If you’re staring at a stack of medical records and a blank application, you already know the stakes are high. It's stressful. Most people assume that having a doctor say they "can't work" is the golden ticket to getting benefits, but honestly, that’s barely the beginning. The Social Security Administration (SSA) doesn't care about your doctor's opinion as much as they care about the objective evidence behind it.

The reality of social security disability requirements is that they are built on a rigid, five-step evaluation process designed to weed people out. It sounds harsh. It is. But if you understand the internal logic the SSA uses—specifically the difference between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)—you have a much better shot at navigating the maze.

The Technical Hurdles: It’s Not Just Your Health

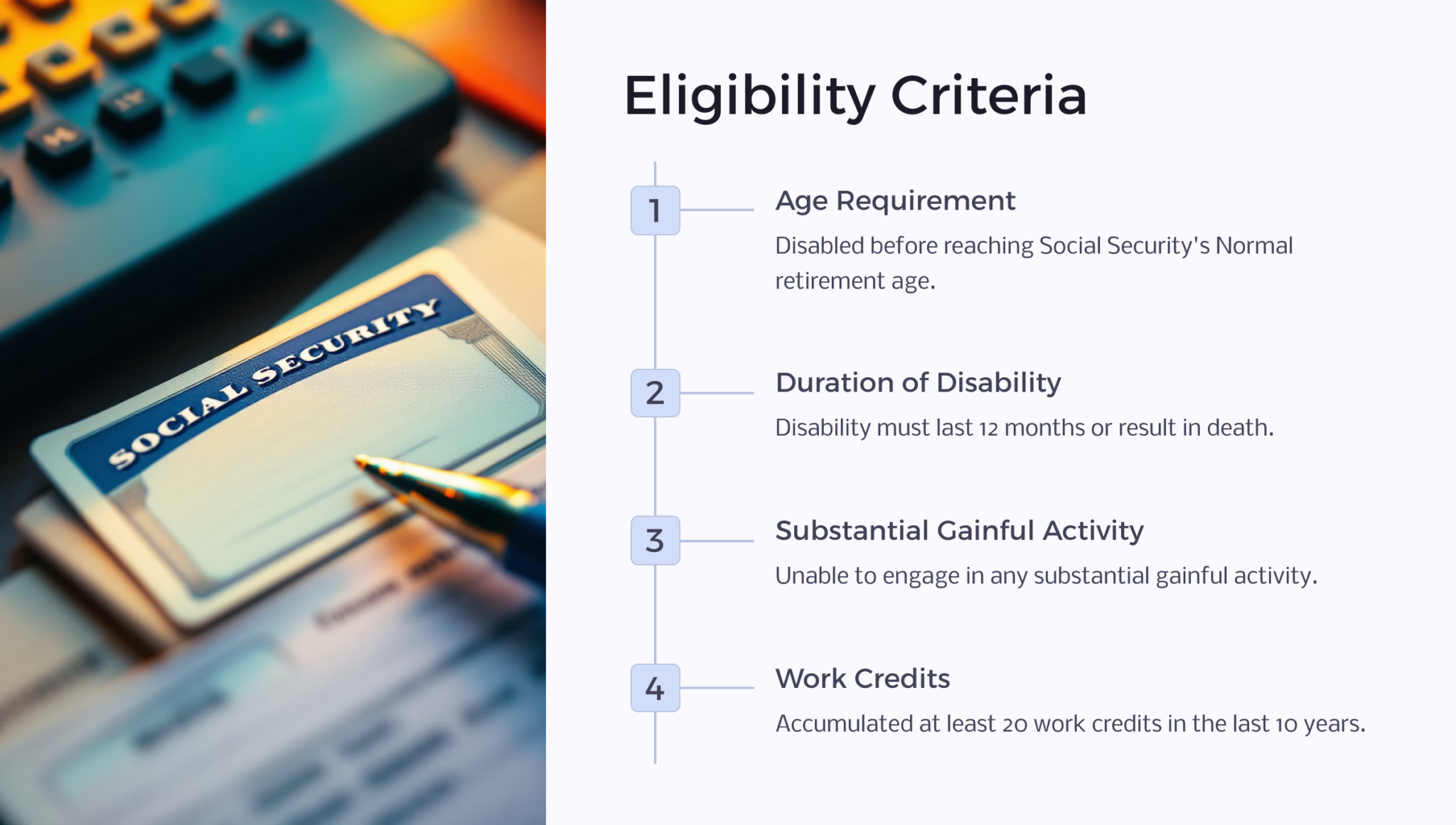

Before a claims examiner even looks at your MRI or your therapist’s notes, they look at your "credits." This is where a lot of people get tripped up. SSDI is essentially an insurance policy you’ve paid into through your payroll taxes. To qualify, you generally need 40 credits, 20 of which must have been earned in the last 10 years ending with the year you become disabled. Think of it as a "recency" test. If you haven't worked much in the last decade, you might be "insured status" expired, regardless of how sick you are.

Then there’s the SGA rule. Substantial Gainful Activity. In 2026, if you’re earning more than a specific monthly threshold (which adjusts annually for inflation), the SSA considers you not disabled by default. It doesn’t matter if you’re in excruciating pain while doing that work. If the paycheck is there, the claim is dead on arrival.

SSI is different. It’s for folks with limited income and resources, regardless of work history. You have to be practically broke to qualify—less than $2,000 in countable assets for an individual. They count almost everything: bank accounts, second cars, even certain types of financial help from family. It's a "needs-based" program, so the social security disability requirements here are as much about your bank balance as your biology.

✨ Don't miss: Williams Sonoma Deer Park IL: What Most People Get Wrong About This Kitchen Icon

The "Blue Book" and Why It Matters

The SSA maintains a massive manual called the Listing of Impairments, or the "Blue Book." This is the holy grail of medical requirements. It’s broken down by body systems—musculoskeletal, respiratory, neurological, and so on.

If your condition "meets or equals" a listing, you're basically fast-tracked. For example, if you’re applying based on a back injury, simply having "chronic pain" isn't enough. The SSA looks for very specific clinical findings like nerve root compression, characterized by neuro-anatomic distribution of pain and limited motion of the spine, confirmed by imaging. They want data. They want measurements.

The Problem With Subjective Pain

Pain is real. But to the SSA, pain is "subjective." They need "objective medical evidence" from "acceptable medical sources." This usually means M.D.s, D.Os, and licensed psychologists. If you’ve only been seeing a chiropractor or a massage therapist, the SSA might not give those records much weight. You need specialists. If you have a heart condition, you need a cardiologist. If it's depression, you need a psychiatrist or a Ph.D. level psychologist.

The Step-by-Step Logic of a Claim

The SSA follows a specific sequence. It’s a flowchart that determines your fate.

🔗 Read more: Finding the most affordable way to live when everything feels too expensive

- Are you working? If you're over the SGA limit, you're out.

- Is your condition "severe"? This is a low bar, but it must interfere with basic work-related activities for at least 12 months.

- Does it meet a Listing? If yes, you win. If no, they keep digging.

- Can you do your past work? They look at what you’ve done over the last 15 years.

- Can you do any other work? This is the hardest part.

Step 5 is where most claims go to die. The SSA will look at your Residual Functional Capacity (RFC). This is a fancy way of saying "what can you still do despite your limitations?" Can you sit for six hours? Can you lift a gallon of milk? Can you follow simple instructions? Even if you can't do your old job as a construction worker, the SSA might argue you can sit at a desk and monitor a security camera or fold laundry.

Age Is More Than a Number

There is a weird, somewhat controversial "grid" system that the SSA uses once you hit age 50. It’s essentially an admission that it’s harder to retrain older workers. If you are 55 or older, have a limited education, and your past work was physical, you might be found disabled even if you could technically do a sit-down job. Younger workers, however, are almost always expected to transition to new types of employment, no matter how much they hate the idea of office work.

The "Grid Rules" are a major factor in social security disability requirements. A 45-year-old and a 60-year-old with the exact same back injury can have completely different outcomes. The 60-year-old gets benefits; the 45-year-old gets a denial letter saying they should go back to school or find a telemarketing job. It feels unfair, but it’s how the system is codified.

The Importance of Consistency

One of the biggest mistakes people make is "toughing it out" and skipping doctor appointments. If you aren't seeking regular treatment, the SSA assumes you're fine. Gaps in medical treatment are the number one reason for denials. You have to be a "compliant patient." Take the meds. Go to the physical therapy. Show up for the follow-ups.

💡 You might also like: Executive desk with drawers: Why your home office setup is probably failing you

Also, be honest but don't exaggerate. Claims examiners are trained to spot inconsistencies. If you tell the SSA you can’t walk a block, but your doctor's notes say you've been "staying active with light gardening," you’re going to have a problem. Your daily activities (ADLs) must match your medical restrictions.

Practical Steps to Strengthen Your Claim

Don't just wait for the SSA to gather your records. They’re overworked and might miss things. You need to be your own advocate.

- Download your own records. Don't assume the SSA will get everything from that hospital visit three years ago.

- Get an RFC form filled out. Ask your treating specialist to fill out a "Medical Source Statement." This form asks them specifically how many minutes you can stand, how much you can lift, and how often you'd need to take breaks. This is often more valuable than 100 pages of messy handwritten notes.

- Keep a symptom diary. Track your "bad days." If you have migraines, how many days a month are you in a dark room? If you have Crohn's, how many times do you need the bathroom? This provides "duration and frequency" evidence.

- Focus on functional limitations. Instead of saying "my hip hurts," say "I cannot stand for more than 10 minutes without needing to sit for 20 minutes to manage sharp radiating pain."

- Check your "My Social Security" account. Verify your earnings history. If your work credits are wrong, your SSDI claim is doomed before it starts.

The process is long. Expect to wait six months for an initial decision and another year if you have to go to a hearing. Most people are denied at the initial level—roughly 65-70%—so a denial isn't the end of the road. It's just the start of the appeal.

Final Action Plan

If you're ready to move forward, start by visiting the official SSA website to create your account and check your "insured status" for SSDI. Once you confirm you have enough credits, schedule a consultation with your primary doctor specifically to discuss your "functional limitations" for work. Make sure your doctor understands that you need them to document not just your diagnosis, but exactly how that diagnosis prevents you from sustained, eight-hour-a-day employment. Collect your list of all medications, dosages, and prescribing physicians before you begin the online application to ensure your "medical map" is complete for the examiner.