You're standing at the checkout line, or maybe you're sitting at your kitchen table with a stack of bills that don't care about your feelings. You check your banking app. Nothing. Then you realize—wait, is today the Wednesday I usually get paid, or was that last week?

Understanding the social security benefit calendar feels like trying to learn a secret handshake. It shouldn't be that hard. Honestly, the Social Security Administration (SSA) actually follows a very strict, mathematical logic, but if you don't know the "birthday rule," you're basically just guessing.

It's not just about knowing when the money hits. It's about knowing why it shifts.

The Birthday Rule That Actually Matters

Most people think everyone gets paid on the same day. That's a myth. Unless you started receiving benefits before May 1997, your payday is tethered to the day you were born.

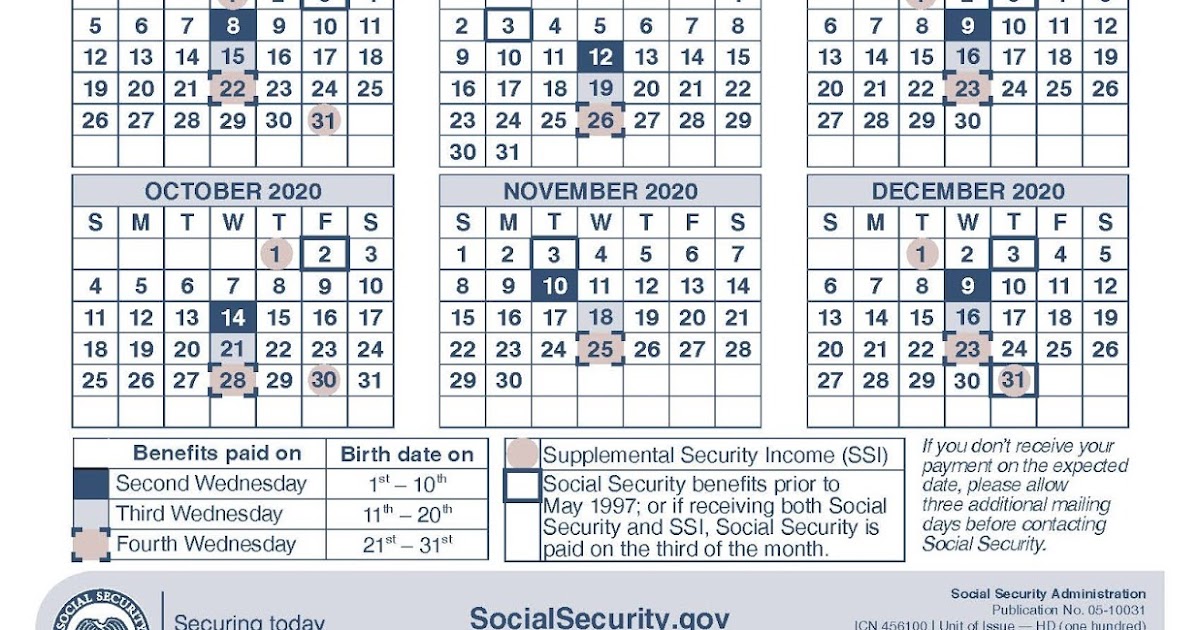

If your birthday falls between the 1st and the 10th of the month, your money arrives on the second Wednesday. It’s consistent. It’s predictable. Usually.

For those born between the 11th and the 20th, you're looking at the third Wednesday. If you were born late in the month—the 21st through the 31st—you have to wait until the fourth Wednesday. It feels like a long wait, especially in months with five weeks. You've basically got to stretch those last few dollars until the finish line.

What about Supplemental Security Income (SSI)?

SSI is the outlier. It doesn't care about your birthday. SSI payments are almost always scheduled for the 1st of the month. However, there is a massive "but" here. If the 1st falls on a Saturday, Sunday, or a Federal holiday, the SSA sends the money out on the earliest business day prior. This means you might get two checks in December and none in January. It’s not a "bonus" check, even though it feels like one; it’s just the social security benefit calendar adjusting for the banking world's holidays.

Why the 3rd of the Month is Special

There's a specific group of people who get paid on the 3rd of every month, regardless of their birth date. This applies if you live outside the United States, if you are a "dual eligible" (meaning you receive both Social Security and SSI), or if you filed for benefits before May 1997.

If the 3rd is a weekend? Same rule applies. You get paid on the Friday before.

💡 You might also like: Jaimi Million Dollar Secret: What’s Actually Inside This Ecom Training

It gets confusing when you’re a dual-eligible recipient. You might get your SSI on the 1st and your regular Social Security on the 3rd. That’s a lot of liquidity at the start of the month, but it leaves a massive three-week gap where you’re basically flying solo. You have to be careful. Budgeting for that "black hole" in the middle of the month is where most people trip up.

The Holiday Glitch and Banking Buffers

Let’s talk about Juneteenth, Labor Day, or Christmas. Federal holidays are the natural enemy of the social security benefit calendar.

Banks are closed. The Federal Reserve isn't moving money.

If your scheduled Wednesday payment hits a holiday, the SSA moves it to the Tuesday. But here is the thing: your bank might not be as fast as the SSA. While the government sends the file, some smaller credit unions or local banks might take an extra 24 to 48 hours to "settle" the deposit. If you use a prepaid debit card like Direct Express, the timing is usually tighter, but even those can lag during peak holiday seasons.

2026 Specific Scheduling Nuances

Since we are looking at the 2026 landscape, pay close attention to months like July and November. In July 2026, the 4th falls on a Saturday, meaning the observed holiday is Friday, July 3rd. If you are one of those folks usually paid on the 3rd, you’ll actually see that money on July 2nd.

Planning for these 24-hour shifts is the difference between a bounced check fee and a smooth month.

💡 You might also like: ALLR Stock Price Target: What the New Survival Data Actually Means for Investors

What to Do When the Money Just Isn't There

The SSA is surprisingly blunt about this: do not call them the minute your direct deposit is late. Their official stance is that you should wait three additional mailing days before reporting a missing payment.

Why? Because 99% of the time, the delay is on the banking side, not the government side.

- Check your "My Social Security" account. This is the fastest way to see if there’s a suspension or a change in your benefit status you didn't know about.

- Verify your direct deposit info. Sometimes banks merge or routing numbers change. If your bank was bought by another bank recently, that could be the culprit.

- Look for a letter. The SSA still loves snail mail. If there’s a "Continuing Disability Review" or a question about your income, they’ll send a paper notice that might explain a payment hold.

Managing the Gap Between Payments

The hardest part of the social security benefit calendar isn't the date—it's the length of time between the dates. Some months have 28 days. Some have 35 days between your specific Wednesdays.

If you're on the fourth Wednesday cycle, you are often the last person in the economy to get paid. By the time your money hits, grocery stores might have already finished their mid-month sales.

Smart beneficiaries often split their fixed bills. You can call your power company or your cell phone provider and ask to move your "due date" to align better with your specific Wednesday. Most utility companies would rather move your date than send you to collections.

Actionable Steps for Your Schedule

Stop guessing when your money will show up. You can actually take control of this.

- Identify your "Wednesday Group" based on your birthday (2nd, 3rd, or 4th Wednesday).

- Mark your 2026 calendar specifically for months where a holiday precedes your payday, as you will likely see the funds a day early.

- Sync your bills. Call at least two providers this week and request a billing cycle change to the Friday following your scheduled deposit.

- Set up "Direct Express" or a high-speed banking app. Digital-first banks often provide "Early Pay" features that can snag your Social Security funds up to two days before the official SSA calendar date.

- Download the official SSA 2026 Schedule of Social Security Benefit Payments PDF. Keep it on your phone or print it for the fridge so you aren't surprised by the SSI "double payment" months.

Understanding the cycle is about more than just math; it's about peace of mind. When you know exactly when the deposit is hitting, the "pending" notification on your app becomes a tool rather than a source of anxiety.