Look, let's be real about college costs. You see a number on a brochure, maybe something like $14,000, and you think, "Okay, I can swing that." Then the bill hits. Suddenly there are "general student fees," "textbook rentals," and something called a "student-to-student grant fee." It's confusing. Honestly, southern illinois university tuition is actually one of the more transparent systems in the Midwest, but you still have to know where to look to avoid a heart attack when the first statement arrives in Carbondale or Edwardsville.

Most people don't realize that Southern Illinois University (SIU) is actually two different vibes entirely. You’ve got the Carbondale campus (SIUC)—home of the Salukis and big-time research—and the Edwardsville campus (SIUE), which sits right outside St. Louis. They don't just have different mascots; their billing structures are separate beasts.

The Carbondale Breakdown: What You’re Actually Paying

If you’re heading to Carbondale for the 2025-2026 or 2026-2027 school year, the base undergraduate tuition rate is hovering around $321.25 per credit hour. For most students taking a full 15-hour load, that’s about $4,818.75 per semester just for the classes.

But wait.

If you are a business major, they tack on a "differential" rate. You’re looking at $369.50 per hour instead. Why? Because the College of Business & Analytics has extra resources, labs, and career services that the history majors aren't using. It feels a bit like a surcharge for your future high salary, basically.

The Truth in Tuition Guarantee

Here is the coolest thing SIU does: the "Truth in Tuition" act. If you start as a freshman in 2026, your tuition rate is locked. It won’t go up for four continuous academic years. If the board decides to hike prices for the next year's freshmen, you don’t pay a dime more. It’s stabilization you can actually plan around.

Mandatory Fees: The "Hidden" Costs

Tuition is just the price of the seat in the room. The fees are what keep the lights on and the gym open. At SIU Carbondale, you’ve got:

👉 See also: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

- General Student Fee: About $130 per credit hour (on-campus).

- Textbook Fee: Roughly $26 per credit hour.

- Student Insurance: Over $1,100 per term (unless you prove you already have coverage).

If you’re taking 15 hours, those "extra" fees can easily add another $2,300+ to your semester bill. That’s before you even buy a single Saluki sweatshirt.

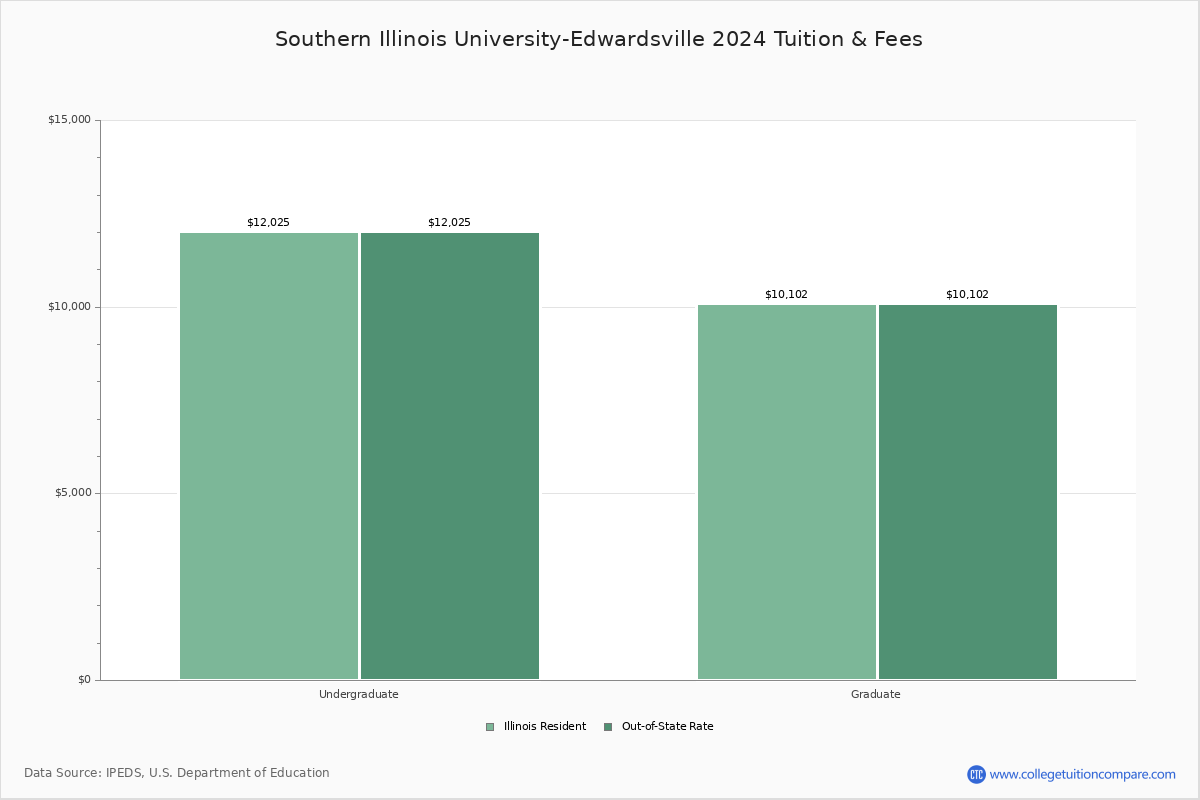

Is SIUE Cheaper? The Edwardsville Comparison

Edwardsville (SIUE) usually markets itself as the more affordable sibling. For the 2025-2026 academic year, their base tuition is approximately $9,855 for the full year (30 credit hours).

When you add in their mandatory fees of about $3,444, the "sticker price" for an in-state student living at home is roughly $13,299.

One big perk at SIUE? Their textbook rental program is legendary. Instead of dropping $800 at a bookstore, you basically "rent" your primary books through your fees. It saves a ton of stress, honestly. Just don't forget to return them at the end of finals week or they will charge you the full retail price, which hurts.

The Legacy Rate and Out-of-State "Lies"

You might have heard that out-of-state students get crushed. At SIU, that’s mostly a myth.

First off, SIU Carbondale offers an "alternative tuition rate" for students from neighboring states (like Missouri, Kentucky, Indiana, etc.) that matches the in-state rate. Even better? If your mom or dad graduated from SIU, you qualify for the Legacy Tuition Rate.

✨ Don't miss: 121 GBP to USD: Why Your Bank Is Probably Ripping You Off

You pay 80% of the regular tuition.

Think about that. A 20% discount just because your parents spent four years at the same school. It’s one of the most aggressive legacy discounts in the country. You just have to make sure you apply for it within the first 30 days of your first semester. If you miss that window, you're out of luck.

Graduate School Costs

If you’re sticking around for a Master's, the math changes. Graduate tuition at Carbondale is roughly $469.50 per credit hour.

Specialized programs are the real outliers:

- Law School: Roughly $547 per hour.

- Physician Assistant (MSPA): A whopping $971 per hour.

- Medical Science (DMSc): Around $645.50 per hour.

Living Costs: Dorms vs. Off-Campus

Carbondale is cheap to live in. Like, surprisingly cheap. You can find a decent apartment off-campus for $500-$700 a month if you have a roommate.

However, if you live in the dorms (which many freshmen are required to do), expect to pay between $10,000 and $11,000 a year for a room and a meal plan. SIUC offers a few different tiers, but the "Saluki Anytime" meal plan is the standard. It’s convenient, but you're definitely paying for that convenience.

Financial Aid: Closing the Gap

Hardly anyone pays the full sticker price for southern illinois university tuition.

Around 97% of SIU Carbondale students receive some form of financial aid.

🔗 Read more: Yangshan Deep Water Port: The Engineering Gamble That Keeps Global Shipping From Collapsing

The "Saluki Commitment" is the big one. If your family makes less than $103,000 a year (and you meet some basic GPA requirements), SIU promises to cover the gap between your aid and your tuition/fees. Basically, it makes tuition $0 for those who qualify. It’s a massive safety net that most people don't realize is as high as it is—$103k is a pretty generous ceiling for "need-based" help.

Common Misconceptions

- "Online is cheaper." Sorta. You save on the "General Student Fee" (paying $80/hr instead of $130), and obviously, you don't pay for a dorm. But the base tuition is usually the same.

- "Fees are optional." Nope. Unless it’s the health insurance fee (and you have a waiver), those fees are mandatory.

- "I'll just buy my books." Don't. The rental programs at both campuses are baked into the cost structure. You're paying for it anyway, so use the service.

Actionable Steps to Lower Your Bill

If you're looking at the numbers and feeling a bit of vertigo, here's how you actually bring that number down before you sign anything.

Step 1: The Insurance Waiver. If you are still on your parents' health insurance, you must file the waiver by the deadline (usually late September for Fall). This saves you over $2,000 a year immediately.

Step 2: Check the Legacy Status. Ask your parents if they graduated from Carbondale. Even if they only attended for a bit, check if they finished. That 20% "Legacy Rate" is the easiest money you'll ever save.

Step 3: FAFSA Early. SIU distributes aid on a rolling basis. The sooner you get your FAFSA in, the better your chances at the "Saluki Commitment" or "Aim High" grants.

Step 4: Resident Assistant (RA) Positions. After your first year, try to become an RA. It usually covers your housing and a portion of your meal plan. In a place where room and board is $11,000, that’s basically a $44,000 scholarship over three years.

The "sticker price" of southern illinois university tuition is rarely what you actually pay, but you have to be proactive. Between the tuition guarantee, the legacy discounts, and the regional rate matches, the math usually works out better than most other state schools—as long as you stay on top of the paperwork.

Check your specific major's "differential" rate on the official SIU tuition calculator before you make your final budget. Some programs in Engineering or Nursing have small surcharges that can add up over 120 credit hours. Be sure to verify your residency status as well; even if you’ve lived in Illinois for years, certain paperwork errors can default you to a higher rate until corrected. Regardless of which campus you choose, the four-year lock is your best friend for avoiding "senior year surprises" when tuition usually spikes at other institutions.