Honestly, if you've ever turned on the news and heard someone say "the market is up today," they are almost certainly talking about the S&P 500. It's the big one. It's the scoreboard for American capitalism. But here’s the thing: most people treat it like a single giant company you can just go out and buy.

It isn't.

The S&P 500 is basically just a list. Think of it as the "Burn Book" or the "Dean's List" for the 500 biggest, most influential companies in the United States. When you hear people talk about the S&P market, they’re talking about the collective heartbeat of these 500 giants, ranging from the iPhone in your pocket to the bank that holds your mortgage.

What is the S&P Market and Why Should You Care?

At its core, the S&P 500 (Standard & Poor's 500) is a stock market index. It tracks 500 of the largest publicly traded companies in the U.S.

It's not just a random collection, though. To get on this list, a company has to be massive. As of mid-2025, the entry requirement for market capitalization—basically the total price tag of the company—was a staggering $22.7 billion. If you're smaller than that, you're sitting at the kids' table.

Why does everyone obsess over it? Simple: it represents about 80% of the total value of the U.S. stock market. If the S&P 500 is healthy, the American economy is usually doing okay. If it's tanking, people start checking their 401(k)s with a sense of dread.

The Weird Way the Math Works

The index is "market-cap weighted." This is a fancy way of saying the biggest kids on the playground have the loudest voices.

If Apple or Microsoft has a bad day, the whole S&P 500 feels it. If a smaller company at the bottom of the list—say, a regional utility company—goes bankrupt, the index might barely wiggle.

Currently, the "Magnificent Seven" tech stocks (Nvidia, Apple, Microsoft, etc.) carry an outsized amount of influence. In early 2026, Nvidia alone accounted for over 7% of the entire index. That's a lot of power for one company to have over your retirement savings.

The Secret Committee Behind the List

Most people think the S&P 500 is automated. It's not.

There is a literal room of people—the Index Committee—who decide who gets in and who gets kicked out. They meet regularly to make sure the index actually reflects the "real" economy. They aren't just looking at size; they want to see "financial viability," which usually means the company has to be profitable for at least four consecutive quarters.

They also look at liquidity. If no one is trading a stock, the committee doesn't want it. They want companies that are "liquid," meaning you can buy or sell millions of shares without the price jumping around like a caffeinated toddler.

Can You Actually Buy the S&P Market?

You can't buy the "index" itself because it's just math. It's a calculation.

However, you can buy an Index Fund or an ETF (Exchange-Traded Fund) that mimics it. These funds essentially go out and buy all 500 stocks in the exact proportions the index dictates.

Why People Love These Funds:

- Diversification: You own 500 companies at once. If one fails, you have 499 backups.

- Low Cost: Because a computer is doing the "picking" based on the list, you don't have to pay a high-priced hedge fund manager.

- Historical Returns: Historically, the S&P 500 has returned an average of about 10% annually over long periods.

But don't get it twisted. 10% is the average.

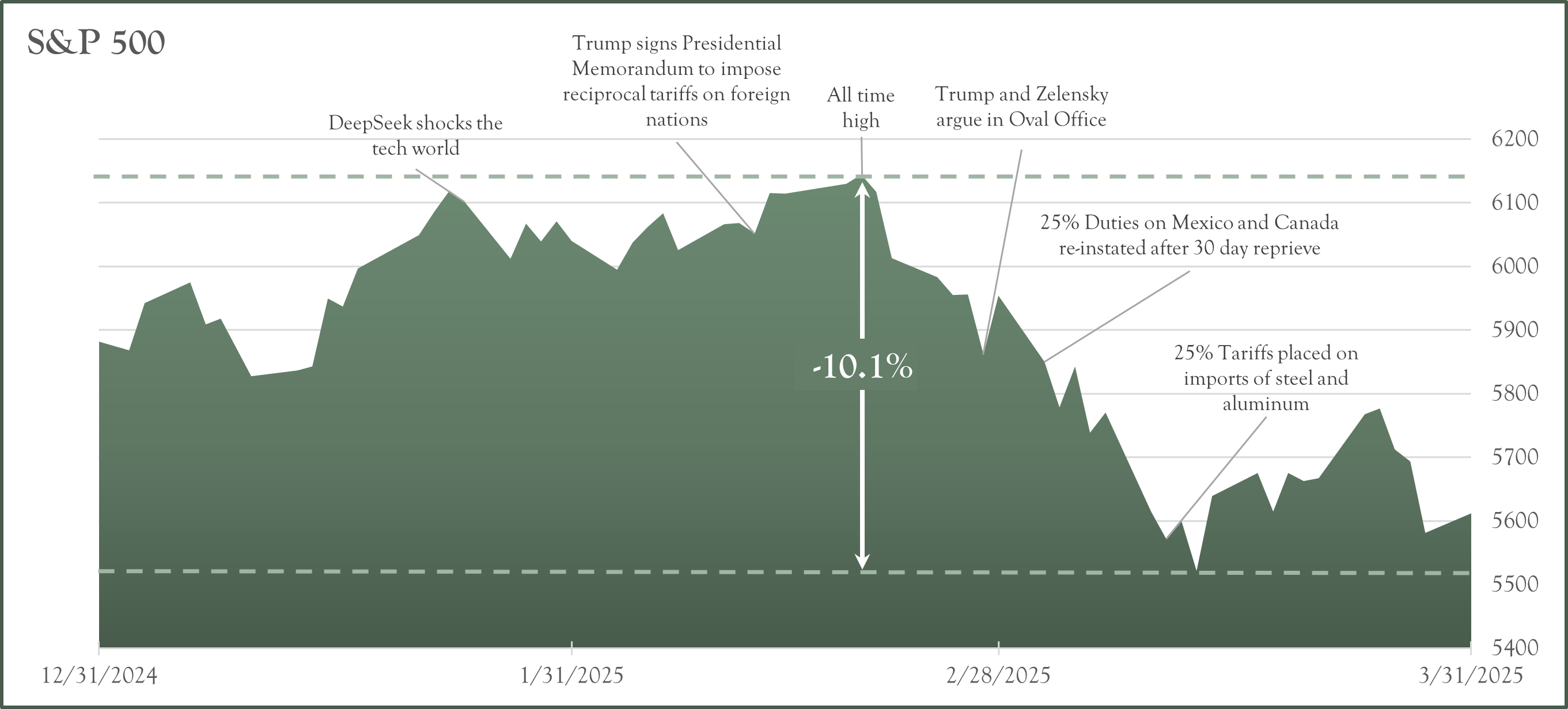

In 2008, the index dropped 37%. In 2023 and 2024, it went on an absolute tear, posting double-digit gains. In early 2026, analysts at firms like Morgan Stanley and Goldman Sachs are still debating whether the AI-driven "supercycle" will keep pushing the index toward the 8,000 mark or if we're due for a correction.

The Eleven Sectors You’re Investing In

When you put money into the S&P market, you aren't just buying "stocks." You’re buying slices of different industries. The S&P splits these into 11 sectors:

- Information Technology: The heavyweight champ (Apple, Nvidia).

- Financials: Banks and insurance (JPMorgan, Visa).

- Health Care: Big pharma and insurance (UnitedHealth, Eli Lilly).

- Consumer Discretionary: Things you want but don't need (Amazon, Tesla).

- Communication Services: Meta, Alphabet, Netflix.

- Industrials: Planes, trains, and machinery (Honeywell, GE).

- Consumer Staples: Things you need (Coke, Walmart, Costco).

- Energy: Oil and gas (ExxonMobil).

- Utilities: Your electric and water bills (NextEra Energy).

- Real Estate: Commercial and residential REITs.

- Materials: Chemicals and mining.

Technology currently dominates, but the "defensive" sectors like Utilities and Consumer Staples are what keep the index from falling apart when the economy gets shaky.

Common Misconceptions (The "Gotchas")

One big mistake? Thinking the S&P 500 is the "whole" market. It's not. It completely ignores small-cap and mid-cap companies. If a small tech startup in Austin is the next big thing, you won't find it in the S&P 500 until it’s already worth billions.

Another one? Thinking "The Dow" is the same thing. The Dow Jones Industrial Average only tracks 30 companies. It's a tiny, old-fashioned snapshot. The S&P 500 is a much better widescreen view of what's actually happening.

How to Get Started

If you're looking to put money into the S&P market, the process is actually pretty boring—which is a good thing.

1. Open a Brokerage Account You need a "wallet" for your stocks. Use a reputable one like Fidelity, Vanguard, or Charles Schwab.

2. Look for the Tickers You don't buy "S&P 500." You buy tickers like VOO (Vanguard), IVV (iShares), or SPY (SPDR). These are the most popular ETFs that track the index.

3. Check the Expense Ratio This is the fee the fund charges. For the S&P 500, this should be incredibly low—often around 0.03%. If you’re paying more than 0.10% for a basic S&P 500 fund, you’re being ripped off.

4. Automate It The pros don't try to "time" the market. They use Dollar-Cost Averaging. They put in $100 or $1,000 every month, regardless of whether the market is up or down.

Actionable Insights for 2026

The S&P market is currently in a weird spot. We've seen record concentration in tech, and valuations (the price of the stocks relative to their earnings) are high by historical standards.

If you are just starting, don't dump your entire life savings in on a Monday morning. Spread it out. Be aware that while the S&P 500 is the "gold standard," it doesn't include international stocks or bonds. A truly balanced portfolio usually needs a little more than just the 500 biggest U.S. companies.

💡 You might also like: Canadian Dollar to US Dollar Historical Rates: What Most People Get Wrong

Focus on the long game. The S&P 500 is designed to survive because it's self-cleansing: it automatically kicks out the losers and adds the winners. Over years and decades, that's a very hard system to beat.