It is January 2026. If you've been glancing at your 401(k) lately, you're probably seeing some numbers that don't quite align with the doom-and-gloom headlines we saw throughout 2025. Markets are weird. Honestly, the S&P YTD performance is a masterclass in why trying to time the stock market is basically a fool's errand for most of us. You see a green number on your dashboard, but what does that actually mean for the next eleven months?

The S&P 500 started this year with a specific kind of momentum. We aren't just looking at a simple upward line. It’s more like a jagged mountain range where the climbers are all arguing about which way is north. People always ask: "Is it too late to get in?" or "Should I sell now while I'm ahead?" The truth is usually found in the boring stuff—the earnings, the Fed's stubbornness, and how much people are willing to overpay for a slice of the tech pie.

What’s Actually Driving the S&P YTD Right Now?

Most people assume the whole market moves together. It doesn't. Not even close. When we talk about the S&P 500, we're really talking about a handful of giants carrying a lot of smaller companies on their backs. If you look at the S&P YTD data, you’ll notice that the "Magnificent Seven"—or whatever we're calling that cluster of tech behemoths this week—is responsible for a disproportionate amount of the gains. It’s lopsided. Kinda like a basketball team where one guy scores 60 points and everyone else just tries not to trip over their own shoelaces.

Inflation is the ghost that won't leave the house. We thought it was gone. Then it peaked its head back out. The Federal Reserve, led by Jerome Powell, has been playing a high-stakes game of "chicken" with interest rates. When the Fed hints at a cut, the S&P 500 jumps. When they stay hawkish, the YTD gains start to evaporate faster than a puddle in July.

The Real Impact of Corporate Earnings

Earnings season is where the rubber meets the road. You can have all the hype in the world, but if a company isn't actually making money, the market eventually notices. This year, we’ve seen a massive divergence. Companies that integrated AI into their actual workflows—not just their marketing decks—are the ones propping up the index.

👉 See also: The VIX Volatility Index Explained (Simply): Why This Number Makes Wall Street Sweat

We saw this clearly in the Q4 reports that rolled in at the start of the year. It wasn't just about revenue; it was about margins. Investors are getting pickier. They want to see that companies can maintain profitability even if the consumer starts feeling the pinch from higher credit card rates.

Why the S&P YTD Matters More Than Individual Stocks

For the average person, the S&P 500 is the benchmark. It's the gold standard. If your "curated" portfolio of trendy biotech stocks is down 10% while the S&P YTD is up 4%, you've got a problem. It’s the ultimate reality check.

Investing in the index is essentially a bet on the American economy's resilience. It's 500 of the biggest players. Some will fail. Others will skyrocket. The index just swaps them out like a sports team trading away underperformers. That’s the beauty of it. It’s self-cleansing.

- Diversification: You aren't reliant on one CEO's bad decisions.

- Liquidity: You can move in and out of these positions in seconds.

- Historical Reliability: Over long periods, it tends to trend upward, despite the occasional heart-attack-inducing dip.

Common Misconceptions About Year-to-Date Returns

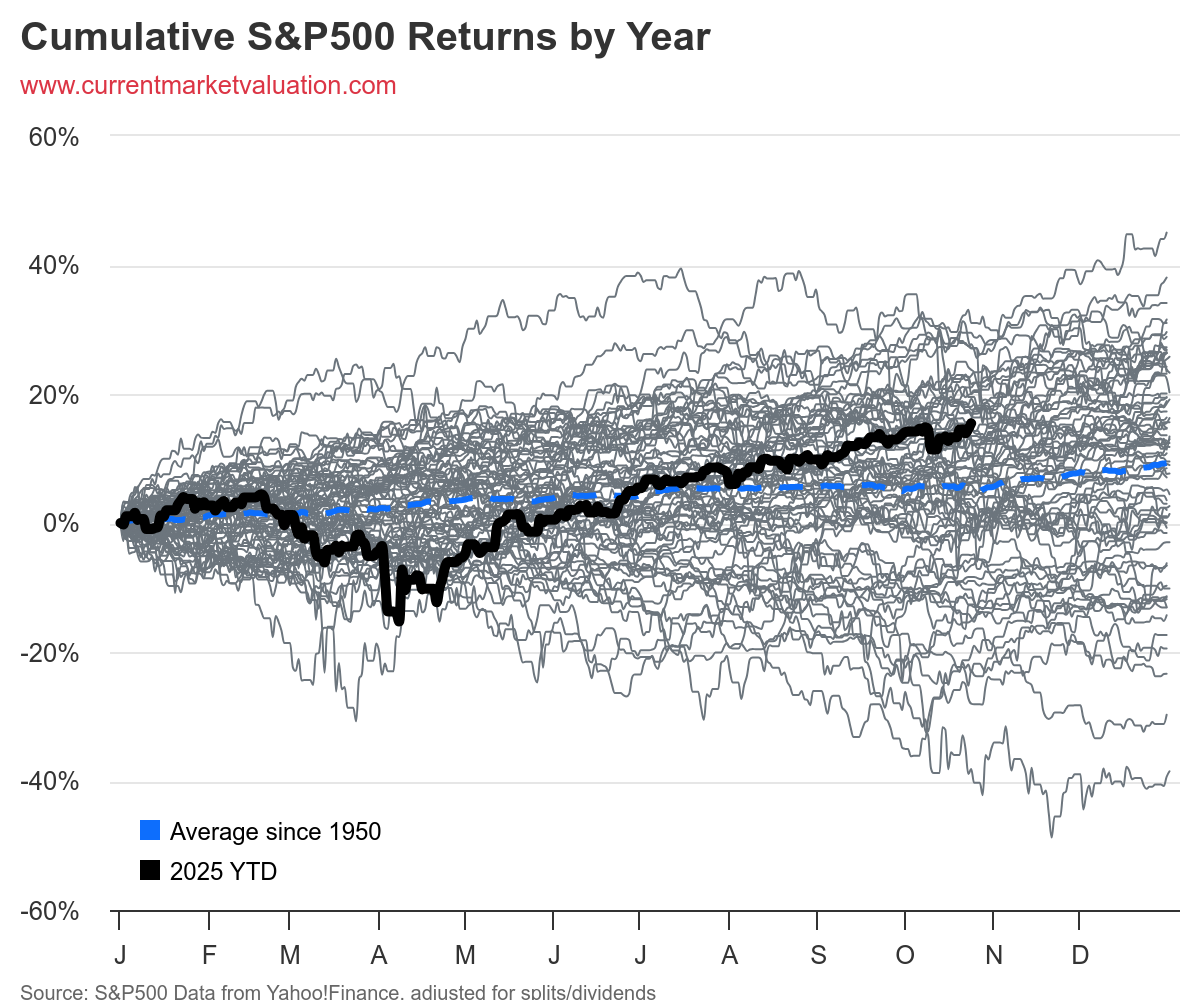

One huge mistake people make is looking at the YTD number on January 15th and assuming that’s the "vibe" for the year. It’s not. A strong start doesn't guarantee a strong finish. Remember 2022? The start of the year was a bloodbath, and it stayed messy. Conversely, sometimes the market starts slow and ends with a massive rally in December.

Another thing? The S&P 500 is market-cap weighted. This means Apple and Microsoft have way more influence on the S&P YTD than a company like Campbell Soup. If the tech sector has a bad day, the whole index looks like it’s crashing, even if 400 other companies are actually doing just fine. It’s a bit of a statistical illusion if you don't look under the hood.

The Role of Sentiment and "The Crowd"

Markets are driven by math, sure, but they’re also driven by feelings. Fear and greed are the two primary colors on this canvas. Right now, the sentiment around the S&P YTD is cautiously optimistic. People are tired of being scared. They want to believe in the "soft landing" narrative.

But "cautiously optimistic" is a dangerous place to be. It usually means people are waiting for a reason to run for the exits. We’ve seen volatility spikes this year that would make a roller coaster look like a flat line. One bad jobs report or a weird comment from a central banker can wipe out a week's worth of gains in two hours.

💡 You might also like: Finding the Real Unemployment NY Telephone Number Without Losing Your Mind

Comparing This Year to Historical Norms

Historically, the S&P 500 returns about 10% annually before inflation. Some years it's 30%. Some years it's -20%. When you look at the current S&P YTD performance, you have to ask: are we above or below that 10% trend line?

If we're already up 8% by March, expect some turbulence. The market rarely moves in a straight line. It needs to "breathe." This usually happens through a correction—a 10% drop that clears out the "weak hands" and lets the long-term investors buy in at a better price.

Actionable Insights for Navigating the Rest of the Year

Don't just watch the ticker. That’s how you end up making emotional decisions that hurt your net worth. Use the S&P YTD as a compass, not a daily instruction manual.

First, rebalance your portfolio. If the tech-heavy parts of the S&P have surged, your portfolio might be out of whack. You might be carrying way more risk than you intended. Sell some of the winners. Buy the laggards. It feels counterintuitive, but that’s how you actually buy low and sell high.

Second, check your cash reserves. If the YTD performance has been stellar, it’s a great time to make sure you have enough "dry powder." If the market takes a dip in the second half of the year, you want to be the person with cash ready to deploy, not the person forced to sell at the bottom because you need to pay rent.

Third, ignore the noise. There will be a hundred "black swan" events predicted on social media this month. Most won't happen. Focus on the macro trends: interest rates, corporate earnings, and consumer spending. Everything else is just entertainment.

Fourth, look at the Equal Weight S&P 500. If you want to know how the "average" company is doing, look at the ticker RSP. It treats every company in the index equally. If the S&P YTD is way higher than the RSP YTD, it means only a few big stocks are doing the heavy lifting. That’s a sign of a "thin" market, which is usually more fragile.

Stay disciplined. The market rewards those who can sit on their hands while everyone else is panicking. Your goal isn't to beat the S&P 500 every single day; it's to be invested long enough that the YTD noise eventually turns into long-term wealth.