You've spent decades paying into the system. Every paycheck, there it was: that FICA deduction staring back at you. Now, you’re finally ready to see some of that money come back your way. But honestly, the process of actually getting your hands on it can feel like trying to navigate a maze in the dark.

Most people think applying is just a matter of clicking a button on a website. It’s kinda more complicated than that. If you don't have your ducks in a row, you could end up stuck in a cycle of phone tag with the Social Security Administration (SSA) or, worse, missing out on a chunk of the money you're owed.

Getting what is needed to apply for social security benefits isn't just about a single document. It’s about a specific "survival kit" of personal history and financial records.

The Absolute Essentials: Your Identity Kit

Before you even think about opening the SSA website, you need to prove you are who you say you are. The government is surprisingly picky about this. You can't just send in a photocopy of your birth certificate that you've kept in a junk drawer for twenty years. They want the real deal.

- The Original Birth Certificate: It must be an original or a certified copy from the issuing agency. Notarized copies? Nope. They won't take them.

- Proof of Citizenship: If you weren't born in the U.S., you'll need your Naturalization Certificate or your current U.S. Passport.

- Social Security Number: You obviously need your number, but having the physical card is better, just in case there's a discrepancy in their records.

If you served in the military before 1968, you also need your discharge papers (Form DD-214). This is a big one that people forget. Those years of service can actually impact your benefit calculation, so don't leave that money on the table.

📖 Related: Coach Bag Animal Print: Why These Wild Patterns Actually Work as Neutrals

The Money Trail: Income and Tax Records

The SSA already has a record of your earnings, but mistakes happen. Seriously. You need to be ready to prove what you earned recently because those records often lag behind by a year or two.

Basically, you should have your W-2 forms from the previous year. If you’re self-employed, you'll need your full federal tax return (Schedule SE) from the last tax year.

Expert Tip: If you are applying late in the year—say, between September and December—the SSA might ask you to estimate what you're going to earn for the entire current year. Have those numbers ready so you don't have to guess on the fly.

Banking and Logistics: How You Get Paid

The days of paper checks are long gone. The government wants to send your money directly to your bank account. It's safer and, frankly, way faster. To set this up, you need your:

👉 See also: Bed and Breakfast Wedding Venues: Why Smaller Might Actually Be Better

- Bank account number

- Routing number (that 9-digit code on your checks)

If you don't have a bank account, you might be required to sign up for a Direct Express® debit card. It's a bit of a hassle, so if you have a traditional bank, just use that.

Spouses, Exes, and the "Hidden" Benefits

This is where things get really messy. You aren't just applying for your record; you might be eligible for benefits based on someone else's work history.

If you’re currently married, you'll need your spouse’s Social Security number and their date of birth. But what if you're divorced? If your marriage lasted at least 10 years and you haven't remarried, you might be able to claim benefits on your ex-spouse's record. You’ll need their SSN too, which can be a bit awkward to ask for if you haven't spoken in a decade.

If you can't get their SSN, don't panic. Provide as much info as you can—their name, date of birth, parents' names—and the SSA can usually track them down in the system.

✨ Don't miss: Virgo Love Horoscope for Today and Tomorrow: Why You Need to Stop Fixing People

The Marriage Paperwork

You need to know the date and place of your marriage. If you’ve been married multiple times, you need the start and end dates for every marriage. That includes dates of divorce or death certificates if a previous spouse passed away.

The 2026 Reality Check: When to Actually Click 'Submit'

You can apply up to four months before you want your benefits to start. But here is the kicker: Social Security pays in arrears.

If you want your first "check" (direct deposit) in July, you need to tell them you want your benefits to start in June. If you tell them you want to start in July, you won't see a dime until August. It’s a small detail that causes a lot of stress for people who are timing their retirement down to the last penny.

In 2026, the Full Retirement Age (FRA) is 67 for anyone born in 1960 or later. If you're turning 62 this year, you can apply, but your check will be roughly 30% smaller for the rest of your life.

Avoid the "Black Hole" of Processing Delays

The most common reason applications get stuck? Missing information. If you don't have a document, apply anyway. Don't wait until you find that missing birth certificate to start the clock. The SSA will actually help you find records if you get stuck. The date you start the application—even if it's incomplete—is often used as your "protective filing date," which can save you months of back pay.

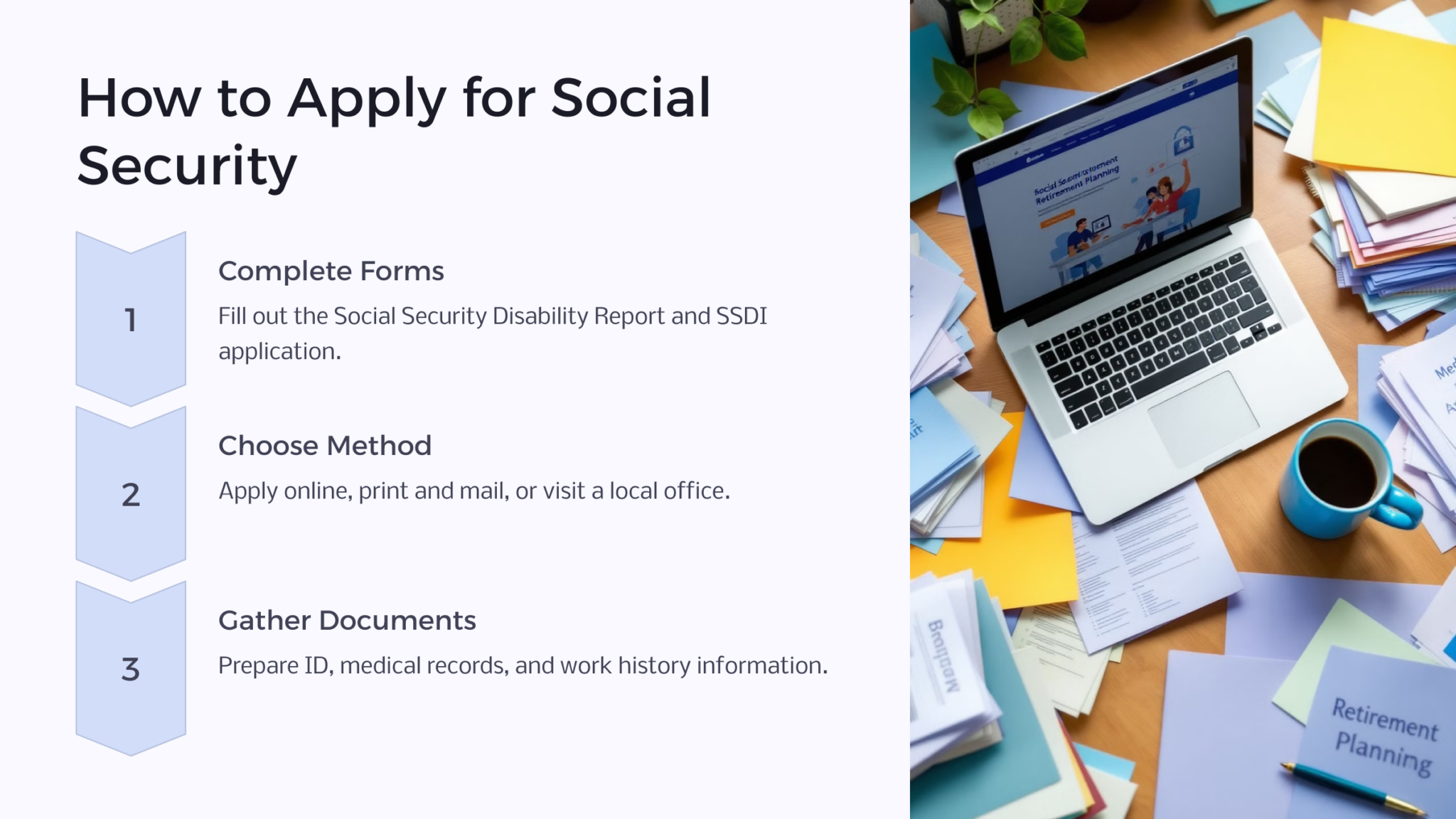

Actionable Steps for Your Application

- Create your "my Social Security" account now. Go to ssa.gov. Do not wait until the day you want to retire. You need to verify your identity through Login.gov or ID.me first, and that can take a few days if things don't clear automatically.

- Check your Earnings Record. Look for "zeros" in years you know you worked. If you find an error, you'll need those old W-2s to fix it.

- Set a "File Date" Reminder. Mark your calendar for exactly four months before your 67th birthday (or whenever you plan to claim).

- Gather your IBAN/Routing info. Keep it in a secure folder along with your certified birth certificate so you aren't scrambling when the online form asks for it.

- Talk to your spouse. Decide together who is claiming when. If the higher earner delays until age 70, it locks in a much higher survivor benefit for the other person later on.

Applying for Social Security is a massive milestone. It’s the reward for a lifetime of work. By gathering these documents early, you turn a potential bureaucratic nightmare into a simple afternoon task.