why the 2026 "Muskonomy" Pivot is Actually Happening

That’s a jump from the previous year. The IRS adjusts these figures annually to keep up with inflation, so you aren't paying a "hidden tax" just because the price of eggs went up. If you're single and under 65, that $14,600 is your magic number. It’s the portion of your income that is essentially tax-free.

Why the Standard Deduction for 2024 Single Filers is a Big Deal

Honestly, it’s about simplicity. Back in the day, everyone had to keep every single receipt for stamps, work boots, and charitable donations just to catch a break. Now, for about 90% of us, the standard deduction is way higher than any list of expenses we could possibly scrape together.

Think of it as a giant shield. If you made $50,000 in 2024, the IRS doesn't actually tax you on $50,000. They subtract that $14,600 right off the top. Suddenly, your taxable income is $35,400. That moves you into a lower tax bracket and keeps more cash in your pocket. It's not a loop-hole; it's the law.

The Over-65 and Blindness "Bonus"

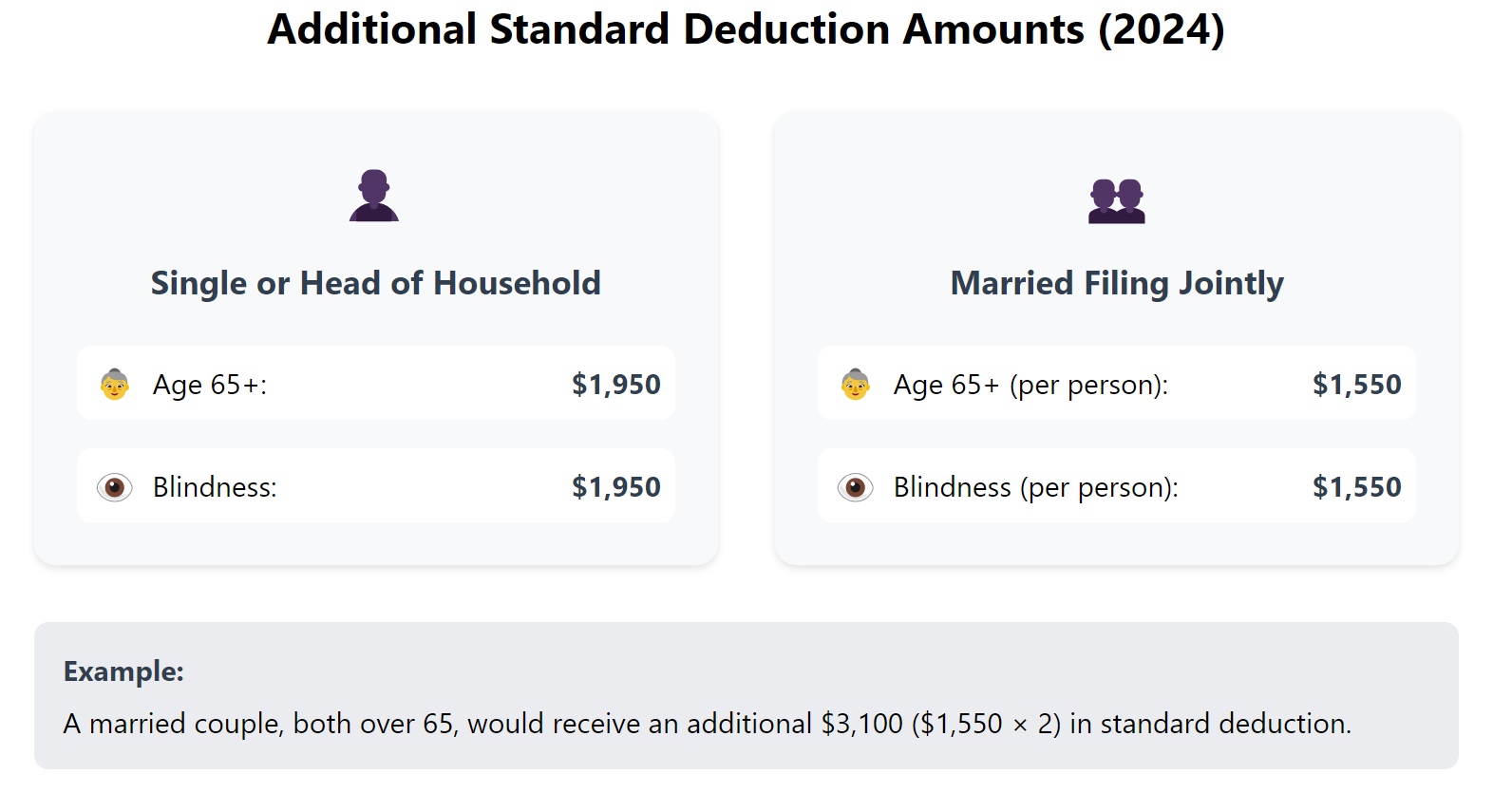

Not everyone gets the same $14,600. The IRS actually gives you a bit of a "seniority" or "hardship" bonus if you qualify. If you were 65 or older by December 31, 2024, your standard deduction isn't just the base amount. You get an extra $1,950.

That brings your total to $16,550.

The same applies if you are legally blind. If you're 65 and blind, you get two of those bonuses. We are talking about $18,500 in total deductions for a single filer in that specific boat. It’s a nuanced detail that people often miss because they assume the "single" number is a flat rate for everyone. It's not.

To Itemize or Not? That is the ($14,600) Question

Should you bother itemizing? Probably not.

💡 You might also like: Is Miss Vickie Still Alive? The Real Woman Behind the Famous Kettle Chips

Unless your mortgage interest, state taxes, and massive medical bills add up to more than $14,600, itemizing is a waste of your time. For a single person, reaching that threshold is actually pretty hard.

Let's look at the math. If you paid $8,000 in mortgage interest and gave $2,000 to charity, that’s $10,000. Since $10,000 is less than $14,600, you'd be crazy to itemize. You’d literally be volunteering to pay taxes on an extra $4,600 of income.

There are exceptions, though. If you had a really rough year with medical expenses—specifically costs exceeding 7.5% of your adjusted gross income—you might actually break that $14,600 ceiling. But for most of us living a standard life, the standard deduction is the clear winner.

What about the "One Big Beautiful Bill" Act?

You might have heard some noise about the "One Big Beautiful Bill" (OBBBA) passed in mid-2025. There's a lot of confusion here.

While that bill did introduce a new $6,000 deduction for seniors, it’s crucial to realize that it generally applies to the 2025 tax year and beyond. When you are filing your 2024 taxes right now, you are still operating under the $14,600 (plus age/blindness additions) rules. Don't go trying to claim 2025 credits on your 2024 return unless you want a very "personalized" letter from an IRS auditor.

Common Pitfalls for Single Filers

- Dependency Status: If your parents can claim you as a dependent, you don't get the full $14,600. Your deduction is limited to a specific formula—usually your earned income plus a small buffer ($450 in 2024), capped at the standard amount.

- Married Filing Separately: If you are technically married but filing separately, and your spouse itemizes, you are forced to itemize too. Even if your itemized total is $0. It’s a brutal rule that catches a lot of people off guard.

- The Birthday Rule: To the IRS, you turn 65 the day before your birthday. If your 65th birthday was January 1, 2025, you are considered 65 for the 2024 tax year.

Actionable Next Steps

Don't just take this as theory. Go look at your last paycheck of 2024. If your total "Gross Income" was under $14,600, you likely don't owe any federal income tax at all. You might still want to file to get back any money they withheld, though.

If you are over 65, make sure you check that box on your Form 1040. It’s a $1,950 difference that takes two seconds to claim.

Lastly, check your state’s rules. Most states have their own version of a standard deduction, and it rarely matches the federal $14,600. Some are higher, many are lower.

Gather your forms, keep that $14,600 figure in the back of your head, and remember: every dollar of deduction is a dollar the government doesn't take. You've earned it.

To prepare for your filing, first verify your total gross income for the year by aggregating all W-2s and 1099s. Then, check your age eligibility for the additional $1,950 senior deduction—remembering the "day before" birthday rule. Finally, compare your total potential itemized expenses (mortgage interest, property taxes, charitable gifts) against the $14,600 threshold to confirm that taking the standard deduction is indeed your most profitable move.