You've probably heard the "10% rule." It's that golden nugget of financial wisdom tossed around by every TikTok guru and neighborhood uncle claiming that the stock market just prints money if you wait long enough. But honestly, when you look at the s&p average return last 20 years, the reality is way more chaotic than a simple, steady climb. It’s a story of absolute collapses, frantic recoveries, and the weird math of inflation that most people completely ignore.

Investing isn't a straight line. It's a jagged mountain range.

If you had dropped $10,000 into an S&P 500 index fund exactly twenty years ago—let’s say at the start of 2006—you would have lived through the 2008 Global Financial Crisis, the longest bull market in history, a global pandemic that shut down the world in 2020, and the aggressive rate hikes of 2022 and 2023. You’d be rich now, sure. But you would have felt like throwing up at least four times along the way.

The Cold Hard Numbers of the S&P 500

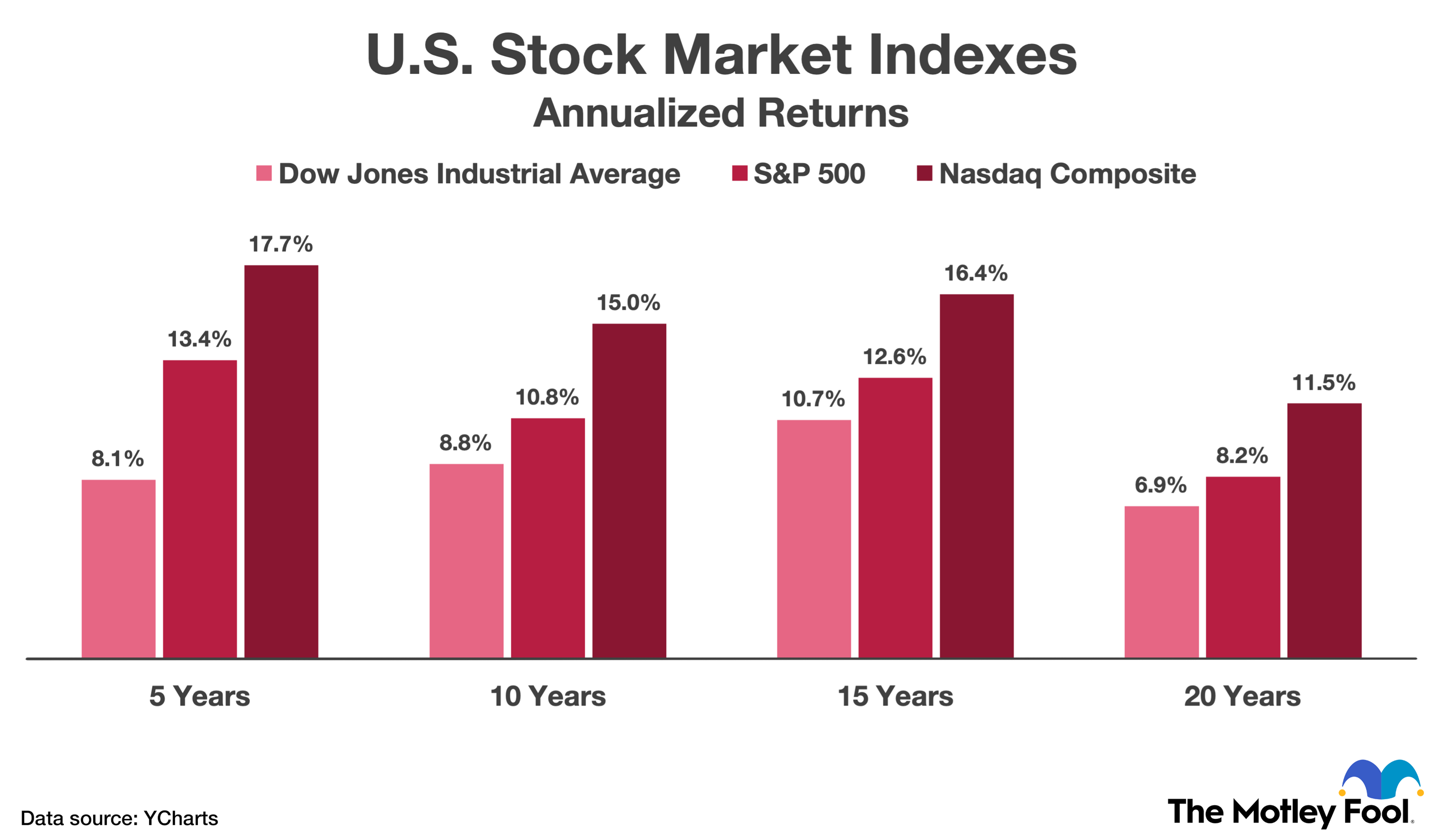

Let's talk raw data. Between the start of 2004 and the end of 2023 (a clean 20-year look), the S&P 500 saw an average annual return of roughly 10.2%. If you include dividends—which you absolutely must, because otherwise, you're just leaving money on the table—the total return for that period sits somewhere around 540%.

That sounds incredible. It is. But "average" is a dangerous word in finance.

Hardly any individual year actually returned 10%. In 2008, the index cratered by about 37%. In 2013, it rocketed up by over 32%. The "average" is just the smoothed-out result of a wild ride. If you panicked and sold in March 2009, your personal "average return" would have been a disaster.

Why the 2008 Crater Still Matters

We can't talk about the s&p average return last 20 years without acknowledging the Great Recession. It’s the scar tissue of the modern market. From October 2007 to March 2009, the S&P 500 lost more than half its value. Think about that. You look at your 401(k) and half of it is just... gone.

Most people didn't have the stomach to stay in. This is why "market returns" and "investor returns" are two totally different things. The market might return 10%, but the average investor often returns far less because they buy when things are expensive and sell when they're terrified.

The Post-2010 Boom

Then came the "Easy Money" era. For over a decade, interest rates were basically zero. This acted like rocket fuel for the S&P 500, especially for the big tech names like Apple, Microsoft, and Amazon. If you look at the stretch from 2010 to 2020, the returns were abnormally high. It spoiled us. We started thinking 15% or 20% years were normal. They aren't. They’re outliers.

Real Returns vs. Nominal Returns (The Inflation Thief)

Here is the part where most "experts" stop talking because it makes the numbers look less sexy. There is a massive difference between your nominal return (the number on your screen) and your real return (what that money actually buys).

Inflation over the last 20 years hasn't been dormant. While it was low for a long time, the spike in 2021 and 2022 reminded everyone that a dollar today isn't a dollar in 2004. When you adjust the S&P 500's performance for inflation, that 10% average annual return drops to something closer to 7.5% or 8%.

Still good? Yes. Life-changing? Absolutely. But it means your purchasing power doesn't grow quite as fast as the S&P chart suggests.

The "Magnificent" Weighting Problem

The S&P 500 is a market-cap-weighted index. This means the biggest companies have the biggest influence. In the last few years, this has become extreme. A handful of companies—Nvidia, Apple, Microsoft, Alphabet, Meta, Amazon, and Tesla—now make up a massive chunk of the index.

When you buy the S&P 500 today, you aren't really buying "the economy." You're buying a huge bet on Big Tech. If those seven companies have a bad year, the whole index drags, even if the other 493 companies are doing okay. Over the last 20 years, we’ve moved from a diversified industrial and financial index to one that is heavily dominated by software and chips.

Survivorship Bias

We also forget that the S&P 500 isn't a static list. Companies that fail get kicked out. Companies that thrive get added. This "survival of the fittest" mechanism is built-in. It’s why the index tends to go up over long periods—it literally filters out the losers and replaces them with the winners of the modern era.

How Dividends Change the Math

If you ignore dividends, you're reading the wrong book. Over the s&p average return last 20 years, dividends accounted for a huge portion of total wealth creation.

Imagine you own a tree. The nominal price of the S&P is the height of the tree. The dividends are the fruit it drops every year. If you take that fruit and plant more trees (reinvesting), your orchard grows exponentially. For the last two decades, the dividend yield has averaged around 1.5% to 2%. That sounds small, but compounded over 20 years, it’s the difference between retiring comfortably and working an extra five years.

Comparing the S&P 500 to Other Assets

Is the S&P 500 the best place to have been? Mostly, yes. But not always.

Gold had a massive run in the early 2000s and again recently. Real estate, despite the 2008 crash, has been a monster in specific markets. However, for the average person with a job and a brokerage account, nothing has matched the liquid, accessible growth of the S&P.

👉 See also: WMT Stock Price Per Share: Why Most Investors Are Missing the Real Story

- Bonds: Have largely struggled in the low-rate environment of the 2010s, though they offered a "buffer" during stock market drops.

- International Stocks: Have significantly underperformed the US market over the last 20 years. If you were "globally diversified," you actually made less money than if you had just stayed in the S&P 500.

- Cash: A guaranteed loser. If you kept your money in a savings account from 2004 to 2024, you lost a massive amount of purchasing power.

The Impact of 2022 and the New Reality

The world changed in 2022. The 40-year tailwind of falling interest rates ended. We hit a wall of inflation and the S&P 500 dropped nearly 20% in a single year.

A lot of people are asking if the s&p average return last 20 years can be repeated in the next 20. It's a fair question. We are starting from a point where stock valuations (Price-to-Earnings ratios) are relatively high. When things are expensive, future returns tend to be lower.

Renowned investors like John Bogle, the founder of Vanguard, often warned that we should lower our expectations. If the last 20 years gave us 10%, the next 20 might give us 7%. That’s not a disaster, but it requires more discipline and a higher savings rate.

The Psychology of the 20-Year Window

The hardest part isn't the math. It's the waiting.

Twenty years is 240 months. Out of those 240 months, probably 60 of them were terrifying. There were moments when the news told you the financial system was ending. There were moments when it felt like "this time is different."

The people who actually captured the s&p average return last 20 years weren't the smartest ones. They weren't the ones who could read a balance sheet or predict interest rate pivots. They were the ones who were too bored or too stubborn to click the "sell" button.

Actionable Steps for Your Portfolio

If you're looking at these 20-year stats and wondering how to apply them to your own money, here is the "no-nonsense" checklist:

Check your expense ratios. If you are paying 1% a year to a financial advisor or an expensive mutual fund, you aren't getting the S&P return. You're getting the S&P return minus 1%. Over 20 years, that 1% fee can eat 25% to 30% of your total potential wealth. Use low-cost ETFs like VOO or SPY.

Automate the "boring" stuff. The data shows that "Dollar Cost Averaging"—putting in the same amount every month regardless of the price—beats trying to time the market. You buy more shares when they are cheap and fewer when they are expensive. It works.

🔗 Read more: Why 151 West Fifth Street Cincinnati Ohio 45202 is the Most Important Corner of Downtown

Reinvest your dividends. Turn on DRIP (Dividend Reinvestment Plan) in your brokerage account. It’s a toggle switch that changes your long-term trajectory. Do it today.

Don't over-rely on the past. While the S&P 500 has been the king for 20 years, keep some perspective. Markets move in cycles. The dominance of US Tech might not last forever. It’s okay to have a little exposure to international stocks or bonds, even if they've been "losers" recently. Diversification is about surviving the times when the S&P 500 isn't returning 10%.

Calculate your "Gap." Work backward. If you need $1 million in 20 years, and you assume a conservative 7% real return, how much do you need to save per month? If that number is $1,500 and you’re only saving $500, the "average return" of the market won't save you. You have to bridge the gap with your savings rate.

The S&P 500 is a powerful wealth-building machine, maybe the greatest ever invented for the common person. But it’s a machine that requires you to stay out of its way. The next 20 years will have their own "2008" and their own "2020." The question isn't what the market will do, but what you will do when the red numbers start flashing on your screen.

Stay invested. Stay boring. Let the math do the heavy lifting.