Waiting for that notification from your bank can feel like forever. Honestly, for millions of retirees and disability recipients, the social security benefits direct deposit isn't just a transaction; it's the literal bedrock of the monthly budget. If it's late by even an hour, panic sets in. You start wondering if the SSA flagged your account or if the bank is holding your cash hostage to pad their overnight interest margins.

It happens.

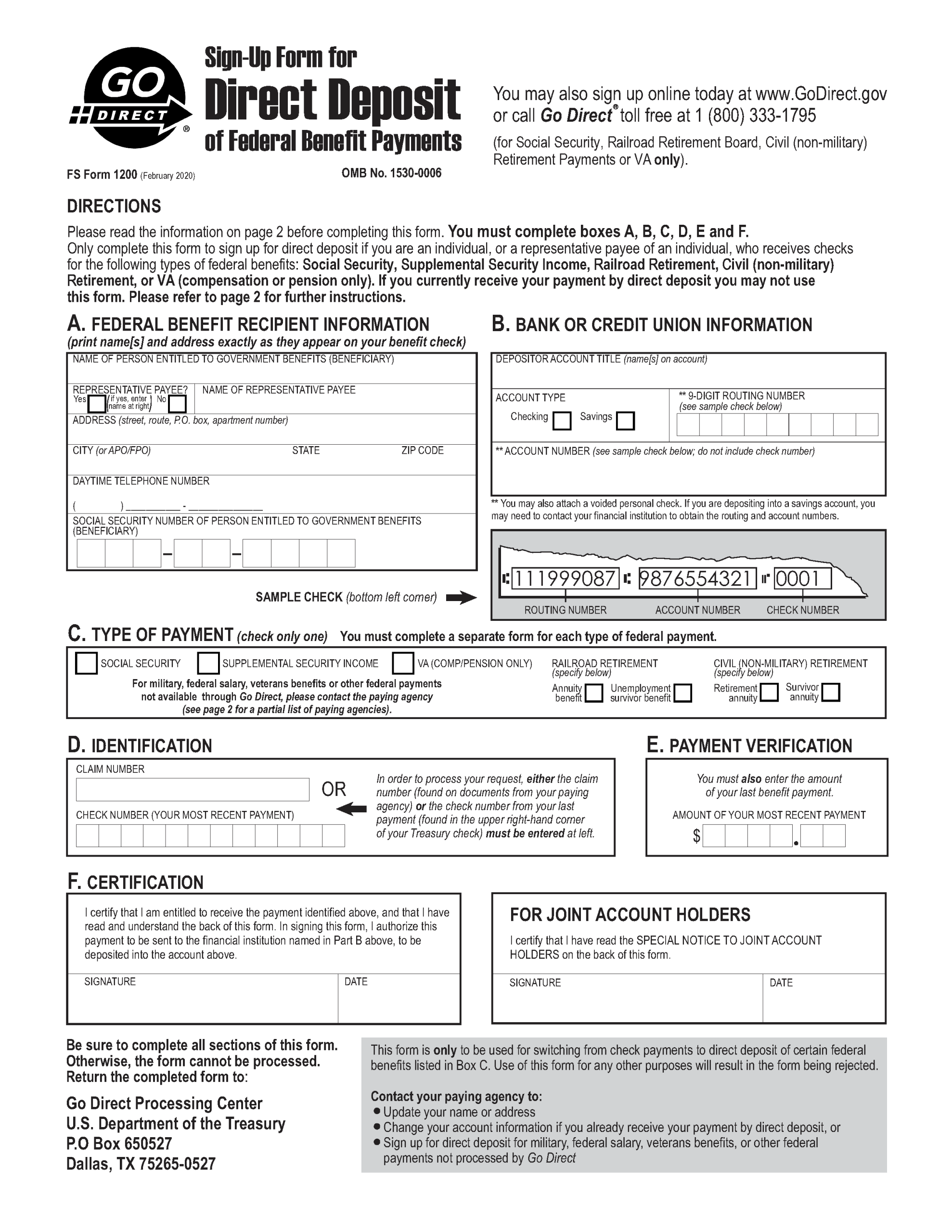

But usually, the "missing" money is just a byproduct of how the Federal Reserve and the Social Security Administration (SSA) dance together. Since 2013, the Treasury has basically mandated electronic payments. Paper checks are mostly a relic of the past, reserved for very specific hardship waivers. If you’re still getting a paper check, you’re basically a unicorn in the eyes of the Treasury Department.

The Wednesday Rule and Other Oddities

Most people think the money drops on the first of the month. That’s a myth. Unless you started receiving benefits before May 1997, your social security benefits direct deposit date is actually tied to your birthday. It’s a staggered system designed to keep the banking system from imploding under the weight of 70 million simultaneous transfers.

If your birthday falls between the 1st and the 10th, you’re looking at the second Wednesday of the month. Birthdays from the 11th to the 20th get paid on the third Wednesday. Everyone else? The fourth Wednesday.

It sounds simple. It’s not.

What happens when Wednesday is a Federal holiday? Or if you’re also receiving Supplemental Security Income (SSI)? SSI usually hits on the 1st of the month. If the 1st is a Saturday, you’ll likely see that money on the Friday before. This creates a "double payment" month once or twice a year, which often confuses people into thinking they got a bonus. They didn't. The SSA just moved the January payment to late December because of New Year's Day. If you spend it all on New Year's Eve, you're going to have a very long, very hungry January.

Why Your Bank Matters More Than the SSA

You might notice your neighbor gets their "Wednesday" payment on a Tuesday afternoon. That isn't because the government likes them more. It’s because of their bank’s internal processing logic.

Chime, SoFi, and even some local credit unions have started marketing "early direct deposit." Basically, they see the "pending" file from the Federal Reserve and credit your account immediately instead of waiting for the funds to actually settle. Bigger, "traditional" banks like Chase or Wells Fargo usually wait until the actual settlement date. They want the certainty.

It's sort of a gamble for the smaller FinTech companies, but it's a huge draw for users. If you need that social security benefits direct deposit to cover a bill due on the 12th, those 48 hours make a massive difference.

The Direct Express Alternative

Then there's the Direct Express card. If you don't have a traditional bank account—maybe because of past credit issues or just a general distrust of big banks—the government shoves you toward this Mastercard. It’s a debit card. No credit check. No minimum balance.

But it has quirks.

While it's safer than a paper check, you’ve got to be careful with the fees. ATM withdrawals can eat into your balance if you aren't using "in-network" machines. Also, if you lose the card, getting a replacement isn't as fast as walking into a local branch. You’re at the mercy of the mail.

When Things Actually Go Wrong

The SSA rarely misses a beat, but human error or tech glitches happen. Maybe you changed banks and forgot to update your "My Social Security" account. Or perhaps there was a typo in the routing number.

If your social security benefits direct deposit hasn't arrived by the end of your scheduled day, don't call the SSA immediately. They’ll tell you to wait three days. Seriously. Their official policy is to wait three mail days before they’ll even open a "non-receipt" case.

💡 You might also like: Stock Market Warren Buffett: What Most People Get Wrong Right Now

Check your bank first. Ask if there's a "pending" ACH transfer. Nine times out of ten, the bank sees it, but it’s stuck in their processing queue. If the bank has nothing, then you check your online SSA portal. Look for "payment suspended." This usually happens if the SSA sent you a piece of mail that got returned to sender. They assume you've moved or, worse, passed away, and they freeze the money until you prove you're still at your desk.

The 2026 Landscape: Scams and Security

We have to talk about the fraud. It's rampant. Scammers are getting incredibly good at "diverting" deposits. They call you, pretend to be an agent named "Officer Miller," and claim your SSN has been linked to a crime in Texas. To "protect" your money, they tell you to change your direct deposit info to a "secured" account they control.

The SSA will never, ever call you to ask for your bank details over the phone.

They already have them.

If you get a call like this, hang up. Go to the official ssa.gov site. Log in. Check your settings. If you see a bank account number you don't recognize, that's when you hit the red alert button. Security experts like Brian Krebs have frequently highlighted how "mule accounts" are used to siphon off these benefits. Once that money hits a fraudulent account and is withdrawn, getting it back from the Treasury is a bureaucratic nightmare that can take months of paperwork.

Nuances for International Recipients

Living the dream in Panama or Portugal? You can still get your social security benefits direct deposit. The SSA has international direct deposit agreements with dozens of countries.

However, you're now dealing with exchange rate fluctuations. The SSA sends US Dollars. Your local bank in Rome or Tokyo converts it to Euros or Yen. Depending on the strength of the dollar that week, your "raise" might be wiped out by a bad conversion rate. Some expats keep a US bank account and use third-party transfer services to move the money manually just to have more control over the timing of the exchange.

Practical Steps to Manage Your Money

Don't just let the money sit there without a plan.

- Set up "Balance Alerts" on your banking app. You want a text the second that SSA money hits. It saves you from logging in every ten minutes.

- Double-check your "My Social Security" account annually. Even if nothing has changed, make sure your address and contact info are current. This prevents the "returned mail" payment suspension.

- Keep a "Buffer" month. If you can, try to have one month's worth of expenses in your account. The system is reliable, but a bank outage or a holiday shift can turn a 24-hour delay into a crisis if you're living down to the last cent.

- Use a bank with "Early Pay." If your cash flow is tight, switching to a credit union or a digital bank that releases funds early can give you a much-needed breathing room of two or three days.

The social security benefits direct deposit system is a massive, complex machine. Most of the time, it works perfectly. When it doesn't, it's usually a matter of timing, not the money being gone forever. Understanding the "Wednesday schedule" and the role of your bank's internal processing is the best way to keep your stress levels down.

Check your birthday. Match it to the calendar. And always, always verify any "change of banking" requests through the official portal rather than a phone call.