You’ve probably logged into the SSA website, looked at that big, bold number next to "Estimated Monthly Benefits," and felt a tiny bit of relief. Don't. Honestly, that number is a placeholder, a "best-case scenario" that assumes you’ll keep earning exactly what you’re making now until the day you retire. Life doesn't work that way. Using a social security payout calculator effectively requires understanding that the math behind your check is surprisingly fluid—and occasionally punishing.

Most people treat these calculators like a crystal ball. They aren't. They’re more like a weather forecast for a decade from now; it gives you the general climate, but it won't tell you if it's raining on your specific wedding day.

The Math Behind the Magic Number

The Social Security Administration (SSA) uses your 35 highest-earning years to figure out your benefit. That's the part everyone knows. But the weird part? They index those earnings to average wage growth. This means $20,000 in 1992 isn't $20,000 in the eyes of the government. It’s adjusted so it feels like 2026 dollars. If you haven't worked a full 35 years, the social security payout calculator starts dropping zeros into those empty slots. Zeros are the silent killers of a comfortable retirement.

Even one or two years of "finding yourself" or taking time off for caregiving can drag your average down significantly.

Then there’s the AIME—Average Indexed Monthly Earnings. This is basically your career boiled down to a single monthly figure. The SSA then applies "bend points" to this number. It’s a progressive formula. You get a bigger percentage of your first few dollars of income than you do of your last few. Basically, Social Security is designed to replace a higher percentage of income for lower-earning workers than for the high-fliers in C-suites.

Why 62 Is Often a Trap

You can start claiming at 62. It’s tempting. The money is right there, sitting on the table. But the math is brutal. If your full retirement age (FRA) is 67—which it is for everyone born in 1960 or later—claiming at 62 means a permanent 30% haircut on your monthly check.

Think about that. 30%. Forever.

A good social security payout calculator will show you the "break-even" point. This is the age where the total amount of money you’ve received by waiting longer finally overtakes the total money you would’ve gotten by starting early. Usually, that point is somewhere around age 78 to 82. If you come from a family of long-livers, waiting is almost always the smarter financial play. If you've got health issues, maybe you take the money and run.

✨ Don't miss: How Many Working Days Until the New Year: Why Your Calendar is Probably Lying to You

Delayed retirement credits are the flip side. For every year you wait past your FRA (up until age 70), your benefit grows by 8%. That’s a guaranteed 8% return. You can’t find that in a savings account or a bond. Not safely, anyway.

Taxes: The Part Nobody Likes to Mention

Wait, you thought the government gave you that money tax-free? Kinda. Maybe. It depends on your "combined income."

If you’re a high earner, or if you have a chunky 401(k) withdrawal hitting your bank account every month, up to 85% of your Social Security benefit could be subject to federal income tax. This is where people get blindsided. They use a social security payout calculator, see $3,000 a month, and plan their life around it. Then April 15th rolls around, and the IRS wants a piece of that $3,000 back.

The Real-World Complexity of Spousal Benefits

Divorced? You might still be able to claim on your ex's record. Seriously. If you were married for at least 10 years and you haven't remarried, you can often get up to 50% of their benefit if it’s higher than your own. And the best part? It doesn’t affect their check at all. They won't even know you're doing it. It’s one of the few areas where the government is surprisingly generous, yet thousands of people leave this money on the table because they’re too embarrassed or uninformed to ask.

The 2030s Funding Cliff

We have to talk about the elephant in the room. The Social Security Trust Funds are projected to run dry in the early-to-mid 2030s. Does this mean the checks stop? No. It means the system will only be able to pay out about 77% to 83% of scheduled benefits using incoming payroll taxes.

📖 Related: 1 Shilling to 1 Dollar: Why the Math is More Confusing Than You Think

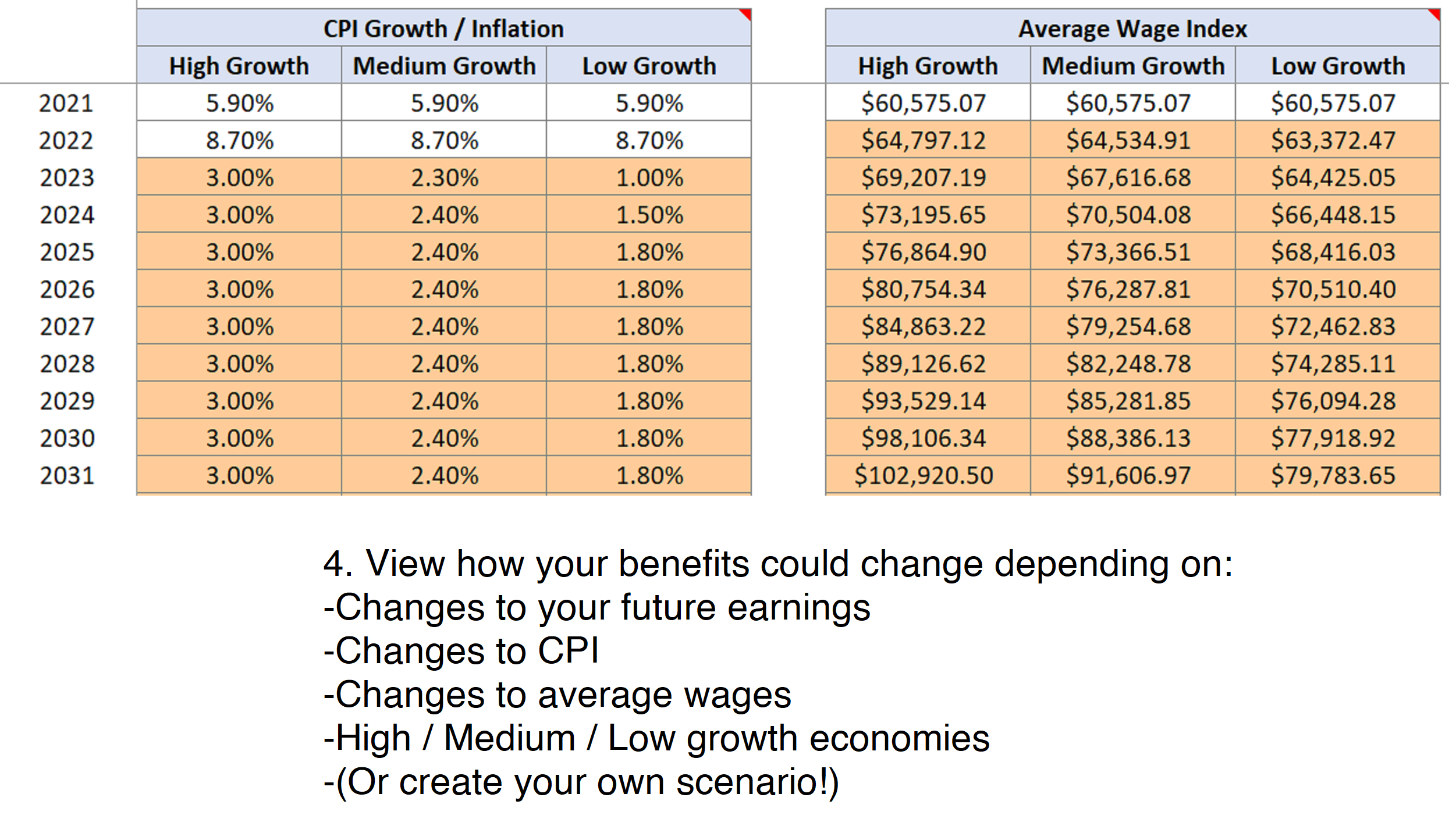

When you use a social security payout calculator, you should probably be running a "stress test" scenario where you manually reduce the output by 20%. If your retirement plan falls apart under that 20% haircut, you need to save more in your private accounts now. Congress will likely "fix" it by raising the retirement age or increasing the payroll tax cap, but betting your entire future on a 535-person committee reaching a consensus is... risky.

How to Actually Use This Information

Don't just look at the number. Poke it. Prod it.

- Verify your earnings history. Go to the SSA website and look at every single year listed. If they missed a year where you worked your tail off, your payout will be wrong. Every dollar counts.

- Account for inflation. The COLA (Cost of Living Adjustment) is great, but it often lags behind real-world costs like healthcare and housing.

- Run the "What If" scenarios. What if you retire at 64 instead of 67? What if you take a lower-paying job for the last five years of your career? Most basic calculators won't show you this nuance, so you might need to use the more advanced tools provided by organizations like AARP or specialized financial planning software.

- Think about the "Survivor" factor. If you’re the higher earner in a marriage, waiting until age 70 to claim isn't just about you. It's about ensuring that when you pass away, your spouse gets the largest possible survivor benefit. It's essentially a life insurance policy funded by your patience.

The reality of Social Security is that it was never meant to be a full retirement plan. It was designed as a safety net—a floor, not a ceiling. Treat the results of any social security payout calculator as a baseline, then build your own fortifications on top of it.

Start by downloading your actual Social Security Statement (Form SSA-7005) today. Check for errors in your reported earnings from your younger years, as correcting these now is much easier than trying to find a 30-year-old W-2 when you're 66. Once you have the raw data, run your numbers through a calculator that allows for custom inflation and tax rate inputs to get a realistic view of your future purchasing power.

Finally, sit down with a fiduciary financial advisor to discuss how your projected benefit interacts with your RMDs (Required Minimum Distributions) from your IRA or 401(k). This prevents the "tax torpedo" where your Social Security benefits push you into a higher tax bracket, effectively neutralizing the COLA increases you worked so hard to wait for.