You’re waiting. It’s that simple.

Most people think of social security benefit payments as this big, monolithic machine that just spits out money on the first of the month, but if you’ve actually looked at your bank statement lately, you know that’s not how it works. Not even close. If you’re new to the system or just trying to help a parent figure out why their neighbor got paid on a Wednesday while they’re still waiting, the logic feels kinda broken.

It’s about your birthday. Seriously.

The Social Security Administration (SSA) doesn't just do this to be difficult, though it certainly feels that way when bills are due on the 1st and your money doesn't show up until the 22nd. Back in the day—we’re talking pre-1997—everyone pretty much got paid at once. It was a nightmare for the banks. Imagine every retiree in America hitting the teller window on the exact same morning. Total chaos. So, they staggered it.

The weird math behind social security benefit payments dates

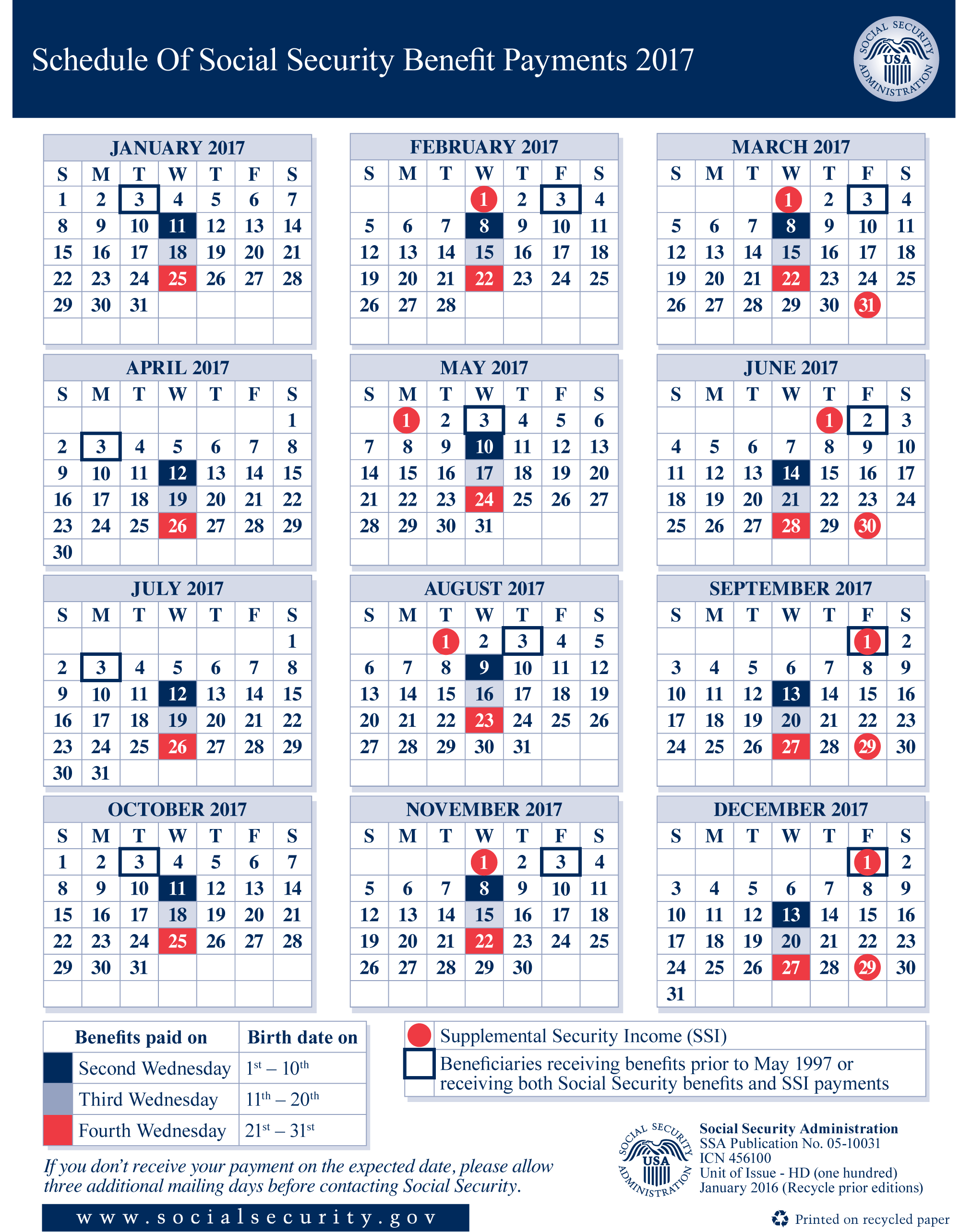

If you were born between the 1st and the 10th of the month, your check hits on the second Wednesday. If you’re a "mid-month" baby (the 11th through the 20th), you’re looking at the third Wednesday. Everyone else? You’re stuck waiting until the fourth Wednesday.

It’s a long gap.

Take 2026, for example. If you’re on that fourth-Wednesday cycle, there are months where you are stretching that last check across five long weeks. That’s where the "lifestyle" part of this hits home. You aren't just managing money; you're managing a calendar that doesn't align with how landlords or utility companies think. They want their cut on the 1st. The SSA doesn't care.

But wait. There’s a massive exception that people constantly trip over. Supplemental Security Income (SSI).

If you’re receiving SSI, or if you started receiving benefits before May 1997, you’re still on the old-school schedule. You usually get paid on the 3rd of the month. Unless the 3rd is a Saturday. Or a Sunday. Or a holiday like New Year's Day. Then, suddenly, you get paid early. You might get two checks in December and zero in January. It looks like a bonus. It isn't. It’s just the calendar shifting the furniture around. If you spend that "extra" check in December like it's a gift from the government, January is going to be a very cold month.

Why the 2026 COLA feels a bit "meh"

Everyone tracks the Cost-of-Living Adjustment (COLA) like it’s a lottery win. Honestly, it rarely covers the actual inflation you see at the grocery store. The 2026 adjustment—based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)—is meant to keep you level. But it’s a lagging indicator. It looks at what happened last year to tell you what you need this year.

By the time the extra dollars show up in your social security benefit payments, the price of eggs has already gone up twice.

Then there’s the "hold harmless" provision. This is a bit of technical wizardry that protects you. Basically, if Medicare Part B premiums go up, the law says your Social Security check can't actually go down because of it. You might not get a raise, but at least you won't get a pay cut. Usually. There are always weird edge cases for high-income earners, but for the average person, it’s a vital safety net.

Taxes are the trap nobody warns you about

You worked. You paid into the system. You’d think the money is yours, tax-free.

Nope.

If your "combined income" (that’s your adjusted gross income + tax-exempt interest + half of your Social Security) hits a certain threshold, Uncle Sam wants a piece back.

📖 Related: Personalized Makeup Bags: Why Everyone Is Ditching Generic Pouches

- If you’re single and earn between $25,000 and $34,000, you might pay taxes on up to 50% of your benefits.

- Over $34,000? You’re looking at 85%.

- For couples filing jointly, those numbers are $32,000 and $44,000.

The kicker? These thresholds haven't been adjusted for inflation since 1984. Think about that. In 1984, $25,000 felt like a decent chunk of change. Today, it’s barely getting by in most cities, yet the IRS still treats you like you’re "wealthy" enough to give some back. It’s a stealth tax that eats into social security benefit payments every single year as COLA pushes more people over the line.

What happens if the check just... doesn't show up?

It’s rare, but it happens. Maybe there’s a glitch, or more likely, you changed banks and the "oops" happened during the transition. The SSA is adamant: wait three mailing days before you start panicking and calling them.

If you’re still using paper checks, stop. Just stop. The Treasury actually requires electronic payments now via Direct Express or a standard bank account. It’s safer. No "lost in the mail" excuses. If a payment is missing, your first move isn't the local office—it’s the "my Social Security" portal online. It’s actually surprisingly functional for a government website. You can see the payment history and verify where the money was sent.

The "Full Retirement Age" (FRA) lie

We say "65" because that’s what our parents said. But for most people working today, your FRA is 67.

If you take social security benefit payments at 62, you’re taking a permanent haircut. About 30%. Every month. For the rest of your life. On the flip side, if you wait until 70, you get "delayed retirement credits." Your payment jumps by about 8% for every year you wait past your FRA.

It’s a gamble on your own longevity.

If you have a family history of living until 95, waiting is the smartest financial move you’ll ever make. If you’re tired, your health is shaky, and you just want to go fishing, take it early. Just know that once you make that choice and hit the one-year mark, you’re pretty much locked in. You get one "do-over" within the first 12 months, but you have to pay back every cent they gave you. Most people can't afford that.

Surviving the gap

Managing social security benefit payments is really about managing the "in-between." When the money hits on a Wednesday, and your rent was due on Sunday, you need a buffer. Expert financial planners often suggest keeping at least one month’s worth of expenses in a liquid savings account specifically to bridge the gap created by the SSA's staggered schedule.

Also, watch out for the "death notification" lag. If a spouse passes away, the SSA needs to be notified immediately. If they send a payment for the month the person died, and that person didn't live the entire month, the SSA will claw that money back out of the bank account without warning. It can leave a grieving spouse with a bounced rent check and a lot of heartache.

Next Steps for You

✨ Don't miss: Does Red Match With Brown? Why Most People Get It Wrong

First, log into your my Social Security account and check your "Earnings Record." If a job you had in 2004 didn't report your income correctly, your future payments will be lower. It happens more than you think. Correcting it now is a thousand times easier than trying to do it when you're 70.

Second, if you’re approaching 62, run the numbers on "break-even." That’s the age where the total money you get from waiting until 67 finally passes the total money you would have collected by starting at 62. Usually, that break-even point is around age 78. If you think you'll live past 78, wait.

Finally, update your direct deposit info at least two months before you actually need it to change. The gears of the SSA turn slowly. You don't want your social security benefit payments floating in the digital void because of a typo in a routing number. Get the paperwork done early, verify it twice, and then you can actually relax on those Wednesdays when the money is supposed to land.