Money isn't free. When you buy a slice of the American economy through an index fund, you’re basically paying for a stream of future cash. But how much are you overpaying? That’s where the S&P 500 price earnings ratio comes in. It’s the sticker price of the stock market.

Right now, if you look at the ticker, things feel expensive. They are. Historically, the S&P 500 trades at a P/E of around 16. Recently, we've seen it drift way higher, sometimes touching 25 or 30 during tech frenzies. It’s wild. Imagine walking into a grocery store where a loaf of bread usually costs $3, but today it’s $6 because everyone thinks the bread will be twice as delicious next year. That’s the P/E ratio in a nutshell.

The Raw Mechanics of the S&P 500 Price Earnings Ratio

Calculating this isn't rocket science, but people trip over the details. You take the current price of the index and divide it by the combined earnings per share (EPS) of all 500 companies. Simple.

$$P/E = \frac{\text{Price}}{\text{Earnings}}$$

But wait. Which earnings?

Wall Street loves to play with numbers. You’ve got "Trailing P/E," which looks at the last 12 months of actual, cold-hard profit. Then there’s "Forward P/E," which is basically a bunch of analysts making educated guesses about what companies like Apple, Nvidia, and Walmart will earn next year. Forward P/E is usually lower because everyone assumes companies will grow. If they don't? Well, that's how market crashes start.

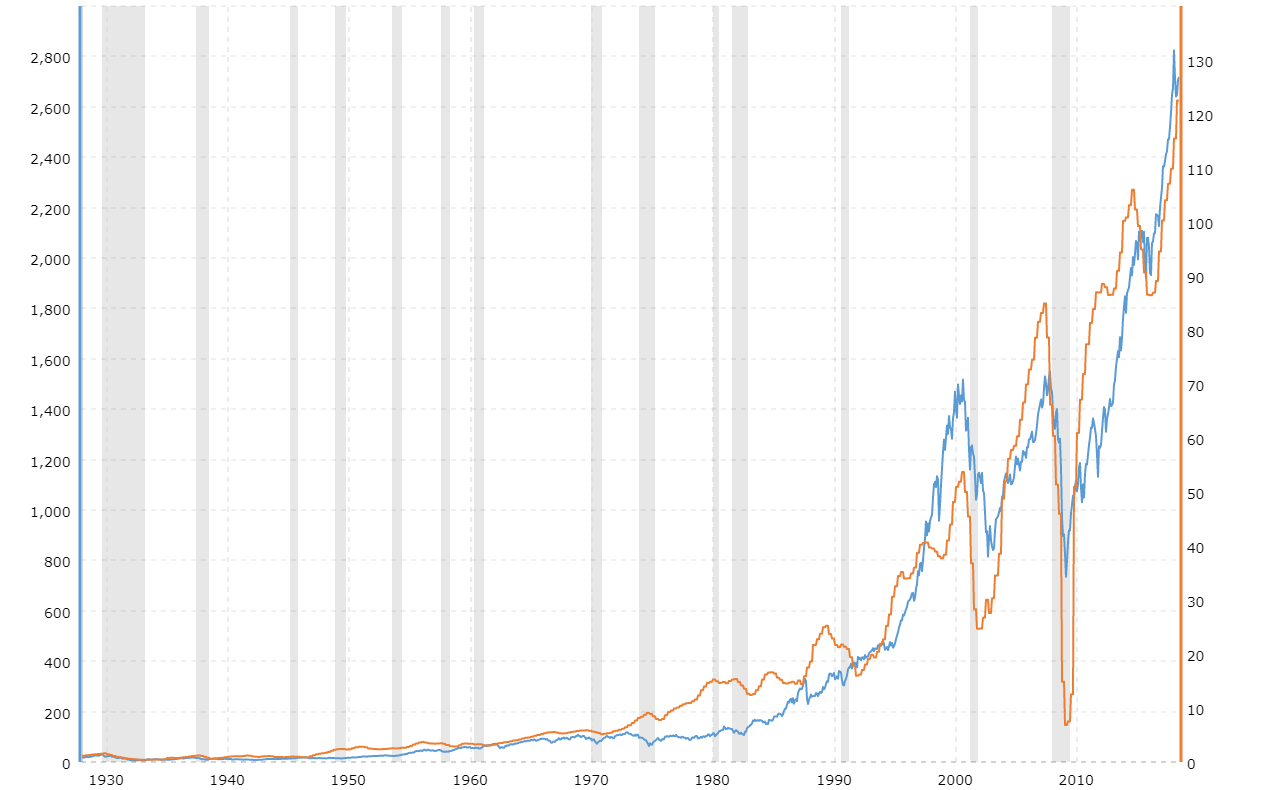

Robert Shiller, a Nobel Prize winner from Yale, famously came up with the CAPE Ratio (Cyclically Adjusted Price-to-Earnings). He didn't think one year was enough. He looks at ten years of earnings, adjusted for inflation. When the Shiller P/E gets too high—like it did in 1929 or 2000—bad things tend to happen.

Why Investors Obsess Over These Digits

It's about the yield. If the S&P 500 price earnings ratio is 20, the "earnings yield" is 5%. You get that by flipping the fraction. 1 divided by 20 equals 0.05.

If a 10-year Treasury bond is paying you 4.5% for basically zero risk, why would you buy stocks for a 5% yield? You wouldn't. Not unless you expect those earnings to skyrocket. This is why the Federal Reserve is the shadow puppet master of the P/E ratio. When interest rates go up, the P/E ratio usually has to come down to stay competitive. It’s a seesaw.

Sometimes the ratio lies to you.

In 2009, during the depths of the Great Recession, the P/E ratio actually spiked to over 120. Was the market expensive? No. It was because earnings had literally evaporated. The denominator was so small that the ratio exploded. You have to look at the context.

The Magnificient Seven Distortion

We can't talk about the S&P 500 today without talking about the heavy hitters. Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, and Tesla. These guys carry the index.

Because the S&P 500 is market-cap weighted, these tech giants have a massive influence on the overall S&P 500 price earnings ratio. If Nvidia is trading at a P/E of 70 and it’s a huge chunk of the index, it pulls the whole average up.

If you look at the "Equal Weight" S&P 500—where every company gets the same vote regardless of size—the P/E ratio is often much lower. This tells us that while the "average" stock might be fairly priced, the "popular" stocks are getting pricey. It’s a two-speed market. Honestly, it’s kinda polarizing. You’re either betting on the tech revolution or you’re waiting for a mean reversion that might never come.

High P/E Doesn't Always Mean "Sell"

There’s a common trap. People see a high P/E and think, "I'm out, it's a bubble."

Not so fast.

Markets can stay "irrational" longer than you can stay solvent. Just because the S&P 500 price earnings ratio is 22 doesn't mean it won't go to 25. In the late 90s, the ratio stayed elevated for years while the internet was being built out. If you sold in 1996 because the P/E looked high, you missed the biggest rally in history.

Growth matters more than the static number. If AI actually doubles productivity, maybe a P/E of 30 is actually cheap? It sounds crazy, but that's the bull case. On the flip side, the bears will tell you that profit margins are at all-time highs and there’s nowhere to go but down. They’ve been saying that for a decade. They've also been wrong for a decade.

How to Actually Use This Information

Don't just stare at the number on a chart. Use it to gauge sentiment.

When the S&P 500 price earnings ratio is low (think 10-14), everyone is terrified. That’s usually the best time to buy. When it’s north of 22, everyone is greedy. That’s when you check your risk tolerance.

- Check the 10-Year Average: Look at where the ratio is relative to its own history.

- Compare to Interest Rates: If the 10-year Treasury is at 5%, a P/E of 25 is a massive red flag.

- Look at the Sector Breadth: Is the high P/E driven by all 500 stocks or just the top 10?

The S&P 500 isn't a monolith. It’s a collection of businesses. Some are growing, some are dying. The P/E ratio is just the collective mood ring of the investing public.

Actionable Next Steps for Your Portfolio

Stop trying to time the market based on a single decimal point. It won't work. Instead, use the P/E ratio to inform your asset allocation.

If the S&P 500 price earnings ratio is significantly above its 10-year mean, consider rebalancing. If your stocks have grown to 80% of your portfolio because of high valuations, sell some. Move it into bonds or cash. You aren't "timing" the market; you're just maintaining your original risk level.

Check the Shiller P/E (CAPE ratio) once a quarter. It’s a better "macro" thermometer than the daily trailing P/E. It helps you see through the noise of a single bad quarter or a one-time tax break that might skew the regular earnings data.

Finally, look at international markets. Sometimes when the S&P 500 P/E is sky-high, European or Emerging Markets are trading at a P/E of 10 or 12. Diversification is the only free lunch in finance, and P/E ratios are the menu that tells you what's on sale.

💡 You might also like: Why New Seasons Market San Jose Never Actually Happened

The S&P 500 is a powerhouse, but it isn't always a bargain. Pay attention to what you're paying for every dollar of profit. Your future self will thank you for not buying at the absolute peak of the hype cycle.

Keep an eye on the upcoming quarterly earnings reports from the "Magnificent Seven." Their results will either justify the current S&P 500 P/E or force a painful correction as the denominator fails to keep up with the numerator.