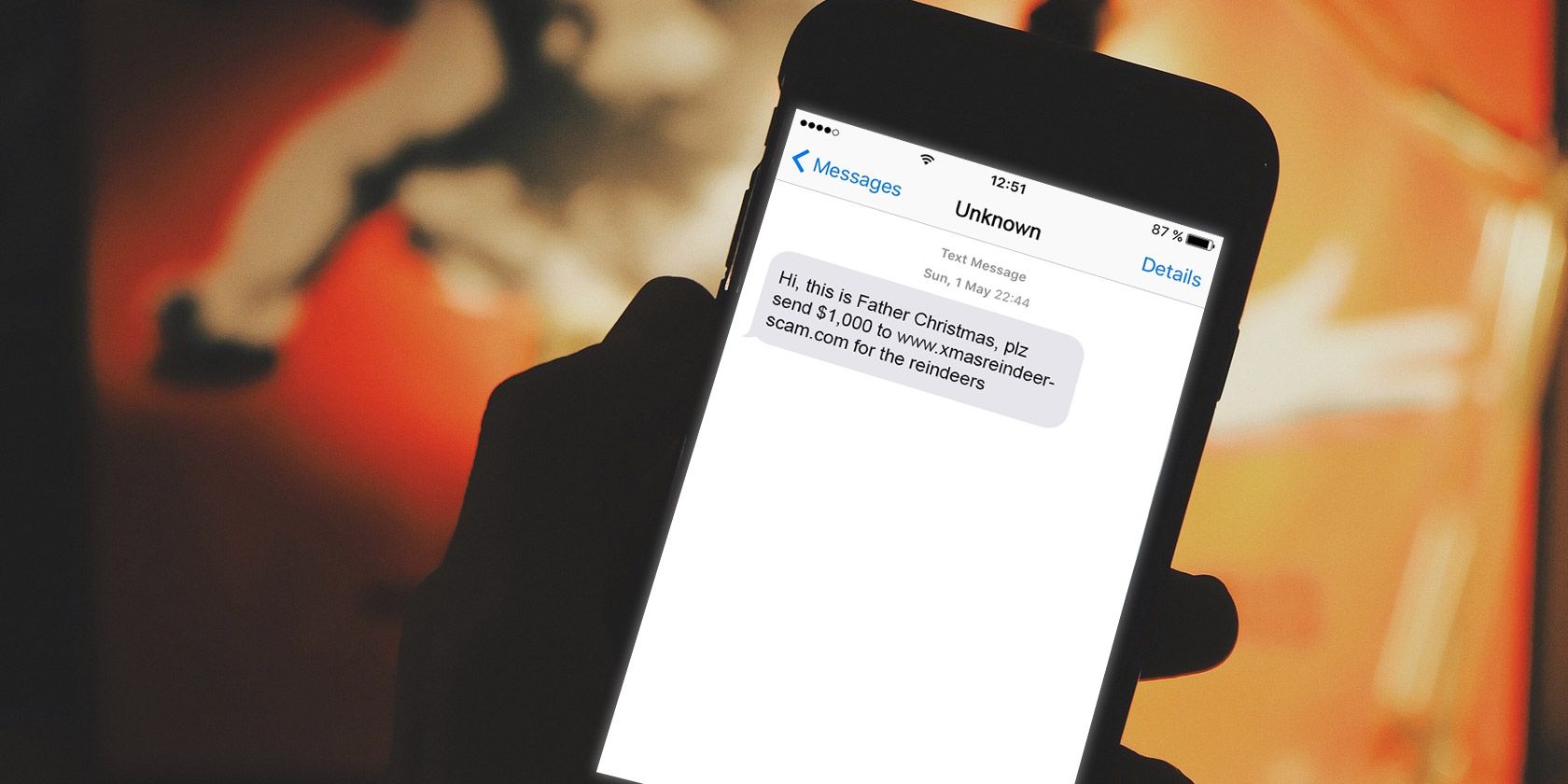

You’re sitting on your couch, half-watching a Netflix show, when your phone buzzes. It’s a text. "UPS: Your package has a $2.50 unpaid customs fee. Click here to resolve or it goes back to the sender." You actually did order something from overseas last week. Your thumb hovers. You click.

That’s it. You’re in.

This is the reality of smishing targeting Android and iPhone users in 2026. It isn't just about Nigerian princes or lottery wins anymore. It’s surgical. It’s quiet. Honestly, it’s getting harder to spot the difference between a legitimate automated alert and a predator looking for a backdoor into your bank account.

The term "smishing" is just a portmanteau of SMS and phishing. Simple enough. But the tech behind it has evolved into something far more predatory than a basic text message. Whether you’re team Blue Bubble or team Green Bubble, you’re a target. Hackers don’t care about your operating system loyalty; they care about the data sitting behind the glass.

The psychology of the "Urgent" text

Scammers rely on a specific cognitive bias called the "urgency effect." When we feel rushed, our logical brain—the prefrontal cortex—basically takes a nap. We switch to lizard-brain mode.

Most people think they’re too smart to get scammed. That’s actually a vulnerability. Overconfidence makes you sloppy. I’ve seen cybersecurity researchers click on bad links because they were tired, distracted, or expecting a message that looked exactly like the fake one.

The Federal Trade Commission (FTC) reported that consumers lost billions to text-based fraud recently. These aren't just random blasts. Many attackers now use "leaked" data from previous company breaches to personalize the attack. If they know you use a specific bank because your email was leaked in a 2023 data breach, they won't send you a generic link. They’ll send one that looks exactly like your bank’s login page.

How it hits differently: Android vs. iPhone

It’s a myth that one is "unhackable" while the other is a "wild west." They just have different doors.

The Android Vector

Android is open. That’s why we love it, right? You can sideload apps and customize everything. But that openness is a smisher's playground. On Android, a smishing link often tries to get you to download an .APK file. This is a package file that, once installed, can act as a keylogger. It records every single tap you make. Your password? Recorded. Your private texts? Read.

Google has gotten better at blocking these with Play Protect, but scammers find ways to trick users into manually disabling protections. They'll tell you the "Update" won't work unless you "Allow Unknown Sources." Don't do it.

The iPhone Vector

Apple users often live in a bubble of false security. Because iOS is a "walled garden," users think a text can't hurt them. Smishers know this. Instead of trying to install malware—which is genuinely hard on an unjailbroken iPhone—they focus on credential harvesting.

💡 You might also like: Microsoft Skype Shut Down: What Really Happened to the App We All Used

They’ll send a "Find My iPhone" alert. It looks perfect. The fonts are right. The Apple logo is crisp. You enter your Apple ID and password to "locate" your device, and suddenly, the hacker has your entire iCloud backup. Photos, notes, contacts, and synced passwords. Game over.

The "Post Office" and "Tax" lures

Real talk: the most successful smishing campaigns are the boring ones.

- The Delivery Failure: This is the king of smishing. Since the pandemic, we all have something in the mail. The text claims there's a problem with a house number or a small fee. It’s usually a low enough amount ($1.50 or $3.00) that you don't think twice about entering your card details.

- The Tax Refund: "The IRS has identified an additional refund of $420.22." The IRS does not text you. Period. But when people see "refund," their brain skips the red flags.

- The Bank Fraud Alert: This one is terrifying. "Suspicious activity on your Chase account. Reply YES to confirm or NO to block." If you reply, they know the number is active. If you click the link, you're sent to a clone of the bank's site.

Spotting the tell-tale signs (The non-obvious ones)

We all know about the bad grammar and the weird links like bit.ly/3xYz123. But scammers are getting smarter. They use "Punycode" to create URLs that look identical to real ones. For example, a "q" might be replaced with a Cyrillic character that looks exactly the same on a mobile screen.

Look at the sender's number. Is it a "short code" (like 555-01) or a full 10-digit mobile number? Legitimate businesses almost always use registered short codes. If "Netflix" is texting you from a random 404 area code, it’s a scam.

Also, check the tone. Real companies are polite but professional. Smishers are aggressive. They use words like "Immediate," "Discontinued," or "Police." They want you to panic. Panic is their best friend.

What happens after you click?

Say you messed up. You clicked.

📖 Related: How to Hack a Vending Machine: The Reality of Modern Maintenance Codes

If you just clicked the link and closed the tab immediately, you’re usually okay, but your IP address and location were likely logged. The scammer now knows your number is "live" and that you’re someone who clicks. Expect more texts.

If you entered a password, change it immediately across every site where you use that same password. (And stop reusing passwords, seriously).

If you downloaded a file on Android, you need to go into Safe Mode and uninstall any apps you don't recognize. Sometimes, a factory reset is the only way to be sure. It sucks, but it sucks less than having your identity stolen.

Advanced Smishing: The "Pig Butchering" angle

There's a darker side to smishing targeting Android and iPhone users called "Pig Butchering" (Sha Zhu Pan). This isn't a quick link click. It starts with a "Wrong Number" text.

"Hey, is this Sarah? It's Mark from the gym."

💡 You might also like: GitHub Actions Runner Explained: What Most People Get Wrong

You reply, "No, sorry, wrong number."

Instead of going away, they strike up a conversation. They're friendly. They’re charming. Over weeks, they convince you to invest in a "crypto platform." It looks real. You see your "profits" grow. But when you try to withdraw, the money—and the person—are gone. This is smishing with a long-tail psychological game.

Actionable steps to lock down your phone

Don't just read this and move on. Do these three things right now.

- Turn on "Filter Unknown Senders": On iPhone, go to Settings > Messages > Filter Unknown Senders. On Android, open the Messages app > Settings > Spam Protection. This won't catch everything, but it puts suspicious texts in a separate "Junk" folder so you aren't tempted to click while distracted.

- Use a Password Manager: If you use a password manager (like Bitwarden or 1Password), it won't "auto-fill" your credentials on a fake site. If the manager doesn't recognize the URL, it won't offer your password. That’s a massive safety net.

- Enable Hardware MFA: Ditch SMS-based two-factor authentication. If a hacker "sim swaps" you (steals your phone number), they get your codes. Use an app like Google Authenticator or, better yet, a physical YubiKey.

If you get a suspicious text, don't reply "STOP." Replying at all confirms your line is active and being monitored by a human. Just block the number and delete the thread. If you're genuinely worried about a bank alert, close the messaging app, go to your browser, and manually type in the bank’s official URL. If there's a real problem, it will be in your account notifications there.

The goal isn't to be paranoid; it's to be friction-heavy. The more friction you put between a text and your data, the safer you are. Scammers want the easy win. Don't give it to them.