You’ve probably seen the letters. Those annual statements from the Social Security Administration (SSA) that arrive like clockwork, whispering promises of a monthly check that'll somehow cover your lifestyle once you finally hang it up. But honestly, most people just glance at the "estimated payment at 67" and move on. That’s a mistake.

Deciding when to pull the trigger on social security benefits and age requirements isn't just about picking a date on a calendar. It's a high-stakes math problem where the variables are your health, your spouse’s genes, and how much you actually enjoy your job. Get it right, and you’re set. Get it wrong, and you could be leaving six figures on the table over your lifetime.

The 62 vs. 70 Tug-of-War

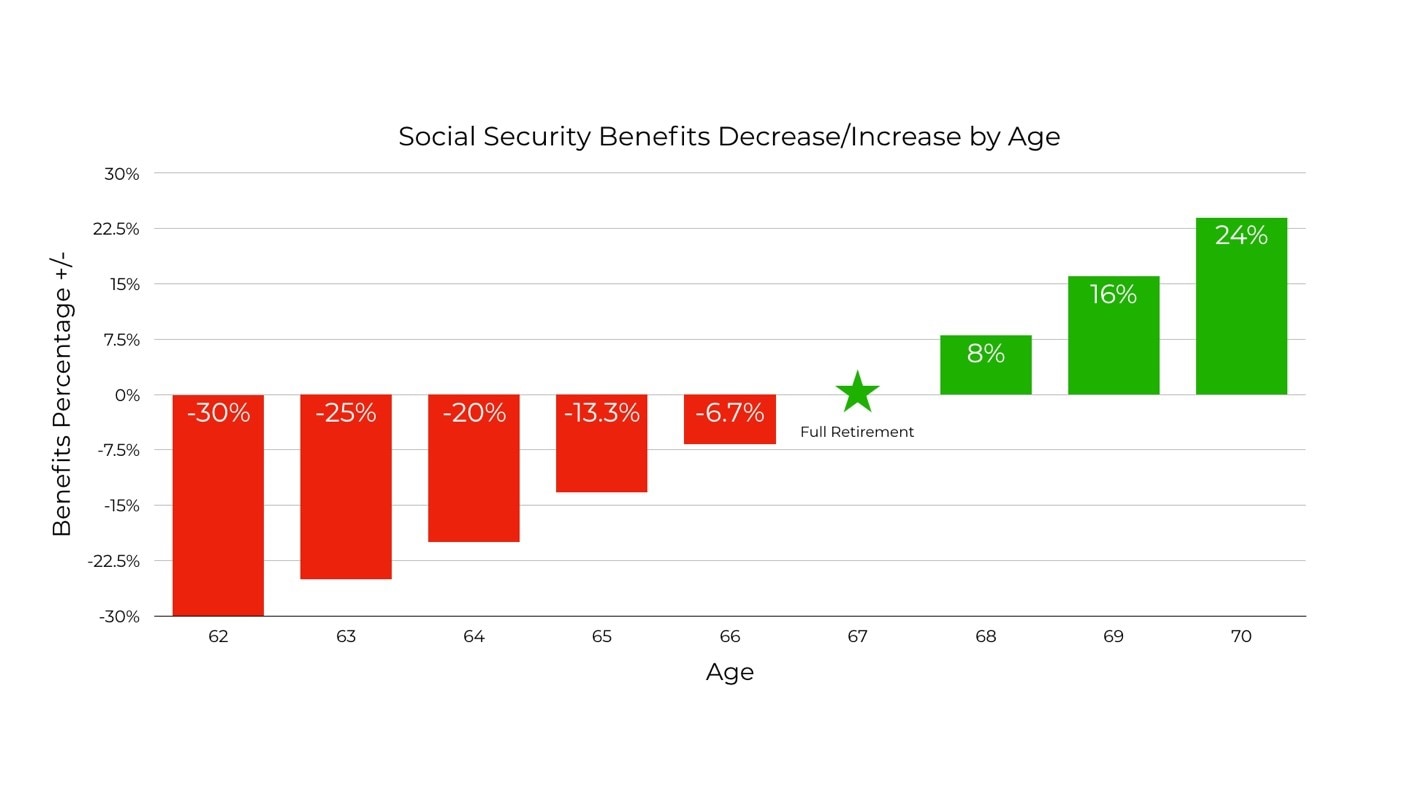

Here’s the deal. You can start as early as 62. It’s tempting. You see that money sitting there, and you want it. But there is a massive catch. If you take benefits at 62, the SSA slashes your monthly check by about 30% compared to what you’d get at your Full Retirement Age (FRA).

Think about that for a second.

For someone born in 1960 or later, the FRA is 67. If your "primary insurance amount" is $2,000 at age 67, taking it at 62 drops that check to roughly $1,400. Forever. On the flip side, if you wait until 70, you get "delayed retirement credits." That’s an 8% bump for every year you wait past your FRA. By 70, that $2,000 check becomes $2,480.

It’s a huge swing. We’re talking about a $1,000 difference every single month.

Why "Average" Advice is Garbage

Financial pundits love to say "wait until 70." They argue that unless you have a terminal illness, the math always favors waiting. They aren't totally wrong, but they're ignoring real life.

What if you hate your job? What if your knees are shot and you can't stand on the factory floor anymore? What if you have a massive gap in your savings and need that Social Security check just to keep the lights on? Sometimes, 62 is the right move because it’s the only move.

📖 Related: Stock Tips for Today: Why the Usual Advice Is Basically Useless Right Now

Expert Laurence Kotlikoff, a Boston University economist who literally wrote the book on Social Security, often argues that most Americans should wait. He focuses on "longevity insurance." Basically, Social Security is the only inflation-protected annuity you have that won't run out if you live to be 105. If you're a woman—statistically likely to outlive men—waiting is often the smartest hedge against poverty in your 90s.

But let's look at the other side. Some people take the money at 62 and invest it. It’s risky. To beat the 8% annual "return" you get by waiting, you’d need to be a pretty savvy investor, especially after accounting for taxes. Most people aren't. They spend it. And that's okay, as long as they understand the trade-off.

The Spousal Strategy Nobody Mentions

If you’re married, your social security benefits and age calculations just got way more complicated.

It isn't just about you.

When one spouse dies, the survivor gets to keep the larger of the two checks. The smaller one disappears. If the "higher earner" (let's say it's the husband in a traditional scenario) claims at 62, he’s not just shrinking his own check. He’s shrinking the survivor benefit for his wife for the rest of her life.

💡 You might also like: CBS Loses 6 Major Advertisers: What Really Happened Behind the Scenes

It’s a legacy decision.

If you are the high earner, waiting until 70 is often an act of love for your spouse. It ensures that when you’re gone, they have the largest possible monthly income to rely on.

What About Taxes?

Yeah, Uncle Sam wants his cut. This catches a lot of people off guard. If your "combined income"—that’s your adjusted gross income, plus non-taxable interest, plus half of your Social Security—exceeds a certain threshold, you’ll pay taxes on up to 85% of your benefits.

For individuals, that threshold starts at $25,000. For couples, it's $32,000.

These numbers haven't been adjusted for inflation since 1983. It’s a "stealth tax" that hits more people every year as the cost of living rises but the brackets stay frozen.

The Earnings Test Trap

If you take benefits before your FRA and keep working, the SSA might take some money back. In 2024, if you earn more than $22,320, they withhold $1 for every $2 you earn above that limit.

It feels like a penalty. Technically, it’s not—they give it back to you later by recalculating your benefit once you hit FRA—but it sure feels like a penalty when your check is smaller than expected. Once you hit that magic FRA mark, you can earn a million dollars a year and they won't touch your Social Security.

Breaking Down the Break-Even Point

People obsess over the "break-even" age. That’s the point in time where the total amount of money you’ve received by waiting (larger checks) finally surpasses the total amount you would have received by starting early (more checks).

Generally, that point is somewhere around 78 to 80 years old.

If you think you’ll die at 75, take the money at 62. You win.

If you think you’ll live to 90, wait until 70. You win big.

But who knows when they’re going to die? Nobody. So you have to look at your family history. If your parents and grandparents all lived into their late 90s, you should probably plan for a long haul. If your health is already failing in your early 60s, the "early bird" strategy starts looking a lot more attractive.

Practical Steps to Take Now

Don't just wing this.

- Download your statement. Go to ssa.gov and actually look at your numbers. Don't guess.

- Run a "what-if" scenario. Use a tool like Maximize My Social Security or Open Social Security. These calculators handle the weird edge cases that the basic SSA calculator misses.

- Check your 35 years. Your benefit is based on your highest 35 years of indexed earnings. If you only worked for 30 years, the SSA puts in five "zeros," which drags your average down. Working just a few more years can sometimes significantly boost your monthly check.

- Coordinate with your spouse. Sit down and look at both records together. If one of you was a stay-at-home parent or earned significantly less, the "spousal benefit" (which can be up to 50% of the higher earner's benefit) might be better than their own record.

- Consider the "Do-Over." Not many people know this, but if you claim early and then regret it, you have a 12-month window to "withdraw" your application. You have to pay back everything you received, but it resets the clock as if you never claimed, allowing your benefit to grow again. You only get one shot at this in your lifetime.

The relationship between social security benefits and age is the foundation of your retirement. It’s not just a government handout; it’s a return on the decades of FICA taxes you've already paid. Treat it like the massive asset it is. Stop thinking about it as a "bonus" and start treating it as the core of your financial security. If you’re 61 and 11 months, you have some big thinking to do before that birthday hits.

The most common regret isn't waiting too long; it's claiming too early because of a short-term cash crunch that could have been solved another way. Take a breath. Look at the data. Then decide.