It’s easy to look at a list of the largest companies in the world and think you’ve got the market figured out. You see the big names. You recognize the logos on your phone. But honestly, the way S&P 500 companies by market cap are currently weighted is creating a version of the stock market we’ve never actually seen before.

We aren't just talking about "big companies" anymore. We're talking about entities so massive they've basically become their own sovereign economic zones.

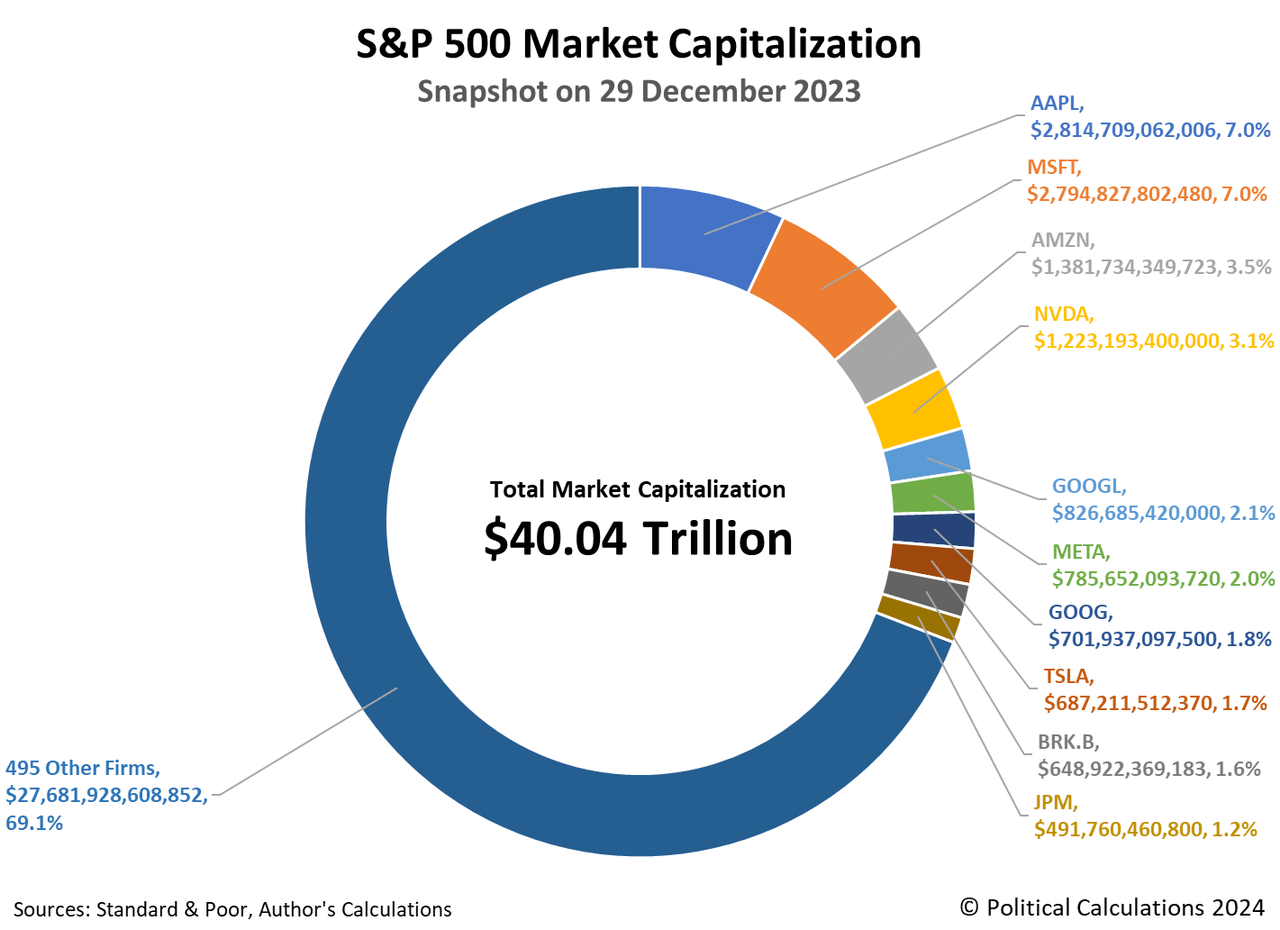

As of mid-January 2026, the S&P 500 has hit a staggering total valuation of roughly $62 trillion. That’s a number so large it feels fake. But what’s even crazier is how much of that weight is carried by just a handful of players. If you’re an index fund investor, you might think you’re diversified across 500 different businesses. You aren't. In reality, your returns are being driven by about ten companies that now make up over 40% of the entire index.

The $4 Trillion Club and the New Hierarchy

For a long time, the $1 trillion mark was the "holy grail." Then it was $2 trillion. Now? We are looking at a leaderboard where $3 trillion is becoming the baseline for the top tier.

Nvidia (NVDA) is currently the undisputed heavyweight champion, sitting at a market cap of approximately $4.5 trillion. Think about that for a second. In late 2025, Nvidia even announced a $100 billion investment into OpenAI. They aren't just selling chips; they are essentially funding the next generation of the tech ecosystem.

Just this week—January 12, 2026, to be exact—Alphabet (GOOGL) officially joined the $4 trillion club. It was a huge move triggered by the news that Apple will be using Google’s Gemini AI to power future Siri models. It’s a weirdly symbiotic relationship. Apple and Google are rivals, sure, but they’re also roommates in the top 1% of the market cap rankings.

The Current Leaderboard (Approximate Figures)

- Nvidia: $4.53 Trillion

- Alphabet: $4.02 Trillion

- Apple: $3.85 Trillion

- Microsoft: $3.55 Trillion

- Amazon: $2.63 Trillion

- Meta Platforms: $1.62 Trillion

- Broadcom: $1.66 Trillion

You’ll notice some shuffling here. Apple and Microsoft, which used to take turns at #1, have actually slipped back a bit while Alphabet and Nvidia soared. This isn't just "tech" growing; it's a very specific flavor of AI infrastructure that is winning.

Why Broadcom Is the One You Should Be Watching

Most people get the Big Five. Everyone understands why Amazon is huge. But Broadcom (AVGO) has quietly become the sixth-largest component of the S&P 500, recently solidifying its spot with a market cap around $1.66 trillion.

Broadcom is a bit of a chameleon. It’s not a consumer brand you see at the mall, but it is the literal backbone of the data centers that make AI possible. On January 9, 2026, its shares jumped nearly 4%, pushing the S&P 500 toward the historic 7,000-point threshold. When Broadcom moves, the index feels it.

Honestly, the "Magnificent Seven" label is starting to feel a little outdated. Some analysts are already talking about a "Fab Four" or a "Great Eight" because the performance gap between a company like Nvidia (up 40% in 2025) and Amazon (up only 6% in 2025) is becoming a canyon.

The Risk Nobody Likes to Talk About

Concentration. That’s the word that keeps fund managers awake at night.

When you look at S&P 500 companies by market cap, the top 10 now account for a larger share of the index than at any point in modern history—surpassing even the peak of the dot-com bubble. Goldman Sachs recently noted that these top tech stocks accounted for 53% of the S&P 500’s total return in 2025.

If Nvidia has a bad day, the entire "market" looks like it's crashing, even if the local bank, the grocery chain, and the utility company in the bottom 400 are doing just fine. It’s a distorted reality. We call it "The S&P 500," but it often acts like "The Tech 10 and those other guys."

Jurrien Timmer at Fidelity pointed out recently that the bull market is "narrower than it looks." This means the average stock isn't actually doing as well as the index suggests. If you own an equal-weighted S&P 500 fund, your 2025 was likely much quieter than if you held the standard market-cap-weighted version.

🔗 Read more: Exactly How Much is 78 Million Won Right Now?

Is the AI Hype Actually Real This Time?

In 2024 and 2025, people kept waiting for the "AI bubble" to pop. It hasn't.

Instead of just hype, we’re seeing actual earnings. TSMC (the world’s largest chipmaker) just reported quarterly profits that blew past expectations, and they’re planning to spend up to $56 billion this year just to keep up with AI demand. This isn't Pets.com in 1999. These companies are generating billions in free cash flow.

However, there’s a nuance here. The market is shifting from "AI excitement" to "AI adoption." Investors are no longer just buying anything with ".ai" in the name. They are looking at the companies that are actually becoming more efficient.

Non-Tech Giants Still Holding the Line

It’s not all code and silicon. Berkshire Hathaway (BRK.B) is still a beast, sitting at a $1.08 trillion market cap. It remains the primary refuge for people who want exposure to the "real" economy—railroads, insurance, and energy.

Eli Lilly (LLY) is another fascinating case. It’s knocking on the door of the trillion-dollar club (currently around $971 billion) largely thanks to the continued explosion of the GLP-1 (weight loss) drug market. It’s one of the few non-tech companies that has managed to keep pace with the growth rates of the software giants.

Then you have Walmart (WMT) at roughly $940 billion. Even in a high-tech world, people still need to buy milk and toilet paper. Walmart’s recent push into its own ad network and high-margin delivery services has kept its market cap climbing, proving that old-school retail can still evolve.

Actionable Insights for Investors

If you're tracking S&P 500 companies by market cap to guide your portfolio, here are a few things to actually do with that information:

- Check your overlap. If you own an S&P 500 index fund AND a "Growth" ETF AND a "Tech" ETF, you are likely 50% or 60% invested in just five companies. You might be more concentrated than you realize.

- Watch the "equal-weight" index (RSP). Comparing the standard S&P 500 to the equal-weight version tells you if the rally is healthy. If the standard index is up but the equal-weight is flat, the "Big Guys" are carrying the whole team.

- Look at the $500B to $800B range. This is where the next trillion-dollar companies are hiding. Names like Visa (V), JPMorgan (JPM), and Oracle (ORCL) are currently in this "middle-weight" tier of the top 20 and often provide a bit more stability when tech gets volatile.

- Rebalance for 2026. With the S&P 500 at record highs near 7,000, some advisors are suggesting "trimming the winners." Taking a little profit from a high-flyer like Nvidia to put into undervalued sectors like mid-caps or international stocks is a classic move to manage the concentration risk we talked about.

The market cap list is a living breathing thing. It tells the story of what humanity values right now. Today, it’s AI and healthcare. Tomorrow? Who knows. But for now, the heavyweights are only getting heavier.