Timing is everything when you're living on a fixed income. Honestly, waiting for that direct deposit to hit can feel like watching a slow-motion movie, especially when the calendar shifts things around. If you are one of the millions of seniors wondering when exactly social security payments for retirees will arrive in March 2025, the answer depends almost entirely on your birthday—or when you first signed up for benefits.

The Social Security Administration (SSA) doesn't just send out a massive wave of checks on a single day. That would be chaos. Instead, they staggered the dates decades ago to keep the system from clogging up. For March 2025, there are some specific quirks you should be aware of, including a "missing" payment for some and a triple-header of Wednesday distributions for others.

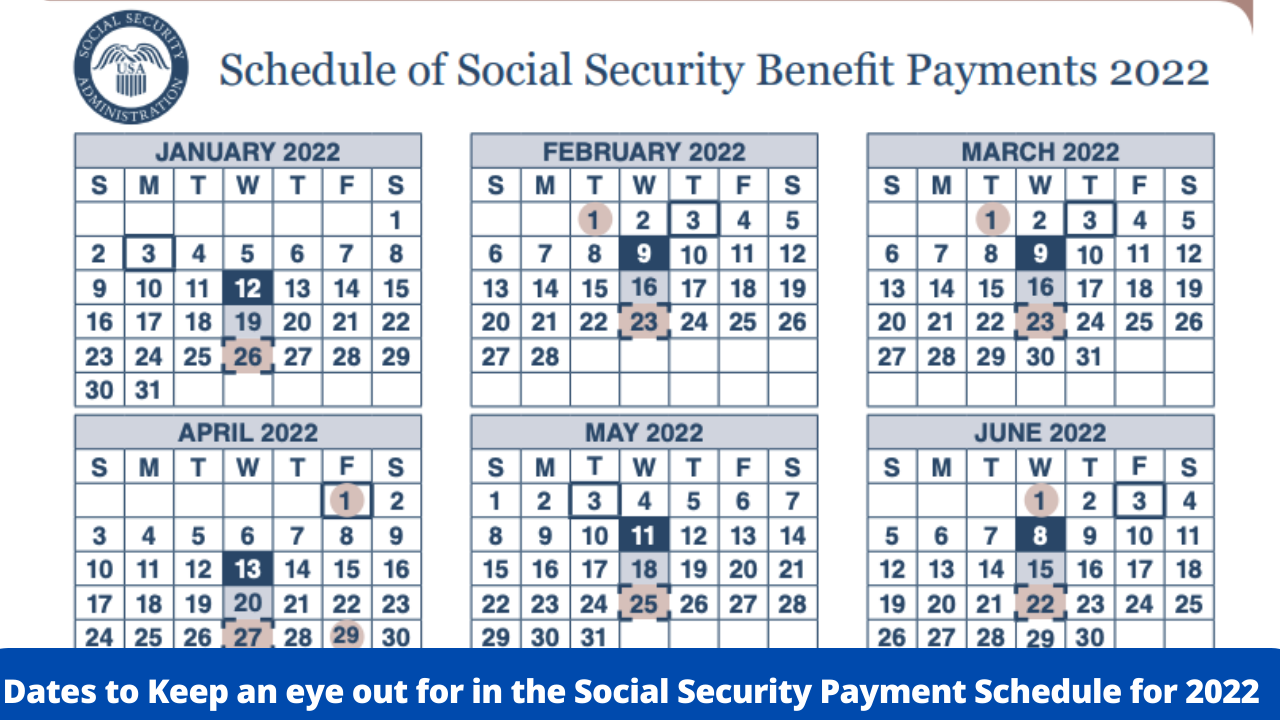

The Specific March 2025 Payment Schedule

Basically, the SSA uses a "Wednesday rule" for most people who retired after May 1997. If your birthday falls early in the month, you get paid early in the month. Simple, right? But the dates change every year because the Wednesdays shift.

Here is how the breakdown looks for the month of March:

- Birthdays 1st – 10th: Your payment arrives on Wednesday, March 12.

- Birthdays 11th – 20th: Your payment hits on Wednesday, March 19.

- Birthdays 21st – 31st: You’ll see the money on Wednesday, March 26.

If you're looking for your Supplemental Security Income (SSI) in March, you might notice your bank account looks a little empty on the 1st. Don't panic. Because March 1, 2025, falls on a Saturday, the SSA actually sends those payments out on the nearest business day before the first. This means SSI recipients will actually get their "March" money on Friday, February 28.

✨ Don't miss: How to make a living selling on eBay: What actually works in 2026

What About the "Early" Retirees?

There is a group of people who don't follow the birthday rule. If you started receiving benefits before May 1997, or if you receive both Social Security and SSI, your payment date is usually the 3rd of the month. Since March 3, 2025, is a Monday, your check should arrive right on time without any weekend interference.

The 2025 COLA Impact

By the time March rolls around, you've likely already seen the 2.5% Cost-of-Living Adjustment (COLA) reflected in your January and February checks. It’s not a life-changing amount—the average retired worker is seeing about a $50 monthly increase—but it helps.

However, there is a "kinda" annoying catch that most people forget about until they see their statement. Medicare Part B premiums usually go up at the start of the year too. For 2025, the standard premium rose to $185 per month. Since this is usually deducted directly from your Social Security check, it eats into that 2.5% raise. Most people end up seeing a net increase that is smaller than they initially expected.

Why Your Payment Might Be Late (And What to Do)

It happens. You wake up, check your banking app, and the balance hasn't moved. Before you spend an hour on hold with the SSA, give it three mailing days. That is the official recommendation.

🔗 Read more: How Much Followers on TikTok to Get Paid: What Really Matters in 2026

Direct deposit is incredibly reliable, but glitches in the banking system or even a change in your personal information can cause a hiccup. If you recently moved or swapped banks and didn't update your "my Social Security" account at least 30 days in advance, your payment might be floating in limbo.

If three business days pass and there is still no sign of the funds, you can call the SSA at 1-800-772-1213. They are available from 8:00 a.m. to 7:00 p.m., Monday through Friday. Pro tip: call early in the morning or later in the evening toward the end of the week. Tuesdays and Wednesdays are notoriously busy.

The Social Security Fairness Act Update

A lot of people are talking about the Social Security Fairness Act lately. This legislation targets the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO), which have historically slashed benefits for teachers, police officers, and other civil servants who also had private-sector jobs.

If you're affected by this, keep a close eye on your March statement. The SSA has been working through a massive backlog of adjustments. While most people saw their corrected amounts in early 2025, some complex cases are still being processed. If your March payment seems higher than February, it might be the result of these long-awaited adjustments finally kicking in.

💡 You might also like: How Much 100 Dollars in Ghana Cedis Gets You Right Now: The Reality

Managing the Gap Between Payments

March is a long month. If you are a "Fourth Wednesday" person (born after the 20th), you have to stretch your February money all the way until March 26. That is a long time to wait for a refill.

- Sync your bills: Call your utility companies or credit card issuers. Many will let you move your due date to the 28th or 30th of the month so it aligns better with your late-month deposit.

- Watch the SSI overlap: Since SSI comes on February 28 instead of March 1, it’s easy to spend it early. Remember, that money has to last you until April 1.

- Check your "my Social Security" portal: This is the fastest way to see a digital copy of your 1099 or verify exactly what deductions are coming out of your check.

Understanding exactly when social security payments for retirees will arrive in March 2025 helps eliminate that mid-month anxiety. Mark your calendar based on your birth date: the 12th, 19th, or 26th. If you belong to the pre-1997 group, keep an eye out on the 3rd.

Next Steps for You:

Log in to your my Social Security account today to verify that your mailing address and direct deposit information are current. This is the single best way to prevent a delay in your March payment. If you are planning a large purchase or have a major bill due in early March, remember that the bulk of retirees won't receive their funds until the second or third week of the month, so plan your cash flow accordingly.