You’re sitting in a bank office or maybe a mortgage lender's cubicle, and they ask for "the papers." Specifically, they want proof of your income. If you're retired or receiving disability, that means a social security print out. It sounds simple. It should be simple. Yet, every year, thousands of people trudge down to a local Social Security Administration (SSA) office, take a paper number from a plastic kiosk, and sit in a plastic chair for three hours just to get one piece of paper.

Honestly, it’s a waste of your afternoon.

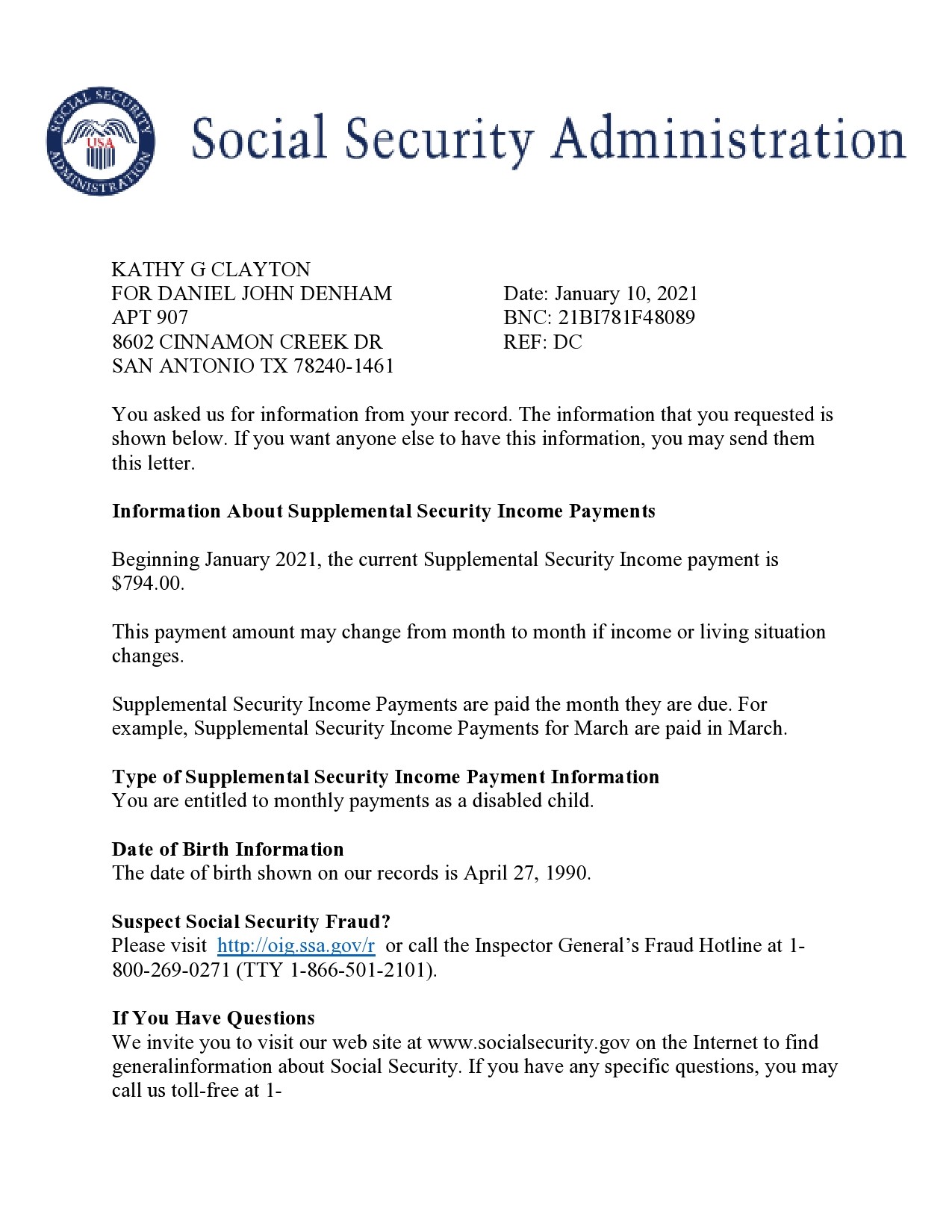

Most people call it a "print out," but the SSA officially calls it a Budget Letter or a Benefit Verification Letter. Whatever name you use, this document is the gold standard for proving you actually have money coming in every month. It shows your gross benefit amount, the date your payments started, and any deductions for Medicare. If you’re trying to rent an apartment, apply for a loan, or get state assistance like SNAP, you need this.

👉 See also: Japan Business News Today: Why the Takaichi Trade Has Everyone on Edge

Why the Social Security Print Out is the Only Document That Matters

Lenders are picky. They don't want to see your bank statements because those only show the net amount deposited. They want to see the "gross" amount—the money before Medicare Part B premiums or tax withholdings are taken out. That’s why a photocopy of your check or a screenshot of your banking app usually won't cut it.

The SSA is a massive bureaucracy. It manages the retirement, survivors, and disability insurance programs that are the literal bedrock of American financial security. Because the federal government generates this letter, it’s considered "verified at the source." It's basically unassailable proof.

I’ve seen people try to use their annual COLA (Cost of Living Adjustment) notice that comes out every December. Sometimes that works. But if it’s July, a lender might worry that your benefits were suspended or changed since January. They want something "fresh," usually dated within the last 30 to 60 days.

Getting Your Letter Online (The "Save Your Sanity" Method)

The fastest way to get your social security print out is through a "my Social Security" account. If you haven't set one up yet, you're making life harder than it needs to be. You go to the official website—ssa.gov—and look for the sign-in link.

Warning: The security is tight. You'll likely need to use Login.gov or ID.me. These are the credentialing services the government uses to make sure some random person isn't trying to steal your identity. You'll need an email address, a working phone number for text codes, and your Social Security number. Once you’re in, the "Replacement Documents" tab is your best friend. Click it. Select "get a Benefit Verification Letter."

Boom.

You can view it, save it as a PDF, or print it right there. It takes about five minutes if you remember your password. If you don't? Well, resetting a government password can be its own special kind of purgatory, but it's still better than the bus ride to the local office.

What if you’ve never received benefits?

Even if you aren't "on the draw" yet, you might still need a social security print out. Why? To prove you don't receive benefits. This is common for younger people applying for certain types of state-level social services. The letter will simply state that you have no record of benefits, which is exactly what the caseworker needs to see to check a box.

👉 See also: When Was the US Treasury Founded? The Real Story Behind America's Piggy Bank

The "Old School" Ways: Phone and Mail

Not everyone is tech-savvy. That's fine. If the thought of "creating an ID.me account" makes you want to throw your laptop out a window, you have options. You can call the national toll-free number at 1-800-772-1213.

Expect hold times.

Monday mornings are the worst. Early mornings or late evenings are usually better. When you finally get a human, tell them you need a "Benefit Verification Letter." They won't email it to you for security reasons. They will mail it to the address they have on file. This usually takes 5 to 10 business days. If you’re in a rush to close on a house, this method is going to stress you out.

The Myth of the "Local Office" Walk-In

There’s a persistent idea that you can just "pop in" to the local SSA office and they’ll hand you a social security print out over the counter. While true in theory, the reality is grimmer. Since the pandemic, many offices have moved toward an appointment-only model or have extremely limited "walk-in" windows.

If you show up at 10:00 AM on a Tuesday without an appointment, you might find a line wrapping around the building. Some offices have security guards who will tell you to go home and call the 800-number. It’s hit or miss. If you absolutely must go in person, try to schedule an appointment first. It won't be for tomorrow—it'll likely be for three weeks from now—but at least you'll have a guaranteed slot.

Dealing with the "Proof of Income" Hassle

When you look at your social security print out, it’s going to look a bit dry. It's a black-and-white letter with a government seal. It lists your name, address, date of birth, and your "Monthly Benefit Amount."

Wait, check the numbers.

Sometimes people are surprised to see their "Gross" amount is much higher than what hits their bank account. This happens because of:

- Medicare Part B premiums (usually deducted automatically).

- Voluntary tax withholding.

- Overpayment recovery (if the SSA thinks they gave you too much money in the past).

- Garnishments for child support or delinquent federal debts.

If you’re applying for a loan, make sure the lender looks at the Gross Benefit. That’s your actual income. If they try to qualify you based on the "Net" (what’s left after deductions), you might not get approved for the amount you need. Be firm about this. It’s your right to be evaluated on your total income.

👉 See also: Ian Epstein Explained: What the Finance World Actually Thinks

Common Errors to Watch Out For

Bureaucracies make mistakes. It’s rare, but it happens. When you get your social security print out, check the address. If you moved recently and didn't update the SSA, the letter might have your old address. Lenders hate this. They want everything to match your current application.

Also, verify the "Type of Benefit." It should say "Retirement," "Disability," or "Supplemental Security Income" (SSI). These are different programs with different rules. Mixing them up can cause major headaches during a financial audit or a background check.

A Quick Note on SSI vs. SSDI

If you receive Supplemental Security Income (SSI), your letter might look slightly different. It often includes information about your "resource limit" or "countable income." Because SSI is needs-based, the letter is more sensitive to changes in your financial situation. If you just got a part-time job or inherited some money, that letter might reflect a lower payment than you were expecting.

Protecting Your Information

This document contains your Social Security number (often masked, but not always) and your income details. It is a target for identity thieves. Don't leave your social security print out sitting in a shared printer tray or in your car. If you’re emailing it to a landlord or a bank, make sure you’re using a secure, encrypted link.

Never—and I mean never—give your SSA login credentials to someone else so they can "print it for you." That’s a recipe for disaster.

Actionable Steps to Get Done Today

Stop stressing about the paperwork and just get it over with. Here is exactly what you should do right now:

- Check your deadline. If you need the letter for a closing or an application due in 48 hours, you must use the online "my Social Security" portal. Do not rely on the mail.

- Verify your portal access. Go to ssa.gov and try to log in. If you can't get past the two-factor authentication, call the help desk specifically for "Technical Support" rather than general benefits.

- Download the PDF. Even if you don't need to print it this second, save the PDF to a secure folder on your computer or a thumb drive. Name it something clear like "SSA_Verification_Jan_2026.pdf".

- Update your address. While you're in the portal, ensure your mailing address is current. This prevents the "address mismatch" red flag that stalls loan applications.

- Print multiple copies. If you're applying for multiple things—like a new apartment and a utility assistance program—print three copies. Having a "wet ink" copy or a fresh laser print is always better than a grainy photo of a document.

- Request a "Certified" copy only if required. Some very specific legal proceedings (like international adoptions or certain court cases) require a "Certified" version with a physical raised seal. You cannot get this online. You must visit a local office for a certified version, so check with the person requesting the document to see if a standard print out is sufficient. Most of the time, the standard one is all you need.

By handling this digitally, you bypass the queues and the hold music. It’s the one part of dealing with the government that is actually, surprisingly, efficient once you have your account set up. Get in, get the PDF, and get back to your life.