So, you've probably seen Solaris Energy Infrastructure popping up on your screener lately. It's been hitting all-time highs—touching $57.19 just this week in mid-January 2026—and everyone is suddenly acting like they saw it coming. Honestly? Most didn't.

For a long time, people looked at this company (formerly known as Solaris Oilfield Infrastructure) and just saw another fracking sand provider. Boring. Cyclical. Risky. But if you're looking at solaris energy infrastructure stock today, you aren't looking at a "sand company" anymore. You’re looking at what is essentially a power-as-a-service play for the AI revolution.

It’s a wild pivot. And the market is finally starting to price it in.

The AI Power Play Nobody Saw Coming

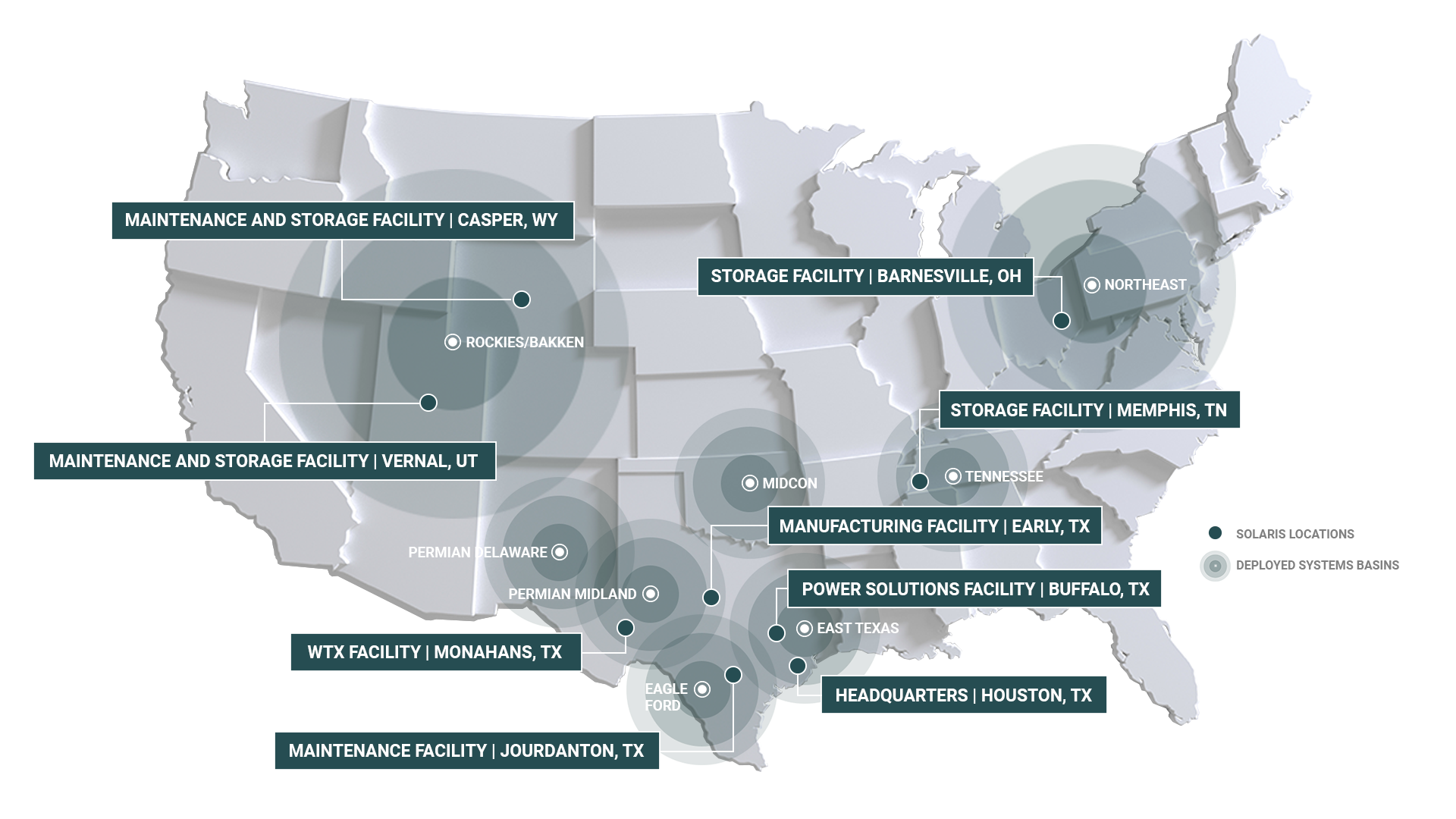

The biggest misconception about SEI is that its fate is tied solely to oil prices. While their "Logistics Solutions" segment still handles a lot of proppant for the Permian Basin, that’s not what’s driving the 80%+ stock surge we’ve seen over the last year.

Basically, big tech companies—the hyperscalers—are in a panic. They need massive amounts of electricity for data centers, and the traditional power grid is, well, slow. You can’t just plug a new AI supercluster into a local utility and expect it to work tomorrow. It takes years.

📖 Related: Joe Shoen U-Haul: Why the King of Moving is Still Making Headlines

Solaris stepped into that gap. They provide "behind-the-meter" power. They’ve already deployed systems at an AI supercluster providing over 450 MW at a single site, with plans to scale to 1.1 GW. That is a massive amount of juice. We're talking utility-scale power delivered in weeks, not years.

The Numbers Are Kind of Aggressive

Let’s talk turkey. If you look at the Q3 2025 earnings reported back in November, the revenue hit $167 million. That was an 18% beat over what analysts were expecting. More importantly, the Power Solutions segment saw revenue jump 39% in just one quarter.

But here is where it gets tricky for investors.

The valuation is... high. Like, "make you sweat" high. The P/E ratio is currently sitting around 60x to 86x depending on which day you check the ticker. For a company in the energy services sector—where 20x is usually considered pricey—that looks like a bubble.

However, bulls argue the P/E doesn't matter because of the growth rate. The company’s PEG ratio is actually around 0.7. In the investing world, a PEG under 1.0 often suggests a stock might actually be undervalued relative to how fast its earnings are growing. Morgan Stanley recently initiated coverage with an "Overweight" rating and a $68 price target. They basically said the market is discounting how much "visible" power generation SEI has contracted out through 2028.

The HVMVLV Acquisition and "Stickiness"

In August 2025, Solaris bought a company called HVMVLV. Most retail investors ignored it, but it was a big deal. HVMVLV does high-voltage distribution and engineering.

By bringing this in-house, Solaris isn't just renting out turbines anymore. They are designing the whole electrical "balance of plant." This makes them much harder to fire. Once a data center or a remote industrial site integrates Solaris’s switchgear and transformers into their infrastructure, switching to a competitor becomes a massive, expensive headache.

It’s a classic "moat" move.

Is the Dividend Worth It?

If you're an income seeker, solaris energy infrastructure stock might feel a bit disappointing right now. They just approved their 29th consecutive quarterly dividend of $0.12 per share.

With the stock price soaring, the yield has shriveled up to about 0.9%.

- The Payout: $0.48 annually.

- The Coverage: It's well-covered by earnings (around a 50% payout ratio).

- The Strategy: Management is clearly prioritizing growth and debt repayment. They recently issued $748 million in convertible notes to pay off an old $325 million term loan. They are cleaning up the balance sheet so they can build more turbines.

What Could Go Wrong? (The "Bear Case")

It’s not all sunshine and rainbows. There are three big risks you should probably worry about.

First, the "Logistics Solutions" side—the old sand business—is actually shrinking. In Q3 2025, that segment's revenue dropped 16%. If oil prices tank and the Permian goes quiet, the legacy side of the business will be a drag on the flashy new power side.

Second, the "Concentration Risk." Solaris is heavily dependent on a few massive contracts. If one of these "AI superclusters" cancels or finds a cheaper way to get grid power, that’s a huge hole in the balance sheet.

Third, the technicals. Some analysts, like the folks at StockInvest, have pointed out that the stock is currently in a "sell" zone for short-term traders because it's been so overbought. It's volatile. It moves 5% or 6% in a single afternoon. If you have a weak stomach, this isn't the ticker for you.

Actionable Insights for Investors

If you're thinking about jumping into solaris energy infrastructure stock, don't just FOMO in at the all-time high.

- Watch the $50 level: There is a lot of "accumulated volume" support around $50.71. If the stock pulls back to that area, it might be a more sensible entry point than chasing it at $57.

- Look at the 1.7 GW milestone: Management is targeting a pro-forma fleet of 1.7 GW. Keep an eye on their quarterly updates to see if they are actually hitting those deployment numbers.

- Check the Bond Market: Those 0.25% convertible notes they issued are a vote of confidence. It means institutional investors were willing to lend them nearly a billion dollars for almost no interest because they want the option to turn that debt into stock later.

The bottom line? Solaris is successfully rebranding itself from an oilfield middleman to an AI infrastructure backbone. It’s a high-stakes transition, and while the "easy money" has probably been made, the long-term story for off-grid power is just getting started.

Your Next Steps:

Check your portfolio's exposure to "energy services" versus "infrastructure." If you are already heavy on big tech, adding SEI might actually give you more exposure to the same AI tailwinds but through a different sector. Review the upcoming Q4 2025 earnings call (expected in February 2026) specifically for updates on the "Power Solutions" backlog, as this is now the primary driver of the stock's valuation.