Honestly, if you took a nap in 2023 and just woke up today, the stock market would look like a sci-fi movie. We aren't just talking about big numbers anymore. We are talking about "how is this even possible" numbers. The S&P 500 list by market cap has basically turned into a race between a few tech titans that are now worth more than the entire GDP of many developed nations.

As of mid-January 2026, the total market value of the S&P 500 has slammed through the $62 trillion mark. It’s wild. Just a few years ago, we were marveling at the first $1 trillion company. Now? If you aren't flirting with $4 trillion, you’re barely in the conversation for the top spot.

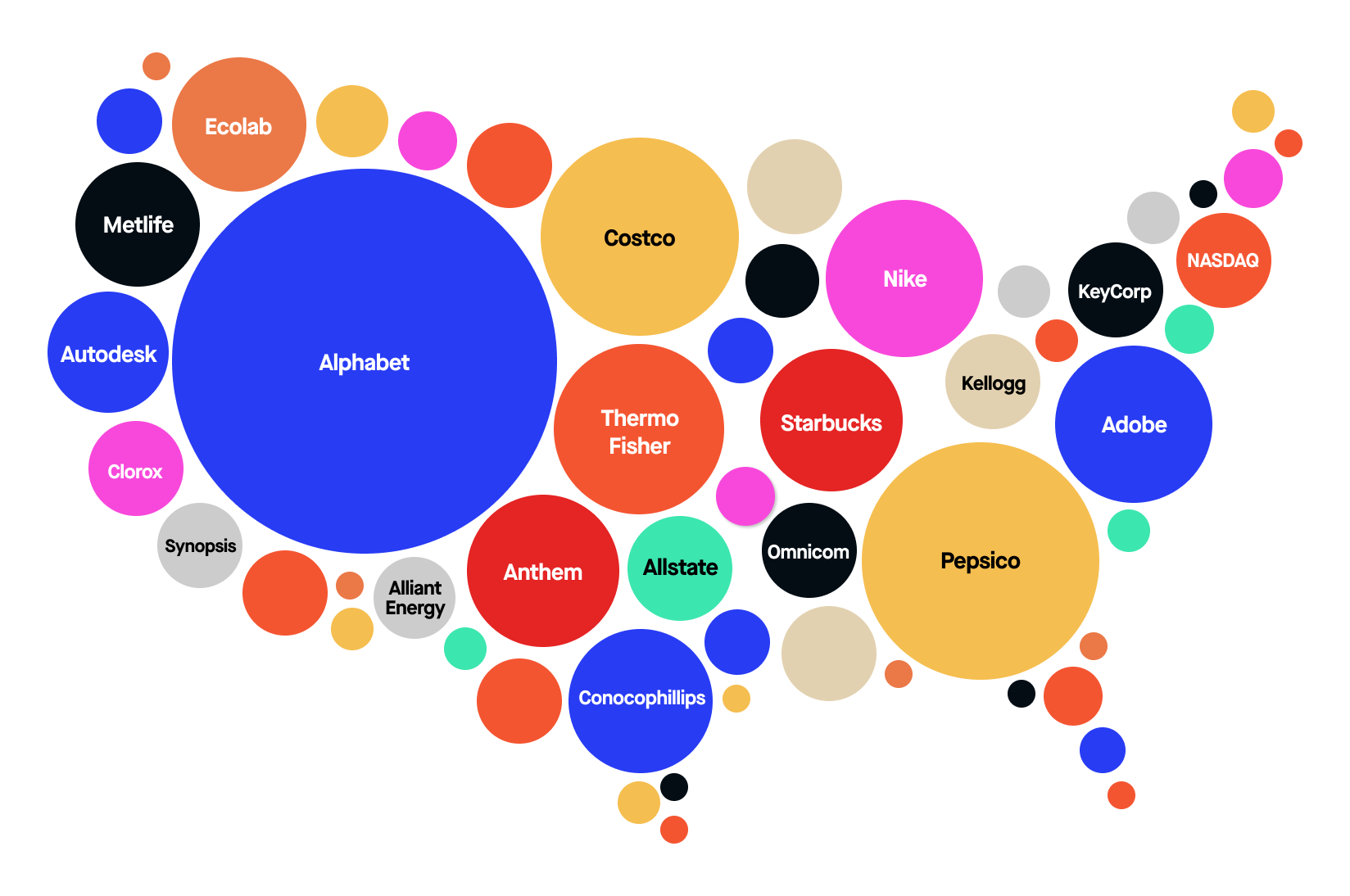

The Current Heavyweights: S&P 500 List by Market Cap

The leaderboard is currently dominated by names you know, but the order changes almost weekly based on which CEO mentioned "AI agents" or "quantum integration" in their latest earnings call. Nvidia has firmly planted its flag at the summit. With a market cap hovering around $4.5 trillion, it has officially unseated the old guard.

Apple and Alphabet are neck-and-neck for that second-place trophy. Just this week, Alphabet—Google's parent company—crossed the $4 trillion threshold for the first time. It actually briefly hopped over Apple to become the second most valuable company in the U.S. index. Microsoft isn't far behind, sitting comfortably in that elite $3.5 to $4 trillion range.

It’s kind of a "Big Four" situation now. These four companies alone carry so much weight that if one of them has a bad Tuesday, the whole index feels like it's catching a cold.

Beyond the Tech Giants

You’ve got to look further down the list to find the "physical" world. Amazon is still massive, holding the fifth spot at roughly $2.5 trillion. Meta Platforms follows it up. But once you get past the tech-heavy top seven, things get a bit more diverse.

🔗 Read more: USD to UZS Rate Today: What Most People Get Wrong

Berkshire Hathaway remains the outlier—the titan built on insurance, railroads, and candy rather than chips and code. It’s still the only non-tech company reliably sticking in the top ten with a valuation over $1 trillion.

Then you have the healthcare and finance kings. Eli Lilly has seen a meteoric rise thanks to its dominance in the metabolic health space, and JPMorgan Chase continues to prove why it’s the "fortress" of American banking.

What the Index Weighting Actually Means for You

Most people don't realize the S&P 500 is float-adjusted market-cap weighted. That's a mouthful. Basically, it means the bigger the company, the more it moves your 4001(k) or brokerage account.

When you buy an S&P 500 index fund, you aren't putting equal amounts into every company. You’re putting way more into Nvidia than you are into, say, a smaller constituent like News Corp or Ralph Lauren.

- Concentration Risk: The top 10 companies now represent more than 35% of the entire index's value.

- The "S&P 490" Effect: Analysts often joke that there are two markets: the 10 giants and the other 490 companies that are just along for the ride.

- Sector Bias: Technology and Communication Services make up nearly half the index weight now.

If you think you're diversified just because you own "500 stocks," you might want to look closer. You're actually very heavily bet on the future of Silicon Valley.

💡 You might also like: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

New Faces and Recent Departures

The S&P 500 list by market cap isn't a static document. It’s a living thing. The S&P Index Committee meets regularly to decide who gets an invite to the party and who gets kicked out.

In late 2025 and early 2026, we saw some big shifts. Companies like Palantir Technologies and DoorDash finally made the cut after proving they could stay profitable. Meanwhile, old-school names that failed to adapt have been shown the door.

For a company to join, it generally needs:

- A market cap of at least $18 billion (though this floor keeps rising).

- Positive earnings over the most recent quarter and the last four quarters combined.

- High liquidity (meaning people actually trade the stock).

It’s not just about being big; it’s about being "institutional grade."

How to Use This List in Your Strategy

Looking at the list is fun, but what do you actually do with it?

📖 Related: Getting a Mortgage on a 300k Home Without Overpaying

First, check your overlap. If you own an S&P 500 fund and a "Growth" fund and a "Tech" fund, you probably own an absurd amount of Nvidia and Microsoft. You might think you're spreading your risk, but you're actually doubling down on the exact same five stocks.

Second, watch the rebalancing. When a company is added to the S&P 500, every index fund on the planet has to buy it at the same time. This often creates a "pop" in price, though savvy investors usually trade that move weeks before it becomes official.

Third, keep an eye on the "Equal Weight" version of the index (ticker: RSP). It treats every company the same, whether it’s Apple or a mid-sized utility company in Ohio. Lately, the equal-weight index has behaved very differently than the standard market-cap one, which tells you a lot about the health of the broader economy versus the AI hype.

Practical Steps for Your Portfolio

If you want to stay ahead of the curve, don't just stare at the top 10. Start looking at the companies in positions 20 through 50. That’s where the "next" giants are hiding.

Review your concentration. Open your brokerage app and look at your "Top Holdings." If the same four tech names account for more than 20% of your total net worth, it might be time to look at some "value" sectors or mid-cap stocks.

Monitor the committee. Follow the S&P Dow Jones Indices announcements. They usually drop news on Friday nights after the market closes. Knowing who is moving into the index can give you a heads-up on where big institutional money is about to flow.

Don't ignore the bottom. The companies at the very bottom of the S&P 500 are often there because they've been beaten down, but they are still large, profitable U.S. businesses. Sometimes, the best "buy" isn't the company everyone is talking about at $4 trillion, but the one nobody is talking about at $20 billion.