You’ve probably seen it. That jagged green line on the S&P 500 chart last 10 years that seems to only want to go up, despite the world feeling like it's falling apart every other Tuesday. It’s a bit of a mind-bender. If you had just closed your eyes in 2016 and opened them today, you'd think we lived through a golden age of peace and prosperity.

But we didn't. We lived through a global pandemic, the highest inflation in forty years, a handful of wars, and the weirdest labor market in modern history. Yet, the index is up significantly. Roughly speaking, the S&P 500 has delivered an annualized return of somewhere around 12% to 13% over this decade, assuming you reinvested your dividends. That's way above the historical average of 10%.

Honestly, looking at the S&P 500 chart last 10 years is like looking at a heart rate monitor of a marathon runner who just discovered caffeine. There are massive spikes, scary drops, and long periods of "is this thing even moving?"

The 2016 to 2019 "Easy" Era

Back in 2016, the world was obsessed with "lower for longer" interest rates. Janet Yellen was the Fed Chair, and the S&P 500 was hovering around the 2,000 mark. It feels like ancient history. People were worried about a "secular stagnation," a fancy term economists used because they couldn't figure out why growth was so slow.

Then came the 2017 Tax Cuts and Jobs Act. It was a massive shot of adrenaline. Corporate earnings soared because companies were suddenly keeping way more of their profits. The S&P 500 loved it. We saw the index climb steadily, even as trade wars with China started making headlines.

Remember 2018? It was a weird one. The market actually ended the year down. It was the first "red" year in a long time, mostly because the Fed tried to raise rates and the market threw a literal tantrum. It’s a pattern we’ve seen repeat: the market hates it when the "free money" tap starts to close.

The COVID-19 V-Shape and the Tech Explosion

Then 2020 happened.

If you look at the S&P 500 chart last 10 years, the 2020 dip looks like a sharp needle. It was the fastest 30% drop in history. Total panic. People were hoarding toilet paper, and investors were dumping stocks like they were radioactive.

But then, something bizarre happened. The recovery was just as fast.

📖 Related: Olin Corporation Stock Price: What Most People Get Wrong

The government pumped trillions into the economy. The Fed dropped rates to zero. Suddenly, everyone was stuck at home with nothing to do but buy Peloton bikes, upgrade their Zoom accounts, and trade options on Robinhood. This created a massive divergence. While the "real" economy was struggling, tech stocks—the heavy hitters in the S&P 500 like Apple, Microsoft, and Amazon—went absolutely nuclear.

By the end of 2020, the index wasn't just recovered; it was hitting new highs. It felt fake to a lot of people. How could the market be thriving while businesses were closed?

The answer is "weighting." The S&P 500 is market-cap weighted. This means the biggest companies have the biggest impact. When the "Magnificent Seven" (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) are winning, the whole chart looks great, even if the other 493 companies are just treadmilling.

The 2022 Reality Check

Gravity eventually caught up. 2022 was the year the party ended, or at least took a very depressing break.

Inflation wasn't "transitory," despite what Jerome Powell initially hoped. The Fed started hiking rates at the most aggressive pace since the Volcker era of the 80s. When interest rates go up, the value of future profits—especially for high-growth tech companies—goes down.

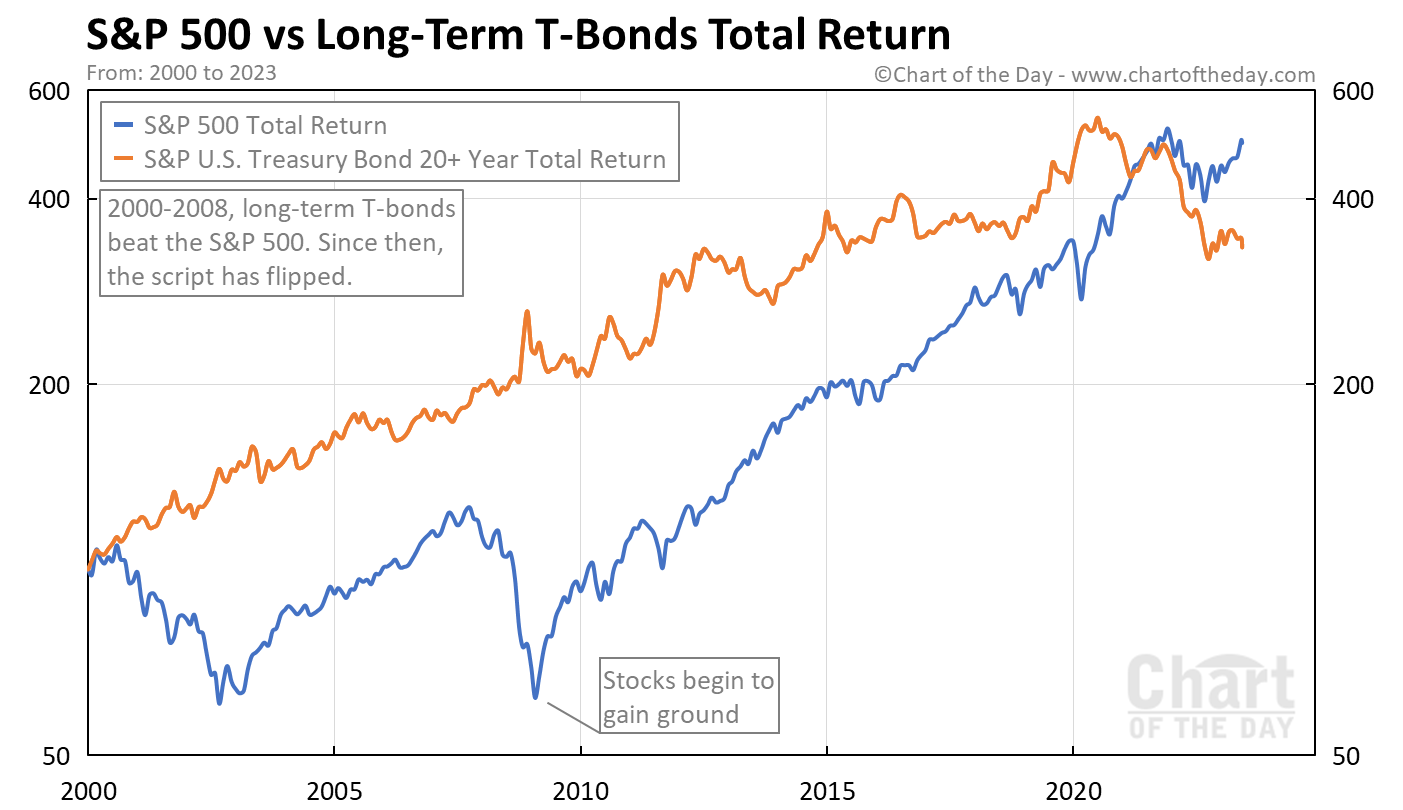

The S&P 500 dropped about 19% that year. Bond markets, usually the "safe" place to hide, got crushed too. It was a miserable time to be an investor. But if you look at the long-term chart, 2022 looks like a necessary correction after the "everything bubble" of 2021. It cleared out the excess.

The AI Revolution and the 2024-2025 Surge

Just when everyone thought we were heading for a long recession, ChatGPT arrived.

The 2023 and 2024 portion of the S&P 500 chart last 10 years is dominated by one word: AI. Nvidia's rise from a niche chipmaker to one of the most valuable companies on the planet is basically responsible for a huge chunk of the index's recent gains.

👉 See also: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

We moved from a "stay-at-home" trade to an "AI-infrastructure" trade. Companies started spending billions on data centers. The market shifted its focus from "how do we survive high rates?" to "who is going to win the AI arms race?"

Why the Chart Can Be Misleading

It's easy to look at a 10-year chart and think, "I should have just bought more in 2020."

Hindsight is a liar.

The chart hides the psychological toll. It doesn't show the nights you couldn't sleep because your 401k lost $50,000 in three weeks. It doesn't show the thousands of "experts" on CNBC predicting a total collapse every six months.

One of the biggest misconceptions is that the S&P 500 is "the economy." It isn't. It's a collection of the 500 largest publicly traded U.S. companies. Many of these companies get 40% or more of their revenue from outside the United States. When you buy the S&P 500, you aren't just betting on America; you're betting on global corporate efficiency.

Another thing: the index changes. In the last 10 years, companies like GE—once the titan of the index—have shrunk or been removed, while new players have cycled in. The index is self-cleansing. It cuts the losers and adds the winners. That's its "secret sauce."

Breaking Down the Returns

Let's talk real numbers.

If you invested $10,000 in an S&P 500 index fund in early 2016, you’d likely have over $35,000 today, depending on the exact dates and fees.

✨ Don't miss: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

- Dividend Yield: Usually hovers around 1.3% to 2%. It sounds small, but over 10 years, it accounts for a massive portion of total wealth creation through compounding.

- P/E Ratios: We are currently trading at a "forward P/E" that is higher than the historical average. This means the market is "expensive." Investors are paying a premium for future growth, mostly because they believe AI will make companies much more productive.

- Concentration Risk: Today, the top 10 companies in the S&P 500 make up about 30% of the entire index's value. That’s the highest concentration in decades. If Apple or Microsoft has a bad year, the whole chart suffers, regardless of how the local grocery chain is doing.

What Happens Next?

History doesn't repeat, but it rhymes.

Most analysts, including folks at Vanguard and Goldman Sachs, are actually tempering expectations for the next 10 years. Why? Because the starting point matters. When you start from a point of high valuations (like right now), the math for 12% annual returns becomes much harder to justify.

We are also facing structural shifts. The era of "globalization" is being replaced by "near-shoring." Demographics are shifting as Baby Boomers retire and start selling their stocks to fund their lives.

However, betting against the S&P 500 has been a losing game for a century. The chart shows resilience. It shows that even in the face of a global shutdown, the largest corporations in the world find a way to pivot, cut costs, and find new revenue streams.

Actionable Steps for Your Portfolio

If you're looking at the S&P 500 chart last 10 years and trying to decide what to do with your own money, stop trying to time the "perfect" entry. You'll miss it.

Check your concentration. If you own an S&P 500 fund and also own a lot of individual tech stocks like Nvidia or Apple, you are doubled up. If tech hits a wall, your portfolio will feel like it's falling off a cliff.

Automate the boring stuff. The winners of the last decade weren't the ones who traded the swings; they were the ones who had an automatic deposit set up every payday. Dollar-cost averaging (DCA) is the only way to turn those scary dips in 2020 and 2022 into "buying opportunities" without having to be a genius.

Look at the Equal-Weight S&P 500. If the concentration of the top 10 companies scares you, look into the RSP (Invesco S&P 500 Equal Weight ETF). It gives every company in the index a 0.2% stake. It underperforms when tech is booming, but it’s a much safer way to play the "broad" economy.

Rebalance your winners. If your stock portion has grown from 60% of your portfolio to 80% because of this 10-year run, it might be time to sell some and move it to cash or bonds. It’s called "selling high." It feels wrong when the chart is going up, but it's how you actually lock in wealth.

The last 10 years taught us that the market can stay "irrational" longer than you can stay solvent. But it also proved that corporate America is incredibly good at making money, even when the world is chaotic. Keep your eyes on the long-term trend, not the weekly noise.