Honestly, if you've ever looked at your 401(k) or scrolled through a finance app, you've seen the S&P 500. It's basically the "pulse" of the American economy. But most people think it's just some magical number that's always been there.

It hasn't.

The history of S&P 500 is actually a wild story of tech breakthroughs, massive ego clashes, and a guy named Henry Varnum Poor who just wanted to help people not get scammed by railroad companies in the 1860s.

How It All Actually Started (Hint: It Wasn't 500 Stocks)

Back in 1923, a company called Standard Statistics—which later merged with Poor’s Publishing—decided to track 233 companies. They weren't doing it daily, though. They were doing it weekly. Can you imagine waiting a week to see how your "index" did? By 1926, they slimmed it down to a 90-stock composite and started calculating it daily.

But the "real" S&P 500 that we know today didn't officially kick off until March 4, 1957.

At that launch lunch in New York, a guy named Lew Schellbach—sorta the "Father of the S&P 500"—showed off a list of 500 companies. It wasn't just random, either. They picked 425 industrials, 15 railroads, and 60 utilities. It was the first time anyone used computers (we’re talking giant, room-sized IBM machines with punch cards) to calculate a market index in real-time.

🔗 Read more: Current NOK to EUR Rate: What Most People Get Wrong About the Krone

The Shifting Balance of Power

The index back then looked nothing like it does now.

In the late 50s and 60s, it was all about "stuff." Steel, oil, and trains. If you looked at the top 10 list in, say, 1990, you'd see names like Exxon Mobil, GE, and Philip Morris.

Fast forward to January 2026, and the landscape is unrecognizable. We’re living in the era of the "Magnificent" tech giants. Today, technology and communications make up over 35% of the index. Just ten companies—mostly AI and software plays like Nvidia and Apple—account for nearly 40% of the entire index's value.

The Moments That Almost Broke the System

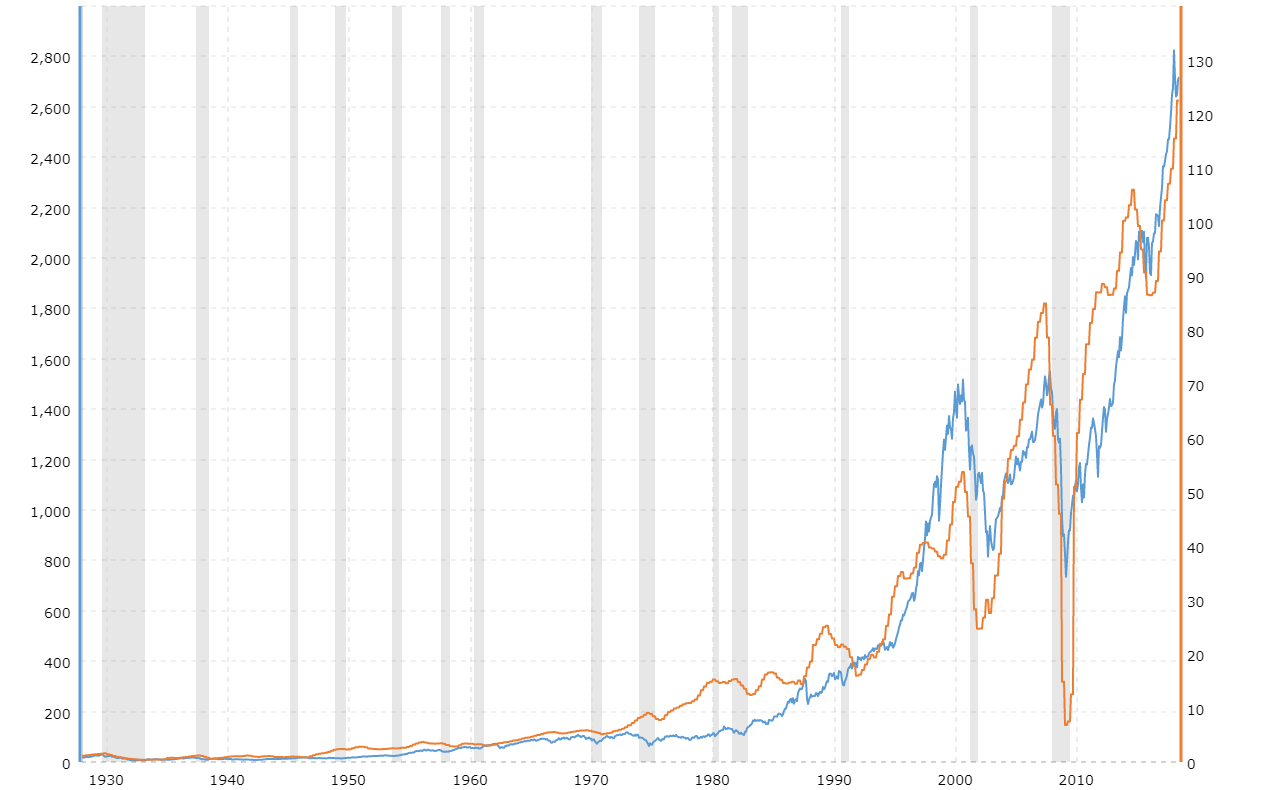

History isn't just a straight line up. It's got some nasty scars.

The biggest single-day drop? Black Monday. October 19, 1987. The S&P 500 plummeted 20.47% in a single trading session. It was pure chaos. People blamed "program trading" (early automated algorithms), but mostly it was just a collective panic that fed on itself.

Then you had the Dot-com bubble. The index hit a peak on March 24, 2000, and then it basically went into a coma for years. It took until 2013—thirteen years later!—for the index to finally, consistently break its old records from the turn of the millennium.

Expert Note: Many investors forget that the S&P 500 can go through "lost decades." Between 2000 and 2010, the total return was actually slightly negative. This is why "time in the market" is a real thing, not just a catchy slogan.

Why 2026 is Feeling a Bit Like 1999

We're currently sitting in a very weird spot in history.

💡 You might also like: How Much Does Donald Trump Make a Year: What Most People Get Wrong

As of mid-January 2026, the S&P 500 is trading at a Shiller CAPE ratio (a fancy way of saying price-to-earnings adjusted for inflation) of around 40. To give you some context, it's only been this high one other time: right before the 2000 crash.

But there’s a counter-argument.

In the 90s, we had the internet. Today, we have AI. Goldman Sachs recently projected a 12% total return for 2026, driven by massive corporate earnings from AI adoption. We've seen three straight years (2023, 2024, and 2025) where the index returned more than 16%. In the 97-year history of the index, that’s only happened five times.

The Rise of the "Passive" Empire

You can't talk about the history of S&P 500 without mentioning John Bogle.

In 1976, he launched the first retail index fund through Vanguard. People literally laughed at him. They called it "Bogle's Folly" because they couldn't understand why anyone would want to settle for "average" returns instead of trying to beat the market.

Boy, were they wrong.

By 2026, trillions of dollars are sitting in S&P 500 index funds. It's become so popular that some experts, like Michael Burry (the "Big Short" guy), have worried about an "index bubble." The logic is that when everyone just buys "the index," the biggest stocks get even bigger regardless of how good they actually are, creating a self-fulfilling loop.

How a Company Actually "Gets In"

It’s not just a list of the 500 biggest companies. That’s a common myth.

A secretive committee at S&P Dow Jones Indices actually picks the winners. To get in, a company generally needs:

- A market cap of at least $15.8 billion (this number shifts).

- Positive earnings over the last four quarters.

- High liquidity (lots of shares trading hands daily).

When a stock like Tesla was finally added in 2020, it caused a massive surge because every index fund on the planet was forced to buy it at the same time.

Actionable Insights for Your Portfolio

So, what does this century of data actually tell us for 2026 and beyond?

Don't panic about the "All-Time Highs."

The S&P 500 hits new record highs all the time. In fact, since 2013, it has closed at a record high on roughly 1 out of every 15 trading days. Reaching a peak isn't a signal to sell; it's usually a sign of a healthy, growing economy.

✨ Don't miss: New Zealand Dollar to PHP Peso: What Most People Get Wrong

Watch the Concentration Risk.

If you own an S&P 500 fund right now, you aren't as diversified as you think. Because it’s "market-cap weighted," you are essentially betting 30-40% of your money on just a handful of tech companies. Consider looking at an Equal Weight S&P 500 ETF (like RSP) if you want to bet on the "other" 490 companies.

The 20-Year Rule is Undefeated.

If you look at any rolling 20-year period in the history of S&P 500, the total return has been positive 100% of the time. Every single time. Even if you bought at the literal peak of the 1929 crash or the 2000 bubble, you were "green" 20 years later.

Next Steps for You:

- Check your weighting: Open your brokerage account and see how much of your total portfolio is tied specifically to the top 10 S&P stocks.

- Review your "Buy" strategy: If you’re worried about high valuations in 2026, use dollar-cost averaging to spread your buys over the next 12 months rather than dropping a lump sum.

- Look at the sectors: The index rebalances quarterly. Keep an eye on the "Reconstitution" news in March, June, September, and December to see which new industries are grabbing a seat at the table.