Honestly, trying to pin down exactly when your money hits your account can feel like you’re trying to solve a puzzle where the pieces keep moving. You’re counting on that deposit to cover the power bill or grab groceries, and then—bam—a holiday or a weekend messes everything up.

Most people think the Social Security Administration (SSA) just sends everyone’s money on the same day. Nope. Not even close. It’s actually a pretty rigid system based on your birthday, but with a few weird exceptions that can throw you for a loop if you aren’t paying attention.

For 2026, things are getting a little more interesting because of the 2.8% Cost-of-Living Adjustment (COLA). That means your check is going up, which is great, but the timing depends on a calendar that feels like it was designed by a mathematician. Basically, if you were born early in the month, you get paid early. If you were born late, you’re waiting until the end of the month.

Let's break down how this actually works so you don't have to keep guessing.

The Birthday Rule: Your Social Security Pay Dates Calendar

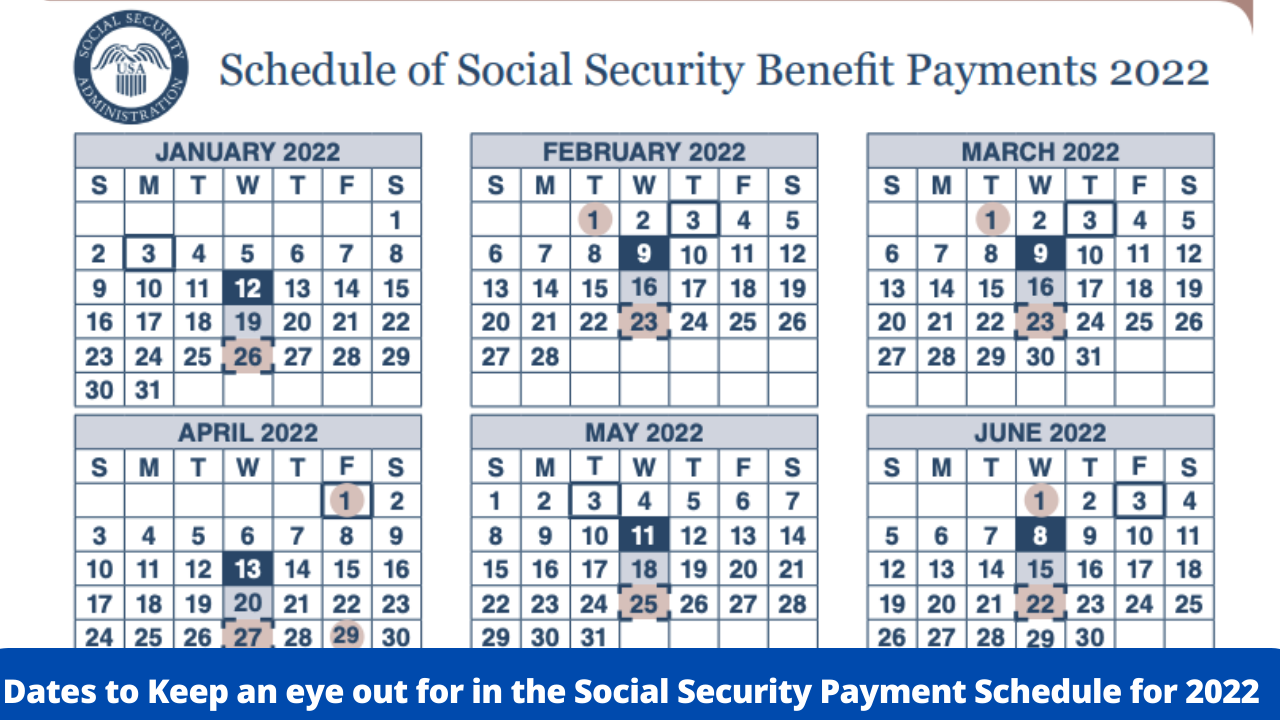

The vast majority of retirees and disability (SSDI) recipients fall into the "Wednesday" group. If you started receiving benefits after May 1997, your payment date is tied directly to the day of the month you were born.

If your birthday falls between the 1st and the 10th, you’re in the first wave. You’ll see your money on the second Wednesday of every month. For someone born on the 5th, this is your life. You’re always the first of the birthday groups to get paid.

What if you were born between the 11th and the 20th? Then you’re looking at the third Wednesday. It’s a bit of a longer wait, but it’s consistent.

And for the folks born from the 21st to the end of the month? You’re in the last group. You get your deposit on the fourth Wednesday. It can feel like a lifetime between that last check of the previous month and the new one, especially in months with five weeks.

There’s a small group of people who don't follow this rule at all. If you’ve been on Social Security since before May 1997, or if you receive both Social Security and Supplemental Security Income (SSI), your payment date is usually the 3rd of the month. It doesn't matter when your birthday is. You just get it on the 3rd. Simple, right? Well, until the 3rd falls on a Sunday.

When Holidays Mess With Your Money

The federal government doesn't work on holidays, and neither do the banks that process these payments.

In 2026, there are several times when the calendar fights back. The rule is pretty straightforward: if your pay date falls on a weekend or a federal holiday, the SSA moves the payment up to the preceding business day.

Take February 2026 as a perfect example. February 1st is a Sunday. If you’re an SSI recipient, you aren’t waiting until Monday the 2nd. You’re actually going to get that "February" payment on Friday, January 30th.

This is where people get tripped up. You see two deposits in January and think, "Sweet, a bonus!" But then February rolls around and there’s no deposit at the start of the month because you already spent it in late January. It’s a classic trap. You’ve got to pace yourself when those "early" payments hit.

The 2026 COLA Bump: What’s Actually Changing?

You’ve probably heard that benefits are rising by 2.8% this year. On paper, the average retired worker is seeing their check go from $2,015 to about **$2,071**. It’s about 56 bucks extra a month.

But here’s the reality check: Medicare Part B premiums are also going up. For most people, that premium is deducted directly from your Social Security check before it even hits your bank account. In 2026, the standard Part B premium is climbing to $202.90.

So, while your "gross" pay went up by $56, about $18 of that might vanish instantly into Medicare costs. You’re still netting more than last year, but it’s not exactly a windfall. It’s more like a "keep-your-head-above-water" adjustment.

Why Your Neighbor Might Get Paid Before You

I get this question a lot. "My friend across the street gets her money on Monday, but the calendar says Wednesday. Is the SSA playing favorites?"

No, it's usually just the bank.

If you use a traditional big-name bank, they likely hold the funds until the actual settlement date (the Wednesday). However, many "neobanks" or online-only banks—and even some credit unions—offer "early direct deposit." They basically see the payment instruction coming from the Treasury a couple of days early and credit your account immediately.

If you're using a Direct Express card, those usually hit exactly on the scheduled date. If you're still getting a paper check in the mail (which the SSA really hates, by the way), you're at the mercy of the USPS. That adds at least three days of uncertainty to your life. Seriously, if you're still on paper, switch to direct deposit. It'll save you a lot of stress.

Troubleshooting Missing Payments

What if the Wednesday comes and goes and your account is empty?

First, don't panic and call the SSA immediately. Their official advice is to wait three additional mailing days before reporting a missing payment. Banks sometimes have internal glitches, or there might be a delay in the electronic transfer system.

📖 Related: The Agen Stock Message Board Crowd: What’s Actually Happening in the Trenches

If three days pass and you’re still seeing zeros, check your "My Social Security" account online. Often, there's a notice there you might have missed—maybe they needed to verify your income if you’re still working, or perhaps there was an issue with your banking info.

Speaking of working, remember that in 2026, the earnings limit is $24,480 if you’re under full retirement age. If you earn more than that, they start withholding $1 for every $2 you make over the limit. That can definitely mess with your expected payment amount or timing if you haven't reported your wages correctly.

Actionable Steps for Managing Your 2026 Payments

- Audit your bank: If you need your money the second it's available, look into an account that offers early direct deposit. It can bridge the gap by 48 hours.

- Watch the "Double Pay" months: Mark your calendar for months like January and May where holiday shifts might result in two payments in one month and none the next.

- Check your Medicare deduction: Log into your SSA portal to see exactly how much is being taken out for Part B so you aren't surprised by the net amount on your first 2026 check.

- Report wage changes: If you've taken a part-time job or gotten a raise, tell the SSA now. It's better to have a smaller check now than a massive "overpayment" bill later.

Navigating the social security pay dates calendar is mostly about knowing your "group" and keeping an eye on the holidays. Once you know your Wednesday, the rest of the year usually falls into place—as long as you account for those pesky Medicare hikes.