Finding a plan that doesn't eat your entire paycheck is a struggle. Honestly, most people I talk to in the Palmetto State think the south carolina health insurance marketplace is just a website for expensive plans they can’t afford.

That's a mistake.

If you're living in Charleston, Greenville, or out in the more rural parts of the Lowcountry, the 2026 landscape has changed significantly. We aren't in the 2020s anymore. Rules shift. Carriers move. Prices oscillate.

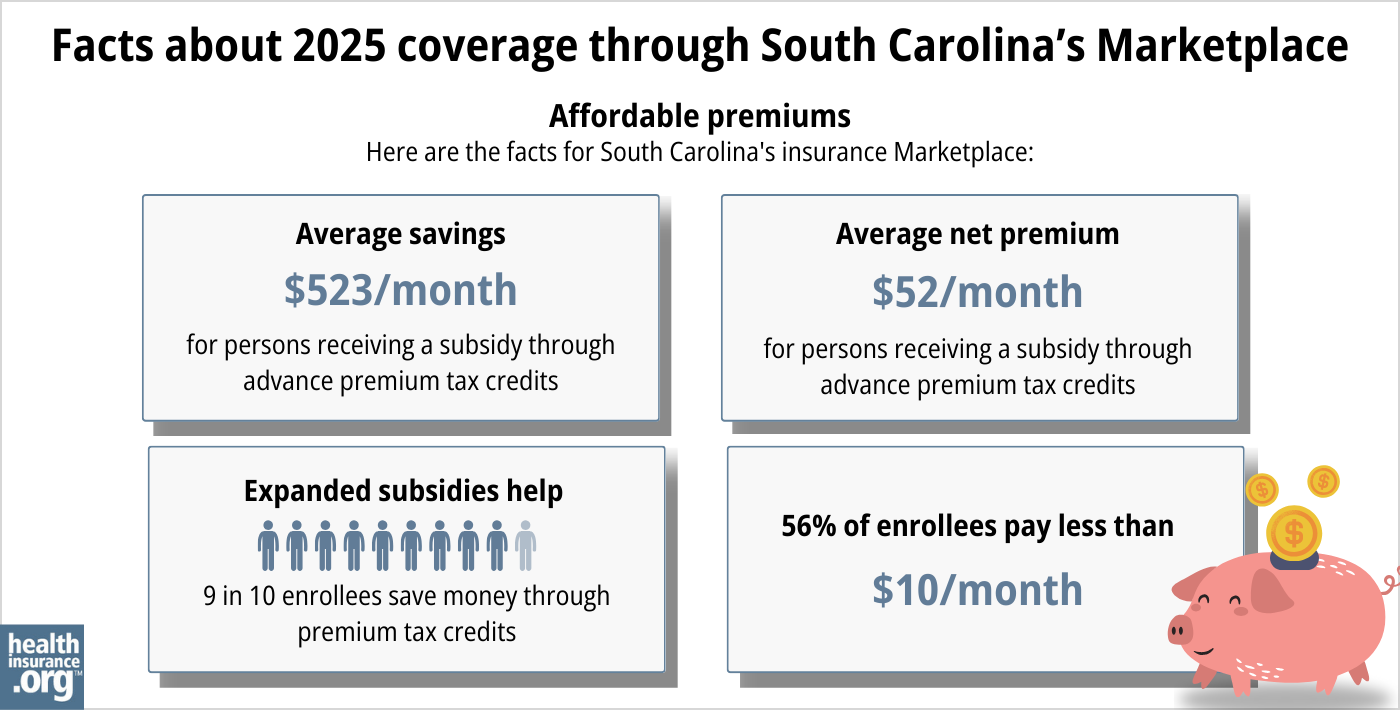

You’ve probably heard that subsidies were "temporary" or that they’d vanish by now. The reality is more nuanced. While the average monthly premium after tax credits is projected to be around $50 for the lowest-cost plans in 2026, that's actually a $13 jump from last year. It’s still cheaper than the pre-2020 era, but it’s a nudge you’ll feel in your wallet.

The 2026 Shift: Who is Actually Writing Plans?

South Carolina doesn't have its own state-run exchange. We use the federal one. You go to HealthCare.gov. But the companies on that site? They aren't federal. They are private entities that decide which counties they want to serve.

For 2026, the big players are still around, but the map is spotty.

- BlueCross BlueShield of South Carolina remains the heavy hitter. They are statewide. All 46 counties. If you live in a tiny town and only see one or two options, BCBSSC is likely one of them.

- Absolute Total Care (Ambetter) is also throwing its weight around statewide this year.

- Molina Healthcare covers a huge chunk—37 counties—but skips some of the northern and western spots.

- Select Health of South Carolina is focused on 20 counties, mostly the high-population hubs like Richland, Greenville, and Charleston.

- UnitedHealthcare is surprisingly selective, hitting only 17 counties, including places like Lancaster and Union.

There is a new kid on the block too: InStil Health. They’re testing the waters in five counties (Chesterfield, Darlington, Florence, Spartanburg, and York). If you’re in Spartanburg and see a brand you don’t recognize, that’s probably why.

💡 You might also like: Mayo Clinic: What Most People Get Wrong About the Best Hospital in the World

Understanding the Money: Subsidies and the 400% Cliff

Basically, how much you pay depends on where you fall on the Federal Poverty Level (FPL) scale.

For 2026, the "subsidy cliff" is a real thing again. During the last few years, even wealthy households got some help. Now? Under current law, if your household income is over 400% of the FPL, you’re likely paying full price.

For a single person, 100% of the FPL is $15,650. If you make less than that, you usually fall into the "Medicaid Gap" because South Carolina hasn't expanded Medicaid like most other states. It’s a harsh reality. If you make $15,650 to $62,600 as an individual, you're in the sweet spot for those tax credits that bring the premium down.

Important Note: If you’re a family of four, that upper limit for help is roughly $128,600. Cross that line by even one dollar, and your premium could double.

The "Silver" Secret Nobody Mentions

Everyone looks at Bronze plans because the monthly price looks like a steal. $0 premiums? Sounds great. Until you break an arm.

Bronze plans in the south carolina health insurance marketplace have massive deductibles. You might have to pay $9,000 out of your own pocket before the insurance kicks in a cent.

📖 Related: Jackson General Hospital of Jackson TN: The Truth About Navigating West Tennessee’s Medical Hub

If you make between 100% and 250% of the FPL, you should almost always look at Silver plans. Why? Cost-Sharing Reductions (CSRs). These are "hidden" subsidies that only apply to Silver plans. They lower your deductible and your out-of-pocket maximum.

I’ve seen Silver plans where the deductible drops from $5,000 to $500 just because the person’s income qualified them for a CSR. You won't see that on a Gold or Bronze plan. It’s a Silver-only perk.

HSA Access Just Got a Major Boost

One of the weirdest updates for 2026 involves Health Savings Accounts (HSAs).

Previously, finding an HSA-eligible plan on the marketplace was like hunting for a needle in a haystack. For 2026, all Bronze and Catastrophic plans on the marketplace are now HSA-eligible. This is huge if you’re healthy and want to stash pre-tax money away for future medical bills.

It makes the "Catastrophic" plans—usually reserved for people under 30 or those with hardship exemptions—actually useful for long-term financial planning.

Dates You Can't Afford to Miss

Open Enrollment isn't a year-round thing. It’s a window.

👉 See also: Images of the Mitochondria: Why Most Diagrams are Kinda Wrong

- November 1, 2025: The gates opened.

- December 15, 2025: The deadline for coverage starting New Year's Day.

- January 15, 2026: The final deadline. Miss this, and you’re locked out unless you get married, lose a job, or have a baby.

If you're reading this after January 15, you're looking at "Short Term" plans. Be careful there. They often don't cover pre-existing conditions and can drop you if you get sick. They aren't "real" marketplace plans.

Practical Steps to Take Now

Don't just hit "renew" on your current plan. Companies change their "Formulary" (the list of covered drugs) every single year. Your insulin might be $10 on your 2025 plan and $100 on the 2026 version of the exact same plan.

Check the network. South Carolina is notorious for "narrow networks." Just because a plan is through BlueCross doesn't mean your specific doctor at Prisma Health or MUSC is in that specific network.

What you should do next:

- Verify your income: Use your 2025 tax return as a base, but estimate your 2026 income as accurately as possible to avoid owing money back to the IRS next year.

- Check the "Extra" benefits: Ambetter and UnitedHealthcare are offering rewards programs (up to $500 in some cases) for things like getting a flu shot or completing a wellness survey. It's basically free money toward your deductible.

- Confirm your county: If you moved from Lexington to Richland, your plan options literally change. Update your address on HealthCare.gov immediately to see the correct 2026 rates.

The south carolina health insurance marketplace is a tool. It's not perfect, and the "Medicaid Gap" remains a massive hurdle for our lowest-income neighbors, but for those who qualify for subsidies, it's often the only way to stay covered without going broke.