Honestly, if you ask the average person what the S&P 500 is, they’ll tell you it’s "the market." Simple, right? But that’s kinda like saying a Ferrari is just "a car." While it’s the most famous benchmark on the planet, the actual list of S&P 500 stocks is way more of a moving target than most people realize. It’s not a static museum of American industry; it's a living, breathing, and occasionally ruthless competition where companies are kicked to the curb the moment they stop performing.

Right now, as we navigate through early 2026, the index is sitting at a fascinating crossroads. You’ve got these massive "hyper-scalers" like Nvidia, Microsoft, and Apple commanding massive chunks of the pie, while smaller legacy players are fighting for their lives just to stay in the club.

The Illusion of "500"

Here is a fun bit of trivia that usually trips people up: the S&P 500 doesn't actually have 500 stocks.

As of January 2026, the count is actually closer to 503. Why the extra three? It’s basically because a few companies—most notably Alphabet (Google), Fox Corp, and News Corp—have multiple classes of shares. When you look at the ticker list, you’ll see GOOGL and GOOG. They’re the same company, but different share classes, and both are in the index. It’s a technicality, sure, but it matters when you’re trying to understand why your index fund holdings look a bit crowded.

Why S&P 500 Stocks Aren't Created Equal

Most people think every company in the index has an equal say in where the price goes. That couldn't be further from the truth.

The S&P 500 is market-cap weighted. This means the bigger the company’s total market value, the more it moves the needle. If a tiny company at the bottom of the list like Mohawk Industries has a great day, the index barely flinches. But if Nvidia (which currently holds over 7% of the entire index weight) drops by 2%, the whole market feels like it’s in a tailspin.

This concentration has reached levels we haven't seen in decades. In fact, the top 10 stocks now account for roughly 30-35% of the entire index. It’s basically a tech fund wearing a "diversified" costume.

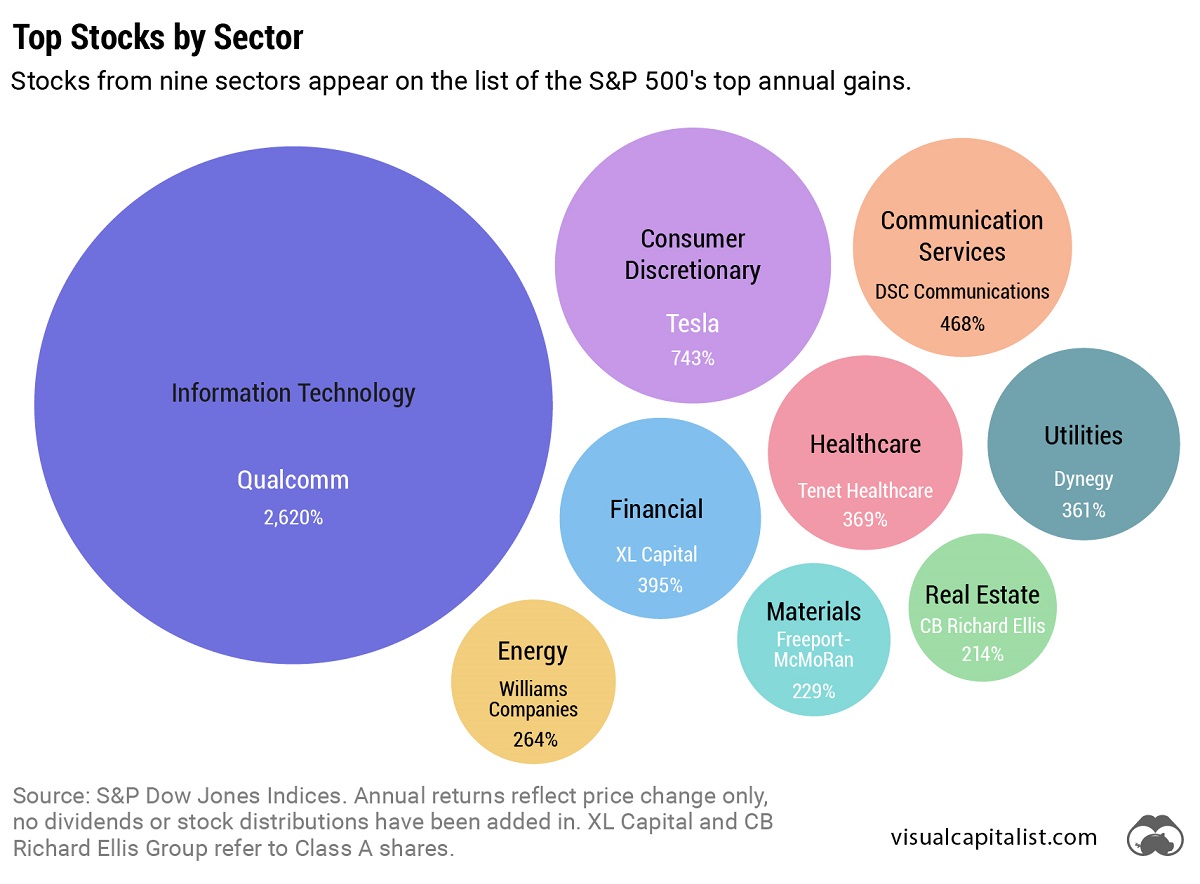

- Information Technology: Still the heavyweight champion at roughly 34%.

- Financials: Making a comeback in 2026 as interest rates stabilize, sitting around 13%.

- Health Care: A steady 9-10% with big players like Eli Lilly leading the charge.

- Consumer Discretionary: Dominated by the likes of Amazon and Tesla, holding about 10%.

The Newcomers and the Departed

The S&P 500 isn't a permanent club. To get in, a company has to be a US-based firm, have a massive market cap (usually over $18 billion these days), and—this is the kicker—be profitable over the last four quarters.

Lately, we’ve seen a shift toward "quality" and infrastructure. Palantir Technologies was a big addition recently, finally proving its profitability to the S&P committee. On the flip side, we’re seeing older, sluggish companies get the boot. When a stock gets removed, it’s usually because its market value has shriveled or it’s been acquired.

There's a lot of chatter in the 2026 prediction markets about companies like SoFi or Vertiv Holdings potentially making the leap. Getting added is a massive deal because every "passive" index fund (like VOO or SPY) is legally required to go out and buy millions of shares of the newcomer, often causing a price spike.

What Most Investors Miss About Diversification

If you own an S&P 500 index fund, you’re basically betting on the American mega-cap tech story.

Is that bad? Not necessarily. These companies—Microsoft, Apple, Amazon—have more cash than some small countries. But in early 2026, we're seeing a "rotation." Investors are starting to get a bit nervous about AI valuations and are looking at boring stuff again. Consumer Staples and Utilities are suddenly looking attractive to people who are tired of the volatility in the Mag 7.

🔗 Read more: Convert ZAR to USD: What Most People Get Wrong About Timing the Rand

Actually, if you look at the S&P 500 Equal Weight Index (RSP) compared to the standard one, the equal-weight version has been outperforming lately. This tells us that the "average" stock is finally doing well, rather than just the top five tech giants carrying the whole team.

The 2026 Outlook: Real Assets and AI Fatigue

We’ve been living in an AI-driven world for a while now, but 2026 is feeling a bit different. Experts from firms like Goldman Sachs and J.P. Morgan are forecasting roughly 12-14% earnings growth for the index this year. But they’re also warning about "crowding."

Basically, everyone is in the same trades. If everyone owns Nvidia, who is left to buy?

This is why you're seeing a rise in "Real Assets" within the index. Energy stocks like ExxonMobil and Chevron are no longer just "old world" relics; they’re becoming essential as the massive data centers needed for AI require insane amounts of power. You can’t have a digital revolution without a whole lot of physical electricity.

Actionable Insights for Your Portfolio

So, what do you actually do with this information?

- Check Your Concentration: If you own an S&P 500 fund and then also own individual shares of Apple or Nvidia, you are way more exposed to tech than you think. Use a "portfolio X-ray" tool to see your true weightings.

- Look at the Equal Weight Alternative: If you’re worried about the index being too top-heavy, consider putting a portion of your money into an equal-weight ETF. It gives you exposure to all 500 companies without being 7% deep in a single stock.

- Watch the Rebalancing: S&P Dow Jones Indices rebalances the list quarterly (March, June, September, December). Keep an eye on these dates. The "index effect" can create short-term opportunities in stocks being added or removed.

- Stop Ignoring the "Boring" Sectors: In 2026, the winners might not be the flashy software names. Keep an eye on Industrials (like GE Aerospace) and Materials. As the US continues to "re-shore" manufacturing, these companies are finally seeing the growth they've lacked for a decade.

The S&P 500 stocks list is the ultimate survival-of-the-fittest game. It's designed to winners-rotate, and while it feels like tech will rule forever, the index's history suggests that the top players today will eventually be replaced by something we haven't even thought of yet.

Your next move should be to pull up your brokerage statement and see exactly what percentage of your total wealth is tied to the top 10 names in the S&P 500. You might be surprised—and a little bit spooked—by how much of your future is riding on just a handful of CEOs in Silicon Valley. Once you have that number, decide if you're comfortable with that level of "stealth" concentration or if it's time to branch out into mid-cap or international names.